ARTICLE IN PRESS

Journal of Retailing and Consumer Services 14 (2007) 383–393

www.elsevier.com/locate/jretconser

Flexible estimation of price response functions using retail scanner data

Winfried J. Steinera,, Andreas Brezgerb, Christiane Belitzb

a

Department of Marketing, University of Regensburg, UniversitätsstraX e 31, 93053 Regensburg, Germany

b

Department of Statistics, University of Munich, LudwigstraX e 33, 80539 Munich, Germany

Abstract

Kalyanam and Shively [1998. Estimating irregular pricing effects: a stochastic spline regression approach. Journal of Marketing

Research 35 (1), 16–29] and van Heerde et al. [2001. Semiparametric analysis to estimate the deal effect curve. Journal of Marketing

Research 38 (2), 197–215] have demonstrated the usefulness of nonparametric regression to estimate pricing effects flexibly. The

empirical results of these two studies, however, also revealed that nonparametric regression may suffer from too much flexibility leading

to nonmonotonic shapes for price effects. In this paper, we show how the problem of nonmonotonicity can be dealt with without losing

the power of flexible estimation techniques. We propose a semiparametric approach based on Bayesian P-splines with monotonicity

constraints imposed on own- and cross-price effects. In an empirical application, we illustrate that flexible estimation of own- and crossprice effects can improve the predictive validity of a sales response model substantially, even when price response curves were constrained

to show a monotonic shape, as suggested by economic theory. We also discuss the consequences from an unconstrained estimation of

price effects.

r 2007 Elsevier Ltd. All rights reserved.

Keywords: Price response modeling; Monotonic regression splines; Bayesian estimation

1. Introduction

1.1. Problem description

It is well known that temporary price reductions offered

by retailers may substantially increase sales of brands (e.g.,

Wilkinson et al., 1982; Blattberg and Neslin, 1990;

Bemmaor and Mouchoux, 1991; Blattberg et al., 1995;

Neslin, 2002). There is also empirical evidence that a price

change for one brand may affect sales of competitive items

in the same product category significantly (e.g., Blattberg

and Wisniewski, 1989; Allenby and Rossi, 1991; Mulherne

and Leone, 1991; Bemmaor and Mouchoux, 1991; Sivakumar and Raj, 1997; Sethuraman et al., 1999). Despite a

wealth of empirical studies on own- and cross-price effects,

however, little was known about the shape of price

response curves for frequently purchased consumer goods

until recently. Most studies addressing this issue employed

Corresponding author. Tel.: +49 941 943 2274; fax: +49 941 943 2828.

E-mail address: winfried.steiner@wiwi.uni-regensburg.de

(W.J. Steiner).

0969-6989/$ - see front matter r 2007 Elsevier Ltd. All rights reserved.

doi:10.1016/j.jretconser.2007.02.008

strictly parametric functions, and came to different results

from model comparisons. Today, multiplicative, semilog

and log-reciprocal functional forms are the most widely

used parametric specifications to represent nonlinearities in

price response for brand sales (e.g., Blattberg and

Wisniewski, 1989; Blattberg and George, 1991; Montgomery, 1997; Kopalle et al., 1999; Foekens et al., 1999; van

Heerde et al., 2001, 2002; Bemmaor and Wagner, 2002). It

is important to note that these parametric functional forms

are inherently monotonic, i.e., monotonically decreasing in

own-price and monotonically increasing in cross-price,

which is in accordance with economic theory (e.g.,

Hanssens et al., 2001).

In order to shed more light on this topic, Kalyanam and

Shively (1998) and van Heerde et al. (2001) proposed

nonparametric regression techniques to estimate price

response curves more flexibly. Specifically, Kalyanam and

Shively proposed a stochastic spline regression approach

and van Heerde et al. a Kernel regression approach, and

both obtained superior performance for their models

compared to strictly parametric models. The empirical

results of these studies indicate that own- and cross-price

ARTICLE IN PRESS

384

W.J. Steiner et al. / Journal of Retailing and Consumer Services 14 (2007) 383–393

effects may show complex nonlinearities which are difficult

or not at all to capture by parametric models. These

complex nonlinearities may be caused by the existence of

threshold effects (e.g., flat own price response at the upper

bound of the observed price range), saturation effects

(decreasing returns to scale with decreasing price levels),

odd pricing effects (which can be considered as a special

type of threshold effects), market segments with distinct

reservation prices, or a convolution of several of these

individual effects.1 In addition, both studies provide

empirical evidence that price response may not only differ

across product categories but also across brands within a

product category. Altogether, the findings of Kalyanam

and Shively (1998) and van Heerde et al. (2001) strongly

support the use of nonparametric techniques to let the data

determine the shape of price response curves. Recently,

Martı́nez-Ruiz et al. (2006) applied the methodology

suggested by van Heerde et al. to daily (instead of weekly)

