Occupational Fact Sheet for Internationally Educated Accountants

advertisement

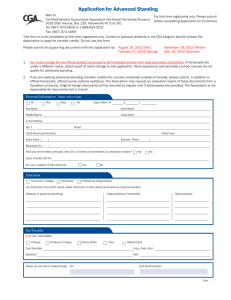

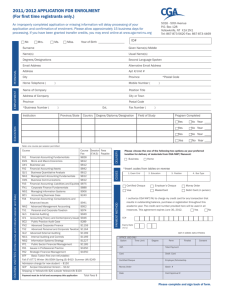

April 2008 Occupational Fact Sheet for Internationally Educated Accountants Guide for Registration as a Certified General Accountant in British Columbia Prepared by the Certified General Accountants Association of British Columbia (CGA-BC) for MOSAIC and the Immigrant Services Society of British Columbia Occupational Fact Sheet for Internationally Educated Accountants Disclaimer This Occupational Fact Sheet was developed by the Certified General Accountants Association of British Columbia (CGA-BC), MOSAIC and the Immigrant Services Society of British Columbia (ISS). Information in this Fact Sheet will be updated regularly. Requirements may change without notice. For clarification, contact CGA-BC. Copyright Copyright of this Occupational Fact Sheet is held jointly by CGA-BC and MOSAIC and ISS, 2008. The Occupational Fact Sheet may be used or reproduced by any third party for non-commercial, not-for-profit purposes, provided that no fee, payment or royalty of any kind shall be charged by the third party for any further use or reproduction of the Fact Sheet by any person. Websites This document resides on the CGA-BC Website at www.cga-bc.org. It can also be accessed via the Website of MOSAIC at www.mosdaicbc.com and ISS at www.issbc.org. 2 Occupational Fact Sheet for Internationally Educated Accountants Contents Purpose of This Fact Sheet What are My Job Prospects as an Accountant in B.C.? Where CGAs Work CGA-BC’s Career Resources Who Certifies Accountants in B.C.? CGA-BC and CGA-Canada What is Required for Certification as a CGA? Academic Component Degree Requirement Practical Work Experience Public Speaking Requirement Duration and Costs Time for the Application Process Time to Complete the CGA Program Costs Documentation for the Application and Assessment Form Six Easy Steps to Apply and Enrol Enrol in Courses to Meet Outstanding Requirements Taking the CGA Program Outside Canada International Designations Recognized by CGA-BC CGA’s Partnerships With ACCA and CPA Australia After the Program: the Certification Process Ethics and Professional Development Requirements Post-Certification Contact CGA-BC Other Resources of Interest for Newcomers to Canada Accelerating Immigration for Skilled Workers Skills Training and Employment Services English as a Second Language (ESL) Employee Rights Articles of Interest 3 Occupational Fact Sheet for Internationally Educated Accountants Purpose of This Fact Sheet This Fact Sheet is for internationally educated accountants, that is, individuals who have been educated and certified as accountants outside Canada. It provides information on how to become certified to practice as a Certified General Accountant (CGA) in British Columbia. What are My Job Prospects as an Accountant in B.C.? It has never been a better time to become an accountant, especially a Certified General Accountant in Canada. Outside Calgary’s oil boom, British Columbia’s economy is experiencing the fastest growth of any province in the country. According to Statistics Canada, the demand for financial professionals continues to outpace supply in several specialties. Demographic changes, such as the retirement of baby boomers and fewer Canadians entering the workforce in coming years have combined to create talent shortages in accounting and finance positions across virtually all industries. Add business expansion and increased compliance requirement, and you have a market in which top candidates with respected designations are now receiving multiple employment offers, high salary ranges and signing bonuses. 2007 Vancouver, BC Position Employer Starting Salary Range Accountant 1–3 Years Small–medium co. $38,850–$47,850 Analyst 1–3 Years Large company $44,750–$56,350 Controller $100–$250 million $89,500–$131,200 Internal Auditor Large company $81,300–$126,050 Manager–Public Tax Accountant Small–medium firm $80,775–$121,650 Manager Credit & Collections Small–medium firm $52,700–$69,500 CFO, Treasurer $100-250 million co. $122,200–$176,000 From the Robert Half International 2007 Salary Guide. Bonuses and incentives are not included in the salary ranges. Add up to 10 per cent for graduate degrees or professional designations. Large companies >$250 million in sales, small-medium <$250 million in sales. Where CGAs Work Certified General Accountants (CGAs) work in large and small businesses throughout B.C.