PDF file of Canberra Labour Market Presentation

advertisement

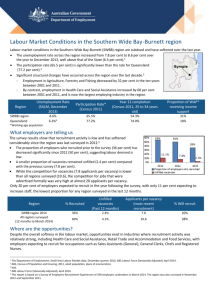

Slide 1 Canberra Labour Market May 2014 Presented by Ivan Neville Labour Market Research and Analysis Branch Department of Employment www.employment.gov.au Slide 2 How is the ACT labour market performing? • Unemployment rate remains below the national rate - 3.8 per cent as at April 2014 compared with 5.8 per cent for Australia • Employment growth has slowed – 0.8 per cent over the year to April 2014, compared with 2.0 per cent growth for the previous year - Significant decline in female full-time employment over the last year • Labour market conditions have been easing - recruitment activity falling, increased competition for fewer vacancies • One in three workers directly employed in the public sector – Federal budget tightening likely to have a significant impact Source: ABS, Labour Force Survey, April 2014 (12 month averages of original data); Department of Employment, Survey of Employers’ Recruitment Experiences in Capital Cities , 2012 & 2013 How is the ACT labour market performing? Source: ABS, Labour Force Survey, April 2014 (12 month averages of original data); Department of Employment, Survey of Employers’ Recruitment Experiences in Capital Cities , 2012 & 2013 As at April 2014, the unemployment rate for the ACT was 3.8 per cent, well below the national rate of 5.8 per cent. Employment growth in the ACT has slowed, recording growth of only 0.8 per cent over the 12 months to April 2014, compared with 2.0 per cent growth for the previous year. There has also been a significant decline in the number of females employed full-time. Labour market conditions have been easing in the ACT with recruitment activity falling and increased competition for fewer vacancies. With one in three workers directly employed in the public sector, federal budget tightening is likely to have a significant impact. Slide 3 Internet vacancies 200 ACT GFC Australia 180 160 140 120 100 80 60 40 20 Source: Department of Employment, Vacancy Report, Trend Index, April 2014 Internet vacancies Source: Department of Employment, Vacancy Report, Trend Index, April 2014 Apr-14 Jul-13 Oct-12 Jan-12 Apr-11 Jul-10 Oct-09 Jan-09 Apr-08 Jul-07 Oct-06 Jan-06 0 Slide 4 Consistently lower unemployment rate in the ACT… 7% 5.8% 6% 5% 4% 3% 3.8% 2% ACT 1% Australia Apr-14 Apr-13 Apr-12 Apr-11 Apr-10 Apr-09 Apr-08 Apr-07 Apr-06 Apr-05 Apr-04 0% Source: ABS, Labour Force Survey, April 2014 (12 month averages of original data) Consistently lower unemployment rate in the ACT… Source: ABS, Labour Force Survey, April 2014 (12 month averages of original data) The unemployment rate for the ACT was 3.8 per cent as at April 2014, well below the national rate of 5.8 per cent. Slide 5 …but youth unemployment remains a challenge… 14% 15-24 years 12% All ages 10% 10.6% 8% 6% 4% 2% 3.8% Apr-14 Apr-13 Apr-12 Apr-11 Apr-10 Apr-09 Apr-08 Apr-07 Apr-06 Apr-05 Apr-04 0% Source: ABS, Labour Force Survey, April 2014 (12 month averages of original data) …but youth unemployment remains a challenge… Source: ABS, Labour Force Survey, April 2014 (12 month averages of original data) In the ACT, for persons aged 15 to 24 years, the unemployment rate was 10.6 per cent as at April 2014. This rate is significantly higher than the unemployment rate at for all ages (3.8 per cent). Slide 6 …and young people respond by staying in education longer 90% 70% 80% 60% 70% 50% 60% 15-19 attending school/tertiary education full-time (LHS) 20-24 attending school/tertiary education full-time (LHS) 15-19 employed full-time (RHS) 20-24 employed full-time (RHS) 50% 40% 40% 30% 30% 20% 20% 10% 10% Apr-14 Jan-14 Oct-13 Jul-13 Apr-13 Jan-13 Oct-12 Jul-12 0% Apr-12 0% Source: ABS, Labour Force Survey, April 2014 (12 month averages of original data) …and young people respond by staying in education longer Source: ABS, Labour Force Survey, April 2014 (12 month averages of original data) Over the past two years, an increasing proportion of young people (aged 15 to 24) are attending school or tertiary education full-time and a smaller proportion are working full-time. Slide 7 Young people who stay do better Of those aged 15-18 living in the ACT in 2006… 82% 18% lived in the ACT in 2011 lived elsewhere in 2011 72% Employed 81% Employed Unemployment Rate 5.7% Unemployment Rate 10.0% Participation Rate 86.1% Participation Rate 80.0% Attending Education Institution 46% Attending Education