CGA Outlook Magazine Autumn 2012

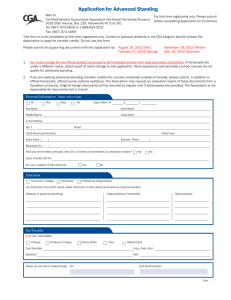

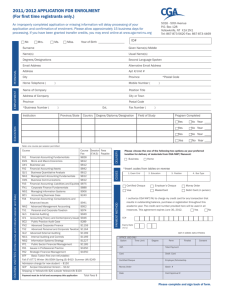

advertisement