cuisinart strategic portfolio plan

advertisement

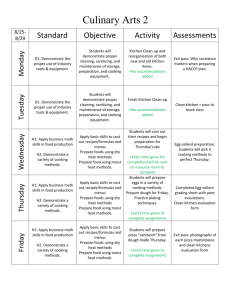

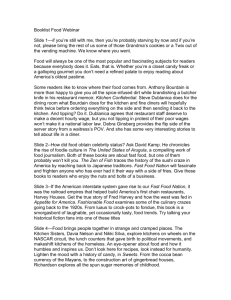

CUISINART STRATEGIC PORTFOLIO PLAN Laura Mattis Portfolio Planning, Spring 2013 CUISINART COMPANY BACKGROUND Cuisinart was founded in 1971 by Carl J. Sontheimer, a retired physicist and entrepreneur who invented a microwave direction finder used by NASA in a moon mission. The Cuisinart Food Processor was released in the US in the mid-1970s and earned celebrity chef endorsements from Julia Child and James Beard in major publications like Gourmet and The New York Times, helping the “phenomenal food processor” quickly become an indispensable product in the home kitchen. At the peak of its popularity in 1986, the company sold 6 million units a year, totaling $70 million in sales. But company sales crashed in 1989 due in part to market saturation and competing products, and Cuisinart was acquired by the Conair Corporation for $17.1 million. Since the acquisition, Cuisinart has greatly expanded its portfolio to other countertop kitchen appliances and cooking tools, sometimes through strategic partnerships. The company now produces food choppers, coffeemakers, toaster ovens, cookware, bakeware, and espresso makers, in addition to handheld gadgets, kitchen tools and specialty cooking appliances. Cuisinart also backs culinary education, through its sponsorship of cooking education and entertainment. This includes three public television cooking series: Chef ’s Eric Ripert’s “Avec Eric”, Chef Hubert Keller’s “Hubert Keller: Secrets of a Chef”, and Jacques Pépin’s “Jacques Pépin: Fast Food My Way”. Johnson & Wales University recently unveiled the 82,000 square foot Cuisinart Center for Culinary Excellence in Providence, Rhode Island. The company has been recognized for quality and design of their marketing, cookware and specialty appliances, including a 2009 Chicago Athenaeum Green Good Design Award and two 2009 Shape You Top Gear of the Year Awards. Stats Wholly Owned Subsidiary of Conair Corporation Located in Stamford, Connecticut 1001-5000 employees Products Bakeware Blenders Brick Ovens Coffeemakers Cookware Countertop Cooking Appliances Food Processors Frozen Treat Makers Hand Mixers Kitchen Tools & Gadgets Microwaves Pizza Ovens Stand Mixers Toaster Ovens Water Filtration Specialty Products Cuisinart Baby Simple & Enticing Recipes Cookbook CuisinArt Resort & Spa Laura Mattis | Cuisinart Product Portfolio: Review & Recommendations | 2 INDUSTRY LANDSCAPE & MARKET TRENDS Exponential Growth Cuisinart created the food processor niche of the small appliances market when they introduced their product in 1973. Within a few years, Faberware, Waring, GE, Hamilton Beach and others joined the fray with competing products. But, Cusinart led in market share with the highest price tag and best performance. Food Processor Product Lifecycle Reaching Maturity Early Within 15 years, the food processor market had become so saturated that many people who wanted the devices already had them; an estimated 43% of all homes had a food processor. Because of the long buying cycle of food processor, sales slumped; in fact, it’s not uncommon for the first generation of Cuisinart food processors to be functional today. New kitchen products like small food chopper/ grinders also pinched sales. Small Appliances Stay Strong In Poor Economic Conditions Introduction (1973) Growth (1975-1989) Even in economic downturns, consumer spending on all categories of small kitchen appliances and housewares remains steady. Consumers spend more time at home and value modern, convenient appliances that save them time and effort. In 2010, the total small kitchen device market increased 2.1% to $5.2 billion. Coffee/espresso makers represented almost $1.5 billion and food processors accounted for $405 million, just behind blenders ($570 million) and mixers ($523 million). By contrast, total major appliances including refrigerators, washing machines, dishwashers and ovens decreased 5.1% to $19.1 billion. 