OTC15-08-14p1_OTC15/11/2005 p1&24 12/08/2014 18:23 Page 1

15 August 2014

COMPANY NEWS

2

Sanofi races ahead

2

of OTC competitors

3

Meda grabs Rottapharm

for SEK21.2bn

Omega outlines European ambitions 4

GSK has no plans to

6

spin off Consumer

Valeant faces US lawsuit

7

over alleged insider trading

RB sees opportunity

8

in medical devices

Procter & Gamble starts culling brands 9

GNC’s Retail plan in doubt

10

as CEO leaves

Negative currency effects

11

damage Bayer

Taisho looks to increase

12

demand for OTCs

Pfizer committed to

13

Consumer Healthcare

Celesio to soon see

14

McKesson benefits

GENERAL NEWS

15

MHRA calls for proposals to

put OTC drugs on black list

Russia considers

non-pharmacy sales

Asthma use worries lead

Singulair safety concerns

Body weight is no issue for

emergency contraceptives

15

MARKETING NEWS

19

Infirst to make global debut

with Dr Cocoa launch in US

Bayer bolsters Berocca

in US and UK

Australians can access

Merck’s Nasonex OTC

Prestige offers dairy defence

19

FEATURES

24

OTC market growth

remains fragile

24

16

17

18

20

21

21

REGULARS

Events – Our regular listing

23

People – Walgreens Boots Alliance 27

appoints leadership team

RB starts revolution with

£100mn R&D investment

A

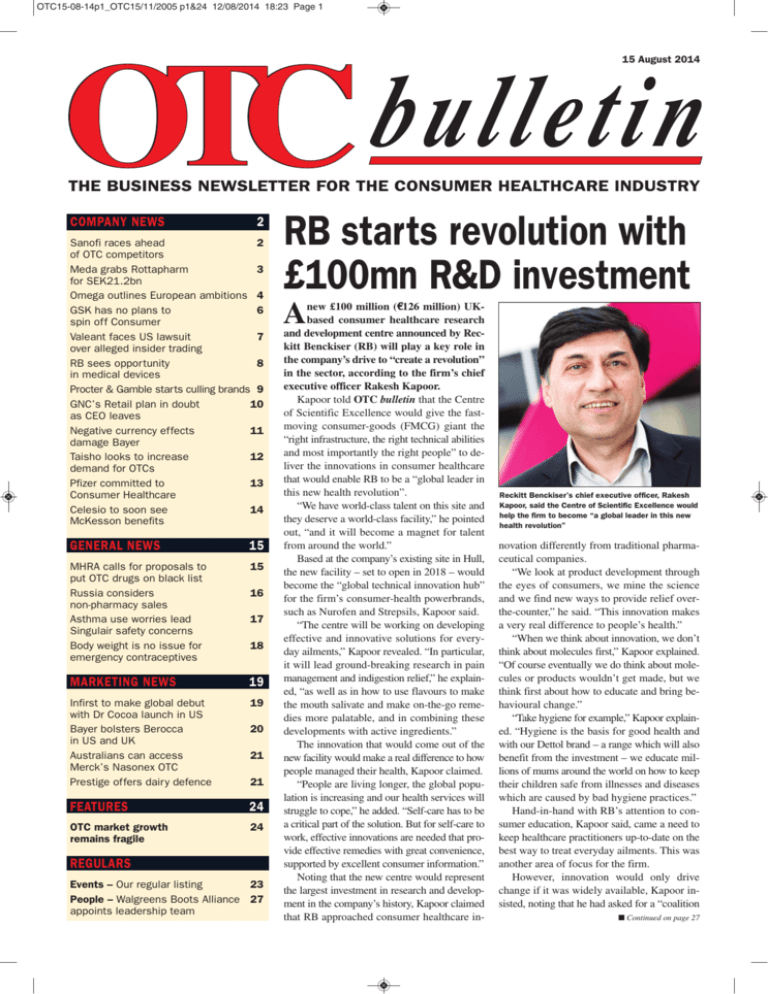

new £100 million (CC126 million) UKbased consumer healthcare research

and development centre announced by Reckitt Benckiser (RB) will play a key role in

the company’s drive to “create a revolution”

in the sector, according to the firm’s chief

executive officer Rakesh Kapoor.

Kapoor told OTC bulletin that the Centre

of Scientific Excellence would give the fastmoving consumer-goods (FMCG) giant the

“right infrastructure, the right technical abilities

and most importantly the right people” to deliver the innovations in consumer healthcare

that would enable RB to be a “global leader in

this new health revolution”.

“We have world-class talent on this site and

they deserve a world-class facility,” he pointed

out, “and it will become a magnet for talent

from around the world.”

Based at the company’s existing site in Hull,

the new facility – set to open in 2018 – would

become the “global technical innovation hub”

for the firm’s consumer-health powerbrands,

such as Nurofen and Strepsils, Kapoor said.

“The centre will be working on developing

effective and innovative solutions for everyday ailments,” Kapoor revealed. “In particular,

it will lead ground-breaking research in pain

management and indigestion relief,” he explained, “as well as in how to use flavours to make

the mouth salivate and make on-the-go remedies more palatable, and in combining these

developments with active ingredients.”

The innovation that would come out of the

new facility would make a real difference to how

people managed their health, Kapoor claimed.

“People are living longer, the global population is increasing and our health services will

struggle to cope,” he added. “Self-care has to be

a critical part of the solution. But for self-care to

work, effective innovations are needed that provide effective remedies with great convenience,

supported by excellent consumer information.”

Noting that the new centre would represent

the largest investment in research and development in the company’s history, Kapoor claimed

that RB approached consumer healthcare in-

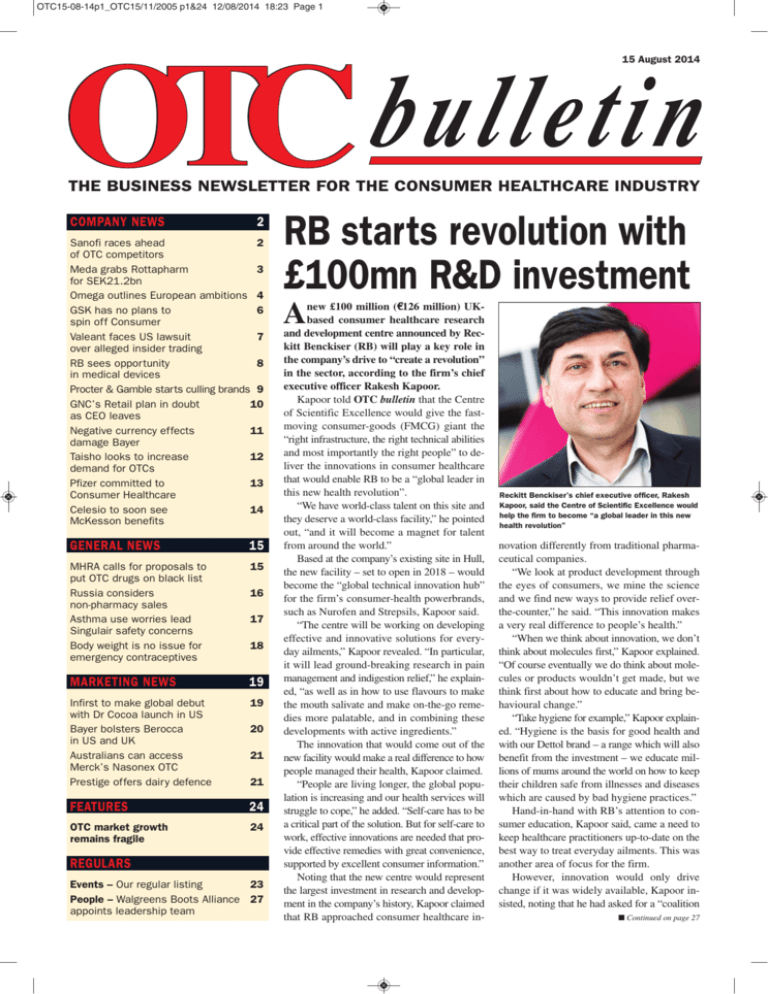

Reckitt Benckiser’s chief executive officer, Rakesh

Kapoor, said the Centre of Scientific Excellence would

help the firm to become “a global leader in this new

health revolution”

novation differently from traditional pharmaceutical companies.

“We look at product development through

the eyes of consumers, we mine the science

and we find new ways to provide relief overthe-counter,” he said. “This innovation makes

a very real difference to people’s health.”

“When we think about innovation, we don’t

think about molecules first,” Kapoor explained.

“Of course eventually we do think about molecules or products wouldn’t get made, but we

think first about how to educate and bring behavioural change.”