—in industry, commerce, education, not-for-profit organizations, government and in public practice. Most (71 per cent) work in and around Vancouver; the balance work in smaller communities on Vancouver Island and in the interior of the province. CGAs provide a broad range of financial, business management, tax and auditing services—either as an employee of a firm, or as a private accountant (public practitioner). A CGA has the skills to analyze financial information, solve complex problems, perform financial planning, forecast, and implement corporate strategies. CGA-BC’s Career Resources The Certified General Accountants Association of BC (CGA-BC) reports an employment rate of 97 per cent for members over the last 10 years. Over 95 per cent of Canada’s CGAs are employed as financial professionals. See A Statistical Profile of CGAs for more information on the CGA program and the students working toward their designation. The CGA-BC Career Centre provides advice, recommended readings and resources on finding employment. CGAjobs.org is CGA-BC’s job matching site, where employers post job openings and CGA students and members can search for new positions and post their resumés. 4 Occupational Fact Sheet for Internationally Educated Accountants As of February 2008, 2,035 registered employers had more than 600 accounting and finance jobs posted to the site. Internationally trained accountants will likely find that after obtaining some Canadian experience, it is much easier to find accounting positions. For employment and labour market Websites, please see Useful Resources at the end of this document and Other Employment Sites in CGA-BC’s Career Centre. Who Certifies Accountants in B.C.? In British Columbia, anyone can be employed as an accountant/bookkeeper; however, to be recognized as a professional accountant, membership in one of the province’s three regulated professional accounting bodies is required. With more than 13,000 members and students, CGA is the largest and fastest growing of these accounting bodies in B.C. and has the largest number of internationally trained accountants in the province. The Institute of Chartered Accountants of BC regulates Chartered Accountants (CAs) in B.C. The Certified Management Accountants Society of British Columbia certifies Certified Management Accountants (CMAs) in B.C. CGA-BC and CGA-Canada The Certified General Accountants Association of British Columbia (CGA-BC) is the regulatory body that certifies an individual as a Certified General Accountant (CGA) in B.C. The Certified General Accountants Association of Canada (CGA-Canada) determines the educational and practical experience qualifications for all CGAs in Canada. This means that if you have a CGA designation from any province or territory in Canada you can work in any other province or territory in Canada. You simply request that your membership be transferred to the province or territory to which you move. The CGA program is also offered in Bermuda, several Caribbean countries, Hong Kong and China. See Related Associations. What is Required for Certification as a CGA? To earn your certification as a CGA in B.C. or elsewhere in Canada, you need to complete the academic component, the degree requirement, and the practical work experience requirement. See Program at a Glance for an overview of the CGA program requirements. • Academic Component The CGA program comprises 19 courses and examinations approved by CGA-Canada. This consists of Foundation Studies, Advanced Studies and Professional Studies (PACE). In addition, students must complete two Business Cases, which apply financial management concepts in a practical manner. The courses make extensive reference to ethical issues. All courses and exams are in English only. Many students will need to take Communications 1 (CM1) if they have not taken courses at a university level where English is the main language of study. Regardless of your prior post-secondary or professional education, all exams at the final PACE Level must be written through the CGA Association. See CGA Courses and Exams for course descriptions. For details about the course content of all CGA courses, see the Course Syllabus. 5 Occupational Fact Sheet for Internationally Educated Accountants • Degree Requirement A bachelor’s degree is required to be certified as a CGA. The degree may be from most postsecondary degree granting institutions and may be in any field. A degree is not necessary to enter the CGA program, but must be obtained prior to certification as a CGA. CGA has partnerships with post-secondary institutions to allow students to combine their previous education and their studies on the CGA program to earn a bachelor’s degree. See Degree Opportunities. CGA-BC can evaluate foreign degrees to determine if they meet the program’s degree requirement. However, in some situations an independent evaluation may be required. • Practical Work Experience Requirement The CGA program is designed to offer individuals the opportunity to study part-time while pursuing full-time employment and career advancement. If you are not currently working in the accounting field, it is strongly recommended that you obtain this employment in order to meet the CGA’s experience requirements for certification—prior to completion of all CGA course requirements. CGA certification requires a wide range of accounting and financial management experience on the job. In general, a minimum