1 Introduction

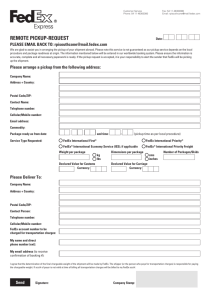

advertisement

1

Introduction

What is the first thing that comes to your mind when you think of sending an important

parcel or letter across to someone. Most likely it is FedEx. Once upon a time FedEx was

almost synonymous with express package shipping. Today Federal Express maintains a

big lead over competitors in express packages and letters sent within the US and from US

to overseas destinations. FedEx has a 43% share in the US market and UPS , its closest

competitor has a share of 27%. FedEx's initial delivery service began modestly with

small packages and documents, but today the world is addicted to shipping all manner of

goods around the globe swiftly and reliably. Even though Fedex’s services initially were

pretty much oriented towards shipping of important documents and parcels, these days

people send just about anything through these express delivery service.

The founder of FedEx, Fredrick Smith figured out two decades ago that this company

was in the information business, so he stressed that knowledge about cargo's origin,

present whereabouts, destination, estimated time of arrival, price and cost of shipment

was as important as its safe delivery. In other words, information about the packages, is

as important as the package itself. FedEx depends heavily on information technology to

conduct its day to day business. Technology is something that competitors too can use to

derive great benefits. But, Fedex, it is found is quite far ahead of its competitors in terms

of application of information technology. It is definitely going to take a lot of time, effort

and money for competitors to catch up with Fedex in this regard.

Recently, FedEx was ranked 18 by the Fortune Magazine in a survey conducted to

determine the top 100 companies to work for in the United States. The employee morale

seems to be pretty high. This is exemplified by the way FedEx employees rose to the

sudden increase in work pressure created by the recent UPS strike. Due to this strike by

the UPS employees, the other shipping companies bore the brunt of handling excess

shipments. Fedex was swamped with 800,000 extra packages a day and according to the

press releases, the employees of Fedex voluntarily worked extra hours to clear the

shipments. This kind of high enthusiasm among the employees is rarely seen in

companies today. The employees are well appreciated for their efforts. Fedex gives away

a lot of awards to the employees in recognition of their performance. This is probably

one of the reasons for the high employee retention at Fedex.

The growth in popularity of the Internet has introduced many new terms such as ecommerce and e-tailing. This has in turn created lots of opportunities for companies

involved in the package delivery business. FedEx and its competitors are vying to gain as

much advantage as possible out of these opportunities. Few of these companies, including

FedEx, are going beyond the package delivery business and getting involved in becoming

full service logistics providers that specialize in orchestrating the flow of goods and

information between customers, retailers, and suppliers. Fedex, which started off as a

simple package deliverer, is now getting itself involved in providing e-commerce

solutions. In fact Fedex’s presence is being felt throughout the supply chain. One of the

best examples in support of this is the case of National Semiconductors (Natsemi).

Natsemi has manufacturing facilities in Singapore, to take care of its product demand in

Asia. But, the company has essentially outsourced most of its warehousing and

distribution to Fedex. Orders coming into Natsemi are processed in the mainframes at the

company’s headquarters in Santa Clara, CA. Once the orders are processed, the

information is sent across to Fedex. From this point onwards, Fedex takes over and sees

to it that the orders are delivered to the customer.

FedEx is part of a bigger company called FDX, whose main objective is to provide the

most innovative transportation and logistics solutions for customers. FDX family

comprises of the following companies: FedEx, RPS Inc, Viking Freight Inc., Caliber

Logistics Inc., Roberts Express Inc., and Caliber Technology Inc. Fedex is the FDX’s

flagship company, providing express, reliable , time-definite delivery of shipments

throughout the world. It would be very interesting to analyze how FedEx goes about

conducting this business.

1.1

Brief History Of FedEx

FedEx was founded by Fredrick Smith in 1973. Smith was also the company’s first CEO,

and he remained in that position until March 1998. Smith got this idea about improving

the existing express delivery system while he was an undergraduate student at the Yale

University, way back in 1966. In those days, mainframes were very popular and many

mission critical applications resided in them. Whenever one of these huge mainframes

broke down, computer parts had to be physically transported from one place to another

and there was no reliable, fast and efficient express delivery system in place. There were

other time sensitive shipments such as medicines that badly required an efficient express

delivery system. Fred Smith recognized this and presented a paper describing the existing

system and recommended improvements to it. Smith received a ‘C’ grade for his efforts.

Obviously, Smith was not discouraged by the letter grade as is evident from the current

standing of Fedex.