“Take hygiene for example,” Kapoor explained. “Hygiene is the basis for good health and

with our Dettol brand – a range which will also

benefit from the investment – we educate millions of mums around the world on how to keep

their children safe from illnesses and diseases

which are caused by bad hygiene practices.”

Hand-in-hand with RB’s attention to consumer education, Kapoor said, came a need to

keep healthcare practitioners up-to-date on the

best way to treat everyday ailments. This was

another area of focus for the firm.

However, innovation would only drive

change if it was widely available, Kapoor insisted, noting that he had asked for a “coalition

■ Continued on page 27

OTC15-08-14p2-14_Layout 1 12/08/2014 18:19 Page 2

OTC COMPANY NEWS

Second-Quarter Results

Sanofi races ahead of OTC competitors

S

anofi’s Consumer Healthcare business is

growing faster than all its competitors in

the segment, thanks to the switch of Nasacort

in the US and strong sales in emerging markets, according to the company’s chief executive officer Chris Viehbacher.

Speaking as the French firm posted Consumer Healthcare sales up by 20.2% to C816

million in the second quarter of 2014, Viehbacher said the business had become an “extremely important part” of Sanofi and had been

growing “incredibly well”.

Even excluding the transfer of products “previously reported in prescription pharmaceuticals” in the prior-year period, the division had

still outpaced the competition, Viehbacher noted,

with sales rising by 9.2% in the quarter.

Expanding on Consumer Healthcare’s place

within the Sanofi group, Viehbacher explained that it enabled brands to “live for decades”

and provided the “long-term revenues” that a

company like Sanofi needed to ensure the financial stability required to take research and development risks.

Furthermore, Consumer Healthcare kept the

company “in touch regularly with actual consumers”, he claimed, adding that it was important for Sanofi “never to forget the people

aspect of our business”.

Meanwhile, following the switch of NasaBusiness

Allegra

Doliprane

Essentiale

Enterogermina

Lactacyd

Dorflex

Nasacort

No Spa

Maalox

Other Consumer Healthcare brands

Consumer Healthcare

Diabetes

Genzyme

Generics

Oncology/Other Pharmaceutical

Pharmaceuticals

Region

Second-quarter

sales (CC millions)

Change (%)

CER*

Proportion

of sales (%)

Emerging Markets

US

Western Europe

Rest of World

434

177

161

44

+36.4

+23.2

±0.0

-25.0

53

22

20

5

Total Consumer Healthcare

816

+20.2

100

* CER is constant exchange rates

Figure 2: Sanofi’s Consumer Healthcare sales in the second quarter of 2014 by region (Source – Sanofi)

cort in the US (OTC bulletin, 25 October 2013,

page 1), the company was gearing up for the

potential switch of Eli Lilly’s erectile dysfunction drug Cialis (tadalafil), Viehbacher noted.

Having acquired the rights to switch the

product in Europe, Japan and the US (OTC

bulletin, 30 May 2014, page 1), Sanofi believed

there was an exciting opportunity to open up

a new OTC category, Viehbacher said, and to

drive further strong growth at its OTC franchise.

If a switch was given the go-ahead, Sanofi

anticipated marketing Cialis OTC after the “expiration of certain patents”, the firm noted.

Cialis has been approved as a prescription

medicine in more than 120 countries worldwide with a number of indications, including

erectile dysfunction and the signs and symptoms of benign prostatic hyperplasia.

Second-quarter

sales (CC millions)

Change (%)

CER*

Proportion

of sales (%)

94

70

55

36

32

27

26

25

23

428

816

1,788

643

466

3,107

6,820

+53.8

+4.4

+10.5

+31.0

+41.7

+55.0

–

+20.8

+4.3

+9.8

+20.2

+16.2

+29.1

+65.7

–

+7.2

1

>1

>1

>1

>1

>1

>1

>1

>1

5

10

22

8

6

38

84

Vaccines

718

-0.4

9

Animal Health

537

+6.2

7

8,075

+6.4

100

Total Sanofi

* CER is constant exchange rates

Figure 1: Sanofi’s sales in the second quarter of 2014 broken down by business (Source – Sanofi)

2

In 2013, Cialis generated worldwide sales of

US$2.16 billion (C1.62 billion) and since its

launch has generated turnover of more than

US$14 billion.

Turning to the company’s second-quarter

results, Sanofi said the 9.2% rise in Consumer

Healthcare turnover – excluding the transfer

of prescription products – had been due to the

successful Nasacort launch and a strong showing in Emerging Markets.

Nasacort (triamcinolone acetonide) had generated C21 million in US sales in the three

months, Sanofi noted. Total Nasacort sales were

C26 million, putting the brand into seventh place

in Sanofi’s roster of Consumer Healthcare

brands (see Figure 1).

Indicated to treat “seasonal and year-round

nasal allergies in adults and children two years

of age or older”, Nasacort offered the 60 million Americans who suffered from nasal allergies a new OTC treatment option, Sanofi said.

The fexofenadine-based brand Allegra was

the best-selling of Sanofi’s established brands

in the three months, with sales up by 53.8% to

C94 million at constant exchange rates.

Sanofi’s nine top-selling Consumer Healthcare brands had total sales of C388 million in

the second quarter, just under half of the division’s total.

On a regional basis, more than half – 53% –

of Consumer Healthcare’s sales were generated

in Emerging Markets, where turnover advanced by 36.4% in constant currencies to C434 million (see Figure 2).

In the US, sales of Nasacort helped to lift

turnover in the region by 23.2% to C177 million.

Sales in Western Europe remained flat at

C161 million, while turnover in the Rest of World

region slipped back by 25.0% to C44 million.

Consumer Healthcare accounted for 10%

of Sanofi’s total second-quarter sales, which increased by 6.4% at constant exchange rates

to C8.08 billion.

OTC

OTC bulletin 15 August 2014

OTC15-08-14p2-14_Layout 1 12/08/2014 18:19 Page 3

COMPANY NEWS OTC

Mergers & Acquisitions

Meda grabs Rottapharm for SEK21.2bn

M

eda is set to buy privately-owned Italian

firm Rottapharm in a deal worth SEK21.2

billion (C2.30 billion) to create what it claims

will be a “European speciality pharma leader”.

The Swedish firm said the deal – which is

worth around 4.6-times Rottapharm’s 2013 sales

of C500 million – boosted its consumer healthcare business with a range of “clinically-proven”

non-prescription brands. These had nearly no

generic competition and were sold primarily

through doctors and healthcare professionals.

Rottapharm’s non-prescription brands include

the Dona glucosamine range, Saugella femininehygiene line and ArmoLIPID nutraceutical.

Jörg-Thomas Dierks, Meda’s chief executive

officer, said the acquisition marked an “important step in creating a stronger, improved Meda”.

officer Heather Bresch told investors.

“The Abbott transaction certainly gives us

a beginning foothold on OTC,” Bresch stated.

“We have got real opportunities to look at some

of these brands that we are now acquiring, as

well as perhaps to add some products that would

be very strategic and would allow us to build

upon the Mylan equity through all channels.”

uary 2017. The deal – which is expected to

close in the fourth quarter of 2014 – would give

Rottapharm’s owners, the Rovati family, a 9%

stake in Meda.

Cost synergies from the deal were expected

to reach SEK900 million per year, Meda claimed, and would come into full effect in 2016.

Synergies would be driven by “efficiencies

in administration, sales and marketing, and research and development”, the firm said, with additional upsides outside of these areas from selling Meda products in new markets as well as

repatriating certain licences to Meda.

The deal comes just a few months after

Meda rejected a takeover approach from generics specialist Mylan (OTC bulletin, 9 May

2014, page 3).

Having already turned down Mylan’s initial

approach in April (OTC bulletin, 11 April 2014,

page 4), Meda rebuffed a second approach in

May, explaining that its decision had been based

on a “strong belief in the continued potential

of Meda as a standalone company and the assumption that a transaction cannot be completed

as it lacks sufficient support from Meda’s largest shareholder”.

Meda posted a 5% rise in sales of its OTC

products to SEK3.13 billion in 2013, as its key

brands entered new markets. OTC brands accounted for 24% of Meda’s 2013 sales, which

grew by 3% to SEK13.1 billion.

OTC

OTC

Rottapharm had a number of “highly-differentiated brands”, he pointed out, and held a

leading position in the doctor-recommended,

clinically-proven consumer healthcare space.

The combined business – with sales of approximately SEK18 billion – would have an

“improved balance” between prescription and

non-prescription products, Dierks claimed, and

benefit from increased investment opportunities.

Furthermore, the deal would expand Meda’s

reach in emerging markets, the company said,

thanks to Rottapharm’s established presence in

regions such as South-East Asia.