of three years’ work experience is required— approximately two years of this must be at an intermediate to senior level. Normally, a beginning student will start in a clerical/junior position and then progress to an intermediate/senior position. Individuals who have international work experience, even if extensive, will be required to have a minimum of one year Canadian experience at an intermediate or senior level. Other practical experience considerations: International work experience may count for up to two of the three years’ practical work experience requirements. One year must be at the intermediate/senior level in Canada. Letters from all employers confirming work experience are required. CGA students may work in a variety of accounting areas, but they may not be selfemployed in the practice of public accounting. However, they may be employees of a public practice firm. Upon admission into membership of CGA-BC, they may become a proprietor or partner of a public accounting firm. Students may request an assessment of their work experience from CGA-BC at anytime. Complete all sections of the online Practical Experience Assessment Questionnaire (PEAQ) found on the Association’s Website and submit it to CGA-BC for evaluation. CGA-BC will assess your work experience and notify you of any areas in which you require further experience or if your experience satisfies the Association’s requirements. See Practical Experience. • Public Speaking Requirement All students must complete a public speaking course prior to graduation. 6 Occupational Fact Sheet for Internationally Educated Accountants Duration and Costs Time for the Application Process When you apply to CGA-BC, your academic qualifications will be assessed and you will be advised how many transfer credits you have. A transfer credit is obtained when CGA-BC assesses your previous academic experience as being equivalent to a course requirement on the CGA program. It may take CGA-BC four to six weeks to assess your qualifications. Time to Complete the CGA Program The time it takes you to become certified as a CGA will depend on how many transfer credits you have and, subsequently, the courses you need to complete and how many you are able to complete each year. The CGA program is designed so that a person may work full-time and take courses part-time. An individual with no transfer credits or bachelor’s degree may take about eight years to obtain certification as a CGA while working full time. If you have been assessed as having the maximum of 15 transfer credits and have a recognized bachelor’s degree or other professional accounting designation, you may be able to complete the final four courses in as little as one year. However, applicants may decide to complete these requirements over two or three years, depending upon their personal circumstances. During this time you may also obtain the required one year of Canadian work experience at an intermediate or senior level. The time it takes you to complete the courses for the CGA program will be determined in the academic assessment and will depend upon how many courses you must take—the more courses, the longer the time that CGA-BC allows you to complete them. If you did not receive any transfer credits and have a recognized Bachelor’s degree, then the maximum time you can be in the program is ten years. If you also need to obtain a Bachelor’s degree, then you have a maximum of twelve years to complete all your CGA courses and your degree. Students may choose to be non-active for a full year if they are not taking any courses for credit towards the CGA program. The time taken as non-active is not counted in the allowed time and the full year tuition fee is reduced by approximately 50 per cent. There are limits to the number of years a student may be non-active. Costs As a CGA student, you only pay an annual basic tuition fee and a fee for each course you take. So the overall cost depends on how many transfer credits you are awarded for prior postsecondary and professional studies. The more extensive your accounting background, the fewer courses you will need to complete. The number of transfer credits is determined in the Application and Assessment process. The cost of applying to the CGA program is $150 for international students. Costs for the CGA program are approximately $650 for basic tuition plus approximately $800– $900 per course. For details on course fees and other costs, see the Fee Schedule. Keep in mind that the Association recommends students take just one course per semester. Documentation for the Application and Assessment Form To complete the Application and Assessment Form you will need to assemble the following official documents: 7 Occupational Fact Sheet for Internationally Educated Accountants • Transcripts from educational institutions attended. If you have attended post-secondary educational institutions, it is not necessary to submit your high school transcripts • Certificate and course