In 1971, Smith bought a company called Arkansas Aviation Company in Little Rock,

Arkansas. While working in this company, Smith got a first hand experience in the

package delivery business and was able to analyze the problems involved much better.

This problem motivated him to do the necessary research for solving the inefficient

distribution system. In 1973, Smith bought an abandoned military hangar in a corner of

Memphis International Airport, and officially launched the operations of Federal Express

from there. During those days, couriers used to deliver packages in family cars and pilots

used to buy fuel for company jets with personal credit cards. In essence, the system was

very crude. The company could afford to do so back then because there were not many

customers and the business was small. As time passed, the business grew in size and the

infrastructure had to be strengthened accordingly. Smith recognized pretty early that

investment in information technology was essential.

Smith's heavy investment in information technology, coupled with a lavish marketing

effort quickly paid off. The company posted its first profit in 1975. In 1983, FedEx

became the first company in American history to earn a revenue exceeding $ 1 billion in

a financial year, without any mergers or acquisitions. In the financial year 1997, FedEx

had revenues of $11.5 billion, out of which more than a billion dollars were invested in

information technology. Federal Express became a publicly held company on April 12,

1978, and has been listed on the New York Stock Exchange since December 1978. The

stock price has had its ups and downs, but it has been steadily rising. The company has

now expanded in the international marketplace and now serves more than 200 countries

in Asia, Africa, Australia, Europe, North and South America.

Throughout its existence, Federal Express has been the industry leader in introducing

new services for customers. It was the first company dedicated to overnight package

delivery, the first express company to introduce the Overnight Letter, first to offer 10:30

AM next day delivery and the first express company to offer time-definite service for

freight. Federal Express was also the first in the industry to offer money back guarantee

and free proof of performance. In keeping with the tradition of “firsts”, FedEx received

the ISO9001 registration for all its worldwide operations in 1994, making it the first

global transportation company to receive simultaneous system-wide certification.

In 1994, Federal Express updated its corporate identity and formally adopted FedEx as its

primary brand name. One of the main reasons for the change in name was that there was

a general feeling that the word “Federal” indicated an association with the government.

Also, with the new name, less paint would be required to put its name on the aircrafts and

ground vehicles. The company’s legal name remains Federal Express Corporation.

1.2

FedEx Facts and Numbers

Began Operations

Headquarters

Worldwide

Asian

European

Latin American

Principal Officer

Revenues

Employees

Countries Served

Airports Served

Aircraft Fleet

Vehicle Fleet

World Service Centers

Drop Boxes

Authorized Shipcenters

Average Package Volume

Average Pounds per Package

Average Revenue per Pound

:

April 1973

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

Memphis, TN

Hong Kong

Brussels, Belgium

Miami, Florida

Theodore L. Weise

$11.5 billion (FY 1997)

More than 141,000 worldwide

211

325

610 Worldwide

More than 40,500 worldwide

Approximately 1,400 worldwide

Approximately 34,000

More than 6,500

2,715,894

7.2

2.11

1.3

The Federal Express System: How it Works

Millions of packages travel through FedEx’s integrated global network every day. Let us

take a look at the FedEx’s system from the moment a customer calls until the package

reaches its final destination.

COSMOS (Customer Operations Service Master Online System) is the nerve center of

FedEx’s operations. COSMOS is a sophisticated package tracking system that can follow

a shipment from pick-up through delivery. This big electronic brain monitors every phase

of the delivery cycle. The employees of FedEx constantly feed COSMOS information

through a number of other systems and devices. When a customer notifies a FedEx

service agent details of their pick up request, COSMOS automatically notifies a

dispatcher nearest the pickup location. The dispatcher then relays that pick up

information to a small on board computer called the DADS (Digitally Assisted Dispatch

System) in the courier’s van. At the point of pick up, FedEx’s courier uses a hand held

computer, called SuperTracker to scan the airbill on each package. This little computer

records information about the package, determines the best way to route the package

through the FedEx system and displays a specific routing code. When the courier returns

to the van, the SuperTracker is plugged into a shoe attached to the dispatch computer.

That shoe is SuperTracker’s link to COSMOS. The package now starts its journey

through the Federal Express system. Every time a package changes locations, the airbill

is scanned and the information transmitted to COSMOS.