Meda has agreed to pay SEK15.3 billion in

cash for Rottapharm, along with 30 million

Meda shares valued at SEK3.3 billion and a

payment of SEK2.6 billion deferred until Jan-

Business Strategy/Second-Quarter Results

Mylan exploring opportunities in Europe

M

ylan intends to explore opportunities to

build up an OTC operation in Europe to

complement the US firm’s pending US$5.3

billion (C4.0 billion) purchase from Abbott of

a roster of more than 100 mature brands and

branded generics in developed markets.

“We think OTC is an interesting channel,

in some respects even outside the US more

than inside the US,” Mylan’s chief executive

15 August 2014

Number 427

Editor: Matt Stewart

Editor-in-Chief: Aidan Fry

Production Editor: Jenna Meredith

Assistant Editors: Liudmila Kotko, Marie McEvoy

Business Reporter: Tom Gallen

Contributing Editor: David Wallace

Advertising Controller: Debi Minal

Director of Subscriptions: Val Davis

Group Sales Manager: Anisa Shan

Awards Manager: Natalie Cornwell

Managing Director: Mike Rice

Editorial enquiries: OTC bulletin,

4 Poplar Road, Dorridge, Solihull,

West Midlands B93 8DB, UK.

Website: www.OTC-bulletin.com

Tel: +44 (0)1564 777550

Fax: +44 (0)1564 777524

Email: info@OTC-bulletin.com

Advertising enquiries:

As above, or ads@OTC-bulletin.com

SUBSCRIPTIONS

Individual subscriptions: An OTC bulletin annual

subscription includes this hard-copy newsletter

15 August 2014 OTC bulletin

published 20 times a year – twice monthly, except

monthly in July, August, December and January, and

delivered by air mail – and a free weekly email

newsflash news@OTCbulletin published at least 45

times a year. Individual annual subscriptions in Europe

cost £715 (additional copies at the same address

£415); outside Europe £745 (£445).

The 20 OTC bulletin newsletters are now available as a

digital edition, OTC bulletin-i, for either Apple or

Android mobile devices at a cost of £975.This

subscription includes news@OTCbulletin.

A combined annual subscription to OTC bulletin

(hard-copy newsletter plus weekly email newsflash) and

OTC bulletin-i (digital edition) costs £1,175.

Single hard-copy newsletters cost £50 each. Subscription

rates may be adjusted to cover any period and can be

backdated. Subscriptions may only be cancelled at expiry.

Corporate subscriptions: Global Site Licences are

available to companies.These provide in-house electronic

access for staff to OTC bulletin or OTC bulletin-i

and news@OTCbulletin. Please ask for a quotation.

Such licences are supplied strictly on the condition that

both publications are the intellectual property of the

copyright holder, OTC Publications Ltd, and are

protected by copyright, trademark and other laws.

Subscription enquiries:

As left, or subs@OTC-bulletin.com

Terms & Conditions: No part of this publication may be

copied, reproduced, stored in a retrieval system, distributed

or transmitted by any means, including electronic, mechanical,

photocopying or recording, without the prior written

permission of the publisher, or under the terms and conditions

of a Global Site Licence or of a licence issued by the Copyright

Licensing Agency (CLA) in London, UK, or rights bodies in

other countries that have reciprocal agreements with the CLA.

Neither may this publication be exported, distributed or

circulated by any means outside the staff who work at the

address to which it is sent by the publisher without the

prior written permission of the publisher.

While due care has been taken to ensure the accuracy of

information contained in this publication, the publisher makes

no claim that it is free of error and disclaims any liability

whatsoever for any decisions or actions taken as a result of

its contents.

© OTC Publications Ltd.All rights reserved. OTC bulletin®

is registered as a trademark in the European Community.

ISSN 1742-0784.

Company registered in England No 2765878.

Printed by Warwick Printing Company Limited,

Leamington Spa CV31 1QD, UK.

3

OTC15-08-14p2-14_Layout 1 12/08/2014 18:19 Page 4

OTC COMPANY NEWS

Business Strategy

Omega outlines European ambitions

O

mega Pharma is committed to becoming

the third-largest OTC player in Europe

within four years, according to chief operating

officer Christoph Staeuble.

Speaking exclusively to OTC bulletin, Staeuble revealed that the Belgium-based company’s

objective was to reach C2.0 billion in annual

sales by 2018. Omega had generated sales of

C1.2 billion in 2013, Staeuble pointed out, putting the firm in fifth place in the European OTC

market, one place behind Reckitt Benckiser.

“Our objective is to get to C2.0 billion, but

we have plans to take us to C3.0 billion,” Staeuble noted. “That is our ambition.”

Omega had spent the last four years building the company into an “efficient machine” that

could have a “transformational impact” on the

categories in which it operated, Staeuble said.

This strategy had involved bringing in new

talent, putting in place the right culture and

developing a “five-year master plan” for the

company’s brands, he explained. “The group

now has a machine in place that operates in 35

countries and in most cases can handle a business double or triple the size.”

The company’s investment had already begun

to pay off, Staeuble noted, with Omega now

among the top-four OTC firms in Belgium,

France, the Netherlands, Sweden and the UK.

Transformation of the UK business

Neil Lister, general manager of Omega

Pharma UK, had led a “transformation” of the

UK business, Staeuble said, which had seen

Omega move from thirteenth to the number-four

spot in the country’s OTC market in three years.

Christoph Staeuble, Omega Pharma’s chief operating

officer, said the firm had the “machinery in place to

commercialise new brands rapidly across the group”

4

Lister told OTC bulletin that putting the

right team in place, focusing on the pharmacist

and educating the consumer had helped to

propel Omega UK up the rankings and had left

the company well-positioned to “accelerate”

its growth momentum going forward.

Staeuble explained that the UK was one of

the first of Omega’s businesses to undergo this

structural and cultural transformation, with the

group planning to replicate this success in a

number of markets including Germany.

Omega had been working on the German

business for 12 months, Staeuble said, and was

committed to turning it into a top-10 OTC company in the country by 2017.

Expanding on how the group ran its 35

national businesses, Staeuble noted that Omega

made central choices concerning brands, categories and best approaches, but each country’s

general manager had the freedom to “push

the envelope locally”. Lessons learnt in one

country could then be applied across the whole

group, he explained.

“What sets us apart from most of our competitors,” Staeuble claimed, “is that our general

managers are entrepreneurs, running their country as if it were their own business.”

“We are a very flat organisation, we have

three people on the executive committee, we

have 25 general managers and we have our corporate staff, but that is pretty much it,” Staeuble

explained. “We don’t have a complex matrix of

support organisations or middle management

and that is part of the secret.”

A focus across the group on delivering organic growth over the past four years had helped

to lift Omega’s sales by 40% in the period to

C1.2 billion in 2013, Staeuble noted.

Omega had invested “amazing amounts of

time and money” into improving its innovation capability, Staeuble said. This investment

had created a “five-year funnel” of new product

development for each of Omega’s brands, and

included line extensions and next-generation

molecules or technologies.

Omega had also benefitted from gaining

GlaxoSmithKline’s (GSK’s) non-core OTC

brands in Europe for C470 million in cash in

2012, Staeuble pointed out (OTC bulletin, 16

March 2012, page 1). The basket of brands included Abtei vitamins, minerals and supplements; Lactacyd feminine hygiene products;

Nytol sleep aids; Solpadeine pain relievers; and

Zantac indigestion and heartburn medicines.

The acquired brands had been a “phenomenal

fit” with Omega’s existing portfolio, Staeuble

insisted, as the company had been able to “bolt

on” most of the assets to categories of products

it was already active in.

All of the assets acquired from GSK had

grown at double-digit rates, Staeuble said. Some

brands, including the German natural remedy product Granufink, had doubled in size.

Developing “razor sharp claims” – such as

“one 15-minute treatment is all that it takes to

kill 100% of head lice” for its Lyclear brand

in the UK – and improving pharmacist training were two of the methods Omega had used

to grow the GSK brands, Staeuble revealed.

Asked if Omega had plans for further acquisitions, Staeuble said if opportunities like

the GSK deal came along, Omega would “gladly go after them”.

On the look-out for opportunities

Staeuble noted that the company was also on

the look-out for new concepts and technologies,

created by entrepreneurs or smaller enterprises,

that it could fund and bring to the market.

In line with this strategy, Omega had in

2012 acquired a small Belgian sports nutrition

brand named Etixx, Staeuble explained. Omega

planned to launch Etixx in nine markets in 2015

and anticipated annual sales of around C25 million in the first year.

“We will continue to do things like this,”

Staeuble insisted, “because we have the machinery in place to commercialise new brands rapidly across the group.”

Turning to the markets Omega wanted to

operate in, Staeuble said the company had resisted setting up subsidiaries outside of Europe.

However, the firm was currently exploring

the possibility of establishing “alliances” with

companies operating in countries like the US

and Japan, Staeuble revealed.