marks from an accounting body in your country • Course descriptions or a course syllabus of courses you completed that are equivalent to CGA courses you are requesting transfer credits. It is very important to provide as much detail as possible about the courses you took, including specific course content and number of hours of each course. The more information that is provided, the more this assists CGA-BC to assess your qualifications to provide you with exemptions. • Marriage certificate or change of name certificate, if the transcripts and certificates show a different name • Immigration documents showing that you are qualified to work and study in Canada (landed immigrant status, study and work visas) • Letters of reference from previous employers indicating proof of accounting experience at an intermediate or senior level are not essential, but they are helpful. These letters, along with job descriptions of past positions, your educational qualifications and membership in a professional accounting body may assist you to obtain advanced standing, as well as assist in the evaluation of practical experience requirements when you are a student • Notarized translations of any documents that are not in English. (Notarized translation is one that has been certified as a true copy of the original by a person who has been accredited as a translator for that language by the Society of Translators and Interpreters of BC or government body.) • A current letter of good standing if you are a member of another professional accounting body For all the above, CGA-BC requires the original documentation. If you wish to keep your original documents, you must provide photocopies along with your originals; original documents will be returned to you after the assessment has been completed. Transcripts from postsecondary institutions or other professional bodies must be originals sent by the institution directly to the attention of CGA-BC. All documentation provided will be subject to the Association’s documentation retention and destruction policy. 8 Occupational Fact Sheet for Internationally Educated Accountants Six Easy Steps to Apply and Enrol Step 1: Ensure you have all the required documentation needed to evaluate your education level and to set up your student file. You will need: Official transcripts If you are seeking transfer credit for prior post-secondary studies, you must submit original transcripts from the post-secondary institution to CGA-BC. For courses completed outside of Canada, official course descriptions or a course syllabus may be required. A notarized English translation must accompany all non-English documents. Transcripts and certificates that show a different name require a certificate of name change or marriage certificate. If you wish to retain your original documentation, you must present photocopies along with your originals. The originals will be returned to you after verification. Degree assessment If you have completed a bachelor’s degree, you must provide an original transcript showing the courses completed with grades, and the date the degree was conferred. CGA-BC may be able to evaluate foreign degrees meeting CGA requirements; however, in some situations an independent evaluation may be required (at your own cost). Contact the International Credential Evaluation Service (ICES) for more information: ICES – (604) 432-8800 (within the Lower Mainland) (866) 434-9197 (toll free) E-mail: icesinfo@bcit.ca Prior work experience If you already have prior work experience in an accounting or financial management related position, it is recommended that you provide a current resumé with your application form. Letters from prior employers confirming your work experience, as well as a copy of job descriptions help the Association verify your work experience when you are a student and have submitted your practical experience assessment questionnaire. Step 2: Fill out the Application and Assessment Form [PDF 93 KB] and Request a Calendar. This form provides the Association with all the information needed to set up a student record under your name. It also provides the Association with the information required to perform an assessment of any post-secondary transcripts you may be submitting for possible transfer credits. Please see the Application and Assessment Form for the fee required to process your application and assessment. Transfer Credits 9 Occupational Fact Sheet for Internationally Educated Accountants Transfer credits may be granted to individuals who have completed courses at other postsecondary institutions or professional accounting association provided the course content and standards are equivalent and are acceptable by the Association. Education deemed out-of-date may be denied. (The Association reserves the right to prescribe a special program of studies for students who have been granted transfer credits.) Transfer credits are valid for one year only. After one year, transfer credits are