Multi-Hub Sorting System: Until recently, FedEx used a hub and spokes system that

was designed long back to handle all packages through the FedEx system. As the daily

volume began increasing, FedEx discovered that it became even more efficient to sort

packages globally. FedEx finally worked out a new multi-hub system which was much

more efficient and flexible compared to the original single hub system. At the end of a

courier’s day, they return to the city station with a fully loaded van. The packages are

consolidated into containers at the stations, loaded on FedEx aircraft and flown into one

of five sorting facilities in the US system. FedEx has sorting facilities in Indianapolis,

Memphis, Newark, Oakland, and Anchorage. In the destination cities, the Federal

Express crews are waiting to sort packages again, this time from containers to courier

vans. When the vans are loaded , the couriers are ready to deliver the packages to the

customers.

1.4

The FedEx Technology at a Glance

Fueling the company’s growth and success has been the development of strategic

information systems that enable FedEx to provide superior service to its customers.

Those efforts have also earned FedEx a solid reputation as the industry’s technology

leader. Today customers are able to complete entire shipping transactions from their

desktop PCs, call for courier pick ups via modem, and track the status of their package

through the Internet. Nightly, FedEx moves over 2.7 million shipments through its

integrated global network. Over 60 percent of the total volume is processed using an

automated shipping system.

•

SuperTracker : In the simplest terms, the SuperTracker is a barcode scanner.

Barcodes are generated by customers using one of FedEx’s proprietary shipping

softwares. The barcodes identify the shipment destination, the type of service delivery

and the delivery commitment time. The information from each scan is transmitted to

the company’s mainframe system in Memphis. Real time information on the shipment

is immediately available for the service agents or customers through a number of

software applications such as PoweShip, FedexShip, Internet email or by accessing

FedEx’s web site.

•

ASTRA:

Automated Sorting Tracking Routing Aid (ASTRA) is a barcode

generator. The system uses specially designed bar code labels to provide accurate and

reliable package delivery information. Each ASTRA label contains all the necessary

information to precisely identify each package and its designated route from pick up

to final delivery.

•

DADS:

Digitally Assisted Dispatch System (DADS) is a nationwide

dispatch network that provides timely response to customers’ request for package

pick up and delivery. After a package is scanned with the SuperTracker, the scanner

is placed into a DADS transmitter, which uploads the necessary data into the

company’s centralized mainframe system in Memphis through an earth-orbiting

communications satellite.

•

COSMOS:

Customer Operations Service Master Online System, as described

earlier is a central component of FedEx’s strategic computer systems. It is a

sophisticated electronic network that contains critical information on the location of

each shipment in the FedEx system. COSMOS connects the physical handling of

packages and related information to the major data systems at FedEx, and in turn,

with customers and employees.

•

ExpressClear: ExpressClear Custom Clearance from FedEx streamlines

international shipping with an automated head start on regulatory clearance. Using

state of the art technology, ExpressClear initiates and expedites regulatory clearance

while cargo is enroute. This creates a competitive advantage for international shippers

by facilitating delivery and reducing the number of potential delays in the clearance

process. FedEx uses EDI (Electronic Data Interchange) to communicate with

governmental agencies and other brokers about the shipments. FedEx also uses

Imaging technology, which scans original documents into the FedEx computer

system for transmission when additional shipment documentation is needed.

•

Automated Shipping Systems:

These automated shipping systems generate more than 60% of FedEx’s daily

package volumes.

1. PowerShip was first introduced in 1984. It is a DOS based system. It

provided substantial efficiencies and benefits by enabling customers to reduce

shipping paperwork, streamline billing and track their shipments in realtime.

Typically, the PowerShip systems consists of a personal computer, software,

and printer. Free of charge, FedEx provides the use of a total shipping system

that includes PowerShip equipment, installation, training, and maintenance.

Each system is menu driven and easy to operate.

2. Tracking Software: This program lets customers track the status of their

shipments enroute and obtain a Proof of Delivery from their own personal

computers. The software and modem connection to FedEx computers are free.

The program is menu driven and compatible with IBM, Macintosh and

Windows applications.

3. FedEx Ship: This was first released in early 1995 and was a modified version

of the PowerShip. The system allows customers to quickly create entire

shipping transactions from their desktop PCs. FedexShip allows customers to

send shipping information to the recipient via an email template that indicates

shipment date, type of service, method of payment and tracking number. The

system is capable of tracking multiple packages simultaneously by tracking

number, date, reference number and city. The necessary equipment and

software to use FedExShip are provided free of cost by FedEx.

4. InterNet Ship: In 1996, FedEx announced InterNet Ship, the first automated

shipping transaction system available on the internet. By entering a valid

FedEx account number, customers complete entire shipping function directly

from the web page. That includes preparing all paperwork online, printing a

barcoded label for the package using any laser printer, scheduling a courier

pickup and automatically uploading the billing information to FedEx.

