Associate - CILA/The Chartered Institute of Loss Adjusters

advertisement

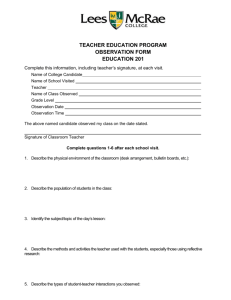

The Chartered Institute of Loss Adjusters THE CLAIMS INSTITUTE ASSOCIATESHIP HANDBOOK 2015 1 The objectives of the Institute are set out in its Royal Charter. Amongst these objectives are the advancement of the study of the promotion of the efficiency and usefulness of the profession by observance of strict rules of professional conduct by members of the Institute and by establishing high standards of education and training. The CILA is an equal opportunities institute and accordingly prohibits any discrimination in terms of sex, disability, religion, sexuality or age. The CILA Examinations are regulated by the CILA Council and the Examinations Committee of the CILA. Superseding all previous handbooks - January 2015 The Chartered Institute of Loss Adjusters 51-55 Gresham Street London EC2V 7HQ Tel: 020 7216 7580 Fax: 020 7216 7581 Email: info@cila.co.uk www.cila.co.uk 2 Contents Introduction ........................................................................................................................................................................ 5 Interview Option of ACS .................................................................................................................................................. 5 Written Option of ACS .................................................................................................................................................... 5 Election to Membership as an Associate ........................................................................................................................ 5 Prizes ............................................................................................................................................................................... 5 Accreditation for Chartered Status (ACS) ........................................................................................................................... 6 Assessment Criteria Interview Option & Written Option ............................................................................................... 6 Technically Correct.......................................................................................................................................................... 6 Informed Decision Making .............................................................................................................................................. 6 Effective Claim Management .......................................................................................................................................... 7 Effective Communication ................................................................................................................................................ 7 Eligibility .......................................................................................................................................................................... 7 Enrolment ....................................................................................................................................................................... 7 Date of ACS Examination ................................................................................................................................................ 8 Fees ................................................................................................................................................................................. 8 Withdrawal from the Examination ................................................................................................................................. 8 Liability of the Institute ................................................................................................................................................... 8 ACS Marking Structure ........................................................................................................................................................ 9 Results ........................................................................................................................................................................... 10 When the Candidate Fails ............................................................................................................................................. 10 Examination Option .......................................................................................................................................................... 11 Results .......................................................................................................................................................................... 11 Appeals .......................................................................................................................................................................... 11 Position for Overseas Candidates ................................................................................................................................. 11 Written Option .............................................................................................................................................................. 11 ACS Format.................................................................................................................................................................... 12 Critical Analysis of Summary of Experience Content .................................................................................................... 12 ACS Summary of Experience – Interview Option .......................................................................................................... 13 ACS Law & Practice ....................................................................................................................................................... 13 3 The Accreditation – Interview Option........................................................................................................................... 14 ACS Presentation........................................................................................................................................................... 