Institution 47% Source: ABS, Census of Population and Housing, 2011 Young people who stay do better Source: ABS, Census of Population and Housing, 2011 Of those aged 15 to 18 years living in the ACT in 2006, 82 per cent were also living in the ACT at the time of the 2006 Census. Compared with the 18 per cent who were living elsewhere in 2011, the people who stayed were more likely to be employed and had a lower unemployment rate. Slide 8 What are the 15-19 year olds doing? Source: ABS, Census of Population and Housing, 2011 At the time of the 2011 Census, 83 per cent of 15 to 19 year olds living in the ACT were studying. Of those studying, 38 per cent were also working while 45 per cent were studying only. Slide 9 What are the 15-19 year olds doing? Source: ABS, Census of Population and Housing, 2011 At the time of the 2011 Census, 17 per cent of 15 to 19 year olds living in the ACT were not studying. Of those not studying, 13 per cent were employed while 4 per cent were either unemployed or not in the labour force. Slide 10 Largest employing industries Total employed, ACT Public Administration and Safety 33% Professional, Scientific and Technical Services 10% Health Care and Social Assistance 10% Education and Training 9% Retail Trade 7% Construction 7% Accommodation and Food Services 6% 0% 5% 10% 15% 20% 25% 30% 35% Source: ABS, Labour Force Survey, February quarter 2014 (4 quarter averages of original data) Largest employing industries Total employed, ACT Source: ABS, Labour Force Survey, February quarter 2014 (4 quarter averages of original data) Public Administration and Safety is the largest employing industry, accounting for one third of total employment in the ACT. Professional and, Scientific and Technical Services and Health Care and Social Assistance are also large employing industries in the ACT. Slide 11 Structural change in the ACT labour market 35% 32.7% 1994 30% 2014 26.3% 25% 20% 15% 9.6% 10% 9.6% 7.9% 10.4% 9.0% 9.9% 7.4% 6.3% 6.0% 6.7% 7.3% 5.7% 5% 0% Public Professional, Health Care and Administration Scientific and Social Assistance and Safety Technical Services Education and Training Retail Trade Construction Accommodation and Food Services Source: ABS, Labour Force Survey, February quarter 2014 (4 quarter averages of original data) Structural change in the ACT labour market Source: ABS, Labour Force Survey, February quarter 2014 (4 quarter averages of original data) This chart illustrates how the ACT’s industry employment composition has changed over the last 20 years. Even 20 years ago, Public Administration and Safety was the largest employing industry in the ACT. Slide 12 Ongoing shift to higher skilled jobs High skill (levels 1 and 2) Medium skill (levels 3 and 4) Low skill (level 5) Change in share of employment (%) 15 10 5 0 -5 -10 Feb-2014 Aug-2013 Feb-2013 Feb-2012 Aug-2012 Feb-2011 Aug-2011 Feb-2010 Aug-2010 Aug-2009 Feb-2009 Aug-2008 Feb-2008 Feb-2007 Aug-2007 Feb-2006 Aug-2006 Feb-2005 Aug-2005 Aug-2004 Feb-2004 -15 Source: ABS, Labour Force, Australia, Detailed, Quarterly, cat. no. 6291.0.55.003, Department of Employment trend. Ongoing shift to higher skilled jobs Source: ABS, Labour Force, Australia, Detailed, Quarterly, cat. no. 6291.0.55.003, Department of Employment trend. The attainment of educational qualifications remains important given the strong past and projected growth of higher skilled occupations, as well as the lower unemployment rates recorded for people with higher qualifications. Looking over the 10 year period from August 2003 to August 2013, it is clear that jobs at the higher skill levels (Skill Level 1, commensurate with a Bachelor degree or higher qualification and Skill Level 2, commensurate with an Associate Degree, Advanced Diploma or Diploma)) are increasing as a proportion of overall employment – up from 37.0 per cent to 41.1 per cent. At the same time, jobs at the lowest skill level (Skill Level 5, commensurate with compulsory secondary education or a Certificate I) are diminishing as a proportion of total employment from 19.9 per cent to 17.5 per cent. What this means for school leavers is that yes, you may get a job when you leave school, BUT you may not experience the same employment stability or earn as much as those students whose education choices set them up for a career, rather than a series of low skilled jobs. The key technical and trade group at skill level 3, corresponding to a Certificate IV or a formal apprenticeship, is