store-level scanner data.2

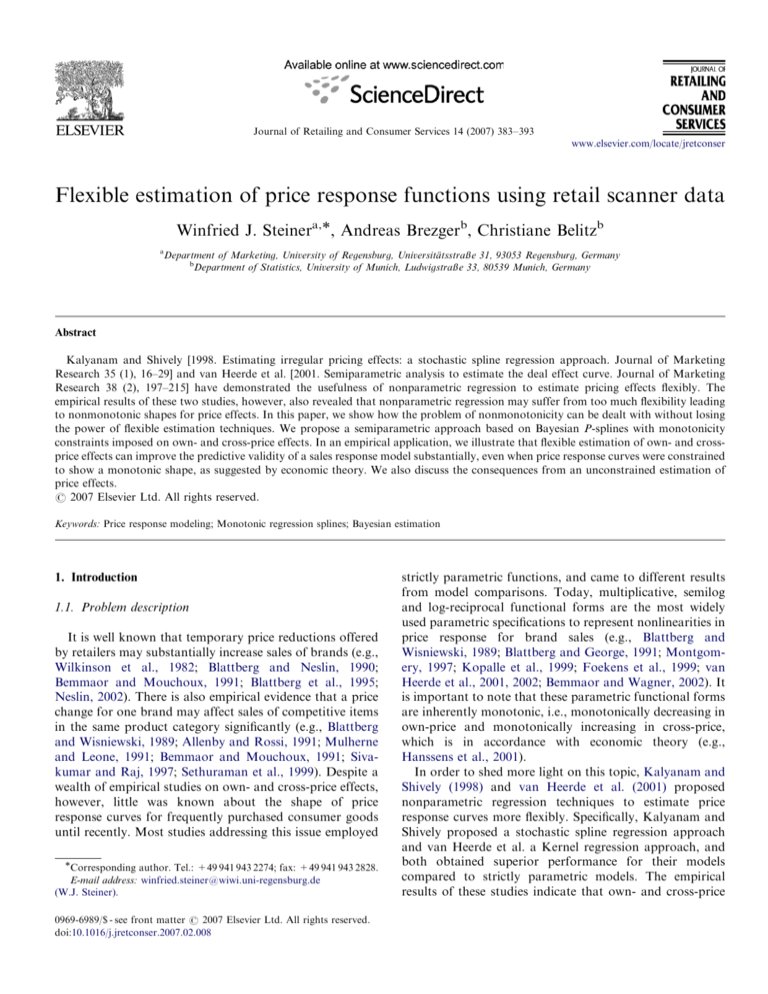

Kalyanam and Shively (1998), however, also reported

strong irregularities in own-price response for some of the

brands examined. Especially, some curves show local

upturns and downturns with spikes at certain price levels,

resulting in less smooth and nonmonotonic shapes (see

Fig. 1 below, right hand, dashed line for an example). The

authors themselves pointed out that in case of an

insufficient number of data points, the estimated curves

may show irregularities where none exist. The problem of

nonmonotonicity also applied to another brand in their

study, where the estimated curve indicated an increase in

unit sales for higher price levels beyond a certain price

point (see Fig. 1 below, left hand, dashed line). This

irregularity is not in accordance with economic theory and,

as a consequence, would suggest an optimal price at

infinity. The response curves estimated by van Heerde et al.

(2001) were more smooth though not untroubled by

nonmonotonicities. For example, one own-price response

curve indicated a decrease in unit sales as price cuts become

very deep which is again difficult to interpret from an

economic point of view. The authors noted that such

nonmonotonic effects might be due to chance.

The power of nonparametric regression for estimating

response functions based on aggregate data has also been

demonstrated for market share models by Hruschka

(2002), who proposed a semiparametric attraction model

allowing for functional flexibility. In his empirical study,

1

Threshold effects are present if consumers do not change their purchase

intentions unless a price cut exceeds a certain threshold level, say, e.g.,

15% (Gupta and Cooper, 1992; Bucklin and Gupta, 1999). A common

argument for the existence of saturation effects is based on the belief that

consumers can stockpile and/or consume only limited amounts of goods,

e.g., due to inventory constraints or perishability (Blattberg et al., 1995).

Odd pricing refers to the practice of retailers of setting prices in odd

numbers (e.g., 99 cents instead of 1.00 h) and may cause steps or kinks at

the respective odd price point (e.g., Kalyanam and Shively, 1998).

2

In another empirical application of nonparametric regression techniques, van Heerde et al. (2004) used local polynomial regression to allow

for a flexible decomposition of different sales promotion effects.

the semiparametric model provided better fits according to

the BIC criterion and error measures determined by

bootstrapping compared to the strict parametric MNL

and MCI attraction models. In another paper, Hruschka

(2001) further shows that a neural net based market share

attraction model can also achieve greater flexibility than a

common parametric attraction model leading to different

managerial implications. Moreover, the use of nonparametric or neural net based (also called seminonparametric)

techniques has become increasingly popular for modeling

brand choice of consumers using disaggregate data. Non-/

semiparametric choice models have been proposed by, e.g.,

Abe (1999), Briesch et al. (2002) or Hruschka et al. (2004),

flexible neural net based (enhanced) choice models have

been developed by, e.g., Bentz and Merunka (2000) or

Hruschka et al. (2004). Shively et al. (2000) introduced a

nonparametric approach to identify latent relationships in

hierarchical choice models.

1.2. Objectives of this study

It is important for retailers to know how sales respond to

price changes. Kalyanam and Shively (1998), van Heerde et

al. (2001) and Martı́nez-Ruiz et al. (2006) have demonstrated in their studies that flexible regression techniques

have the power to uncover complex nonlinearities in price

response. Large improvements in fit and/or predictive

validity from using nonparametric instead of parametric

regression to estimate price effects have been reported in all

three studies. On the other hand, these studies also revealed

that nonparametric regression techniques are very sensitive

and may suffer from too much flexibility leading to

economically implausible results (i.e., nonmonotonic price

response curves). Nonmonotonic shapes for price response

functions are not only a questionable result from an

economic point of view, but also pose serious problems to

marketing managers for related pricing decisions. In this

paper, we show how the problem of nonmonotonicity can

be dealt with without losing the power of flexible

estimation methods. The way we choose is similar to many

applications of conjoint analysis which include the price as

an attribute (e.g., Allenby et al., 1995): we impose

monotonicity constraints on own- and cross-item price

effects. Importantly, imposing monotonicity constraints

does not preclude the estimation of exceptional pricing

effects like steps and kinks at certain price points or

threshold and saturation effects at the extremes of the

observed price ranges.

The remaining part of the paper is organized as follows:

in Section 2, we introduce a semiparametric approach

based on Bayesian P-splines to model own- and cross-price

effects flexibly. We further provide some details about the

MCMC techniques used for estimation; in Section 3, we

illustrate our methodology in an empirical application

using weekly store-level scanner data for eight brands of

refrigerated orange juice offered by a large supermarket

chain. Our results show that the semiparametric model,

ARTICLE IN PRESS

W.J. Steiner et al. / Journal of Retailing and Consumer Services 14 (2007) 383–393

385

Fig. 1. Parametrically (solid line) versus nonparametrically (dashed line) estimated own-price effects. Numbers along the price response curves indicate the

number of times a price level occurred in the data (Kalyanam and Shively, 1998, p. 26).

although constrained to provide monotonic price effects,

outperforms three widely used parametric models in

predictive validity for all but one of the brands; in Section

4, we compare our Bayesian model to a semiparametric

model without monotonicity constraints estimated in a

frequentist (i.e., non-Bayesian) setting with backfitting;

finally, in Section 5, we conclude with a summary of the

key findings of the paper.