22% of households with less than 10K household income have a food processor, over 45% of households over 70K in income have a food processor, and 37% have a mini food processor. In such a mature market, Cuisinart and its competitors must differentiate themselves, or risk entering decline as other companies or products take over. NPD Group, Kitchen Audit 2011 Maturity (1989-Present) EMERGING CONSUMER TRENDS Spender (High Cost) Serious Home Chefs Consumers Are Cooking – A Lot According to a 2012 survey by Share Our Strength, 78% of low-income families cook and eat dinner at home five or more nights a week, with price and time being the most agreed upon barrier to healthy cooking. And when families cook often, they typically cook from scratch. Changing Demographics Shifts in home sizes and family roles are having an impact on who is cooking and how. Men now handle 33% of cooking chores and are more likely to love cooking than women. Also, as populations shift toward urban environments, consumers have to work in smaller kitchens and prefer to buy multifunctional products that optimize their limited space. Newlyweds/ New Home Buyer Professional Chefs Sightseers Hobby Work Busy Home Cooks Experimenting In The Kitchen Harris Interactive found that across all socio-economic levels, 79% of consumers enjoy cooking. In addition, interest is increasing in local foods, artisanal ingredients and environmental issues and is fueling a more conscious approach to food selection and preparation. In 2012, more than 56% of home cooks tried making a smoothie or fresh juice last year and most of them tried it for health reasons, according to Allrecipes.com. Social Media Influence Social media sites like Pinterest and Instagram are prime candidates for dinner inspiration; 57% of consumers interacted with food content on Pinterest in 2012. So far this has had a nominal impact on cooking behavior because looking at food or collecting recipes is considerably easier than the perceived effort required to cook those recipes. (Low Cost) Frugal Food Sightseers These food “window shoppers” have aspirations to cook great meals and treats, thanks to social media and recipe aggregators, but rarely step inside the kitchen. Newlyweds / New Home Buyers These food processor buyers are looking to stock their kitchen with the gadgets they need. Busy Home Cooks These cooks rely on the recipes they know and use shortcuts to quickly feed their families. Serious Home Chefs Cooking is a fun activity, and these chefs enjoy experimenting with new dishes and entertaining. Professional Chefs These people made a career out of cooking or are looking to. They produce in great volumes and Cuisinart products are an business investment. Laura Mattis | Cuisinart Product Portfolio: Review & Recommendations | 4 CUISINART’S FOOD PROCESSOR PORTFOLIO Cuisinart offers 16 food processor models that range across the entire price and customer segment spectrum. It is unclear what the distinction is between the “Prep”, “Custom” and “Pro” models, however “Elite” models are considered the top-tier, highest- Food Sightseers performing products of the portfolio. This chart does not include the 20 food processors discontinued as of March 2013. Each product, current and discontinued, is supported by a suite of slicing disks, bowls and replacement parts. Newlyweds & New Home Buyers Busy Home Cooks Serious Home Chefs Professional Chefs Over $300 20-Cup Food Processor $200-$299 Cuisinart has focused their portfolio on mid-tohigh capacity machines at a high price range. The distinction between the models is based on capacity, power, number of bowls, slicing disks and nominal aesthetic differences. Elite Collection 12-Cup Food Processor Elite Collection 