14 ACS Interview ................................................................................................................................................................ 14 The Accreditation Panel ................................................................................................................................................ 14 Monitoring .................................................................................................................................................................... 15 Guidance Notes to Candidates for Accreditation ............................................................................................................. 15 Critical Analysis ............................................................................................................................................................. 15 Key Issues ...................................................................................................................................................................... 17 Options .......................................................................................................................................................................... 17 The Proposed Solution .................................................................................................................................................. 17 Critical Appraisal and Analysis of Experience ................................................................................................................ 17 Confidentiality ............................................................................................................................................................... 18 References .................................................................................................................................................................... 18 Presentation – Interview Option................................................................................................................................... 18 Interview ....................................................................................................................................................................... 19 Fail ................................................................................................................................................................................. 19 Accreditation for Chartered Status – Assessment Report ................................................................................................ 20 ACS – Written Option .................................................................................................................................................... 21 Scenario Based Question .............................................................................................................................................. 21 Example Commercial Property Scenario Based Question ............................................................................................ 21 4 Introduction The Associateship examination is made up of two components, which together can be used to apply for the Membership of the CILA as an Associate. The first component is the Advance Diploma (see separate handbook). The second component is the Accreditation for Chartered Status (ACS). The CILA has two options for sitting the ACS Examinations, an interview option and a written option. Interview Option of ACS This entails the candidate submitting a Critical Analysis and a Summary of Experience and attending a professional interview with two Chartered Loss Adjusters, where the submitted documents will form the basis of the interview. Written Option of ACS This entails the candidate submitting a Critical Analysis that will be marked independently as a standalone document. In addition the candidate will sit a 3½hr written paper that can be taken twice a year in April and October. A pass is required for both the written ACS and the written paper. Election to Membership as an Associate A person shall be eligible for admission as an Associate or as a Certified member of the Institute if he/she has: i ii has acquired the Advance Diploma. shown that he/she has at least 5 years experience as an independent loss adjuster (reduced to 3 years if he/she holds one of the professional qualifications approved by the Institute) and passed the Accreditation for Chartered Status (ACS). iii Candidates seeking admission as Associates of the Institute must comply with the regulations as set out in the Charter or have been granted dispensation by Council under the terms of the EC Directive on Mutual Recognition. Prizes Prizes are awarded to the candidate achieving the best results in one examination session subject to the Examination Committee’s approval. The available prizes are: The Cuthbert Buckle Prize The Institute Prize 5 Accreditation for Chartered Status (ACS) The Accreditation for Chartered Status (ACS) is the method by which the CILA ensure that those who have the appropriate level of competence to carry out the work as a professionally qualified loss adjuster on behalf of clients or an employer are admitted as Associates of the Institute. Assessment Criteria Interview Option & Written Option The assessment criteria for the ACS are detailed below; however, the CILA are seeking to ensure that the candidate can operate unsupervised in an effective, competent and professional manner. Technically Correct Knowledge and practices are technically up to date Is up to date with current law and practice (legislation, case law, arbitration, mediation, regulation and market practice) Demonstrates sound practical application of technical knowledge Displays breadth and depth of professional experience in their chosen discipline Exhibits business knowledge and understanding, business acumen and commercial awareness Is aware of the professional and commercial implications of their work Relevant areas of knowledge: o Hazards that affect the risk o Material facts o Proximate cause o Policy liability issues, including warranties o Extent of cover o Subrogation o Contribution o Fraud o Underinsurance Informed decision-making Gathers relevant