Omega had made a “conscious choice” a

number of years ago to focus purely on European markets, Staeuble noted. “Each of the

group’s European countries has a plan in the

next four years to at least double, but in many

cases to triple or quadruple, its scale. We feel

that focusing on these markets will yield bigger rewards than if we start to spread ourselves too thinly.”

Commenting on the specific plans for the

UK business, Lister explained that Omega was

aiming to become the third-largest OTC company in the country by 2017.

Omega had recently overtaken Bayer as the

fourth-largest OTC company in the UK, Lister

pointed out, reporting sales up by 19.5% to £127

OTC bulletin 15 August 2014

OTC15-08-14p2-14_Layout 1 12/08/2014 18:19 Page 5

COMPANY NEWS OTC

million in the 52 weeks ended 14 June 2014.

Noting that Omega UK occupied thirteenth

position in 2011, Lister said he “hoped and

expected” the growth recorded over the past

three years would continue and accelerate going

forward. Each year since 2011, Omega UK had

averaged like-for-like growth of 20%, he noted.

Omega’s existing portfolio of OTC brands

– including Buttercup cough syrups, Jungle

Formula insect repellents and TCP first-aid

products – had been boosted by GSK’s household names such as Hedex analgesics and Phillips’ Milk of Magnesia upset-stomach remedies.

But Lister played down the impact that the

GSK acquisition – which had given Omega

UK 10 brands – had made on the growth of

the business.

“I know the GSK deal made a lot of headlines when it happened,” Lister said, “but actually there has been a lot more to the success

of Omega than that.”

“If I look at the specific areas where we’ve

made a difference, the main element is in our

approach to self-care,” he explained.

Omega had “cracked the code of self-care”,

Lister claimed, and had established a model

for delivering it in a sustainable way.

Expanding on the changes to Omega’s approach in the UK, Lister said the company had

begun by investing in its regulatory affairs team.

Omega’s “regulatory army” was responsible

for generating health claims for brands and

putting together materials that the firm could

take to pharmacists and consumers, he noted.

Increased focus on pharmacy

Omega had also increased its focus on the

pharmacist and pharmacy, Lister revealed. “We

built the first in-house pharmacy field salesforce to focus on training rather than just selling,” he pointed out. This had been supported

by investments into brand and category training for pharmacists.

Noting that Omega had put the “first ever”

pharmacist on television in advertisements for

its Prevalin allergy brand (OTC bulletin, 12

April 2013, page 14), Lister insisted that the

company had “put the pharmacist first” in a

number of its activities.

Omega had also adapted its approach to

consumers, Lister pointed out. “The important

thing is our focus on educating consumers and

telling them more about the benefits of our

products,” he explained. “When you see our advertisements, you’ll see a big focus on education, a big focus on factual comments about our

brands and how consumers can use them.”

To get the message across to consumers,

Omega had increased its marketing spending,

Lister pointed out. The company had estimated

that so far in 2014, Omega had been the sec15 August 2014 OTC bulletin

ond-biggest spender among its OTC competitors on advertising in the UK.

By implementing this strategy over the past

three years, Omega had created a “blueprint”

for future growth, Lister said. This model could

be applied across the company’s existing categories to unlock the growth potential of its

brands, he added.

Omega had already applied this blueprint

to a number of the brands acquired from GSK

in 2011, Lister revealed. The brands that the

company had supported had grown by a “minimum of 10%”, Lister said, with sales of some

brands doubling.

Lister noted that Omega had been able to

add value to some of the GSK brands by coupling them with existing technologies in the company’s portfolio.

“We had for many years in the Omega

group a fantastic anti-snoring product called

Silence and we rebranded that as Nytol,” Lister explained. “We’ve turned that product from

nothing to £1.0 million (C1.3 million) in sales

within a year.”

Omega had also picked up Beconase hayfever nasal sprays from GSK, Lister pointed

out, and launched an antihistamine tablet variant under the BecoAllergy brand name. “We’ve

been able to leverage the scale of both of those

brands to create something that has grown the

category and grown the share of the brand,”

Lister noted.

Asked about how Omega planned to develop its UK brands going forward, Lister said

the company was focusing on opportunities

to grow its categories as a whole, rather than

individual brands.

Lister pointed out that there were still opportunities in “mature categories” that had “existed for many years and had been declining”

to which Omega could apply its approach. The

firm had proven that its model could introduce

innovative products in mature categories, Lister

said, pointing to the sleep-aid category with

Nytol and the allergy category with Beconase.

What was important, Lister said, was to

have brands with “disruptive” claims that challenged the status quo, and that consumers and

pharmacists could buy into.

Looking at untapped categories

Omega would also look at “untapped categories” in the UK such as weight management, sports nutrition and cholesterol, Lister

said. “We are experiencing phenomenal growth

in these categories that didn’t really exist 10

to 20 years ago,” he noted.

Weight management was the category of

products that presented Omega with the best

opportunity for growth, Lister said. The XLSMedical brand had grown from its launch in

Neil Lister, general manager of Omega Pharma UK,

said the company had “cracked the code of self-care”

2012 to be the number-one slimming tablet

in the UK, Lister explained.

“Globally, the UK is second only to the US

in the obesity rankings,” Lister pointed out, “so

I think that this brand has a long way to go.”

Lister noted that Omega had experienced

some difficulties in getting XLS-Medical to

market, as retailers were more interested in meal

replacements than slimming products.

“It has taken us a long time to unwind a lot

of the miscommunication over this category

that’s existed for many years,” commented

Lister, “as well as public perceptions about side

effects or ineffectiveness.”

XLS-Medical had been clinically proven

to work, Lister said, and higher sales figures

recorded by Omega in the French market indicated that the brand could grow to be up to

four-times larger in the UK.

Asked if Omega UK planned to develop

any new brands in the future, Lister said that

this was definitely out of the question. “I certainly don’t want to be creating new local brands

because history would show it’s a very inefficient way to be growing categories.”

“So I’m looking to the group to launch European and global brands which we will happily

take,” Lister explained. “I am also looking at

the technologies that exist in Omega’s global

portfolio to identify ones that can be launched under our 40 existing brands in the UK.”

Lister promised that Omega UK would continue to invest behind its brands to ensure continued growth going forward. “As we increase our

brand portfolio, we’ll invest more and spend

more money on advertising and training.”

Omega had already taken “significant strides”

towards becoming the third-largest OTC company in the UK by 2017, Lister said.

“We’ve done a lot of work over the last

three years putting the machinery together and

putting the team in place,” he noted. “This will

allow us to deliver our products to consumers

in a meaningful way going forward.”

OTC

5

OTC15-08-14p2-14_Layout 1 12/08/2014 18:19 Page 6

OTC COMPANY NEWS

Business Strategy/Second-Quarter Results

GSK has no plans to spin off Consumer

G

laxoSmithKline (GSK) has insisted that

it has no near-term plans to spin off its

Consumer Healthcare business, after the company’s chief executive officer, Andrew Witty,

hinted at the possibility.

Speaking to the Financial Times newspaper,

Witty said that the firm had the option to spin

off its Consumer Healthcare division if a time

came when it offered more value as a standalone company.

Responding to the comments, a spokesperson for GSK told OTC bulletin that “there are

no such plans to spin off the Consumer Healthcare business in the near term”.

However, the company’s recent deal to establish a consumer healthcare joint venture with

Novartis (OTC bulletin, 25 April 2014, page 1)

had strengthened the value of the business,

the spokesperson added, and delivered “enhanced options for the long-run”.

Witty’s remarks came a few months after

GSK announced that its Consumer Healthcare

business would assume 63.5% control of the

Consumer Healthcare joint venture with proforma 2013 sales of £6.5 billion (C7.9 billion).

The Consumer Healthcare joint venture is

one part of a three-part deal between GSK and

Novartis. This will also see the Swiss firm

Region

Second-quarter sales

(£ millions)

Business

Second-quarter sales

(£ millions)

Oral health

Wellness

Nutrition

Skin health

Consumer Healthcare

-10

-18

-7

-27

±0

-9

+7

-19

42

36

15

7

1,022

-14

-4

100

* CER is at constant exchange rates

Figure 1: GlaxoSmithKline Consumer Healthcare’s sales in the second quarter ended 30 June 2014 broken

down by business (Source – GlaxoSmithKline)

snap up GSK’s oncology business for up to

US$16.0 billion (C11.9 billion), including

US$1.5 billion contingent on a development

milestone. Meanwhile, Novartis will divest its

Vaccines business, excluding flu products, to

GSK for US$7.1 billion plus royalties, including US$1.8 billion in milestone payments.

GSK reported Consumer Healthcare sales

down by 14% to £1.02 billion in the second

quarter. At constant exchange rates, the fall was

a less dramatic 4% (see Figure 1).

The company blamed the decline on supply

issues which had hit sales of its smoking-cessation products and Alli weight-loss brand, as

well as the Bactroban skin-care line in China.