14-Cup Food Processor $100-$199 Pro Custom 11 Food Processor Custom 14 Food Processor 7-Cup Food Processor Pro Classic Food Processor $0-$99 Mini-Prep Plus 4-Cup Food Processor Mini-Prep Processor Elite Collection 4-Cup Chopper/ Grinder Prep 7® 7-Cup Food Processor Prep 11® Plus 11-Cup Food Processor Prep 9® 9-Cup Food Processor Mini-Prep Plus Processor Mini-Mate Plus Chopper/Grinder Spice & Nut Grinder Laura Mattis | Cuisinart Product Portfolio: Review & Recommendations | 5 FOOD PROCESSOR COMPETITOR ANALYSIS Product Leadership Product Leadership Product Leadership Cuisinart (Mostly) Leads The Pack Compared to its main competitors, Cuisinart has set a premium on offering consumers the most features, styles and power. But, food processor operation varies little between brands and has not changed much since the 1970s. Facing A Category Leader KitchenAid has a strong reputation in developing reliable, high performance stand mixers. Like food processors, stand mixers are considered an kitchen investment. KitchenAid’s entrance into the food processor market directly challenges Cuisinart’s product leadership. In order to fend off KitchenAid, Cuisinart must ensure they maintain their reputation for quality products. Lots Of Budget Options Customization Operational Efficiency Cuisinart Cuisinart food processors are consistently top rated and come in a large variety of sizes and strengths. The products are only available in high-end department and specialty stores. Black & Decker, Oster and Hamilton Beach occupy the lowest price brackets in all market segments. The most expensive products are priced at less than $100, while the average Cuisinart machine costs twice that. Cuisinart But, these products offer fewer features, such as KitchenAid available capacity and slicing options. Customization Operational Efficiency KitchenAid Standing mixers are KitchenAid’s flagship product. However, they offer food processors at comparable price points and markets to Cuisinart, but with fewer options. Customization Operational Efficiency Black & Decker, Oster Hamilton-Beach, These inexpensive products can be picked up at most major, big-box stores. Hamilton Beach Black & Decker Price Ease of Use Optional Blades/ Features Speed/ Power Ease of Cleaning Ease of Storage Color/Styles Laura Mattis | Cuisinart Product Portfolio: Review & Recommendations | 6 FOOD PROCESSOR COMPETITOR ANALYSIS, CONT. A Crowded Competitive Landscape Using an averagely-priced product from Cuisinart’s product portfolio, it’s quickly apparent that one of Cuisinart’s leading competitors is itself. With so many varieties within the form and category, Cuisinart can be attributed to some of the market clutter. Hamilton Beach Big Mouth Duo 14-Cup Elite Collection 12-Cup Food Processor Hamilton Beach Big Mouth 14-Cup KitchenAid 12-Cup Ultra Wide Mouth Cuisinart Custom 14 KitchenAid 13-Cup Cuisinart Pro Classic Black & Decker PowerPro Wide Mouth Category: Consumer Level Food Processors Generic: Small Kitchen Appliances Cuisinart Mini-Prep Plus 4-Cup Blender Cuisinart 7-Cup Electric Skillet Slow Cooker Hamilton Beach ChefPrep 500/525 Cuisinart Pro KitchenAid Custom 11 Cook For The Cure Braun Multiquick 3 Hamilton Beach Big Mouth Duo Black & Decker 8-Cup Juicer Coffee Machine Hamilton Beach Bowl Scrapper Breville Sous Chef Cuisinart Elite Collection 14-Cup Form: Large Capacity, Multiple Bowl Food Processor The Cuisinart food Cuisinart processor occupies Prep 9 9-Cup market spaces that are also cluttered Cuisinart with irregularly used, Prep 11 Plus niche products 11-Cup designed for single Popcorn Cuisinart Maker purposes, such as the Prep 7 fondue pot or food 7-Cup dehydrator. But, food processors, in particular Bread Maker Cuisinarts, are among the most expensive Food small appliances and Dehydrator represents a bigger loss to the consumer because they must assume the product will