facts and information – detailed, relevant to the claim, timely and accurate Consideration of issues continues throughout the life of the claim as details unravel Identifies key issues and problems Analyses facts to consider suitable options Validates assumptions – information challenged rather than accepted at face value Justified use of specialists and experts Exhibits logical thought processes – the final decisions/proposals flow logically from consideration of the available options Makes reasoned judgements on policy liability and the extent of cover Assesses correctly the extent of damage/injury/loss caused by the insured peril Validates the loss under the claim by collecting sufficient evidence/information Clearly identifies and explains the all the available options to deal with the key issues 6 Effective claim management Plans, organises and monitors the claim in a timely manner. Negotiates and agrees settlement effectively Identifies ways to mitigate the loss and takes the appropriate, justifiable action Shows an awareness of fraud and investigates as appropriate Sets the reserve accurately and updates it throughout the life of the claim Manages relationships and expectations with client, broker, policyholder, third parties Liaises and agrees course of action with client, as appropriate. Uses administrative skills to manage a portfolio of claims to achieve accurate and timely claims settlements Acts within CILA Rules of Conduct and general professional ethics Effective communication Oral: (Interview Option) o Confident body language and positive interaction with Panel. o Material is well prepared and presented in a logical, signposted manner Written: o Well-presented, clear, neat and professional o Correct use of English, including spelling, grammar, punctuation – Plain English rules apply o Logically-structured with appropriate use of headings Impact – establishes a rapport with the panel, using body language and positive interaction Handles questions well, using active listening, answering confidently and admitting any gaps in knowledge. Influencing skills – uses appropriate styles and strategies to win co-operation from all parties and gain their commitment. Provides a clear rationale for their decisions Is assertive and convincing in the role of a loss adjuster. Ambassador for the profession Eligibility Candidates must have completed the Advanced Diploma before undertaking the ACS. Enrolment Candidates must apply to the Institute, by completing the application form available from www.cila.co.uk sending this to the Institute and making the appropriate payment. The Institute will check that eligibility requirements have been met and will notify the candidate of their acceptance or otherwise to the accreditation process within one month. At this time the candidate will be asked to state their chosen discipline and to submit their Critical Analysis and/or Summary of Experience, by e-mail, to the Institute within one month of the acceptance. 7 Where the interview option is chosen CILA reserve the right to review the Critical Analysis and Summary of Experience before arranging a panel, to ensure the submission meets the standard set out in the Objectives above. Should the submission not be acceptable the candidate will be asked to resubmit an amended/new submission. The Candidate will be asked for dates that they are available and a panel will be organised that has a suitable level of knowledge in the chosen discipline. Conflicts of interest will be avoided. Date of ACS Examination The interview option: ACS examinations are held anytime throughout the year at the candidate’s convenience, subject to the availability of suitable Accreditation Panel. The Candidate should liaise with the CILA to arrange an ACS. The Written option ACS: The Critical Analysis can be submitted at any stage, although the written examination is available to be taken in April and October. Candidates must also complete and forward to the Institute an official entry form downloaded from the Institute’s website - www.cila.co.uk, together with the entry fee, no later than 31st January for the April examinations and 31st July for the October examinations. Fees The entry fee is £150 for the ACS examination, payable on the submission of an examination entry form. Withdrawal from the Examination If after the payment of the entry fee a candidate withdraws or is absent from the examination, no part of the fee will be returned. At the Institute’s discretion a credit for the fee may be carried forward. Candidates are advised to notify the Institute at their earliest opportunity that they intend to withdraw, and include an explanation for consideration by the Institute as to whether the fee can be credited to a future sitting of the examination. Changes of examination centre or the subjects to be taken will be considered but the Institute is unable to guarantee that changes will be possible. Candidates are recommended to submit requests for alterations at least six weeks prior to the examinations. Liability of the Institute If the Institute, for reasons outside its control, should find it impossible to hold any of its scheduled examinations, or if a candidate’s completed examination script be lost or destroyed, the Institute’s liability shall be limited to a complete refund of the examination fee paid in respect of the examination concerned. 