subject to reevaluation. Step 3: Submit your Application and Assessment Form and all required documents prior to the deadlines for the session in which you wish to begin your studies. Forms and supporting documents may be mailed to the CGA-BC Association office at: 300–1867 West Broadway, Vancouver, BC V6J 5L4. Please submit your documents as early as possible. Incomplete or incorrectly filled out forms may delay the evaluation process. All submitted documents become the property of CGA-BC and are retained by the Association unless otherwise specified. Step 4: Allow four to six weeks for the Association to process your documents, set up your student record, and assess any post-secondary or professional studies you may have completed. You will receive an e-mail advising you of your status, any transfer credits that you have been granted as well as what is remaining to complete. You will also receive a CGA Enrolment Package with instructions on how to activate your student file and start your studies in the CGA program, should you wish to at that time. The evaluation is good for one year, during which you may enrol at any time. If you do not enrol within the year, you will need to reapply. Possible reasons for a delay in your application include: • Your application was incomplete when submitted • Your educational transcripts were incomplete or official copies not provided • Your documents were not translated by a certified translator • If you have a criminal record, you didn’t provide a copy of the conviction and details. Step 5: Enrol as a CGA student. Follow the instructions provided in your CGA Enrolment Package. Fees will be required at this step in the process. You will be able to select a CGA course at this time if you choose to begin your studies immediately. Once the Association has received and processed this submission, your student file will be activated and you will officially be a CGA student. Step 6: Begin your CGA studies. You will receive a confirmation of enrolment. If you are taking a course through the CGA Association, you will receive related course materials with instructions on how to proceed. 10 Occupational Fact Sheet for Internationally Educated Accountants Other Resources CGA-BC has many student support services in place to help you assess your progress towards earning your designation. The CGA-BC Website includes information on degree opportunities, transfer credits, scholarships and bursaries, financial aid. The site’s Career Centre links to our job site, CGAjobs.org, career search resources, and our own Student Employment Counsellor. Contact Student Services for answers to specific questions before and during your time as a student, and to help you choose the best path for you during your studies. Enrol in Courses to Meet Outstanding Requirements After your assessment, you will need to enrol in the CGA program should you wish to start your studies. Do this by completing the enrolment information form and submitting with the required fee. CGA-BC will have informed you about how many transfer credits you have obtained. You will need to pay CGA-BC a fee for each transfer credit. CGA-BC will also have informed you what courses you need to take to obtain your CGA designation. The required courses can be taken through CGA-BC or at specific post-secondary institutions in Canada or another CGA affiliate (e.g., CGA-Caribbean, CGA-China, CGA-Hong Kong) — except for the PACE Level courses which must be completed through CGA. See the Transfer Credit Guide for courses that may be completed at B.C. post secondary institutions for transfer credit to the CGA program. This list may change annually, so it is important to check each year. In some situations, you may be allowed to take a challenge exam rather than first take the required course. Most CGA courses have weekly lectures scheduled at the University of British Columbia. Audio lectures for all courses are also available online from CGA-BC. All CGA courses have a final exam scheduled at the end of the course. The exams for all courses are three hours, except for FA4 and PACE Level courses that have four-hour exams. See the full description of all CGA courses and exams. Taking the CGA Program Outside Canada Students in the Caribbean, Bermuda, Hong Kong and China can enrol in the CGA Program of Professional Studies. In addition, through an agreement between the Association and the University of Monterrey Technology, students in Mexico may also be able to enrol in the CGA program. For more information click on the links below: • • • • • Caribbean Bermuda Hong Kong China Mexico—Tecnológico de Monterrey International Designations Recognized by CGA-BC 11 Occupational Fact Sheet for Internationally Educated Accountants The following foreign accounting designations are recognized by CGA-BC for advanced standing in the CGA program: Country Australia Bangladesh France Hong Kong India Pakistan Philippines United Kingdom United States Accounting Organization CPA