pay for itself. Cuisinart Mini-Prep Electric Kettle Deep Fryer Hand Mixer Small Kitchen Table Range Hood Mini Refrigerator Toaster Oven Stand Mixer 2 Weeks of Groceries Fondue Pot Rice Cooker Griddle Personal Chef Ice Cream Machine Microwave Budget: $249 Kitchen & Home Items Laura Mattis Beer/Wine Refrigerator | Cuisinart Product Portfolio: Review & Recommendations | 7 OPTIONS FOR CUISINART New Market Education & Support In the mature food processor market, Cuisinart could differentiate themselves from their competitors by considering compliments to their product portfolio. Cuisinart has historically sponsored cooking shows as an educational and marketing vehicle, but high-touch interactions may be the most beneficial. In order to appeal to serious consumer cooks, Cuisinart could also leverage cooks’ creativity and consider innovative ways to keep them experimenting in the kitchen. This experimentation will ensure that Cuisinart food processors remain key tools to the cooking process. Penetrate In order to penetrate the current market with existing products, Cuisinart should consider reducing their overall lineup to simplify options for new food processor buyers. Local Cooking Classes/ Tastings Cuisinart Cook-offs Existing Market Cook Mentors Combine Cooking Actions (slice/steam, dice/saute) Newlywed Gift Set Composting Bin Attachment Extend Innovate Eliminate Professional Suite of Processors Stylish Designs Expand Dissemination Channels Easy to Store/Clean Products Market Product’s Versatility Handheld Product for Quick Jobs Penetrate Expand Expand Current products best serve the informed consumer but the addition of simpler, more stylish machines could encourage current owners to upgrade or compliment their existing products. Existing Products New Products Extend Cuisinart can reach new markets through linking food preparation to the broader social experience and context of food. Innovate Augmenting future products to tackle additional food prep steps in a single machine could position Cuisinart food processors as the tool to have in the kitchen. Laura Mattis | Cuisinart Product Portfolio: Review & Recommendations | 8 PORTFOLIO RECOMMENDATIONS Option 1: Local Cooking Classes/Tastings Extend Cuisinart Products Into Social Experiences Extend Penetrate Innovate Expand Food preparation is a means to creating a meal for those we care about. Cuisinart could develop activities and experiences that tap into the social aspects of cooking. Cuisinart should return to its roots of product demonstrations, by offering social activities focused on food preparation and sharing. Small local events provide an intimate setting to bond with others and could appeal to any consumer looking for a novel activity. Cuisinart Cook-Offs Cook-offs, or cooking contests, give Cuisinart’s most passionate customers an opportunity to show off their cooking skills and recipes. Such events could feature high profile judges, attendee voting/tasting and merchandise. Newlywed Gift Sets Gift product bundles with custom packaging could provide a suite of customized cooking tools, such as spatulas, mixing bowls and measuring cups that facilitate machine use. Buyers could assemble the set in retail stores with assistance from an interactive display or gift advisor. Option 2: Innovate How Consumers Use Their Kitchens Consumers are increasingly tempted by convenience foods and non-cooking activities, so it’s important to efficiently use the cooking time that consumers have. More cooks enter the kitchen, they are increasingly faced with lots of choices on what to invest in. With a creative lens of this crowded kitchen, Cuisinart can serve a key role in managing the clutter. Extend Innovate Penetrate Expand Cooking Mentors Particularly for those cooks starting out or who are mildly interested in the idea of cooking, Cuisinart can offer mentors who facilitate the learning