5. Virtual Order: This is a software that links Internet order with FedEx

delivery and online tracking. Specially designed for startups and small

business communities.

•

Technological Improvements: FedEx customer service operations have greatly

benefited from improvements in technology. A CTI “screen pop” was implemented

that provides customer service representatives with information that connects

incoming callers with customer account information. This now allows the service

representatives to answer the phone in a much friendlier and more informed manner.

FedEx also has a Proof Of Delivery imaging system. This system can now provide a

letter on company letterhead that states the proof of delivery information to a

customer. The system is probably one of the most complex and largest object

databases in the world. The signatures are captured and archived in optical storage

where they are instantly accessible. FedEx recently implemented another component

of their Enterprise Image System architecture – Domestic Customer Invoicing

System. The system is designed to scan, recognize, and store images of nearly one

million airbills each day. Imaged air bill invoices are then accessible and viewable on

client/server workstations. This new system improves the invoicing process by

reducing keystrokes, eliminating paper handling, and increasing worker productivity.

Fedex is also planning a major overhaul of its IT infrastructure under project GRID

(Global Resource for Information Distribution). The objective of this project includes

replacing 60,000 terminals and some PCs with 75,000 network computers. The NCs

will be connected to to Windows NT servers. Citrix Systems WinFrame software and

the Citrix ICA (Independent Computing Architecture protocol) will be used to present

the Windows desktop environment on the NCs, which will also run native-mode Java.

Fedex has traditionally used the two-tier client/server approach for a long time to

develop applications. The three-tier network computing architecture will allow Fedex

to build robust, scalable systems. The other obvious reasons for Fedex to move

towards NCs include low cost of maintenance and low cost of ownership. Another

objective is to retire Fedex’s three Hitachi Skyline mainframes and four IBM

mainframes by June, 2001, replacing them with Sun and HP Unix servers.

Developments such as these reinforce the company’s leadership position in

information technology and add value to Fedex’s transportation services.

2

Competitive Industry Analysis

Strategic importance of an information system has to be evaluated within the context of a

competitive environment an organization is operating in. In our analysis of express

package delivery industry, we will use Michael Porter’s industry an competitive analysis

framework (Figure 1).

Potential

new entrants

Bargaining power

of suppliers

Industry

competitors

Bargaining power

of buyers

Threat of substitute

services

Figure 1. Industry and Competitive Analysis Framework

We will first present our research on who we consider the primary competitors of Federal

Express to be. We will continue to analyze the service FedEx provides and its bargaining

power with customers (i.e.: price elasticity). Finally, we will outline technology vectors

that are present and are likely to drive the industry into the future.

2.1

Primary Competitors

The freight and air transportation industry can be segmented in a variety of ways. In

considering primary competitors to FedEx we have tried to select those companies the

have similar service offerings. The only exception to this rule is Ryder, that offers ground

transportation services. Since Ryder is trying to position itself as a provider of integrated

logistics solutions, we included the company in the primary competitors list. Figure 2

provides approximate market share for express package delivery.

DHL

Other

Airborne Express

UPS

Federal Express

0%

10%

20%

30%

40%

50%

Source: Fortune Magazine

Figure 2. Market share in express package and letter delivery in the U.S.

The charts depicts only those companies that offer time-definite service, that is, they

provide a guarantee that a delivery will be completed within a given number of days. US

Postal Service does not offer such guarantee and thus is not included on the chart.

2.1.1 DHL Worldwide Express

The company has been created in 1969 by Adrian Dalsey, Larry Hillblom and Robert

Lynn (hence the name) on the west coast. Initially, it delivered shipping manifests from

port to port by air to speed ocean cargo. In the next 10 years, it expanded into global

markets in Asia, Australia, Europe, Middle-East, Latin-America. Currently, it operates in

227 countries and territories and reaches 635,000 cities.

The company is privately held. Its major holders include Japan Airlines (25.001%) and

Lufthansa Cargo AG (25.001%). Recently, German postal service Deutsche Post AG

announced plans to acquire a 22.5% stake in the company. This gives DHL a solid

international backing from major industry players.

In 1997, DHL has spent $240 million in infrastructure and technology, and in Europe it

plans to open at least 30 new service centers and acquire nine A-300 aircraft. 40,000

people. As a result of continued 16% growth, DHL has doubled in size in five years.