8 ACS Marking Structure Interview Option: In making their assessment the Accreditation Panel will take a holistic view of the candidate’s performance. However the Critical Analysis and the Summary of Experience will be judged together. Candidates will be marked in line with the table below with regard to each core competence:Grade Technically Correct Distinction Always displays indepth knowledge across specialised and general areas. Clear evidence of independent thinking and study. Easily applied theory knowledge to practical situations Pass Mostly displays knowledge across specialised and general areas. Some evidence of independent thinking and study. Able to apply theory knowledge to practical situations Marginal Fail Sometimes displays some knowledge that is inadequate and sometimes out of date, but not in a key technical area. Evidence of independent thinking or study, but somewhat thin. Occasional difficulty in applying theory knowledge to practical situations Rarely displays up to date knowledge in specialised and/or general areas. Little or no evidence of independent thinking or study. Unable to apply theory knowledge to practical situations. Fundamental misunderstanding of key crucial element of key claims handling issues. Fail Informed Decision Making Always deals highly effectively with complexity, contradictions and incomplete data. Can analyse, reason and identify alternative options. Exhibits sound judgement and gives clear justifications. Mostly deals effectively with complexity, contradictions and incomplete data. Can analyse, reason and identify alternative options. Exhibits sound judgement and gives clear justifications. Sometimes dealt effectively with complexity, contradictions and incomplete data. Some weakness in the ability to analyse, reason and identify alternative options. Judgement occasionally unsound or with poor justification. Effective Claim Management Always displays highly effective planning, organisation and monitoring of the claim, in a timely manner. Good at identifying and delivering ways of reducing the cost of the claim to the client. Sees the whole picture and delights all parties. Mostly displays effective and timely planning, organisation and monitoring of the claim. Identifies and delivers ways of reducing the cost of the claim to the client. Sees the whole picture and satisfies all parties. Effective Communication Always communicates their work highly effectively, both orally and using the written word. Sometimes some aspects of planning, organisation or monitoring of the claim inadequate or behind time. Missed some minor ways of reducing the cost of the claim to the client. Occasionally focussed on one party to the detriment of another. Sometimes showed they can communicate their work effectively, both orally and using the written word, but some minor aspects detracted from the message. Rarely deals with complexity. Displays contradictions and incomplete data. Did not analyse, reason and identify alternative options. Exhibits poor judgement and unable to give clear justifications. Inadequate planning, organisation and monitoring of the claim or behind time. Misses ways of reducing the cost of the claim to the client. Does not see the big picture - fails to satisfy all parties Rarely able to communicate effectively, either orally or using the written word. Style, use of English or lack of structure detracts from the message. 9 Mostly effectively communicates their work, both orally and using the written word. An overall decision will be made of the candidate’s pre-accreditation submissions, the presentation and the interview. Marginal under-achievement in one area may be balanced by a distinction elsewhere. However in view of the fact that the candidate’s Critical Analysis and Summary of Experience are not prepared under examination conditions, technical and literary accuracy and a high standard of presentation will be expected. Should a candidate fail in any one of the four core competence or receive two marginal fails then the candidate will fail the ACS. Adjudicators have to be satisfied that the candidate has received reasonably balanced professional training and experience and possesses the communication skills, both oral and written, of a professionally competent loss adjuster. Successful candidates will be eligible for election to the class of Associate of the Institute. Results Results will be sent to the candidate’s correspondence address within 21 days after the interview. When the candidate fails In the event that the candidate fails to satisfy the panel the candidate will receive a report giving the reasons for the decision and advice to assist the candidate to prepare for a future accreditation application. The Accreditation Panel will in the report advise the candidate on what he/she will need to submit to the Institute in the event that the candidate wishes to seek re-accreditation. Candidates seeking re-accreditation may apply to the Institute and will need to submit to the Institute: A plan in no more than 500 words of how the candidate proposes to address the deficiencies in the Fail report and, A new 3000 word Critical Analysis or if recommended, re-submit the original Analysis suitably amended and updated and/or Submit a revised Summary of Experience. In the event of the candidate being referred on the Critical Analysis a new ten minute presentation will be necessary. A further fee of £150 is required to re-sit the ACS. 10 Examination Option: Results The CILA Council will communicate the results of the written examinations to candidates. The marks required for a pass in any paper of the examination will be 60% of the maximum marks. Although the marks awarded will not be revealed an indication will be given to the candidate of the degree of his success or failure by use of the following code: D = Distinction P = Pass X = Fail Y = Fail Z = Fail A = Absent (75% - 100% of the maximum marks) (60% - 74% of the maximum marks) (50% - 59% of the maximum marks) (40% - 49% of the maximum marks) (0% - 39% of the maximum marks) Appeals Interview Option: An unsuccessful candidate may lodge an appeal with the Institute within 30 days of receiving the result. A fee of £150 will be charged (which is refundable in the event of the appeal being upheld). The candidate will need to outline in no more than 500 words the reasons why he/she feels the result was incorrect. This submission together with the candidate’s original Critical Analysis and Summary of Experience will then go before an Appeals Committee comprising two chartered members representing the Institute and one chartered member nominated by the appellant, none of whom was a member of the Accreditation Panel that referred the candidate. The Appeals Committee reserves the right to interview the appellant and/or the Chairman/Adjudicators of the original Accreditation Panel. The appellant will receive a written report of the Appeals Committee giving its decision on the application. The decision of the Appeals Committee will be final. Position for Overseas Candidates Overseas candidates will follow the same paths as detailed above. Regional training will be given to adjudicators for the Accreditation Panels. The same Appeals procedure will apply with regard to the decision of the Accreditation Panels. Written Option: Appeals will only be considered from candidates who gained an X fail and within one month of the publication of results. The appeal must be in writing and accompanied by a payment of £100. No appeal will be considered without both criteria being met. Following an appeal the decision of Council on the examination result is final. The Institute will endeavour to provide the appealed result within 28 days. The fee is non-refundable. 