Protection against unconscionable business conduct — some

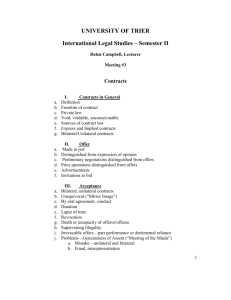

advertisement