Econ 627 Econometric Theory II 2013

advertisement

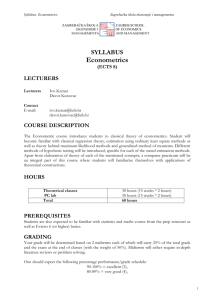

Econ 627 Econometric Theory II 2013-14 Winter Session Vadim Marmer Office: BuTo 1016 Phone: (82)2-8217 Email: vadim.marmer@gmail.com Time and Location: Tuesdays & Thursdays, 9:30AM - 10:50PM, Buch D222. Office Hours: Wednesdays 11AM-noon. Course web-page: http://www.econ.ubc.ca/vmarmer/econ627 TA: Jutong Pan, panjutong@gmail.com Discussion group: Mondays, 1PM-2:30PM, Neville Scarfe, 203. Office hours: Mondays, 3:00PM-4:00PM, BuTo, 1099C. Web-page: https://sites.google.com/site/jutongpan/ta-courses/econ627 Textbooks: I will provide lecture notes that will cover the essential part of the material. The main textbook for the course is Econometrics by Fumio Hayashi, Princeton University Press, New Jersey, 2000 (required). Answers to selected questions, data sets for empirical exercises and other accompanying materials are available on the web from http://fhayashi.fc2web.com/hayashi_econometrics.htm . Additional textbooks/sources that students might find helpful include: • J. Davidson, Stochastic Limit Theory: An Introduction for Econometricians, Advanced Texts in Econometrics, Oxford University Press, New York, 1994. • J.R. Magnus and H. Neudecker, Matrix Differential Calculus with Applications in Statistics and Econometrics, John Wiley & Sons, New York, 1999. • H. White, Asymptotic Theory for Econometricians, Revised Edition, Academic Press, 2001. • Bruce Hansen’s Lectures on Econometrics, available online at http://www.ssc.wisc.edu/~bhansen/econometrics/ • Peter Phillips’ Lecture Notes on Stationary and Nonstationary Time Series and Unit Roots and Cointegration, see http://cowles.econ.yale.edu/korora/phillips/teach/lec-notes.htm Course Description: This course is a continuation of Econ 626. We will start with a discussion linear econometric models, linear simultaneous equations, and system estimation methods. Nonlinear models will be covered in the context of extremum estimation. We will cover a general theory of extremum estimators with the main focus on generic approaches for establishing consistency and asymptotic normality of extremum estimators. The course will conclude with various topics in stationary and nonstationary time series econometrics. Students will receive analytical and practical exercises. The practical questions will require handling and analyzing data with MATLAB, Gauss, or similar software. Grading: There will be regular (weekly) assignments (20% of the final grade), a midterm exam (30%), and a final exam (50%). Topics: 1. Linear simultaneous equations. Identification and estimation methods: GMM, 2SLS, 3SLS, FIML and LIML. 2. Extremum estimators. Asymptotic normality and consistency of extremum estimators including MLE, GMM estimator for nonlinear models, Classical Minimum Distance estimator, and quantile regression. 3. Time series. Dependence structure, ergodicity, stationarity, mixing processes, LLNs and CLTs for weakly dependent data, linear regression with weakly dependent data, HAC variance estimation, Wold decomposition, linear processes.