(1996) in a frequentist setting. Accordingly, we assume that

an unknown price response function f ij ðPjs;t Þ can be

approximated by a cubic spline with equally spaced knots

within the observed price range. Suppressing brand index i,

store index s and time index t for convenience, we can write

such a spline for the jth price effect in terms of a linear

combination of M j cubic B-spline basis functions Bjm , m ¼

1; . . . ; M j (we refer to De Boor, 2001 as a key reference for

B-splines):

2. Methodology

f j ðPj Þ ¼

2.1. Semiparametric model

J

X

f ij ðPjs;t Þ þ gi Dis;t

j¼1

þ

4

X

di;q W q;t þ is;t ;

bjm Bjm ðPj Þ,

(2)

m¼1

We suggest a semiparametric approach in which we

model a brand’s (log) unit sales as (1) a sum of

nonparametric functions for own- and cross-item price

variables and (2) a parametric function of other variables

(capturing store effects, display effects and seasonal effects):

ln Qis;t ¼ ais þ

Mj

X

is;t Nð0; s2 Þ,

ð1Þ

q¼2

where Qis;t is the unit sales of brand i in store s and week t,

Pjs;t the observed price of brand j in store s and week t, Dis;t

the dummy variable capturing usage (¼ 1) or nonusage

(¼ 0) of a display for brand i in store s and week t, W q;t the

seasonal dummy indicating if week t belongs to the qth

quarter ðq ¼ 2; 3; 4Þ, with spring representing the reference

season, ais the random store effect for brand i accounting

for heterogeneity in baseline sales across different stores,

f ij ðPjs;t Þ the unknown smooth functions for price effects on

unit sales of brand i, referring to own price ð j ¼ iÞ and

prices of competing brands ð jaiÞ, gij the own-display effect

for brand i, diq the seasonal effects for brand i ðq ¼ 2; 3; 4Þ;

and is;t the disturbance term for brand i, store s and week t.

To model own- and cross-price effects flexibly, we follow

Lang and Brezger (2004) who proposed a Bayesian version

of P-splines originally introduced by Eilers and Marx

where bjm denotes the regression coefficient to be estimated

for the mth B-spline basis. Eilers and Marx (1996) have

suggested to use a moderately large number of knots (usually

between 20 and 40) to ensure enough flexibility for the

unknown function on the one hand, and to introduce a

roughness penalty on adjacent regression coefficients bjm to

guarantee sufficient smoothness and to avoid overfitting on

the other hand. The resulting penalized least-squares problem

for the semiparametric model (1) is stated in Appendix A. For

our empirical application presented in Section 3, we use 20

knots for all own- and cross-price effects.

In a Bayesian approach, as considered in this paper, the

unknown regression coefficients bjm (as well as all other

parameters of the semiparametric model (1)) are considered

as random variables and have to be supplemented with

appropriate prior distributions. In our Bayesian model

setting, penalization is accomplished by using a second

order random walk for adjacent regression coefficients:

bjm ¼ 2bj;m1 bj;m2 þ ujm ;

ujm Nð0; t2j Þ.

(3)

The second order random walk is the stochastic analogue

to the second order difference penalty suggested by Eilers

and Marx (1996). The variance parameter t2j controls the

trade-off between flexibility and smoothness of the P-spline

and corresponds to the smoothing parameter in classical

spline regression (compare Appendix A). In Appendix B,

we illustrate with a simulation example how the P-spline

approach works.

ARTICLE IN PRESS

W.J. Steiner et al. / Journal of Retailing and Consumer Services 14 (2007) 383–393

386

2.2. Bayesian estimation

ln Qis;t ¼ ais þ bii Pis;t þ

The main advantage of our Bayesian approach is that

the amount of smoothness for each price effect can be

estimated simultaneously with all other model parameters

by defining an additional hyperprior for the variance

parameters t2j . We assign inverse Gamma IGðaj ; bj Þ

distributions on the variance parameters t2j (and also on

the scale parameter s2 , compare Eq. (1)) with aj ¼ bj ¼

0:001 leading to almost diffuse priors. To obtain monotonicity, i.e., f 0j ðPj Þp0 for own-price response (j ¼ i) and

f 0j ðPj ÞX0 for cross-price response ðjaiÞ, it can be shown

that it is sufficient to guarantee that subsequent parameters

bjm are ordered, such that

bj1 Xbj2 X XbjM

or bj1 pbj2 p pbjM ,

(4)

respectively. These constraints are easily imposed by

introducing indicator functions to truncate the second

order random walk prior (3) appropriately. Finally,

concerning the parametric effects, we assume diffuse priors

for the display and seasonal effects ðgi ; diq Þ and highly

dispersed normal priors for the random store effects ðais Þ.

Estimation of the semiparametric model is fully Bayesian

and uses recently developed MCMC techniques. More

specifically, we subsequently draw from the full conditionals which are all known distributions (i.e., multivariate

normal distributions for both price effects bj , j ¼ 1; . . . ; J,

and store, display and seasonal effects a, g and d; inverse

Gamma distributions for all variance parameters). Technical details on the full conditionals, especially that of the

smooth functions for price effects, the employed Gibbs

sampling scheme and efficient implementation, are available from the authors upon request.

J

X

bij ð1=Pjs;t Þ þ gi Dis;t

j¼1

jai

þ

4

X

di;q W q;t þ is;t ;

is;t Nð0; s2 Þ.

ð7Þ

q¼2

Models (5)–(7) differ from the semiparametric model (1)

only with respect to own- and cross-price effects which are

specified parametrically, too. Model (5) uses a multiplicative (log–log) functional form like the well-known

SCAN*PRO model in its strictly parametric versions (e.g.,

Foekens et al., 1999; Kopalle et al., 1999; van Heerde et al.,

2001, 2002), with bij representing the constant elasticity of

unit sales of brand i with respect to the price of brand j.