From an Information Technology perspective, DHL faces major challenges in creating a

infrastructure that will support its global operations. In 1993, DHL has initiated a $1.25

billion worldwide capital spending program, emphasizing computer technology.

The company operates a private, high-availability TCP/IP based network to link their IT

centers as well as individual branches. The backbone system is a mainframe based

database, that is linked to a distributed relational DBMS (Informix 7) that provides

almost 100GB of real-time shipping data.

DHL expects to loose 18% of its documents-transport business because of electronic

communications, mostly over the Internet.

2.1.2 Airborne Express

Airborne Express was founded in 1968 with headquarters in Seattle, WA. It originally

offered freight services for the west coast region. In 1981, the company purchased

Clinton County Air Force Base in Wilmington, OH, and became the first and only carrier

to own and operate an airport. It also created the hub-and-spoke system for fast and

express package delivery in the US.

Airborne Express owns two other subsidiaries. ABX Air, Inc operates and maintains

company-owned chartered aircraft and Airborne’s package sorting facility in

Wilmington, and Sky Courier offers fast delivery services to both US and international

via next-flight-out air courier and expresss freight services.

Services offered by Airborne ranged from US domestic same-day/next-flight-out,

overngiht air express, next afternoon, and second day services, to international air

express, Global Post, air freight, and ocean service.

In FY1997, the company has a total revenue of $2.9 billion, and net earning of $120

million. It handled more than 302 million shipment, and enjoyed a yearly revenue

growth of 17%.

Airborne Express employed 21,970 workers, owns 14,140 delivery

vehicles, 12,140 drop boxes, 303 shipping facilities, and with a monthly active customer

base of 529,350. It operates out of 9 regional hubs in US, and owns 175 aircrafts, and

one airport.

2.1.3 United Parcel Service

United Parcel Service is a major competitor to Federal Express in the "delivery service"

marketplaces. For example, in 1995 UPS had revenues of $ 21.05 billion and a net

income of $ 1.04 billion. While their envelope market share was 12.8% compared to

Federal Express' 59%. In the overnight delivery market UPS has 42.5% compared to

Federal Express' 40%. As a trucking company, UPS ranks first in the US where Federal

Express doesn't even compete. Both Federal Express and UPS have massive service

areas, gross sales, employee base, delivery fleet, and aircraft fleet. In fact UPS's airlines

is the 10th largest airline!

UPS uses a similar technology base to accomplish their basic services much as Federal

Express does. They use technology to find efficiencies in the system and makes it more

profitable in a similar fashion. As with Federal Express, they employ a hub and spoke

system where packages are picked up locally, sorted at regional hubs, and then sent on

their way. Both Federal Express and UPS use the same competitive paradigm in

distribution systems they employ. UPS is also employing the technique of building

infrastructure costs with their customers. UPS, better know for its trucking side of its

business (where as FedEx is better know for its airplanes), has established bases of

operations with their business customers that ship at very high volumes, integrated IS

with high volume customers, and established IS links with other valued customers. This

is the same IS strategy that Federal Express in employing.

2.1.4 United States Postal Service

The USPS is an independent agency of the United States government, providing various

services to the public. The USPS recognized that the expedited and package market is a

very profitable one and that it continues to grow rapidly every year. In the express

delivery category, USPS has two main services to offer – Express Mail and Priority

Mail.

Express Mail is the faster of the two services. It is the only overnight service that

delivers 365 days a year, including weekends and holidays. Express Mail is very

convenient to use in that there are more than 40,000 post offices and 26,000 Express Mail

boxes in which you can deposit your shipments. On demand pick up service is also

available by calling a toll free 1-800 telephone number. When the speed of Express Mail

is not needed, but preferential handling is desired, Priority Mail is a better option. Priority

Mail offers fast delivery and is very economical.

The USPS is planning to simplify its product line and improve its parcel services to steal

market share from United Parcel Service and Federal Express. Under this plan, USPS is

considering merging its Express Mail service under the Priority Mail umbrella, calling it

something like Next Day Priority Mail Service. USPS would also offer a Two Day

Priority Mail and perhaps a Same Day Priority Mail service. USPS is not a player in the

Same Day Service market, but believes that its existing infrastructure can support it. Its

plan is to enter the Same Day market by initially offering service between major markets

and within some major markets, called intra-city delivery.

It is important to note that USPS faces some challenges that other express delivery

systems don’t face. Federal Regulations set forth in the Postal Reorganization Act of

1970 prevent the organization from offering products and services with prices and

characteristics that compare favorably with competitive offerings. These regulations

constrain the Postal Services ability to respond to rapidly changing market conditions

and to control costs. The USPS is not subsidized by the government, but the revenue

generated by the Postal Service goes into the US Treasury, that help reducing our taxes.