11 ACS Format Critical Analysis - Background The choice of disciplines for the Critical Analysis are: Property Claims Subsidence Claims Theft Claims Business Interruption Claims Employers’ Liability, Public Liability & Product Liability Claims Contractors All Risks (Material damage) Claims Specialist e.g., Agriculture/Fraud/Fidelity Guarantee The Critical Analysis will be used: to assess to assess to assess to assess to assess the breadth and depth of the Candidate’s professional experience in the chosen speciality, the candidate’s written communication skills, the candidate’s claim management skills, the candidate’s decision making ability the candidate’s critical appraisal of the claim analysed The Critical Analysis should be a word processed document of no more than 3000 words relating to the resolution of a loss extensively handled by the candidate. The total number of words must be shown at the end of the document. Critical Analysis of Summary of Experience Content Care must be taken to protect the confidentiality of all the parties to the case and the identity of the subject property. The choice of topic is important. The candidate may be working for a large company and been involved with an instruction of complexity size or importance in which the candidate’s role and contribution could be appropriate. Alternatively the instruction may not be too complicated or of great value. It may simply be typical of the type of work with which the candidate has been involved during his training period. This could equally be a suitable topic. The candidate may wish to choose an issue or aspect of their work which is common to a number of cases with which he/she has been involved as the core of the Critical Analysis as opposed to the case itself. It is not expected that the candidate will be an expert in every area of professional activity. The CILA will be seeking a demonstration of a satisfactory level of competence in key areas, subject always to the level of professional conduct expected from a member of the CILA. Guidance Notes on the Critical Analysis are attached to this document. There is no set template for the Analysis. Photographs may be attached together with any other documents relevant to the case to highlight the Critical Analysis. It is to be noted that no more than four such appendices may be attached to the Analysis. 12 ACS Summary of Experience – Interview Option The candidate is required to submit a brief review of no more than 750 words per case in respect of six cases handled by the candidate either solely or as part of a team in the preceding two years. The summary to each case should show the nature of the claim, the input of the candidate, the decisions taken and their reasons and the outcome of the claim, including, if relevant, recoveries. Care must be taken to protect the confidentiality of all the parties to the cases and the identity of the subject properties. Whilst recognizing that the candidate may be placed in a position where all cases handled are of one type it is important that each case as summarized should reveal a breadth of experience and the cases should involve different characteristics, causes, issues or resolutions. The Summary of Experience will enable the Accreditation Panel, with the assistance of questioning, to judge whether the candidate has obtained sufficient experience in breadth and depth to warrant the title of Chartered Loss Adjuster. There is no pre-set template for the Summary of Experience. The CILA reserve the right to review the Critical Analysis and Summary of Experience before arranging a panel, to ensure the submission meets the standard set out in the Objectives above. Should the submission not be acceptable the candidate will be asked to resubmit an amended/new submission. ACS Law & Practice Where questions of law and practice are involved candidates will be expected to answer these according to the law and practice in either of England, Wales, Scotland and Northern Ireland or of their domiciled country. The candidate should give a clear indication of the country and this must be stated on the examination answer sheet. Candidates must display an up-to-date knowledge of law and practice. However they will not be examined on changes which came into effect within 6 months of the examination. Where a question arises on a topic affected by such a change the answer may be based on either the old or the new position and equal credit will be given in either case. 13 The Accreditation – Interview Option The presentation and interview will take place at an Accreditation Centre and will conclude the assessment process. At the Accreditation a panel of two representatives of the Institute will interview the candidate. The interview will last approximately 60-90 minutes (but may, at the discretion of the panel, be extended), comprising two parts: ACS Presentation The candidate will be provided with a ten-minute opportunity to introduce to the panel an outline of the approach, rationale, investigations and conclusions concerning his/her Critical Analysis. During this period the panel will not interrupt the candidate. ACS Interview The interview will occupy the balance of the period with the panel and the candidate will be questioned on: Matters arising from the Critical Analysis Matters arising from the Summary of Experience The broader aspects of the candidate’s experience, knowledge, including ethics and the CILA’s Rules of Conduct. The candidate will be offered a closing 5 minutes to re-visit any aspect of the interview for further explanation of what he/she may have said or to correct anything that on reflection the candidate considers was wrong. The Accreditation Panel Each Accreditation Panel will comprise two adjudicators at least one being Associates or Fellows with five years experience of the Institute. Each adjudicator will have undergone training under the auspices of the Institute at which interview techniques, the judgement of competency and body language will have been core subjects. No adjudicators will be members of the same company as the candidate and wherever both panel adjudicators will be from different companies. Each adjudicator prior to the Accreditation will have studied the submissions and discussed with their fellow adjudicator the salient points and agreed amongst them an allocation of subjects for questioning and the line of questioning to be adopted. 