Model (6) is a semilog (or exponential) model and has been

used by, e.g., Blattberg and George (1991), Montgomery

(1997) or Kalyanam and Shively (1998). Model (7) follows

Blattberg and Wisniewski (1989) and is semilog in own

price and log-reciprocal in competitive prices (also see

Blattberg and Neslin, 1990; Bemmaor and Mouchoux,

1991). Accordingly, bii corresponds to the own-price effect

of brand i and bij ðjaiÞ to the cross-item price effects. All

three models imply a convex (decreasing) shape for ownprice effects. With respect to cross-price effects, the

multiplicative model (5) allows for both increasing and

decreasing returns to scale (i.e., a convex or concave

shape), the semilog model (6) for increasing returns to scale

(i.e., a convex shape), and the log-reciprocal specification in

(7) for an s-shape. All involved full conditionals in models

(5)–(7) are fully known and can therefore be easily updated

by Gibbs sampling steps, too.

3. Empirical study

3.1. Data

2.3. Benchmark parametric models

To provide a benchmark for the predictive performance

of our semiparametric model, we compare it in our

empirical application to the three most widely used

parametric models for analyzing sales/price response:

ln Qis;t ¼ ais þ

J

X

bij lnðPjs;t Þ þ gi Dis;t

j¼1

þ

4

X

is;t Nð0; s2 Þ,

ð5Þ

is;t Nð0; s2 Þ,

ð6Þ

di;q W q;t þ is;t ;

q¼2

ln Qis;t ¼ ais þ

J

X

bij Pjs;t þ gi Dis;t

j¼1

þ

4

X

q¼2

di;q W q;t þ is;t ;

In this section, we present results from an empirical

application of our Bayesian semiparametric model to

weekly store-level scanner data for eight brands of

refrigerated orange juice offered by Dominick’s Finer

Foods, a major supermarket chain in the Chicago

metropolitan area. The data were provided by the James

M. Kilts Center, GSB, University of Chicago and include

unit sales, retail prices and display activities for these

brands in 81 stores of the chain over a time span of 89

weeks. Table 1 shows summary statistics pooled across the

stores for average, minimum and maximum weekly market

shares, mean prices as well as price ranges of the individual

brands.

Among the brands are 2 premium brands (made from

freshly squeezed oranges), 5 national brands (reconstituted

from frozen orange juice concentrate) and the supermarket’s own private label brand (Dominick’s). The

differences in quality across the three tiers are well

represented by higher (lower) average prices for higher

(lower) quality tier brands as well as by different price

ARTICLE IN PRESS

W.J. Steiner et al. / Journal of Retailing and Consumer Services 14 (2007) 383–393

Table 1

Market shares (%), mean prices and price ranges ($) for brands in the

refrigerated orange juice category

Brand

Average

market

share

Lowest

market

share

Highest

market

share

Mean price

Price range

Tropicana Pure

Florida Natural

15

5

3

1

73

53

2.95

2.86

[1.60; 3.55]

[1.57; 3.16]

Citrus Hill

Minute Maid

Tropicana

Florida Gold

Tree Fresh

8

21

21

4

4

1

3

2

1

1

78

87

75

63

42

2.31

2.23

2.20

2.17

2.15

[1.09;

[1.29;

[1.49;

[0.99;

[1.07;

Dominick’s

22

1

83

1.75

[0.99; 2.47]

2.82]

2.92]

2.75]

2.83]

2.48]

ranges. The weekly market shares of all brands vary

considerably reflecting the high price variation in this

product category.

3.2. Cross-price effects

To account for multicollinearity and for the fact that

cross-price effects are usually much weaker than own-price

effects (see Hanssens et al., 2001 for an overview of

empirical findings), we capture cross-price effects in a more

parsimonious way at the tier level rather than at the

individual brand level: we define price_premiumst as the

lowest price of a premium brand and price_nationalst as the

lowest price of a national brand in store s and week t,

respectively. It is important to note that the price of a

brand i under consideration (i.e., the brand for which a

response model is estimated at a time), is excluded from the

computation of price_premiumst (price_nationalst) if brand i

is a premium (national) brand. For example, if our

semiparametric model or any of the parametric models is

estimated for the national brand Citrus Hill, price_nationalst

represents the lowest price level of either of the four other

national brands (Minute Maid, Tropicana, Florida Gold,

Tree Fresh) in store s and week t. Finally, price_Dominicksst denotes the actual price for Dominick’s, the only

private label brand, in store s and week t. Previous

approaches have modeled competitive effects either in a

much more parsimonious way through the use of a single

competitive variable (e.g., Blattberg and George, 1991;

Kopalle et al., 1999) or by focusing only on a limited

number of major brands in a product category (e.g.,

Kalyanam and Shively, 1998; van Heerde et al., 2001).3

3.3. Predictive validity

We compared the forecasting performance of our

semiparametric model (1) to that of the three parametric

3

In general, there is no need to have only a limited number of

nonparametric terms in our Bayesian semiparametric model in order to

obtain good estimation results.

387

models (5)–(7) in terms of the average mean squared sales

prediction error (AMSE) in validation samples. Specifically, we randomly splitted the data into nine equally sized

subsets and performed nine-fold cross-validation. For each

subset used once for validation, we fitted the respective

model to the remaining eight subsets making up the

estimation sample and calculated the mean squared sales

prediction error (MSE) of the fitted model when applied to

the observations in this holdout subset (Efron and

Tibshirani, 1998). Eventually, we computed the AMSE

measure by averaging the individual MSE values across the

nine holdout subsets. Because we are interested in unit sales

rather than log unit sales of a brand, the conditional mean

predictions from the estimated log-normal models were

obtained as follows (Goldberger, 1968; Greene, 1997):

Q^ is;t ¼ expðln Q^ is;t þ s^ 2i =2Þ,

(8)

where s^ 2i denotes the residual variance of the respective lognormal model and is included to minimize the bias in the

conditional mean predictions due to estimation in the logspace.

3.4. Empirical results

3.4.1. AMSE performance

Table 2 firstly displays the validation results (AMSE

values) for the three parametric models and shows that the

multiplicative model performed best for six of the eight

brands. This finding indicates that the multiplicative model

has its high popularity in price response modeling not only

due to its constant elasticity property. It also offers a

competitive (and for these six brands a higher) forecasting

accuracy compared with other parametric specifications. In

one case, however, the semilog model (for the store brand

Dominick’s) and in another case the semilog/log-reciprocal

model (for the national brand Tropicana) provided the

highest predictive performance.