Australia Institute of Chartered Accountants in Australia Institute of Cost and Management Accountants of Bangladesh Compagnie Nationale des Commissaires Aux Comptes l'Ordre des Experts Comptables Institute of Certified Public Accountants (HKCPA) Institute of Chartered Accountants of India Institute of Cost and Works Accountants of India Institute of Chartered Accountants of Pakistan Institute of Cost and Management Accountants of Pakistan Philippines Institute of Certified Public Accountants Association of Chartered Certified Accountants (ACCA-UK) Chartered Institute of Management Accountants (CIMA-UK) American Institute of Certified Public Accountants (CPA-US) Institute of Management Accountants (CMA–US) Note: Foreign accounting designations not listed here will be considered on an individual basis. As a member in good standing with any of these organizations, you are eligible to obtain advanced standing on the CGA program. You must include a letter of good standing from your professional accounting body and provide it when you apply to the CGA program. You must have obtained your recognized designation by way of the program/examination set by the professional body; that is, the designation in question cannot be obtained through a ‘mutual recognition’ process. Should you have any questions about the CGA program or your assessment, contact the Coordinator, Evaluation Programs at CGA-BC for assistance. CGA’s Partnerships With ACCA and CPA Australia CGA-Canada has separate mutual recognition agreements (MRAs) with two of the world's largest and most prestigious accounting bodies: the London-based Association of Chartered Certified Accountants (ACCA)—the world's largest and fastest growing international accountancy body— and the Chartered Practising Accountants of Australia (CPA Australia). CPA Australia is the sixth largest accounting body in the world, with more than 117,000 finance, accounting and business professionals across the globe. ACCA has 110,000 members and 260,000 students in 170 countries. Each agreement allows for qualified members of either body to become a member of the other, and to enjoy the benefits that both Associations offer. To learn more about becoming an ACCA or CPA Australia member once you are a CGA, or how members of our mutual recognition partner associations can become CGAs, see ACCA and CPA Australia. After the Program: the Certification Process 12 Occupational Fact Sheet for Internationally Educated Accountants • Once you have met all academic, degree and practical work experience requirements, you may apply for certification as a CGA. • When you have written your last CGA exam, CGA-BC will send you an application for a membership package. The membership application form requires that you have two CGA-BC members sponsor you. • New members are admitted on a quarterly basis during the year. In addition, an annual graduation ceremony is held to formally recognize all the graduates each year. • CGA membership allows you the right to practice as a CGA in B.C., as well as the right to transfer your membership to any province or territory in Canada and the designated countries where CGA has affiliate offices. • New CGA members who plan to be self-employed in the practice of public accounting, as an owner or partner, are required to first register with the Association. Registration in the practice of public accounting is subject to certain other educational requirements. Ethics and Professional Development Requirements Post-Certification As a CGA student and member, you are pledged to adhere to a strict Code of Ethical Principles and Rules of Conduct. All CGA courses refer to business ethics in assignments and exams. As of January 1, 2008, new graduates are required to complete a one-day rules and ethical standards course as a requirement of certification in the first full year after graduation. Members must also complete a three-hour ethics seminar every three years. In compliance with the highest international standards, CGA-BC monitors and reviews the professional development of each member through our Continuing Professional Development (CPD) program. Members are responsible for their own professional development and reporting their CPD activities by January 31 each year for the preceeding year All members begin a new three-year CPD reporting cycle in 2008. Members have three years to reach the required minimum of 120 total hours. Of the 120 hours, a minimum of 60 hours must be verifiable. Contact CGA-BC If you have questions regarding anything in this document or have need additional information for any reason, please contact a Student Services advisor. Lily Dayson, CGA Manager, Evaluation Programs and Liaison E-mail: ldayson@cga-bc.org Or Raymond Yim, CGA Coordinator, Evaluation Programs E-mail: ryim@cga-bc.org 13 Occupational Fact Sheet for Internationally Educated Accountants Mail: Certified General Accountants Association of British Columbia 300–1867 West Broadway, Vancouver, BC V6J 