2.1.5 Ryder System

Ryder System is the world’s largest provider of logistics and transportation services.

Annual revenues of 5.5 billion. Part of Down Jones Transporation Average. Ryder’s tree

core competencies are: integrated logistics, truck leasing and rental, and public

transportation services. Integrated logistics services provide companies with inbound

transportation of raw materials to manufacturing facilities through the delivery of

finished goods. These services are also offered in Canada, the United Kingdom,

Germany, Poland, Mexico, Argentina, Brazil and The Netherlands.

Ryder rents and leases trucks to over 13,000 customers and has over a hundred thousand

vehicles on lease.

Recognizing the value to customers in integrated logistics, the company has recently

formed an alliance with IBM and Andersen Consulting to deliver integrated logistics

services to customers. IBM and Andersen will develop information services to support

these services.

2.1.6 Other Competitors

Almost any major airline has cargo operations. These services are targeted at companies

that need freight service for either large products or for products that need to be delivered

in a short time.

There is also a multitude of smaller shipping companies that typically are either regional

or have a specific industry focus. These companies may only play a role of shipment

coordinators, where they arrange shipment services with airlines or freight operators.

2.1.7 Potential for New Entrants

The potential for new entrants in the industry is small. To pose a significant competitive

threat to FedEx, requires an immense capital investment. On top of that, FedEx has a

substantial customer base and brand equity that is very difficult to duplicate.

Additionally, in order to provide efficient delivery service, sophisticated information

systems need to be developed. These are not off-the-shelf systems and can be considered

an advantage that FedEx has over any potential entrants.

2.2

Customers

Depending on the type of service, customers have different bargaining power. At the low

end, letter and small package delivery, the customers do not have any or have low

bargaining power. At higher volumes, and more specialized service (such as warehouse

management, catalog operations, etc) the customers are able to negotiate long term

contracts with the company and offer lower than retail rates. We view customer

bargaining power as low to moderate.

2.3

Threat of Substitute Services

Federal Express is clearly operating in a very competitive industry where customer does

have a lot of choice. Express mail package delivery has a lot attributes of a commodity

service:

• high volume;

• low differentiation;

• low margins (FedEx profit margins are about 3.2%).

The threat of substitute services is therefore very high. It may be diminished by the

temporary high market demand, but in the long run, the company should look for ways to

provide improve customer value through product differentiation.

2.4

Other Considerations

All delivery services are labor intensive. Packages have to be unloaded from aircraft and

sorted. Even if some of these operations are automated, human involvement is remains

high. Federal Express employs almost 110 thousand people. High portion of its cost of

operations (almost $11 billion) is therefore related to labor costs.

UPS strike brings to focus problems that companies face when it comes to negotiating

labor contracts. That also applies to pilots associations and unions. With FedEx pilots are

more of an issue than for UPS, because the company has a very large and expanding

aircraft fleet.

On the other hand, employee loyalty at FedEx is reported by be very high. According to a

recent Fortune Magazine article on FedEx some employees describe their blood as

purple. This is a result of an extensive performance evaluation system setup for

managers, who are not only evaluated by their superiors but also by workers they

supervise.

2.5

Technology Vectors and Market Trends

As indicated earlier, express package delivery is becoming a commodity. There are two

basic ways to grow revenues in this kind of business: improve efficiency (i.e.: reduce

cost) or diversify business into high growth, high profit areas. While efficiency

improvements are certainly a viable option, their potential for improving the bottom line

is limited. Diversification, while certainly riskier, offers a much higher potential for

growth.

According to industry analysts, the express delivery market will growth rapidly from $36

billion in 1996 to about $250 billion in 2016. During that period, express delivery

services will substantially increase their share in the freight and delivery market (see

Figure 3).

Less-ThanTruckload

Non-Express

Delivery

Express Delivery

0%

10%

20%

1996

30%

40%

50%

60%

70%

2016

Figure 3. U.S. Domestic Shipping Market, 1996. (Source: Federal

Express Corporation, 1997 Annual Report)

This trend can be explained by corporations’ struggle to reduce inventory and build justin-time inventory and delivery services, both for in-bound materials from suppliers and

outbound products for customers. Supply chain integration offers to deliver substantial

efficiency improvements but dramatically increases information requirements. Express

shipping companies, including FedEx, find themselves in the information business:

knowledge about cargo's origin, present whereabouts, destination, estimated time of

arrival, price, and cost of shipment is as important as its safe delivery.