Table 3 adds the AMSE values we obtained for our

semiparametric model and compares them to those of the

best parametric model (see Table 2). The results indicate a

superior predictive validity of our flexible approach for all

national and premium brands in the refrigerated orange

juice category (i.e., for 7 out of 8 brands), with improvements in AMSE over the best performing parametric

model ranging from 6.6% for Minute Maid and Florida

Natural up to 41.6% for Florida Gold. Importantly, the

improvements in predictive validity were attained despite

enforcing monotonicity on the nonparametrically estimated own- and cross-price effects. We achieved, however,

no improvement for Dominick’s, the retailer’s own store

brand. This implies that flexible estimation of price effects

does not matter for this brand, and that the semiparametric

model here virtually degenerates into the semilog model

(which is nested in our flexible approach). The latter

finding is important, because it demonstrates that nonparametric modeling of price effects need not necessarily

ARTICLE IN PRESS

W.J. Steiner et al. / Journal of Retailing and Consumer Services 14 (2007) 383–393

388

Table 2

Predictive validity (AMSE results) for strictly parametric models

Brand

Multiplicative

model (5)

Semilog

model (6)

Semilog/logreciprocal model (7)

Tropicana Pure

Florida Natural

3.081

728

3.355

895

3.458

911

Citrus Hill

Minute Maid

Tropicana

Florida Gold

Tree Fresh

8.401

2.795

14.012

58.015

7.440

10.538

3.004

13.615

63.875

8.155

10.803

2.972

13.200

64.234

8.395

Dominick’s

103.075

101.381

101.705

Table 3

Predictive validity (AMSE results) for the semiparametric and the best

parametric model

Brand

Semiparametric

model (1)

Best

parametric

model

Improvement

in AMSE

Tropicana Pure

Florida Natural

2.844

680

3.081

728

7.7%

6.6%

Citrus Hill

Minute Maid

Tropicana

Florida Gold

Tree Fresh

5.502

2.612

11.894

33.892

4.637

8.401

2.795

13.200

58.015

7.440

34.5%

6.6%

9.9%

41.6%

37.7%

Dominick’s

102.022

101.381

No

lead to better prediction results than strictly parametric

modeling. The greater flexibility of nonparametric techniques, however, pays off if nonlinear effects in price

response are present that cannot be adequately captured

parametrically. We discuss this issue in more detail below.

3.4.2. Estimated price effects

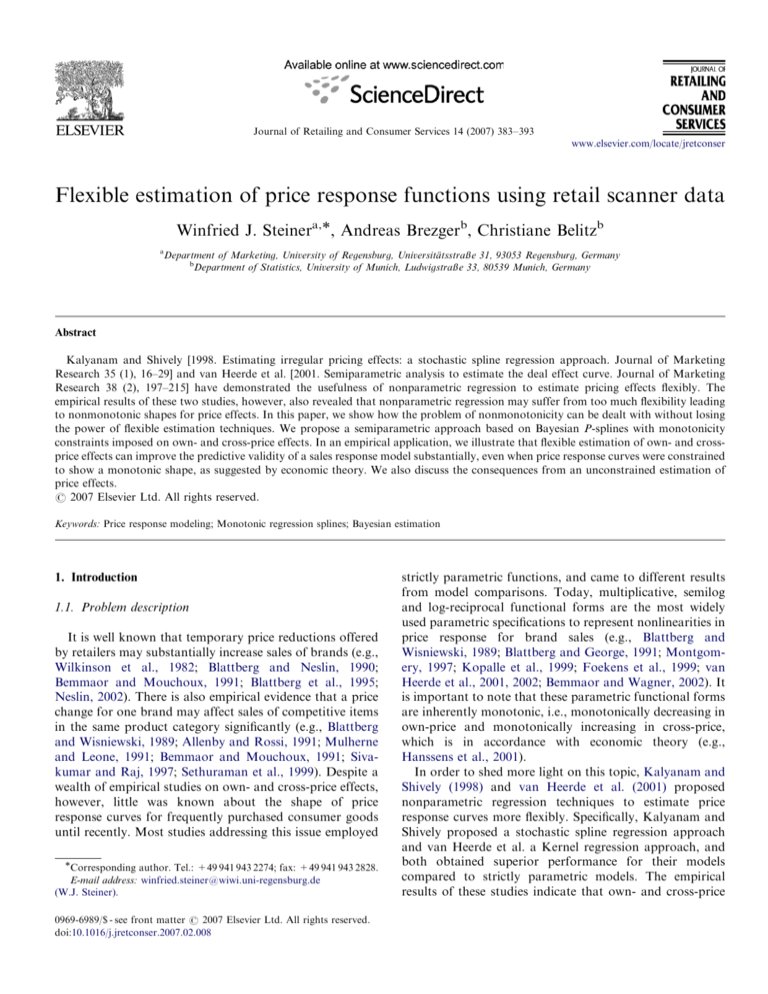

Fig. 2 depicts selected price response curves (with price

on the x-axis and predicted sales on the y-axis) and reveals

why the semiparametric model (1) can provide more

accurate forecasts than the best performing parametric

model. The solid lines represent the flexibly estimated price

effects from our semiparametric model (i.e., the P-splines),

whereas the dashed lines refer to the estimated price effects

with respect to the best performing parametric model

(which is the multiplicative model for the displayed brands,

compare Table 2). Also shown are the 95% pointwise

credible intervals (dotted lines) for the nonparametric price

effects.

Figs. 2a–c show estimated own-price effects for the

national brands Florida Gold, Tree Fresh and Citrus Hill,

which are the three brands with the most noticeable

improvements in predictive validity from flexible estimation of price effects. All three nonparametric own-price

response curves show an L-shape indicating a threshold

level beyond which unit sales rapidly increase for still lower

prices, while the multiplicative model yields an exponential

price response curve. For Florida Gold, the strong sales

spike can be attributed to an odd pricing effect at 99 cents,

the lowest observed price for this brand. The threshold

levels occur at rather low price levels implying that these

brands can increase its sales significantly only by setting

very low prices. The multiplicative model, in contrast,

dramatically understates the sales effect for low prices. The

estimated P-spline for the premium brand Florida Natural

(see Fig. 2d) shows a reverse s-shape with a threshold effect

around 2.00$ and further indicates a saturation effect at the

lowest observed prices. The estimated own-price effects for

the second premium brand Tropicana Pure (not shown

here) are quite similar to those of Florida Natural. The

differences between the nonparametric and the best

parametric own-price response curves for the national

brands Minute Maid and Tropicana and for the store

brand Dominick’s are much less distinct.