14 After the interview the adjudicators will prepare their own marking schedule. The two will be compared and discussed followed by the preparation of one master schedule. Where the two adjudicators have differences the candidate will have failed. A specimen template for the Marking Schedule to be used in the Accreditation is attached to this document for the information of the candidates. Monitoring The Accreditation interviews will be monitored at each centre on a regular basis by an invigilator appointed by the Institute. At some point during the interview it is possible that the invigilator will monitor the panel. The purpose of the monitoring is to: Enable a judgement to be made on the consistency of interviews and to develop and improve them and Ensure that the candidates are treated fairly by the panels and are given every opportunity to demonstrate their professional competence. If requested the invigilators will give feedback to the panels on the day and may also discuss training needs. They will not however become involved or take part in the decision making process of the panel. Invigilators will receive copies of the Fail Reports for those panels that were monitored by them. Guidance Notes to Candidates for Accreditation Critical Analysis The Critical Analysis is a written report, which, at its simplest, is a detailed analysis of a case with which the candidate has been extensively involved during their training period, the conclusion to which includes a critical appraisal of the case together with an outline of the lessons learned. The choice of topic is very important. The candidate may be working for a large firm and have been involved with an instruction, which is considerable in complexity, size or importance and his role and contribution in that could be an appropriate topic. On the other hand the instruction or case may not be too complicated or of great value. It may simply be typical of the type of work with which the candidate has been involved during the training period and this could be an equally suitable topic. The candidate is able to use a case or a number of cases as being a suitable choice for the Critical Analysis. The reason for this is the candidate may wish to choose an issue or aspect arising from his work that is a part of and is common to the number of cases with which he/she has been involved and upon which s/he wishes to concentrate in the analysis. It must be emphasized that the candidate is not expected to be running the case, but it is his involvement in the team that he/she is expected to outline, analyze and provide comment on. It may be the position that the case has been ongoing for some time and that the involvement has not been continuous or may not have begun at the outset of the case. It may be that at the time of writing the Critical Analysis the case has not reached a conclusion. The Critical Analysis will comprise the detail up to the date of writing and it may be that the report contains a prognosis of the outcome. Alternatively the outcome may be known at the date of the assessment and the candidate may wish to include this in his oral presentation to the Accreditation Panel. 15 Overall the Critical Analysis should provide the panel with detailed evidence of the candidate’s ability to work competently and that he/she is able to apply the core knowledge relevant to the specialist discipline. After the presentation the panel will question the candidate in detail on this and other matters. One of the main reasons potentially for Fail is that the format of the Critical Analysis becomes similar to the type of report that the candidate may write at work. This should be resisted and whilst the Critical Analysis should be structured it may take a free flow path with the content relating to the candidate’s core skill but it may also touch upon other aspects of what may be taken as the common competencies expected of a chartered loss adjuster. The candidate should put himself in the position of a potential client looking at the report for the first time and whether he/she would be impressed with the style of presentation and structure. The candidate should also note that the information contained in the Critical Analysis will be treated in the strictest of confidence by the panel. The candidate should ensure that he/she not only understands the case itself and the processes followed but also the rationale behind the decision making in the context of the cover afforded under the policy. The panel will be extending their questioning beyond what the candidate actually did to why he/she did it and possibly why he/she did not use an alternative approach. They will also probe the candidate’s understanding of any wider issues surrounding the case. Whilst the Accreditation Panel will be endeavouring to determine the candidate’s general level of ability they are not expecting him to be an expert in every area of professional activity. They are seeking a demonstration of a satisfactory level of competence in key areas, for the client served, subject always to the level of professional conduct expected from a member of the CILA. The Critical Analysis must be a maximum of 3000 words (not including the appendices limited to a maximum of four) and can include photographs and plans etc, but the latter should be no larger than A4 size when folded. The total number of words must be shown at the end of the document. The Critical Analysis is a professional piece of work and as such should be signed and dated by the candidate and certified as his own unaided work by a chartered member of the CILA. It is to be noted that if external assistance to the preparation of the Critical Analysis is taken and this is subsequently established then the candidate will not be able to proceed to the Accreditation for Chartered Status. It is quality not quantity that is important so a word count should be used and the appendices should be limited (maximum of 4), each element of which should be included to support the report, not add to or expand upon it. It is important that the report includes the following headings: Key issues Nature and extent of cover The magnitude of the loss and the eventual settlement cost Options Reasons for rejection of certain options. The candidate’s proposed solution to the problem/s and reasons supporting this choice. 