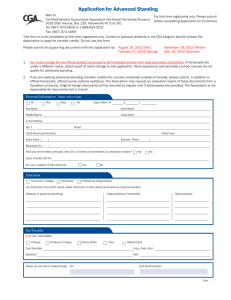

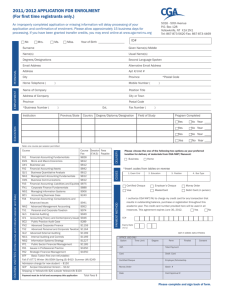

Here - Climate Smart

advertisement