Figs. 2e–g illustrate selected cross-price effects for the

brands Tree Fresh, Minute Maid and Florida Gold with

respect to competing items in the national brand tier. The

nonparametric curves show a reverse L-shape (indicating a

saturation effect for prices below a certain price level) or a

mixture of an s- and reverse L-shape. For example, if one

of the competing national brands Citrus Hill, Minute

Maid, Tropicana or Florida Gold only slightly decreases its

price, unit sales of Tree Fresh strongly decrease (compare

Fig. 2e). Noticeably, the nonparametric curve lies above

the parametric curve for high(er) price levels for all three

national brands. The nonparametric cross-price effect for

the premium brand Tropicana Pure with respect to its

direct competitor Florida Natural, the other premium

brand, shows an s-shape indicating both a threshold and a

saturation effect (compare Fig. 2h). In general, cross-price

effects turn out to be weaker than own-price effects, as

becomes evident from the predicted sales numbers on the yaxis in Fig. 2.

All estimated own- and cross-price effects of the best

performing parametric models were significant at 5%. The

display effects for the premium brand Florida Natural, for

the national brand Minute Maid and the store brand

Dominick’s are not significant, while the display effects for

the brands Citrus Hill, Tropicana, Florida Gold Gold and

Tree Fresh are significant at 5% and show the expected

sign. The display effect for the premium brand Tropicana

Pure shows the wrong sign. However, this effect is near

zero (0.04) and hence probably due to chance.

3.4.3. Price elasticities

It is also important to note that the semiparametric

model provides different managerial insights with regard to

price elasticities. Table 4 reports own-price elasticities for

Citrus Hill, Florida Gold, and Tree Fresh, the brands with

the largest improvements in predictive validity from our

semiparametric model. The best performing parametric

ARTICLE IN PRESS

W.J. Steiner et al. / Journal of Retailing and Consumer Services 14 (2007) 383–393

389

Fig. 2. Estimated price effects from the semiparametric model (solid lines) and the best performing parametric model (dashed lines). Dotted lines indicate

the 95% pointwise credible intervals for the P-splines.

model for these brands has been the multiplicative model

which is characterized by a constant elasticity over the

entire price range. Shown are separate elasticity measures

for low, medium and high price levels of these brands.

Importantly, the differences are very large for low prices of

Citrus Hill and Florida Gold, where the semiparametric

model suggests a much higher elasticity than its parametric

counterpart. For high prices, the semiparametric model

suggests a noticeably lower elasticity than the multiplicative model for all three brands.

3.4.4. Unconstrained estimation

In order to assess the impact of the monotonicity

constraints, we also compared our results to those obtained

ARTICLE IN PRESS

W.J. Steiner et al. / Journal of Retailing and Consumer Services 14 (2007) 383–393

390

Table 4

Estimated own-price elasticities from the semiparametric and the best

parametric model

Brand

Semiparametric model

Price ranges

p1.5 $ [1.5;2.5] $ 42.5 $ p1.5 $ [1.5;2.5] $ 4 2.5$

Citrus Hill

6.65

Florida Gold 9.15

Tree Fresh

2.94

2.05

3.87

1.71

3.04

2.35

0.89

Multiplicative model

3.60

3.75

2.28

3.60

3.75

2.28

3.60

3.75

2.28

from an unconstrained semiparametric model estimated in

a frequentist setting like the van Heerde et al. (2001) model.

Specifically, we estimated a non-Bayesian version of our

semiparametric model (1) without monotonicity constraints using the backfitting algorithm (also compare

Appendix A). In this case, the amount of smoothness of

each price effect can no longer be estimated simultaneously

with all other model parameters. Details on the estimation

procedure, which uses the improved AIC criterion for

smoothing parameter selection, can be obtained from the

authors upon request.

Fig. 3 shows three selected price effects as representative

examples from the estimation of the unconstrained

semiparametric model. Fig. 3a refers to the unrestricted

own-price effect for the premium brand Florida Natural

and reveals a strong nonmonotonic downward kink in sales

response in the lower range of the observed prices for this

brand. Fig. 3b displays the own-price effect for the national

brand Minute Maid and also indicates a sharp decrease in

unit sales as price becomes very low. These nonmonotonicities are similar to that reported by van Heerde et al.

(2001) and are difficult to interpret from an economic point

of view. At first glance, one explanation may be that

consumers associate a loss in quality with very low price

levels, but this argument seems very questionable with

frequently purchased consumer nondurables (like orange

juice brands). In addition, the constrained semiparametric

model suggests a somewhat lower predictive validity for the

brand Florida Natural, as compared to the semiparametric

model with monotonicity constraints (also see below). The

own-price effect for Minute Maid further shows some local

upturns and downturns in the medium price range. Fig. 3c

illustrates the cross-price effect for the brand Tree Fresh

with respect to competing items in the national brand tier.

The curve is also rather unsmooth and exhibits a strong

nonmonotonic effect near the upper bound of the price

range. Accordingly, unit sales of Tree Fresh increase with a

decreasing competitive price in this price area. There is no

(economic) rationale for a meaningful interpretation of this

pattern.

Nearly all price effects estimated by the unconstrained

model suffer from nonmonotonicities and impose serious

problems for interpretation and managerial implications.

There is a tendency that cross-price effects turn out to be

less smooth (i.e., showing more local upturns and down-

Fig. 3. Estimated price effects from the unconstrained semiparametric

model.

turns) than own-price effects from an unconstrained

estimation.