Simon Dingemans, GSK’s chief financial

Change 2013/2014 (%)

£

CER*

Proportion

of total (%)

536

-12

+3

52

Europe

291

-15

-10

28

US

195

-18

-11

19

1,022

-14

-4

100

* CER is at constant exchange rates

Figure 2: GlaxoSmithKline Consumer Healthcare’s turnover in the second quarter ended 30 June 2014 broken

down by region (Source – GlaxoSmithKline)

Second quarter

(£ millions)

Change 2013/2014 (%)

£

CER*

Proportion

of total (%)

Core sales

Pharmaceuticals and Vaccines

4,539

-12

-4

82

Consumer Healthcare

1,022

-14

-4

18

Total

5,561

-13

-4

100

Core operating profit

Pharmaceuticals and Vaccines

Consumer Healthcare

Total**

1,485

-21

-12

91

142

-29

-20

9

1,407

-25

-14

100

* CER is at constant exchange rates ** After corporate and other unallocated costs of £220 million

Figure 3: GlaxoSmithKline’s ‘core’ sales and operating profit in the second quarter of 2014. Core results

exclude amortisation, goodwill, restructuring costs, legal charges and other items (Source – GlaxoSmithKline)

6

Proportion

of total (%)

434

366

151

71

Rest of World

Total Consumer Healthcare

Change 2013/2014 (%)

£

CER*

officer, said that the supply issues had impacted all three of the firm’s key regions – Europe,

US and Rest of World – but remediation plans

had now been put in place and supply levels

had started to improve.

“Overall we expect the consumer business

to be broadly flat at the top line this year,”

Dingemans reported.

The supply issues that hit sales of smokingcessation products and Alli pushed Wellness

turnover down by 18% as reported – 9% at

constant exchange rates – to £366 million.

Wellness’ poor performance meant Oral

health maintained its position as the leading

Consumer Healthcare segment for the second

quarter running, despite sales falling by 10% as

reported and remaining flat at constant exchange

rates at £434 million. Sensodyne sales had risen

by 6% at constant exchange rates, GSK said,

offsetting a 19% decline in Aquafresh sales,

due in part to supply issues related to a move

to a new manufacturing site in the US.

Commenting on the company’s Oral health

franchise, Witty said that it remained “very

strong”, but now existed as almost two separate businesses.

Over the past few years, GSK’s priority in

Oral health had moved away from the base

Aquafresh brand – which operated in the general toothpaste market – and towards the premium sector, Witty noted, pointing out that

Sensodyne and Parodontax as well as dry mouth

and dentures brands, now accounted for 76%

of the firm’s sales in the category.

Skin health sales, down by 27%, or 19% at

constant exchange rates, to £71 million, had

been primarily affected by lower turnover of

Bactroban in China.

Sales of Horlicks rising by 5%, with particularly strong growth in India, and of Boost

growing by 11%, were behind the 7% constantcurrency improvement of the Nutrition segment

to £151 million. As reported, however, turnover fell back by 7%.

OTC bulletin 15 August 2014

OTC15-08-14p2-14_Layout 1 12/08/2014 18:19 Page 7

COMPANY NEWS OTC

Switches

Flonase OTC to

hit US in 2015

G

laxoSmithKline’s (GSK’s) Flonase Allergy Relief nasal spray will soon be available without a prescription in the US after the

Food and Drug Administration (FDA) approved

the prescription-to-OTC switch of the fluticasone propionate-based product.

Noting that fluticasone propionate was the

“number one prescribed allergy treatment ingredient”, GSK said that Flonase Allergy Relief

had been approved as an OTC treatment for the

“temporary relief of the symptoms of hayfever

or upper respiratory allergies”.

A once-a day treatment, the product was the

first OTC medicine indicated for all nasaland eye-related allergy symptoms, GSK pointed out, adding that the product was “full

prescription strength” and provided “24 hours

of non-drowsy relief”.

Flonase Allergy Relief would be launched

in stores in early 2015, the company noted.

Vidhu Bansal-Dev, vice-president of respiratory health research and development at

GSK Consumer Healthcare, said Flonase Allergy Relief provided allergy suffers with simple and effective OTC relief that would make

the difference between a “day lost to allergies

and a day enjoying their favourite activities”.

Flonase Allergy Relief will enter an already

crowded US OTC allergy market, which was

recently bolstered by the launch of Sanofi’s

Nasacort Allergy 24HR (triamcinolone acetonide) following the product’s switch in 2013

(OTC bulletin, 25 October 2013, page 1).

OTC

Constant-currency shortfalls in European

and US sales – of 10% and 11% respectively –

had reflected the supply issues, GSK said, highlighting the 3% growth in Rest of World markets (see Figure 2). As reported, turnover in

Europe slipped back by 15%, in the US by 18%

and in Rest of World by 12%.

Consumer Healthcare contributed 18% of

GSK’s core sales that declined by 13% – 4%

at constant exchange rates – to £5.56 billion in

the second quarter (see Figure 3). Core sales and

operating profit exclude amortisation, goodwill,

restructuring costs, legal charges and other items.

Less than 10% of GSK’s core operating

profit came from Consumer Healthcare after a

29% drop to £142 million. At constant currency

rates, Consumer Healthcare’s operating profit

declined by a fifth.

OTC

15 August 2014 OTC bulletin

Legal Cases/Second-Quarter Results

Valeant faces US lawsuit

over alleged insider trading

V

aleant Pharmaceuticals is facing a lawsuit

in the US brought by ophthalmics specialist Allergan that accuses the company of violating federal securities law.

The Canadian firm is involved in a protracted takeover move for Allergan that began in

April (OTC bulletin, 25 April 2014, page 5).

In June, Valeant took its bid hostile after

Allergan’s board rejected a revised takeover

offer (OTC bulletin, 27 June 2014, page 3).

The lawsuit filed in California alleges that

Valeant, along with hedge fund Pershing Square

and its principal William Ackman, “violated

federal securities law prohibiting insider trading, engaged in other fraudulent practices and

failed to disclose legally-required information”.

Allergan claims that between February and

April 2014, Pershing Square purchased Allergan stock and securities, which were then valued at over US$3.2 billion (C2.4 billion), from

shareholders “while fully aware of Valeant’s

non-public takeover intentions”.

This move, Allergan alleges, secured value

for Pershing Square and “deprived the selling

stockholders of value appreciation, worth approximately US$1.2 billion, upon Valeant’s initial takeover bid on 22 April 2014”.

In response to the lawsuit, Valeant said that

Allergan’s “true purpose” behind bringing litigation was to interfere with Allergan shareholders’ efforts to call a special meeting.

In July, Valeant called on Allergan shareholders to hold a meeting to “remove six of

the firm’s directors and appoint new directors”

who could “fully evaluate” Valeant’s offer.

Valeant insisted that it was confident that

Allergan’s “desperate attempt” to delay the meeting by filing a lawsuit would not succeed.

Allergan filed its lawsuit two weeks after

Valeant revealed it had contacted financial market regulators in the US and Canada in response to “false and misleading statements”

regarding its business made by Allergan.

Explaining the reason for contacting the

Securities and Exchange Commission (SEC) in

the US, Valeant said Allergan had “falsely asserted” that its Bausch & Lomb eye-care business

was experiencing stagnant or declining sales.

Bausch & Lomb had performed “extremely

well”, Valeant noted, delivering 11% organic

growth over the 11 months the company had

owned the business. In May 2013, Valeant

agreed to pay private-equity firm Warburg Pincus US$8.7 billion for the global eye-health

specialist (OTC bulletin, 31 May 2013, page 1).

Valeant pointed out that it had also contacted Canada’s Autorité des marchés financiers

in response to “comments made by Allergan’s

management board about Valeant” at recent

investor meetings held in the country.

Allergan misled investors

Michael Pearson, Valeant’s chairman and

chief executive officer, said Allergan had attempted to “mislead investors and manipulate

the market for Valeant stock” in both Canada

and the US.

Valeant’s bid for Allergan, Pearson claimed, represented a “strategically compelling and

enormously value-creating opportunity for Allergan shareholders”.

Pearson’s comments came shortly before

Valeant reported second-quarter sales up by

86% to US$2.04 billion, driven by double-digit

gains in its Developed Markets and Emerging Markets regions.

The double-digit growth of Bausch & Lomb

had boosted sales in Developed Markets, which

had risen by 85% to US$1.48 billion, Valeant

said, as had turnover increases across its dermatology prescription brands and its consumer

and oral-health businesses.

Turnover had jumped by 90% to US$561

million in Emerging Markets, Valeant noted,

thanks to double-digit advances across SouthEast Asia, South Africa and the company’s

EMENA region, which covers Eastern Europe,

the Middle East and North Africa.

