Life & Work - Budget Assignment Introduction: The following

advertisement

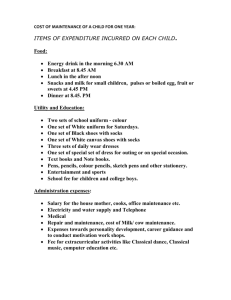

Life & Work - Budget Assignment Introduction: The following activities will guide you through the process of how to budget your money responsibly. You will begin by deciding on a career of your choice, determining your monthly income, and estimating your monthly expenses. You will be responsible for keeping track of money earned as well as money spent. At the end of this lesson you will be able to: Apply math to real life situations, develop a realistic view of the cost of living, differentiate between necessities and luxuries, use technology as a resource. The Process: How likely is it that you will become a professional athlete or other elite professional? Your first task will be to decide on a "realistic" career that would be suitable for you in the future. You are required to research the career that you have chosen. Once you have chosen a career, you will use the Internet, family/household information, and newspaper classifieds to find information about various wages and expenses, which will be used to create a personal budget. Part A – How much can I afford Step 1 Find and choose a career of your own to use to create an actual budget. What are the requirements of this job (educational/other)? (Steps I need to take after high school) 1. 2. 3. 4. What is the starting average salary as well as the top end salary? Some resources you may utilize: http://www.bls.gov/oes/current/oessrcst.htm http://www.payscale.com http://kiplinger.salary.com/ http://jobcentral.salary.com/ http://www.themint.org/kids/starting-salaries.html Life & Work - Budget Assignment Part B - Creating a Budget Okay...we're not going to bore you with a lot of details here. Simply put: we want you to imagine how you want to live once you're on your own. What kind of car are you going to buy? Where are you going to live? Do you love to go to the movies or to the clubs every weekend? Remember, it's your life, you can do whatever you want...or can you? • Step 1: After class discussion, answer the following questions. • What is a budget? • What does a balanced budget mean? • What are regular expenses? • What are discretionary expenses? * Step 2: You are responsible for creating a monthly budget. Your budget must be realistic and you must "live" within your means. Use the Internet, family/household information, and newspaper classifieds to complete the budget worksheet on the back of this assignment. You must include documentation to support all of your numbers, such as website address, copy of bill from home, copy of classified ad, etc. Convert yearly or weekly income/expenses to monthly amounts i.e. $30000 yearly salary divided by 12 = $2500 income per month i.e. $125 weekly groceries X 4 (roughly, number of weeks in month) = $500 per month * Step 3: Recreate the budget worksheet as a spreadsheet. Your spreadsheet should contain formulas in every instance where math was involved. (Hint - Starred cells on budget worksheet should contain formulas on your spreadsheet!) Print two copies of your spreadsheet, one showing answers and one showing formulas. Monthly Budget Worksheet Income Monthly Income - Deductions (monthly income X 25%) = Net Monthly Income * * Monthly Expenses Regular Expenses Housing/Shelter Garbage Pickup Water Parking Fees Heating Electricity Phone Renters'/Homeowners' Insurance Auto Payment Auto Insurance Auto Maintenance (gas, oil, repairs, etc.) Clothing Food/Household (groceries, paper towels, cleaner, etc.) School Loans Personal care (hair cuts, manicures, etc.) Total Regular Expenses * Discretionary Expenses Internet Cell Phone Cable Television Life Insurance Health Care Entertainment (movies, music, games, vacations) Miscellaneous Gifts Savings Total Discretionary Expenses Total Monthly Expenses * * Balancing Budget Net Monthly Income Total Monthly Expenses Balance * * *