process and act as coaches that build new cooks’ confidence and excitement. By learning tips and tricks about the process, these cooks can learn the best and most efficient ways around the kitchen. Combine Cooking Actions In an increasingly crowded kitchen, counter space is of the essence. Streamlined products that take up minimal space and which achieve multiple tasks in the same meal will be more likely to stay on the counter. By chopping and steaming vegetables in the same appliance, cooks save time cooking and cleaning. Composting Bin Attachment Environmental conscious consumers may already have one set up in the backyard. But by considering such an attachment, Cuisinart could provide any easy way to save scraps and put waste to use. Laura Mattis | Cuisinart Product Portfolio: Review & Recommendations | 9 REFERENCES Company Background Cuisinart. “Cuisinart Milestones.” Mar. 2011. http://www.cuisinart.com/about/timeline.html Cuisinart. “The Cuisinart Story: Turning The Art Of Great Cooking Into An American Lifestyle.“ May 2010. http://www.cuisinart.com/about.html Lemelson-MIT Program. “Inventor of the Week: Carl Sontheimer.” May 1998. http://web.mit.edu/invent/iow/sontheimer.html PCWorld. “The Steve Jobs Biography: 5 Tidbits You Need To Read.” Oct 2011. http://www.pcworld.com/article/242277/steve_jobs_biography_5_tidbits_you_need_to_read.html Industry Landscape The Wall Street Journal. “The Gifts On Every Wedding List.” June 2011. http://online.wsj.com/article/SB10001424052702304906004576371352048939270.html New York Times. “What’s In Your Kitchen.” December 2011. http://well.blogs.nytimes.com/2011/12/13/whats-in-your-kitchen/ The Wall Street Journal. “For Appliance Makers, Less Is More.” May 2012. http://online.wsj.com/article/SB10001424052702303879604577410193241593100.html The Chicago Sun-Times. “The Food Processor Turns 40.” Sept. 2012. http://www.suntimes.com/lifestyles/food/3429100-423/processor-says-gilletz-cuisinart-recipes.html The New York Times. “How Cuisinart Lost Its Edge.” Apr. 1990. http://www.nytimes.com/1990/04/15/magazine/how-cuisinart-lost-its-edge.html?pagewanted=all&src=pm ApplianceMagazine.com. “Small Appliance Market Will Stay Strong “ Jan. 2008. http://www.appliancemagazine.com/editorial.php?article=1902&zone=1&first=1 Cooks Illustrated. “Food Processors.” Jan 2013. http://www.cooksillustrated.com/equipment/overview.asp?docid=26352 Harris Interactive. “Three in Ten Americans Love to Cook, While One in Five Do Not Enjoy It or Don’t Cook.” Jul. 2010. http://www.harrisinteractive.com/NewsRoom/HarrisPolls/tabid/447/mid/1508/ articleId/444/ctl/ReadCustom%20Default/Default.aspx AllRecipes.com. The Measuring Cup: 2013 Trends: What Americans are Cooking & Eating.” Jan 2013. http://press.allrecipes.com/wp-content/uploads/Allrecipes-Measuring-Cup-Jan-2013-WEB.pdf JWT Intelligence. “What’s Cooking? Trends In Food.” Feb. 2012. http://www.slideshare.net/jwtintelligence/whats-cooking-trends-in-food Compete. “Pinning Down the Impact of Pinterest.” June 2012. http://blog.compete.com/2012/06/28/pinning-down-the-impact-of-pinterest/ The New York Times. “So, Wait, People Are Cooking?“ http://bittman.blogs.nytimes.com/2012/02/01/wait-so-people-are-cooking/ Competitor Analysis Cooking.com. “Top Rated Food Processors.” Feb 2013. http://www.cooking.com/top_food-processors_45-91-4294966687_p01/ MarketResearch.com. “Small Kitchen Appliances In The U.S.” Dec 2006. http://academic.marketresearch.com.ezproxy.gl.iit.edu/product/display.asp?productid=1281485 NPD Group. “NPD’s Kitchen Audit 2011 Study Information Preview.” https://www.npd.com/lps/pdf/Kitchen_Audit_Information_Preview.pdf IBISWorld. “Food Processor & Blender Manufacturing in the US: Market Research Report.” Sept. 2011. http://www.ibisworld.com/industry/food-processor-blender-manufacturing.html Laura Mattis | Cuisinart Product Portfolio: Review & Recommendations | 10