FedEx is currently working on a project with KPMG and SAP as partners, to deliver a

module that will integrate FedEx shipping software and warehouse management services

with enterprise resource planning packages such as SAP R/3. The module will provide

logistics and shipment functions with SAP's R/3 software system.

Finally, electronic (not just Internet) commerce is gaining importance and acceptance.

This is closely related to just-in-time inventory services but goes beyond that.

Companies, such as National Semiconductor Corporations, are looking to outsource their

warehouse operations and shipping of product to customers. Electronic commerce should

enable linking of computer systems between a manufacturer and a shipper to provide

integrated delivery system.

3

The SWOT Analysis

We believe that doing a SWOT analysis will provide us with another view point on

Federal Express' competitive and strategic technologic positions in their current market.

And so below you shall find in each of the traditional four sections of a SWOT analysis,

and what we think are the major points for Federal Express with respect to technology

and information technology use in their business and industry.

3.1

Strengths

Having covered the story of Federal Express in previous sections, it should be apparent to

you at this point that Federal Express is a very large company. This is one of its biggest

strengths as it provides stability from local and regional market fluctuations, provides

deep pockets, and has been in business for a long period of time. This long period of

time has allowed Federal Express to establish a brand name, a complex and well

supported infrastructure in their home markets, and a basis for expansion into other

markets as well. If you look at UPS, they have developed similarly to Federal Express

since they too had a long time to build their infrastructure. And since there is no

switching cost to the typical individual user, Federal Express needs to protect itself from

market fluctuations.

Being one of the biggest players in the delivery marketplace means having a large service

vehicle fleet. Both Federal Express and UPS have armies of delivery trucks and planes,

and so they have made heavy investments in transportation technology. For example,

Federal Express kept on top of this as they introduced the Overnight Letter in '81, they

had already contracted 15 727s from Boeing. It is due to these necessary heavy

investments in transportation technology that has allowed Federal Express to expand as

quickly as it has. Fortunately for Federal Express, plane and vehicle technology has not

drastically changed over time, it has been more incremental change than discontinuous

change. This has played well for Federal Express as it means no need for replacement for

large amounts of new transportation technology. For example, a discontinuous

innovation would be the introduction of a supersonic transportation for the masses. This

would create more market opportunities father away that Federal Express would be

obligated to server. And so they would be forced to invest in the new technology as it is

an extension of their core competencies.

Another strength of Federal Express has been their continual investment in materials

handling technology. Within their hub and spoke system lay a sorting system, and that

relies on the effective combination of information systems and materials handling

technologies. In each of the regional hubs they have a conveyer belt system with

electronic eyes and diverting arms that steer the packages to the right destination vehicle.

This investment in technology has been the means for Federal Express to keep costs

down (instead of employing thousands of employees to sort) while increasing volume

dramatically. Again, the sorting technology for this system has not seen discontinuous

innovation, and so Federal Express has enjoyed the use of it without serious reinvestment.

Lastly, Federal Express has locked in the high volume customers with information

technology infrastructure. Federal Express realizes that it isn't going to be the single one

time user of their services that with profit them the most, it is the business segment of

their markets. Therefore, they have taken strategic steps to retain their business in the

long run. By far this is Federal Express' best strength, and most important one. If Federal

Express didn't do this, the business would have surely degenerated into a commodity

business, much like with residential customers today. With businesses, forming links and

ties to the business allows them to establish switching costs, which effectively locks that

customer in.

Allow me to further divert your attention to this point. Federal Express know that

creating switching costs are critical to keep their customers in the long run, so they have

developed a full array of tactics to do so. Concentrating on the business customer,

Federal Express has developed a suite of informational programs to use to interact with

Federal Express' computers and shipping software. For example, the more common

program is that which allows you to track packages at each stage of the delivery process.

The goal is to establish that initial link with that customer with respect to their

information technology infrastructure. This gets the customer more pliable for later

investment with Federal Express in their IT, and so creating the tangible switching costs.

If you go to Federal Express' homepage, and look at the levels of software integration,

you can see that each one is geared to a different level of commitment (or integration)

with Federal Express. If we look at Federal Express' operations in Hong Kong, they have

an operation where they have taken on the warehousing function of a prominent

semiconductor manufacturer. Federal Express has taken on the function of the

warehousing as well as delivery, and I believe this is an example of the extent to which

Federal Express is willing to take their integration. If you look around the market place,

their competitors are doing this as well to some degree (i.e. UPS in trucking

manufacturer's goods).