16 A critical appraisal of the outcome and reflective analysis of the experience gained. Key issues The chosen case could be complex and if too many issues are selected it is likely that the candidate will only skim the surface and not cover what is required i.e. a detailed analysis. The candidate needs to be selective and to think about the depth required as being beyond simple basic levels of knowledge and understanding such as data collection and inspection but to a level demonstrating the practical application of skills and the use of judgment. The candidate may have come across one key issue in a case that in itself is so substantial that it is capable of forming the basis of the Critical Analysis. It may be an issue which is common across a number of cases with which the candidate has been involved and which become the basis of the Analysis. Options Before proposing a solution on an issue in the case the candidate will need to consider all of the options to demonstrate his ability to think both logically and laterally. He/she must also demonstrate that he/she has genuinely considered the options over and above the preferred solution and give reasons why some solutions may not be feasible. The candidate should avoid the trap of going down one route only and should consider options or possible courses of action and also give reasons for rejection of those options not selected. Options should relate to alternative courses of action to address the key issues within the professional case selected. The option to accept the instruction to act or not to accept it is not what this section should relate to. The Proposed Solution The candidate must give a detailed account of the reasons supporting their adopted course of action and the recommendation placed before his client and it is important that his thoughts are wide ranging. The candidate should try to ensure that he/she widens his/her thought processes in respect of the proposed solution. he/she should think about all of the aspects that support his/her decision; customer care; market practice; policy cover; legal precedents; financial; technical; professional; rules of conduct; ethics and conflicts of interest, but he/she does not have to address each of these if they do not form part of his decision. Critical Appraisal and Analysis of Experience It is essential that the conclusion to the report must include a critical appraisal of the outcome together with the candidate’s own views and feelings as to what he/she learned from the experience and where in the future he/she may take a different approach, with reasons given. This part of the report may comprise up to a quarter of the total number of words. 17 The critical appraisal is about being introspective. The candidate needs to be able to look at the case, consider what has gone well and, most importantly, be able to identify what has not gone well, so that he/she can plan how he/she might improve next time he/she carries out a similar task. This will comprise the candidate’s critical appraisal of the case. The next step is for the candidate to stand back from the case and reflect upon what he/she has learnt from the experience gained. The Accreditation Panel will be looking to take the candidate’s critical appraisal as a starting point to question him beyond what he/she actually did and to probe his understanding of the wider issues surrounding the case. It is therefore useful to start these processes whilst writing the Critical Analysis so that the candidate is well prepared for the interview. Confidentiality The candidate must ensure that he/she has his employer’s consent to the disclosure of the matters that feature in the Summary of Experience and Critical Analysis. For confidentiality to the policy holder and the Insurer names and addresses should be altered and the candidate may disguise facts that might otherwise make the case identifiable. References Extracts from Acts of Parliament, case law and other sources should not be quoted at length but essential references must be given if relevant to the case in question and the decisions taken. Conclusion Above all the Critical Analysis and Summary of Experience must reflect the candidate’s abilities in respect of: Written and graphic communication Professional standards of organization and presentation Analysis, reflective thought and problem solving Learning from experience gained The candidate and a chartered member of the CILA must certify that the Critical Analysis and Summary of Experience are the candidate’s own unaided work and a true and faithful reflection of his experience during the training period. If this is not the position then the candidate will become barred from Accreditation for Chartered Status. Presentation – Interview Option In addition to the written submission the candidate will make a ten minute oral presentation of the Critical Analysis as the first component of the interview. The candidate should remember the panel will have already read the submission so it should not be read verbatim. The candidate should identify before the assessment the key points he/she wants to address in the oral presentation and speak to these. 