growth and innovation policies for a knowledge economy

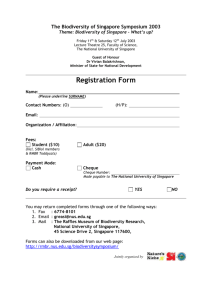

advertisement