3.2

Weaknesses

We have touched on the idea that Federal Express in a poor position if the markets they

compete in degenerate into service commodities. Strong price competition would mean

little or no margin, and this would drive everyone out of the business. Federal Express is

required to generate that premium over base cost as it must make the aforesaid

investments in technology to keep up with demand, competition, and technological

discontinuities. Simply put, Federal Express is susceptible to price competition with

their strong competitors.

Another weakness with Federal Express is their high vulnerability to transportation cost

fluctuations. If you see gas prices go up by thirty cents, you'll grumble and complain,

and be able to afford it. If Federal Express sees this gas shortage, and must pay the price

difference, multiplied by thousands of vehicles, how fast will they go out of business?

3.3

Opportunities

Federal Express has the ability to extend this "locking in" procedure with IT to individual

customers (or what I called residential customers before). In a way they've already

begun. By providing a higher level of service by allowing the customer to know that they

know for no additional cost. This requires software for that individuals must install and

use to interact with Federal Express' information systems. That is where the level of

interaction is now, but if Federal Express wants to lock in these customers, and are half

way there, all they need to do now is create something like a reward system for continual

use. Since IS can easily keep track of this, it seems like such a little effort/cost for

potentially large returns.

More recently Federal Express has made bids and spent a lot of money to get into the

Chinese delivery marketplace. This is evidence that Federal Express is expanding the pie

as well as fighting for more of it. They are seeking other markets to expand into, and this

is what they need to keep doing as the world becomes more integrated. This pays off in

the end when they are more integrated around the globe than their competitors. It also

pays off in that when they expand the pie, they get more of the expanded part; or in other

words, they grow faster than their competitors.

Lastly Federal Express is one of the market leaders in the delivery markets, and in being

one, they can set standards for everyone. This would be applicable for the information

systems that they are distributing for interaction with theirs. Comparatively UPS's

information systems are unsophisticated, and so Federal Express has the opportunity to

'standardize' their IT processes to create switching costs for their competitors, and

asserting their leadership position.

3.4

Threats

By far the biggest threat to Federal Express' document business is electronic commerce

(the use of the Internet). Federal Express saw this years ago, and that is why they

attempted "Zapmail." It was too soon for such a product, and so it was divested in '86.

Today there is no way Federal Express can recover that market, the customers are talking

to each other via computer, bypassing Federal Express entirely. Since this is cheaper

than using Federal Express, the trend will continue as more companies get increasingly

computer savvy. Federal Express will have to create more business elsewhere (i.e.

foreign markets) to make up for lost revenue here.

Presently Federal Express employs a hub and spoke system that allows them to reap the

benefits of the cheapest way to distribute products. Currently this is the best practice, or

strategic paradigm. This is what Wal-Mart Figured out, and the airlines adopted. If

another competitor comes out with another strategic paradigm that is cheaper, then

Federal Express has really big problems since they've invested heavily in the one they're

using now. Whether or not they are able to change when that day comes will determine

whether or not they will remain in business (much like the other retailers when Wal-Mart

rolled in).

Strong competitors are likely to follow suit as Federal Express is one of the market

leaders. Already UPS has a similar tracking system, although lacking, they already

realize the utility of such a system, and are taking the cue from Federal Express.

Obviously Federal Express needs to keep innovating and keep on top. Already UPS is

employing swishing costs much like Federal Express has. With strong competitors in

Federal Express' back yard, it is not easy to make early mover's strategic moves to leave

the rest to follow.

Federal Express has a high dependency on IT in general, and they employ a wide variety

of system architectures. This means a lot of configuration and man hours involved with

such systems. And with any complex systems, there is a buildup time. We could not find

any evidence that Federal Express has addressed their year 2000 problem, and this could

be a crippling problem in the near future. Federal Express has a high dependency on IS

technology ('Strategic' on the IS Strategic Grid), and if the y2k problem kills their

information systems, then their business will die too.

References:

1)

2)

3)

4)

5)

6)

7)

8)

9)

10)

11)

12)

FedEx Information Packet

Information Week, Oct 27, 1997

Fortune Magazine, Oct 27, 1997

Fortune Magazine, Nov 10, 1997

Fortune Magazine, Jan 12, 1998

FedEx web site (www.fedex.com)

Airborne Express web site (www.airborne-express.com)

United Parcel Service web site (www.ups.com)

US Postal Service web site (www.usps.gov)

Sun-Sentinel , January 7, 1998

Business Mailers Review, March 9, 1998.

The USPS 5-Year Strategic Plan summary.