OTC

IN BRIEF

■ KRKA said turnover from its non-prescription products – including self-medication lines

and cosmetics – had declined by 9.1% to C58.8

million in the first half of 2014. The Slovenian

firm said gains in its West Europe region had

been offset by lower sales in its domestic market due to the weak cough and cold season.

Turnover in Slovenia had fallen by 19.4% to

C2.9 million, Krka reported.

OTC

7

OTC15-08-14p2-14_Layout 1 12/08/2014 18:19 Page 8

OTC COMPANY NEWS

First-Half Results

RB sees opportunity in medical devices

R

eckitt Benckiser (RB) will look to take advantage of the less heavily-regulated medical-device route to introduce innovative consumer healthcare products to the market, according to chief executive officer Rakesh Kapoor.

Speaking as RB announced its first-half results, Kapoor said that while the company would

continue to operate in the more tightly-regulated licensed OTC medicines space, it saw an

opportunity to introduce new products more

quickly in categories such as sexual health by

using medical-device regulations.

Explaining the advantages of the medicaldevice route, Kapoor said it allowed RB to

make health claims for a product while also

creating enough barriers to entry for the company’s competitors.

Asked if the firm was looking to avoid

heavily-regulated categories, Kapoor insisted

that the company was “just using regulation

appropriately” to introduce innovative products

faster to market.

Kapoor recently criticised the strict regulation of OTC medicines at the 50th Annual Meeting of the Association of the European SelfMedication Industry, the AESGP. He called for

OTC medicines to be authorised for non-prescription sale globally as soon as safety, efficacy

and appropriate use had been established (OTC

bulletin, 16 June 2014, page 1).

Conceding that it was true that the OTC industry needed regulation to “ensure that only

safe and effective products get into consumers’

daily lives”, he argued that the role of regulators

should be “to protect supply chains, not to limit

access or limit the market-place for consumers”.

“The goal should be to look for reasons to approve, not excuses to block,” Kapoor insisted.

Turning to the company’s first-half results,

Kapoor reported sales at RB’s Health division

up by 4% – 14% in constant currencies – to

£1.25 billion (C1.58 billion) during the first

Region

First-half sales

(£ millions)

Business

First-half sales

(£ millions)

Proportion

of total (%)

Hygiene

Health

Home

RB Pharmaceuticals

Portfolio Brands

Food

1,825

1,247

871

344

228

152

-8

+4

-11

-14

-14

-5

+3

+14

–

-8

-7

+3

39

27

19

7

5

3

Total Reckitt Benckiser

4,667

-7

+3

100

* CER is constant exchange rates

Figure 1: Reckitt Benckiser’s sales in the first half ended 30 June 2014 by business (Source – Reckitt Benckiser)

six months of 2014. Health accounted for 27%

of RB’s total first-half sales, which fell back

by 7% to £4.67 billion (see Figure 1).

“Broad-based growth” across RB’s Powerbrands – including Durex, Gaviscon, Mucinex

and Scholl – had been driven by brand innovation and the roll-out of existing products

into new markets, Kapoor said.

Scholl had delivered strong results, Kapoor

pointed out, with the launch of Scholl Velvet

Smooth Pedi “well received” across Europe. RB

was now preparing to introduce the product

into China and a number of emerging markets

in the second half of 2014, he added.

After the close of the period, RB announced

that it had agreed to sell its Scholl footwear

business to German private equity firm Aurelius

for an undisclosed sum. RB noted that it would

retain the rights to Scholl footcare.

Furthermore, Durex and Gaviscon had also

been stand-out performers during the six months,

Kapoor said, with both brands demonstrating

“strong underlying growth”.

In addition to the continued growth of RB’s

established brands, “good progress” had also

been made integrating the recent K-Y buy into

its US and Canadian businesses, Kapoor noted.

Announcing the acquisition in March, RB

Change 2013/2014 (%)

£

CER*

Proportion

of total (%)

Europe and North America

LAPAC**

RUMEA***

Other****

2,375

1,175

621

496

-3

-8

-12

–

+2

+9

+5

–

51

25

13

11

Total Reckitt Benckiser

4,667

-7

+3

100

* CER is constant exchange rates

** LAPAC region consists of Australia/New Zealand, Latin America, North Asia, and South and South-East Asia

*** RUMEA consists of Middle East, North Africa and Turkey, Russia and the CIS, and Sub-Saharan Africa

**** RB Pharmaceuticals and Food, which are not reported as part of any region

Figure 2: Reckitt Benckiser’s sales in the first half ended 30 June 2014 by region (Source – Reckitt Benckiser)

8

Change 2013/2014 (%)

£

CER*

said that the brand would sit beside its existing Durex line of condoms, lubricants and sex

aids to create a “unique portfolio of brands”

in the sexual well-being market (OTC bulletin,

17 March 2014, page 4).

On a regional basis, only Europe and North

America reported a rise in Health turnover.

Growth had been led by new product launches

under the Scholl and MegaRed brands across

a number of European markets, RB said. An

overall downturn in group turnover in the region

had been due to negative currency effects, the

company noted (see Figure 2).

In the LAPAC region – consisting of Australia/New Zealand, Latin America, North Asia

and South and South-East Asia – the “positive

benefits” of RB’s OTC collaboration with Bristol-Myers Squibb in Latin America (OTC bulletin, 22 February 2013, page 1), had been

offset by a slowdown in India and the “negative impact of currency movements”.

Health turnover in RB’s RUMEA region

– which covers the Middle-East, North Africa

and Turkey, Russia and the Commonwealth of

Independent States (CIS), and Sub-Saharan

Africa – had been hit by the “volatility” of a

number of markets due to the political situation in Eastern Europe.

Meanwhile, RB has announced plans to

pursue a “de-merger” of its Pharmaceuticals unit

over the next 12 months. Explaining the rationale

behind the move, RB said it felt the division

had the “potential to deliver significant longterm value creation as a stand-alone business”.

Spinning off RB Pharmaceuticals would

allow the company to focus on its core strategy

to be “a global leader in consumer health and

hygiene”, RB claimed. The firm announced

the strategic review of its Pharmaceuticals business in October last year (OTC bulletin, 8 November 2013, page 12).

OTC

OTC bulletin 15 August 2014

OTC15-08-14p2-14_Layout 1 12/08/2014 18:19 Page 9

COMPANY NEWS OTC

Business Strategy/Annual Results

Procter & Gamble starts culling brands

P

rocter & Gamble is to cut radically its portfolio of brands and focus on just 70 to 80 core

brands organised into a dozen business units,

according to chief executive officer AG Lafley.

Speaking as the consumer goods giant announced its annual results, Lafley said that the

70 to 80 core brands were “consumer preferred

and customer supported”. However, he did not

provide a list of which brands would stay with

the company.

A spokesperson for Procter & Gamble told

OTC bulletin that it was too early to say whether

the brand cull would impact on the company’s

wholly-owned US OTC unit or PGT Healthcare, the OTC joint venture it established with

Teva Pharmaceutical Industries in 2011 (OTC

bulletin, 16 November 2011, page 1).

Lafley noted that over the past three years

the 70 to 80 core brands had accounted for 90%

of the firm’s sales and over 95% of its profits.

“This new streamlined Procter & Gamble

will continue to grow faster and more sustainably, while creating more value,” Lafley claim-

15 August 2014 OTC bulletin

ed. “Importantly this will be a much simpler,

much less complex company of leading brands

that is easier to manage and operate.”

The firm planned to “harvest, partner-out, discontinue or divest” 90 to 100 brands, Lafley said,

noting that combined sales of these brands had

fallen by 3% per year over the past three years.

“As we rationalise business and brand portfolios, product lines and stock-keeping units,

Procter & Gamble’s brands and products will

be easier to shop,” Lafley insisted, “and more

productive and profitable for our customers,

partners and for the company.”

Lafley’s announcement came just a few

months after Procter & Gamble said it was

looking for acquisitions to expand its OTC operations (OTC bulletin, 9 May 2014, page 5).

Speaking in April, Jon Moeller, the firm’s

chief financial officer, revealed that the company

was considering adding to its OTC business and

was currently “looking for opportunities”.

Noting that PGT had enabled Procter &

Gamble to “accelerate significantly” the growth

of its OTC operations internationally, Moeller

said the company was seeking to expand into

new markets that offered “smart, value-creating opportunities”.

Meanwhile, Procter & Gamble noted that

sales at its Personal Health Care business –

which includes its OTC operations – had improved in the 12 months ended 30 June 2014.

The firm said the rise in turnover – including sales from PGT – had been driven by “innovation and market expansion” which had “more

than offset” a weak cough and cold season.

Sales at Procter & Gamble’s Health Care

unit – including its Oral Care, Pet Care and

Personal Health Care businesses – edged up

by 1% to US$7.80 billion (C5.82 billion).

Procter & Gamble said that better Oral Care

and Personal Health Care turnover had offset a

fall in Pet Care sales due to product recalls.