declining as a share of employment, but growth rates vary considerably within this category (see next slide). Note: This chart plots the percentage change in the percentage shares of employment from August 2003 onward. Source: ABS Labour Force Survey data to August 2013, seasonally adjusted and trended by the Department of Employment. Slide 13 Recent occupation growth in the ACT Change in persons employed in the 12 months to February 2014 Occupation Annual growth (persons employed) Contract, Program and Project Administrators 2620 Midwifery and Nursing Professionals 1420 Accounting Clerks and Bookkeepers 1150 Logistics Clerks 1080 General Clerks 860 Architects, Designers, Planners and Surveyors 730 Tertiary Education Teachers 600 Social and Welfare Professionals 590 Financial Brokers and Dealers, and Investment Advisers 520 Health Diagnostic and Promotion Professionals 490 Bricklayers, and Carpenters and Joiners 470 Source: ABS, Labour Force Survey, February quarter 2014 (4 quarter averages of original data) Recent occupation growth in the ACT Change in persons employed in the 12 months to February 2014 Source: ABS, Labour Force Survey, February quarter 2014 (4 quarter averages of original data) In the 12 months to February 2014, the largest growing occupations in the ACT were Contract, Program and Project Administrators, Midwifery and Nursing Professionals and Accounting Clerks and Bookkeepers. Slide 14 Literacy and numeracy for year 9 students Proportion of students not at the national minimum standard 9% 8% 7% ACT 7.8% Australia 6.2% 6% 5.5% 5.0% 5% 4.6% 4% 3% 2.5% 2% 1% 0% Reading Spelling Numeracy Source: 2013 NAPLAN National Report Literacy and numeracy for year 9 students Proportion of students not at the national minimum standard Source: 2013 NAPLAN National Report A smaller proportion of year 9 students in the ACT are not meeting the national minimum standard for reading, spelling and numeracy compared with the average for Australia. Slide 15 Levels of educational attainment Persons aged 25-34 years % completed Yr 12 or higher % attained Advanced Diploma, % attained Diploma or Bachelor Degree Certificate III/IV or higher Level Australian Capital Territory 93% 23% 51% Australia 85% 30% 35% Source: ABS, Census of Population and Housing, 2011 Levels of educational attainment Persons aged 25-34 years Source: ABS, Census of Population and Housing, 2011 At the time of the 2011 Census, a higher proportion of 25 to 34 year olds had completed Year 12 or higher (93 per cent) compared with Australia (85 per cent). Over half of 25 to 34 years olds in the ACT had also attained a Bachelor Degree or higher. Slide 16 Educational attainment and labour market outcomes ACT, persons aged 25-34 years 13.7% 14% 12% 90.9% 91.1% 100% 90% 92.0% 85.4% 80.0% 72.1% 10% 70% 8.4% 8% 80% Unemployment Rate (LHS) 60% Participation Rate (RHS) 50% 6% 40% 3.8% 4% 2.2% 2.2% 30% 20% 2.1% 2% 10% 0% 0% Bachelor Degree or Advanced Certificate Level III higher Diploma/Diploma & IV Year 12 Certificate I & II Below Year 12 Source: ABS, Census of Population and Housing, 2011 Educational attainment and labour market outcomes ACT, persons aged 25-34 years Source: ABS, Census of Population and Housing, 2011 (Figures are for the highest level of education attained) This chart demonstrates the positive relationship between educational attainment and labour market outcomes. In the ACT, those who hadn’t completed Year 12 or had a Certificate I/II as their highest level of education faced low rates of labour force participation and high rates of unemployment. Slide 17 What are employers telling us? Slide 18 Recruitment conditions have eased 2012 2013 All Capital Cities 2013 Recruitment activity Recruited for staff 85% 82% 74% Increased staff numbers 28% 20% 22% Annual vacancies per 100 staff 12.1 10.3 10.0 Recruitment difficulty Applicants per vacancy 6.0 8.0 12.2 Experienced recruitment difficulty 53% 53% 42% 10.2% 8.3% 7.3% Unfilled vacancies Recruitment expectations Expected to increase staff 27% 22% 26% Expected to decrease staff 7% 12% 9% Source: Department of Employment, Survey of Employers’ Recruitment Experiences in Capital Cities , 2012 & 2013 Recruitment conditions have eased Source: Department of Employment, Survey of Employers’ Recruitment Experiences in Capital Cities, 2012 & 2013 Labour market conditions have softened significantly in Canberra where a growing number of employers reported reducing staff numbers in