18 The candidate should also remember that when speaking what he/she has in mind to say might, if spoken fast, last only a few minutes leaving an embarrassing gap to the interview. The candidate should rehearse the oral presentation at normal speaking rate and trim so that it lasts ten minutes. Owing to the number of interviews held simultaneously, presentation facilities at accreditation centres are unlikely to match the best available in the candidates’ offices. No presentational facilities will be provided by the Institute. Those candidates who wish to use a stand-alone laptop personal computer may do so if the format is appropriate for an audience of three. It is emphasized, however, that what is being assessed is the candidate’s ability to communicate effectively rather than his use of technology. Interview The interview will occupy the balance of the period with the panel and the candidate will be questioned on: Matters arising from the Critical Analysis and Summary of Experience. Other matters arising from the answers to the above. Broader aspects of the candidate’s experience. The candidate’s approach to professional ethics. Knowledge of the Rules of Conduct of the CILA. In making their assessment the panel will take an holistic view of the candidate’s performance. No one component of the accreditation will constitute a pass or a Fail. An overall judgement will be made of the candidate’s pre-accreditation submissions, his presentation and the interview. It can be that marginal under-achievement in one area can be balanced by a better than average achievement elsewhere. In view of the fact that the Summary of Experience and Critical Analysis are not prepared under examination conditions technical and literary accuracy and a high standard of presentation will be expected. Fail The panel has to be satisfied that the candidate has demonstrated receipt of a properly structured and balanced professional training and experience. If the professional training and experience are considered unsatisfactory the candidate will be referred and required to undertake further training and gain further experience before attending another interview at a future date. Successful candidates will be eligible for election to the class of Associate of the Chartered Institute of Loss Adjusters. 19 Accreditation for Chartered Status - Assessment report Candidate: Assessment Area and Criteria including written submission and oral examination Date: Grade Examiner: Evidence Technically correct Correct, up to date and current Sound practical application of knowledge Breadth and depth of professional experience Business knowledge and commercial awareness Aware of professional and commercial implications Informed decision making Gathers all relevant facts Identifies key issues and analyses suitable options Validates assumptions, using experts appropriately Logical thought process & reasoned judgements Correct assessment of claim issues Effective claim management Plans, organises & monitors claim effectively Effective negotiation of settlement Loss mitigation opportunities and fraud Reserve management Management of relationships & expectations Effective communication Oral: Confident body language, voice clear and audible, material presented in a logical manner Written: Well presented, neat, professional, correct use of English, logical structure Impact, assertiveness & influencing skills Question handling Grades as defined in the Assessment Criteria Distinction (D): Pass (P): Marginal Fail (MF): Fail (F): Overall Pass requirements: Pass grade in each of the Assessment Areas = Pass One Marginal Fail can be balanced by a Distinction in another Assessment Area = Pass One or more Fails or more than one Marginal fail = overall fail Two Distinctions would provide an overall Distinction providing one Distinction is in the Technical category and there are no marginal Fails. 20 ACS – Written Option The Written ACS process is made up of a Critical Analysis and a Scenario Based Paper. These two papers may be sat in any order and are weighted equally. Scenario Based Question The purpose of this aspect of the ACS is to provide a judgement as to how well the candidate can apply technical knowledge and provide a solution to a given scenario. There will be a range of scenarios according to the specialities available to candidates namely: Business Interruption Claims Employers’ Liability Contractors All Risks (Material damage) Claims Property Claims Public Liability Product Liability Claims Subsidence Claims Specialist e.g., Agriculture/Fraud/Fidelity Guarantee Theft Claims Example Commercial Property Scenario Based Question The following is an example of a Commercial Property based scenario question. You have been appointed to deal with a Commercial Claim, following a sudden downpour of torrential rain in a major city. The risk property is a steel portal warehouse 30m span, 100m long, 10m high. It is occupied by “Carpet Carpet Carpet” a well-known carpet and underlay retailer. The company specialises in the supply of moderately priced carpets and underlay mainly to on-line purchasers but also to a limited extent to commercial building companies to fit out “Show Homes”. The building has a concrete base, steel doors and standard services such as rainwater guttering and has three phase electrical supply. The warehouse has rolls of carpet of varying lengths, all of which has been drenched, most of the carpet is foam backed nylon carpet but around 20% is hessian backed and is part wool and man-made fibres. The total value of the carpet is around £150,000 and the initial impression is that the entire stock has been severely affected. The cover provided by the Policy is as follows: Buildings £2,000,000 Stock £120,000 Plant and Machinery £40,000 In addition there is Business Interruption Policy with a 12 month indemnity period and a sum insured of £1 million. 21 You are advised that there are two warranties – a minimum security warranty and a stillage warranty. In addition the Buildings Policy is written on a Day One basis and the Stock on a Stock Declaration basis. Firstly, you are required to outline the enquiries you would undertake to establish: 1. Extent of Policy liability if any 2. Reserve 50 Marks Secondly, you are required to propose with rationale 1. What measures can be taken to mitigate the loss 2. What steps that should be taken to rule out fraud or determine any fraud indicators 50 Marks Thirdly, you are required to provide two sections, one from your Preliminary report to Insurers namely “Initial Measures”, to include your rationale and secondly the “Claim and Adjustment” from the Final Report. 100 Marks 22