The results for the unconstrained semiparametric model

with respect to predictive validity are comparable to those

of our constrained semiparametric model for most of the

ARTICLE IN PRESS

W.J. Steiner et al. / Journal of Retailing and Consumer Services 14 (2007) 383–393

brands. The AMSE value is slightly worse for Dominick’s

and Florida Natural, virtually identical for Florida Gold,

and somewhat better for the other five brands. Importantly, for Citrus Hill, Tree Fresh and Florida Gold, the

three brands which benefit most from nonparametric

estimation, the difference between the unconstrained and

constrained semiparametric models in relative improvement in AMSE over the best performing parametric model

is at most 3.3%.

4. Conclusions

We proposed a new semiparametric model embedded in

a Bayesian framework to predict retail sales. Our results

from an empirical application based on retail scanner data

for brands of orange juice showed that flexible estimation

of price response functions can improve the predictive

validity of a sales response model substantially, even when

the price effects were restricted to have a monotonic shape,

as suggested by economic theory. Specifically, we obtained

a higher predictive accuracy for our semiparametric model

compared to three widely used parametric models for 7 out

of 8 brands. Interestingly, flexible estimation of price

effects offered no advantage over the best parametric

model for the retailer’s own store brand. We also compared

our Bayesian model to a semiparametric model without

monotonicity constraints estimated in a frequentist (i.e.,

non-Bayesian) setting using the backfitting algorithm. The

results indicated a similar predictive performance of both

models for most of the brands. However, nearly all

unrestrictedly estimated price effects revealed strong

nonmonotonicities, which are not in accordance with

economic theory and are likely to represent an artifact

caused by too much flexibility of the unconstrained

semiparametric model.

Acknowledgments

The data for our empirical study was provided by the

James M. Kilts Center, GSB, University of Chicago. We

thank Stefan Lang for his idea to visualize how the Psplines approach works.

Appendix A

A.1. Penalized least-squares problem

Let vn denote the vector of all parametric effects of the

semiparametric model (1) for the nth observation and let

index j cover all smooth functions for own- and cross-price

effects, this leads to the following penalized least-squares

criterion (suppressing brand index i, store index s and time

index t):

N

X

n¼1

yn J

X

!2

f j ðPjn Þ vTn z

j¼1

þ

391

J

X

j¼1

lj

Mj

X

ðDðkÞ bjm Þ2 ,

m¼kþ1

(A.1)

where N is the sample size (number of stores times number

of weeks), DðkÞ the differences of order k between adjacent

regression coefficients bjm , and lj the smoothing parameter

for price response curve f j ðPj Þ.

Frequently, as suggested by Eilers and Marx (1996), a

second order difference penalty Dð2Þ bjm ¼ bjm 2bj;m1 þ

bj;m2 is used. The penalized sum of squared residuals (A.1)

is minimized with respect to the unknown regression

coefficients bjm and z. The trade-off between flexibility

and smoothness for price effect j is controlled by the

smoothing parameter lj ðj ¼ 1; . . . JÞ. In a non-Bayesian

setting, estimation of the semiparametric model (1) given

the smoothing parameters can be carried out with backfitting (Hastie and Tibshirani, 1990). ‘‘Optimal’’ smoothing

parameter selection is typically performed via cross

validation or by minimizing an information criterion with

respect to predetermined values lj ðj ¼ 1; . . . JÞ.

A.2. Illustration of P-splines

Fig. 4 gives an illustration how the P-splines approach

works: (a) suppose you know the true shape of a response

function with respect to an independent variable x within

the range from 3 to þ3 (solid line) and you generate 100

observations by adding a random error term. The objective

is to re-estimate the curve based on this simulated data with

a cubic P-spline. In a first step, using cubic B-splines as

basis functions, the spline can be stated in terms of a linear

combination of M of those P

B-spline basis functions

Bm ðm ¼ 1; . . . ; MÞ as f ðxÞ ¼ M

m¼1 bm Bm ðxÞ (compare

Eq. (2)). (b) A moderately large number of knots is chosen

to divide the domain of x into equidistant intervals, and

cubic B-splines are constructed around the knots. (c)

Estimating the unknown regression coefficients Bm ðj ¼

1; . . . ; MÞ from the data implies nothing else than weighting

each of the B-spline basis functions Bm accordingly. (d) The

estimated function value f(x) of the spline is obtained by

simply adding up the values of all overlapping basis

functions at position

x (i.e., by computing the linear

PM

combination

m¼1 bm Bm ðxÞ). However, the estimated

spline (dotted line), although approximating the true

function (solid line) quite well, obviously suffers from

overfitting which is reflected by a rather ‘‘wiggly’’

(unsmooth) curve. This overfitting is the result of not

having incorporated a roughness penalty on adjacent

regression coefficients. (e) By using a second order random

walk to penalize differences between regression coefficients

(compare Eq. (3)), adjacent B-spline basis functions Bm are

coupled and, as a result, come closer to each other in

magnitude. (f) The estimated P(enalized)-spline is now

much more smooth and approximates the true function

still better compared to the unpenalized estimation.

ARTICLE IN PRESS

W.J. Steiner et al. / Journal of Retailing and Consumer Services 14 (2007) 383–393

392

B-spline basis functions

true shape and simulated observations

0.7

1.3

0.9

0.53

0.5

0.35

0.1

-0.3

0.18

-0.7

0

-1.1

-3

-1.8

-0.6

0.6

1.8

3

-4.7

-3.2

-1.7

-0.2

x

1.3

2.8

4.3

x

estimated B-spline (unpenalized)

weighted B-spline basis functions

0.7

1.3

0.9

0.35

0.5

0

0.1

-0.3

-0.35

-0.7

-0.7

-1.1

-3

-2

-1

0

1

2

3

-3

-1.8

-0.6

x

0.6

1.8

3

x

optimal smoothing

estimated P-spline (penalized)

0.7

1.3

0.9

0.35

0.5

0

0.1

-0.3

-0.35

-0.7

-1.1

-0.7

-3

-2

-1

0

1

2

3

-3

-1.8

x

-0.6

0.6

1.8

3

x

Fig. 4. How the P-splines approach works.

References

Abe, M., 1999. A generalized additive model for discrete choice data.

Journal of Business & Economic Statistics 17, 271–284.

Allenby, G.M., Rossi, P.E., 1991. Quality perceptions and asymmetric

switching between brands. Marketing Science 10 (3), 185–204.