5L4 Telephone: (604) 732-1211 or toll-free in B.C. (800) 565-1211 Fax: (604) 732-1252 Our office hours are 8:30 a.m. to 4:30 p.m. Pacific Standard Time. E-mail: admissions@cga-bc.org Website: cga-bc.org Other Resources of Interest for Newcomers to Canada Accelerating Immigration for Skilled Workers British Columbia’s Provincial Nominee Program The British Columbia Provincial Nominee Program (BC PNP) offers accelerated immigration for qualified skilled workers and experienced entrepreneurs who wish to settle in British Columbia (B.C.) and become permanent residents of Canada. This program is administered by the B.C. Ministry of Economic Development in partnership with Citizenship and Immigration Canada (CIC), the federal government agency responsible for immigration. Skills Training and Employment Services These programs are government-funded and generally free to participants. Individual contributions for further training or courses are sometimes required. Please check each program for specific eligibility requirements. Some services are available only to unemployed or underemployed (working less than 20 hours per week) immigrants, while others such as Skills Connect programs can assist individuals employed in a job outside their field. Some also require immigration to Canada within the last five years. Federal Government Employment Programs for Immigrants This site presents governmentsponsored employment services for immigrants and newcomers to Canada. The centres listed provide immigrants with free assistance finding work with the help of an employment counsellor. Many centres also offer help with translations, legal advocacy, housing, English language classes and child-care. BC Skills Connect is a $14.5 million strategy launched by The Ministry of Economic Development to help highly skilled immigrants move more quickly into jobs that match their professional qualifications, mainly in the healthcare, construction, tourism & hospitality, energy and mining, and transportation industries. Accounting positions in these industries qualify. The Skills Connect initiative is offered via several different employment organizations throughout the province. See the complete list of services providers. Immigrant Services Society of B.C. Immigrant Services Society of B.C. offers a language college, career services, and settlement assistance at various campuses in Vancouver, Richmond, Surrey, and Coquitlam. Services are provided in multiple languages. Career planning, job 14 Occupational Fact Sheet for Internationally Educated Accountants placement, and funding for training are available to unemployed and underemployed (working less than 20 hours per week) immigrants, with priority to Employment Insurance recipients. S.U.C.C.E.S.S. is a multi-service agency delivering programs for immigrants in social services, housing, senior care, child care, employment counselling, business and economic development, training and education, translation, legal clinics and health services. Various locations are in Vancouver, Burnaby, Richmond, Surrey, New Westminster, and Coquitlam. MOSAIC is a multilingual organization dedicated to addressing issues that affect immigrants and refugees in the course of their settlement into Canadian society. Offers various employment programs, skills training, English language classes, family counselling and violence prevention, legal advocacy, translations and interpretations, and settlement services. Several locations are in Vancouver and North Vancouver. Douglas College Training and Community Education offers various job search and career development programs such as The Practice Firm, which provides Canadian work experience in a simulated business environment. Working Solutions for Skilled Immigrants is a Skills Connect initiative helping internationally trained professionals find work in their chosen field. DIVERSEcity Community Resources Society A Surrey-based organization that addresses the employment needs of immigrants by offering specialized work search programs, job placement assistance, career decision-making and combined skills training programs. Also offers a Skills Connect program. Other services in multiple languages are family counselling, interpretation, translation, ESL classes, and community development. English as a Second Language (ESL) English Second Language Courses Searchable ESL and employment programs by location in B.C. are specifically for newcomers. Worldwide Learn Live online ESL tutoring, business English, pocket dictionaries and more. See the TalktoCanada.com’s one-on-one English tutoring program. Employee Rights The Employment Standards Act The Act lists the rules B.C. employers have to follow in areas such as hours of work, minimum wage, overtime, public holidays, vacation time and pay, maternity and parental leave, termination and severance pay. Articles of Interest Visit these sites for more about learning the customs of a new workplace in Canada: Career Journal Arrive BC 15