The Health Care unit accounted for 9.4%

of Procter & Gamble’s total annual sales, which

increased by 1% to US$83.1 billion.

OTC

9

OTC15-08-14p2-14_Layout 1 12/08/2014 18:19 Page 10

OTC COMPANY NEWS

Business Strategy/Second-Quarter Results

GNC’s Retail plan in doubt as CEO leaves

G

NC Holding’s turnaround plan for its US

Retail business has been cast into doubt

following the sudden departure of the company’s chief executive officer Joe Fortunato.

Michael Archbold – former head of US

clothing retailer Talbots and previously chief

operating officer of Vitamin Shoppe – has been

named as GNC’s new chief executive officer

with immediate effect.

The US-based nutritional supplements retailer made the announcement one week after

Fortunato had outlined a fresh strategy to “turn

the tide” for the company’s Retail business in

2014, based on “simplified pricing, more impactful marketing, and appealing to a broader

consumer base”.

Asked if GNC would still implement Fortunato’s turnaround plan, a spokesperson for the

firm did not rule out a change of direction.

Speaking before his sudden departure – as

GNC reported sales down by 0.2% to US$675

million (C504 million) in the second quarter –

Fortunato claimed that during 2014 the “broader market” for supplements had “softened”.

There had also been a “broad shift in shopping patterns” across the whole retail industry for supplements, he added, with consumers

making less frequent visits to stores.

To address the challenges facing its domestic Retail business, Fortunato said GNC would

launch a programme of “strategic initiatives”.

GNC’s product pricing in its retail stores

needed to become more straightforward, Fortunato insisted. The company planned to reduce bundled product promotions, he said, and

instead run event-driven promotions to draw

consumers into stores.

Noting that GNC’s core consumer base was

male, Fortunato said the company wanted to

use “tailored products” to attract more females.

Therefore, protein-based drinks, probiotics and

cosmetics aimed at women would be introduced, he revealed.

New marketing strategy

Going forward, GNC would utilise social

media better to increase brand awareness, Fortunato said. This formed part of a new marketing strategy that would increase brand awareness of GNC products among new consumers.

By pursuing this strategy, GNC would protect its brand, and position the company for

future success, Fortunato claimed. “We expect

to see progress on these fronts as the year

goes on and into 2015,” he added.

Turning to GNC’s second-quarter results,

Fortunato said the expansion of the company’s

e-commerce business – consisting of gnc.com,

luckyvitamin.com and discountsupplements.

co.uk – had helped to push up sales at the

Retail division by 0.6% to US$506 million.

Growth in the Retail segment had also been

supported by the performance of GNC’s newlyopened stores, Fortunato noted, with 149 outlets added in the past 12 months.

The Retail performance had been hampered

by an increased dependence on bundled promotions and a fall in store traffic, Fortunato said.

Meanwhile, GNC’s Franchise revenue had

declined by 0.4% to US$110 million, Fortunato

reported, due to “regulatory and geopolitical

factors” in a number of international markets.

A decrease was also reported at GNC’s

Manufacturing/Wholesale division, with sales

falling by 5.8% to US$59.6 million.

As of 30 June 2014, GNC was present in

more than 8,700 locations, of which over 6,500

– including 1,050 franchises and 2,232 Rite

Aid in-store units – were based in the US.

The company also had franchise operations

in some 50 countries.

OTC

Business Strategy/Second-Quarter Results

Herbalife to expand Chinese operation

H

erbalife has announced plans to expand

its manufacturing capabilities in China

to meet increased demand for its products in

the country.

Located in Nanjing, Jiangsu province, the

“state of the art facility” would ultimately produce up to 65% of Herbalife’s total product

requirements for China, the US-based directselling supplement company said.

The plant was expected to be open by the

end of 2015, Herbalife noted, with the company

investing US$40 million (C30 million) into the

facility’s development.

Explaining the rationale behind the move,

Richard Goudis, Herbalife’s chief operating officer, said the company was opening the plant in

response to “steady and sustainable growth

in China”.

“It is important that our infrastructure is robust enough to meet the demand we are seeing

now and expect to see in the future,” he added.

Herbalife already has a presence on the

ground in China, with a manufacturing facility

10

in Suzhou, Jiangsu province, and a botanical extraction plant in Changsha, Hunan province.

The firm revealed its plans for China shortly

after it reported a single-digit rise in secondquarter sales to US$1.31 billion, as turnover improved in five of its six global business regions.

Herbalife’s sales advanced by 7.1%, led by

growth in China and the Europe, Middle East

and Africa (EMEA) region.

China – Herbalife’s second-smallest market

in terms of sales – was the stand-out performer,

with turnover jumping by 44% to US$170

million (see Figure 1).

Meanwhile, Herbalife said it continued to

face an “unprecedented and unrelenting attack”

on its business from hedge fund Pershing Square.

In December 2012, Pershing Square claimed

that Herbalife was an illegal pyramid scheme

as it made more money from recruitment than

from selling products (OTC bulletin, 18 January 2013, page 5).

Pershing Square had continued to wage “a

campaign of misinformation” against Herbalife,

Region

Second-quarter Change

sales (US$ millions) (%)

Asia-Pacific

306

+2.4

North America

251

+1.2

EMEA*

227

+22

South and Central

America

203

-8.5

China

170

+44

Mexico

149

+2.1

1,306

+7.1

Total Herbalife

* Europe, Middle East and Africa

Figure 1: Herbalife’s sales in the second quarter of

2014 broken down by region (Source – Herbalife)

the company said. This had included presentations criticising Herbalife’s business model

and offering financial incentives to former employees to complain about their experiences,

the company claimed.

Despite the ongoing allegations, Herbalife

said it had the “utmost trust” in the integrity of

its business model. Pershing Square’s claims

would “crumble under serious and independent

scrutiny”, the firm insisted.

OTC

OTC bulletin 15 August 2014

OTC15-08-14p2-14_Layout 1 12/08/2014 18:19 Page 11

COMPANY NEWS OTC

Second-Quarter Results

Negative currency effects damage Bayer

N

egative currency and portfolio effects had

offset gains made by a number of Bayer

Consumer Care’s key brands, the German firm

said, as it posted a 1.9% fall in OTC sales in

the second quarter of 2014.

Consumer Care reported turnover of C932

million in the three months, as only one out

of the division’s six best-selling brands – the

Bepanthen/Bepanthol skin-care range – reported an increase in sales.

However, excluding currency and portfolio

effects, Consumer Care’s sales improved by

4.2%, with four of the company’s best-sellers

– Aleve analgesics, Canesten antifungals and

Supradyn multivitamins, as well as Bepanthen/

Bepanthol – all posting gains.

Only sales of the division’s leading brand

Aspirin and the One-A-Day vitamin line failed

to deliver better constant-currency sales in the

quarter, Bayer noted, adding that Aspirin’s turnover had been impacted by a weak cough and

cold season in Europe.

As a result, worldwide Consumer Care sales

of Aspirin slipped back by 16.4% to C92 milBrand (business unit)

Contour (Medical Care)

Advantage (Animal Health)

Aspirin**

Bepanthen/Bepanthol

Aleve/naproxen

Ultravist (Medical Care)

Canesten

Gadovist (Medical Care)

Supradyn

One-A-Day

Top-10 total

Consumer Health total

Business

Second-quarter sales Change

(CC millions) 2013/2014 (%)

Pharmaceuticals

2,960

+4.6

656

+39.0

932

595

358

1,885

-1.9

-9.4

-1.1

-4.3

–

–

–

310

–

–

–

+20.6

Total Bayer HealthCare

4,845

+0.9

729

+32.5

Figure 3: Breakdown of Bayer HealthCare’s sales and earnings before interest and tax (EBIT) in the second

quarter of 2014 (Source – Bayer)

lion in the second quarter. Adjusted for currency

effects, the decline was 9.0%. Total Aspirin

sales – including Aspirin Cardio, which is part

of the Pharmaceuticals division – were 7.5%

lower at C209 million (see Figure 1).

Consumer Care’s best performer was Bepanthen/Bepanthol, whose sales improved by

16.7% – 22.4% adjusted for currency effects –

to C91 million. Turnover had been “considerably higher in all regions”, Bayer noted, but

especially in emerging markets.