Allenby, G.M., Arora, N., Ginter, J.L., 1995. Incorporating prior

knowledge into the analysis of conjoint studies. Journal of Marketing

Research 32, 152–162.

Bemmaor, A.C., Mouchoux, D., 1991. Measuring the short-term effect of

in-store promotion and retail advertising on brand sales. A factorial

experiment. Journal of Marketing Research 28 (2), 202–214.

Bemmaor, A.C., Wagner, U., 2002. Estimating market-level multiplicative

models of promotion effects with linearly aggregated data: a

parametric approach. In: Franses, P.H., Montgomery, A.L. (Eds.),

Advances in Econometrics, vol. 16, Econometric Models in Marketing.

Bentz, Y., Merunka, D., 2000. Neural networks and the multinomial logit

for brand choice modelling: a hybrid approach. Journal of Forecasting

19, 177–200.

Briesch, R.A., Chintagunta, P., Matzkin, R.L., 2002. Semiparametric

estimation of brand choice behavior. Journal of the American

Statistical Association 97, 973–982.

Blattberg, R.C., George, E.I., 1991. Shrinkage estimation of price and

promotional elasticities. Journal of the American Statistical Association 86 (414), 304–315.

Blattberg, R.C., Neslin, S.A., 1990. Sales Promotion: Concepts, Methods,

and Strategies. Englewood Cliffs, NJ.

Blattberg, R.C., Wisniewski, K.J., 1989. Price-induced patterns of

competition. Marketing Science 8 (4), 291–309.

Blattberg, R.C., Briesch, R., Fox, E.J., 1995. How promotions work.

Marketing Science 14 (3 Part 2), G122–G132.

Bucklin, R.E., Gupta, S., 1999. Commercial use of UPC scanner data:

industry and academic perspectives. Marketing Science 18 (3),

247–273.

De Boor, C., 2001. A Practical Guide to Splines, revised ed. Springer,

New York.

Efron, B., Tibshirani, R.J., 1998. An Introduction to the Bootstrap.

Chapman & Hall, CRC, London, Boca Raton.

ARTICLE IN PRESS

W.J. Steiner et al. / Journal of Retailing and Consumer Services 14 (2007) 383–393

Eilers, P.H.C., Marx, B.D., 1996. Flexible smoothing using B-splines and

penalized likelihood (with comments and rejoinder). Statistical Science

11 (2), 89–121.

Foekens, E.W., Leeflang, P.S.H., Wittink, D.R., 1999. Varying parameter

models to accommodate dynamic promotion effects. Journal of

Econometrics 89, 249–268.

Goldberger, A., 1968. The interpretation and estimation of Cobb–Douglas

functions. Econometrica 35, 464–472.

Greene, W., 1997. Econometric Analysis. Prentice-Hall, New Jersey.

Gupta, S., Cooper, L., 1992. The discounting of discounts and promotion

thresholds. Journal of Consumer Research 19, 401–411.

Hanssens, D.M., Parsons, L.J., Schultz, R.L., 2001. Market Response

Models—Econometric and Time Series Analysis. Chapman & Hall,

London.

Hastie, T., Tibshirani, R.J., 1990. Generalized Additive Models. Chapman

& Hall, London.

Hruschka, H., 2001. An artificial neural net attraction model (ANNAM)

to analyze market share eects of marketing instruments. Schmalenbach

Business Review 53, 27–40.

Hruschka, H., 2002. Market share analysis using semi-parametric

attraction models. European Journal of Operational Research 138,

212–225.

Hruschka, H., Fettes, W., Probst, M., 2004. An empirical comparison of

the validity of a neural net based multinomial logit choice model to

alternative model specifications. European Journal of Operational

Research 159, 166–180.

Kalyanam, K., Shively, T.S., 1998. Estimating irregular pricing effects: a

stochastic spline regression approach. Journal of Marketing Research

35 (1), 16–29.

Kopalle, P.K., Mela, C.F., Marsh, L., 1999. The dynamic effect of

discounting on sales: empirical analysis and normative pricing

implications. Marketing Science 18 (3), 317–332.

Lang, S., Brezger, A., 2004. Bayesian p-splines. Journal of Computational

and Graphical Statistics 13, 183–212.

393

Marı́tnez-Ruiz, M.P., Mollá-Descals, A., Gómez-Borja, M.A., RojoÁlvarez, J.L., 2006. Using daily store-level data to understand price

promotion effects in a semiparametric regression model. Journal of

Retailing and Consumer Services 13 (3), 193–204.

Montgomery, A.L., 1997. Creating micro-marketing pricing strategies

using supermarket scanner data. Marketing Science 16 (4), 315–337.

Mulherne, F.J., Leone, R.P., 1991. Implicit price bundling of retail

products: a multiproduct approach to maximizing store profitability.

Journal of Marketing 55 (4), 63–76.

Neslin, S.A., 2002. Sales Promotion. Marketing Science Institute, Cambridge, MA.

Sethuraman, R., Srinivasan, V., Kim, D., 1999. Asymmetric and

neighborhood cross-price effects: some empirical generalizations.

Marketing Science 18 (1), 23–41.

Shively, T.S., Allenby, G.M., Kohn, R., 2000. A nonparametric approach

to identifying latent relationships in hierarchical models. Marketing

Science 19, 149–162.

Sivakumar, K., Raj, S.P., 1997. Quality tier competition: how price change

influences brand choice and category choice. Journal of Marketing 61

(3), 71–84.

van Heerde, H.J., Leeflang, P.S.H., Wittink, D.R., 2001. Semiparametric

analysis to estimate the deal effect curve. Journal of Marketing

Research 38 (2), 197–215.

van Heerde, H.J., Leeflang, P.S.H., Wittink, D.R., 2002. How promotions

work: SCAN*PRO-based evolutionary model building. Schmalenbach

Business Review 54, 198–220.

van Heerde, H.J., Leeflang, P.S.H., Wittink, D.R., 2004. Decomposing the

sales promotion bump with store data. Marketing Science 23 (3),

317–334.

Wilkinson, J.B., Mason, J.B., Paksoy, C.H., 1982. Assessing the impact of

short-term supermarket strategy variables. Journal of Marketing

Research 19 (1), 72–86.