the six months prior to the survey. Recruitment conditions in the six months following the survey were expected to continue to ease with a large number of employers anticipating further reductions in staff numbers. Slide 19 Recruiting employers who experienced difficulty Higher skilled occupations 71% 16% of vacancies unfilled Lower skilled occupations 41% 5% of vacancies unfilled 24% of vacancies for Technicians and Trades Workers went unfilled Source: Department of Employment, Survey of Employers’ Recruitment Experiences in Capital Cities , 2013 Recruiting employers who experienced difficulty Source: Department of Employment, Survey of Employers’ Recruitment Experiences in Capital Cities, 2013 Employers in Canberra still experienced recruitment difficulty recruiting for both higher (71 per cent) and lower (41 per cent) skilled positions. Slide 20 Some employers do not formally advertise vacancies Formal methods 84% Internet Newspaper Company Website 9 applicants per vacancy, 3 rated suitable Informal methods ONLY Word of Mouth 16% Approached by Job seeker 4 applicants per vacancy, 2 rated suitable Source: Department of Employment, Survey of Employers’ Recruitment Experiences in Capital Cities , 2013 Some employers do not formally advertise vacancies Source: Department of Employment, Survey of Employers’ Recruitment Experiences in Capital Cities, 2013 In Canberra, 84 per cent of employers used a formal method of recruitment in their most recent recruitment round including use of the internet, newspaper and company website. On average, formal recruitment methods attracted 9 applicants per vacancy of which 3 were considered suitable by the employer. 16 per cent of employers used an informal method ONLY, most commonly word of mouth and being approached by the job seeker. On average, using an informal method only attracted 4 applicants of which 2 were considered suitable by the employer. Slide 21 Reasons applicants didn’t get an interview 60% 52% 74% of applicants don’t get an interview 50% 40% 30% 24% 20% 18% 15% 14% 14% Interview not required Applicant located overseas/ out of area 10% 0% Lack of relevant experience Insufficient Poorly Lack of soft skills qualifications or written/presented training application Source: Department of Employment, Survey of Employers’ Recruitment Experiences, All regions in the 12 months to March 2014 Reasons applicants didn’t get an interview Source: Department of Employment, Survey of Employers’ Recruitment Experiences, All regions in the 12 months to March 2014 On average, 74 per cent of applicants so no get an interview. When asked why applicants didn’t get an interview, 52 per cent of employers mentioned that a lack of relevant experience was a factor. Slide 22 Improving young people’s chances of getting a job – employers’ views 45% 40% 39% 35% 30% 25% 20% 14% 15% 11% 10% 11% 7% 7% 6% 7% 5% 5% 3% 3% 0% Attitude Reliability & responsibility Physical Communication presentation Realistic role/salary expectations Improving attitude to work and basic employability skills Work Experience Further education & training Higher quality Funding for Increase career schooling apprenticeships expos/career & traineeships information Further develop job skills Change employer attitudes Other Source: Department of Employment, Survey of Employers’ Recruitment Experiences, Gladstone ESA, Bundaberg-Hervey Bay PEA, Central Victoria PEA, October – December 2013 Improving young people’s chances of getting a job? – employers’ views Source: Department of Employment, Survey of Employers’ Recruitment Experiences, Gladstone ESA, Bundaberg-Hervey Bay PEA, Central Victoria PEA, October – December 2013 The results in this report are based on 1151 responding employers who were surveyed between October-December 2013 in the Gladstone Employment Service Area (ESA), the BundabergHervey Bay Priority Employment Area (PEA) and the Central Victoria PEA. Some employers provided more than one response. Slide 23 Employability skills essential What employers considered essential in an applicant 71% of employers said that personality traits/qualities are more or equally as important as technical skills • Enthusiastic/positive attitude • Interact/connect with others/teamwork • Hardworking/good work ethic • Communicate • Make good decisions • Reliable Source: Department of Employment, Survey of Employers’ Recruitment Experiences, December 2013; All regions surveyed in the 12 months to Dec 2010. Employability