Second-quarter sales

(CC millions)

165

140

92

91

83

76

66

57

38

43

Change 2013/2014 (%)

C

CER*

-16.2

-5.4

-16.4

+16.7

-2.4

-12.6

-5.7

+16.3

±0.0

-4.4

-13.9

-1.7

-9.0

+22.4

+4.5

-8.4

+0.9

+22.3

+7.8

-0.8

851

-6.2

-1.3

1,885

-4.3

+1.1

Figure 1: Sales of the top-10 best-selling brands in Bayer’s Consumer Health division in the second quarter of

2014. Brands are part of the Consumer Care business unit unless stated (Source – Bayer)

Region

Second-quarter sales

(EE millions)

Europe

726

Change 2013/2014 (%)

C

CER*

+0.8

+2.9

North America

589

-8.5

-3.3

Asia/Pacific

286

-5.0

+1.7

Latin America/Africa/Middle East

284

-6.6

+10.2

1,885

-4.3

+1.1

* CER is constant exchange rates

Figure 2: Breakdown of Bayer Consumer Health’s sales in the second quarter of 2014 by region (Source – Bayer)

15 August 2014 OTC bulletin

Change

2013/2014 (%)

Consumer Care

Medical Care

Animal Health

Consumer Health

* CER is constant exchange rates

** Total Aspirin sales – including Aspirin Cardio, which is part of the Pharmaceuticals division – were C209 million

Total Bayer Consumer Health

EBIT

(CC millions)

Supradyn had also performed well, Bayer

noted, with sales boosted by product launches.

This had advanced the brand’s turnover by 7.8%

to C38 million when adjusted for currency effects. As reported, Supradyn’s sales were flat.

Meanwhile, sales of the naproxen brand

Aleve dropped back by 2.4% – a rise of 4.5%

when adjusted for currency effects – to C83

million, while Canesten posted turnover down

by 5.7% to C66 million, or up by 0.9% excluding a 4.8% negative currency impact.

The Consumer Care business accounted

for 49% of second-quarter turnover at Bayer’s

Consumer Health division, which dropped back

by 4.3% to C1.89 billion. Sales edged up by

1.1% when adjusted for currency and portfolio effects.

Bayer’s top-10 Consumer Health brands

formed 45% of total divisional sales, the same

as in the prior-year period.

Europe remained Consumer Health’s biggest

region in terms of sales, with turnover improving by 0.8% – 2.9% adjusted for currency

effects – to C726 million (see Figure 2).

Turnover in the Asia/Pacific region shrank

by 5.0% to C286 million. When adjusted for

currency effects, sales moved forward by 1.7%.

However, turnover in the region is likely to

be boosted going forward following Bayer’s

recent acquisition of Dihon Pharmaceutical in

China for an undisclosed sum (OTC bulletin,

17 March 2014, page 1).

In North America, turnover slipped back by

8.5% – 3.3% adjusted for currency effects –

to C589 million.

Consumer Health’s second-quarter earnings

before interest and tax (EBIT) jumped by a

fifth to C310 million (see Figure 3).

The results were announced as Bayer prepared to complete its US$14.2 billion (C10.6

billion) deal for Merck & Co’s Consumer Care

unit (OTC bulletin, 9 May 2014, page 1).

OTC

11

OTC15-08-14p2-14_Layout 1 12/08/2014 18:19 Page 12

OTC COMPANY NEWS

First-Quarter Results

Taisho looks to increase demand for OTCs

J

apan’s Taisho Pharmaceutical said that it

was working to strengthen its sales and marketing activities and help drive demand for

OTC products in what it described as a sluggish domestic market.

Domestic turnover at the company’s SelfMedication division fell back by 4.6% to ¥34.0

billion (C247 million) in the company’s first

quarter ended 30 June 2014, as turnover in the

majority of product categories declined following tax-driven price rises.

To help drive demand, the Self-Medication

division was “increasing coordination between

marketing and sales activities”, Taisho pointed

out, “and working to enhance direct communication with consumers by expanding into new

distribution channels, such as mail-order”.

Furthermore, the company would continue

to respond to the growing consumer need to

“age healthily and beautifully” by developing

new products to tackle “lifestyle diseases”, such

as metabolic syndrome.

In April last year, Taisho successfully claimed Japan’s first prescription-to-OTC switch of

a medicine indicated to treat high cholesterol

with the launch of Epadel T (600mg ethyl icosapentate), and said it would continue to broaden its range of category 1 medicines – OTC

products deemed to hold the greatest degree

of risk – by identifying further switch candidates (OTC bulletin, 26 April 2013, page 1).

Later in 2013, Taisho explained that it intended to introduce further prescription-to-OTC

Business

Business

First-quarter sales Change

(¥ billions)

(%)

Change

(%)

-4.6

+6.2

+3.8

–

+5.6

+3.3

153.5

17.2

9.6

0.9

27.7

3.1

-0.2

+11.1

+7.1

–

+9.1

+23.2

Japan

International OTC drugs

International energy drinks

International other

International

Others

34.0

4.0

2.4

0.2

6.6

0.6

Total Self-Medication

41.2

-3.0

184.3

+1.4

Prescription operations

27.2

+5.6

114.7

+0.4

Total for Taisho

68.4

+0.3

299.0

+1.0

Figure 1: Taisho Pharmaceutical’s sales in the first quarter ended 30 June 2014. Forecasted sales are for the

year ending 31 March 2015 compared with actual sales in the previous year (Source – Taisho Pharmaceutical)

switch products in Japan in the coming years to

help revive the domestic OTC market and address growing concerns surrounding the country’s low birth rate and ageing population (OTC

bulletin, 11 October 2013, page 4).

Overall turnover at Taisho’s Self-Medication division fell back by 3.0% to ¥41.2 billion,

despite a 5.6% rise in international sales to

¥6.6 billion (see Figure 1). Other sales added

the remaining ¥0.6 billion to the total.

International sales of the division’s OTC

products grew by 6.2% to ¥4.0 billion, while

international turnover from energy drinks improved by 3.8% to ¥2.4 billion.

Earlier this year, Taisho expanded its international offering by acquiring the rights to the

Flanax OTC naproxen-based analgesic in the

First-quarter sales Change

(¥ billions)

(%)

Forecast sales

(¥ billions)

Change

(%)

Lipovitan D

Other Lipovitan

Total Lipovitan brand

Cold remedies (Pabron brand)

Hair treatments (RiUP brand)

Biofermin

Livita series

Gastrointestinal treatments

Analgesics (Naron brand)

Laxatives (Colac brand)

Zena brand

Cold remedies (Vicks brand)

Tokuhon

Other Self-Medication products

10.5

5.8

16.3

4.1

3.0

1.6

1.0

0.9

0.9

0.8

0.7

0.4

0.3

4.0

-4.3

-1.3

-3.3

-2.5

-8.1

+0.6

-14.7

-3.0

-8.3

-10.4

-6.6

-10.4

-33.4

–

43.2

23.7

66.8

26.0

14.2

6.8

4.8

4.2

4.1

3.6

3.2

3.4

1.4

15.0

-2.6

+2.2

±0.0

±0.0

-8.9

+2.1

+1.9

-2.4

-1.3

+1.1

-1.0

+6.4

+6.1

–

Total Domestic Self-Medication

34.0

-4.6

153.5

-0.2

Figure 2: Breakdown of Taisho Pharmaceutical’s Self-Medication sales in Japan in the three months ended 30

June 2014. Forecasted sales are for the year ending 31 March 2015 compared with actual sales in the financial

year ended 31 March 2014 (Source – Taisho Pharmaceutical)

12

Forecast sales

(¥ billions)

Philippines from Roche for an undisclosed sum

(OTC bulletin, 17 March 2014, page 4).

Commenting on the deal at the time, Taisho

pointed out that Flanax – which it described

as one of the leading brands in the local analgesics market – reinforced its position in a

category where it already offered the Tempra

range of anti-inflammatories.

Meanwhile, domestic sales of Taisho’s core

Lipovitan brand of tonics and nutrient drinks

slipped back by 3.3% to ¥16.3 billion during

the three months (see Figure 2).

Turnover from Lipovitan D fell by 4.3% to

¥10.5 billion, while sales of other Lipovitan

products dropped by 1.3% to ¥5.8 billion.

The decline in sales of other Lipovitan products had been driven by lower sales of both the

100ml variant and 50ml variant, Taisho noted,

although the firm expected turnover from both

sizes to improve in the remainder of the year.

Sales of Pabron cold remedies declined by

2.5% to ¥4.1 billion, as a poor performance from

mainstay general cold remedies offset a good

showing from nasal decongestants. Turnover

from the Vicks brand of cold remedies dropped

even faster, falling by 10.4% to ¥0.4 billion.

The RiUP minoxidil-based hair-regrowth

brand posted first-quarter sales down by 8.1%

to ¥3.0 billion, as demand slumped after consumers stocked up before a price rise took effect in April.

Meanwhile, sales of the Livita brand in

Japan’s “food for specified health use” category

dropped by 14.7% to ¥1.0 billion, while turnover from gastrointestinal treatments declined

by 3.0% to ¥0.9 billion.

The Naron brand of analgesics fell by 8.3%

to ¥0.9 billion, while the Colac range of laxatives posted sales down by 10.4% to ¥0.8 billion.

OTC