skills essential Source: Department of Employment, Survey of Employers’ Recruitment Experiences, December 2013, All regions surveyed in the 12 months to December 2010 Employers want people who can/have • Enthusiastic/positive attitude • Interact/connect with others/teamwork • Hardworking/good work ethic • Communicate (higher order skill – e.g. hold an argument) • Make good decisions • Reliable Slide 24 Future expectations of surveyed employers ANTICIPATED STAFF CHANGE ANTICIPATED STAFF INCREASES 30% 26% 25% Canberra All Capital Cities 22% 20% 15% Accommodation and Food Services 26% Health Care and Social Assistance 26% Construction 25% 12% 9% 10% Professional, Scientific and Technical Services 20% 5% Retail Trade 0% Increase Staff Decrease Staff 11% 0% 10% 20% 30% Source: Department of Employment, Survey of Employers’ Recruitment Experiences in Capital Cities , 2013 Future expectations of surveyed employers Source: Department of Employment, Survey of Employers’ Recruitment Experiences in Capital Cities, 2013 In Canberra, a smaller proportion of employers (22 per cent) anticipated the need to increase staff numbers in the following months compared with the average for all cities combined (26 per cent). A higher proportion (12 per cent) anticipated having to decrease staff numbers in the near future compared with the average for all cities combined (9 per cent). Employers in the Accommodation and Food Services and Health Care and Social Assistance industries were most likely to increase staff numbers in the six months following the survey. Slide 25 Where will the jobs be? National projected employment growth (‘000) – five years to November 2018 Health Care and Social Assistance Education and Training Retail Trade Professional, Scientific and Technical Services Construction Accommodation and Food Services Public Administration and Safety Administrative and Support Services Transport, Postal and Warehousing Other Services Financial and Insurance Services Wholesale Trade Arts and Recreation Services Rental, Hiring and Real Estate Services Electricity, Gas, Water and Waste Services Information Media and Telecommunications Agriculture, Forestry and Fishing Mining Manufacturing 229.4 118.8 98.2 88.7 83.5 55.2 48.5 37.3 32.1 20.7 20.5 19.9 15.6 15.1 9.8 0.2 -2.8 -12.3 -40.3 -100 -50 0 50 100 150 200 250 Source: Department of Employment, 2014 Employment Projections to November 2018 Where will the jobs be? National projected employment growth (‘000) – five years to November 2018 Source: Department of Employment, 2014 Employment Projections to November 2018. Slide 26 Conclusion Unemployment remains low but conditions easing • Employment growth slowing • Vacancies falling • Increased competition for jobs Challenges for the region • Public service cuts • Unemployment rate for young people much higher and increasing Opportunities • Strong growth industries: Health Care and Social Assistance • Unfilled vacancies for many higher skilled occupations, particularly Trades Workers Job seekers require • Education / training • Employability skills • Work experience / apprenticeships • Literacy and numeracy Collaborate with key stakeholders Conclusion Unemployment remains low but conditions easing Employment growth slowing Vacancies falling Increased competition for jobs Challenges for the region Public service cuts Unemployment rate for young people much higher and increasing Opportunities Strong growth industries: Health Care and Social Assistance Unfilled vacancies for many higher skilled occupations, particularly Trades Workers Job seekers require Education / training Employability skills Work experience / apprenticeships Literacy and numeracy Collaborate with key stakeholders Slide 27 Further Information – www.employment.gov.au/lmip – www.employment.gov.au/skillshortages – www.employment.gov.au/regionalreports – www.employment.gov.au/australianjobs – www.joboutlook.gov.au Further Information More information on labour market conditions and other research on small areas can be found on these web sites • • • • • www.employment.gov.au/LMIP www.employment.gov.au/SkillShortages www.employment.gov.au/RegionalReports www.employment.gov.au/australianjobs www.joboutlook.gov.au A report on the survey findings for the fourth annual Survey of Employers’ Recruitment Experiences in Capital Cities has been placed on the regional reports section of the Department of Employment - Regional Reports web site. Thank you. Slide 28