PRIME ACADEMY 25 SESSION MODEL EXAM PE-II

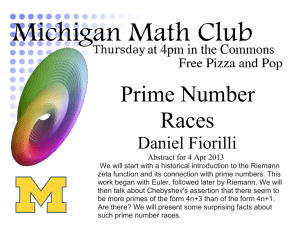

advertisement

25 TH PRIME ACADEMY SESSION MODEL EXAM PE-II Total No. of Questions : 9 Time Allowed : 3 Hours Total No. of Printed Pages: 5 Maximum Marks : 100 CT Question Nos 1 and 6 are compulsory. Attempt any three questions out of the remaining 2,3,4 and 5 and attempt two questions from the remaining question numbers 7,8 and 9 Working notes should form part of the answer 1a. The following data are available in respect of process I for March 2007 - Opening stock of work in progress : 800 units at a total cost of Rs.4,000 - Degree of completion Material - 100 % Labour - 60% Overheads – 60% - Input of materials at a total cost of Rs.36,800 for 9,200 units - Direct wages incurred Rs.16,740 - Production overhead Rs.8,370 - Units scrapped 1,200 units. The stage of completion of these units are Material - 100 % Labour - 80% Overheads – 80% - Closing work in progress 900 units. The stage of completion of these units are Material - 100 % Labour - 70% Overheads - 70% - 7,900 units were completed and transferred to the next process - Normal loss is 8% of the total input - Scrap value is Rs.4 per unit. Compute the following a) Equivalent production b) Cost per equivalent unit for each element c) Calculate the cost of abnormal loss or gain, closing wotk in process and the units transferred to the next process using the FIFO method d) Show process account for March 2007 (14 Marks) 1b. Write a brief note on Integrated accounts Prime/ME/Oct 07 (4 Marks) 1 2a. Ramakrishna owns a luxury bus which runs from Bangalore to Chittor and back for 10 days in a month. The distance from Bangalore to Chittor is 200 km an d the bus completes the trip from Bangalore to Chittor and back on the same day. The bus goes another 10 days in a month towards Mysore. The distance from Bangalore to Mysore is 130 km and the trip is also completed on the same day. For rest of 4 days of its operation in a month it runs in the local city. The daily distance covered in the local city is 70 km. Calculate the rate that the company should charge per passenger when he wants to earn a profit of 25% of his takings. The other information is given below. Rs. Cost of the Bus 10,00,000 Depreciation rate 15% per annum Salary of the driver 5,000 per month Salary of conductor 5,000 per month Salary to part time accountant 2,500 per month Insurance 18,000 per annum Diesel consumption 6 km per litre costing Rs.30 per litre on outside the city trips Diesel consumption 4 km per litre on within the city trips Token tax Rs. 9,000 per annum Lubricating oil Rs.200 per 100 km Repairs & Maintenance 3,000 per month Permit fees 800 per month Normal capacity 50 persons The bus is generally 90% of the capacity when it goes to Chittor and 80% when it goes to Mysore. It is always full when it runs with in the city. The passenger tax is 25% of the net takings. (10 marks) 2b. Explain controllable and non-controllable costs with illustrations. (4 Marks) 3a. The standard time for a job is 60 hours. The hourly rate of guaranteed wage is Rs.0.75. Because of saving in time, a worker gets an hourly wage of Rs.0.90 under the Rowan Premium Bonus plan. For the same saving in time, calculate the hourly rate of wages a worker B will get under the Halsey-weir Bonus payment system assuming 40% to a worker. (6 marks) 3b. The purchase department of an organization has received an offer of quantity discounts on its order of materials as under: Price per tonne Tonnes Rs.1,200 Less than 500 1,180 500 and less than 1,000 1,160 1,000 and less than 2,000 1,140 2,000 and less than 3,000 1,120 3,000 and above. The annual requirement for the material is 5,000 tonnes. The delivery cost per order is Rs.1,200 and the stock holding cost is estimated at 20% of material cost per annum. Advise the purchase department the most economical purchase level (8 Marks ) Prime/ME/Oct 07 2 4a. A company produces a boat that sells for Rs.1,800. An increase of 7-1/2 % in the cost of materials and 6-1/4% in the cost of labour is anticipated. What must be the selling price to produce the same percentage of gross profit as before? The only data available are : The material cost has been 50% of the cost of sales The wages cost has been 20 % of the cost of sales The overhead has been 30% of the cost of sales The anticipated increased costs in relation to the present sales price would cause a 25% decrease in the amount of the present gross profit. Prepare a statement of profit and loss per unit, showing the new selling price desired, and new cost per unit. (10 marks) 4b. Write four limitations of inter-firm comparison (4 marks) 5a. A company maintains separate cost and financial accounts and the costing profit for 2006 differed to that revealed in the financial accounts, which was shown as Rs.50,000. The following information is available Cost Accounts Financial accounts N Opening stock of raw material Rs.5,000 Rs.5,500 Closing stock of raw material 4,000 5,300 Opening stock of finished goods 12,000 15,000 Closing stock of finished goods 14,000 16,000 Dividend of Rs.1,000 were received by the company A machine with net book value of Rs.10,000 was sold during the year for Rs.8,000 The company charged 10% interest on its opening capital employed on Rs.80,000 to its process costs. Work out the profit figure which was shown in the cost accounts (8 marks) 5b.How would you treat the following in the Cost Accounts? (i) Employee welfare costs (ii) Research and development costs (iii) Depreciation (2 marks) (2 marks) (2 marks) 6a. A product is currently manufactured on a plant that is not fully depreciated for tax purposes and has a book value of Rs.60,000 (it was bought for Rs.1,20,000 six years ago). The cost of the product is as under: Unit cost (Rs) Direct costs 24.00 Indirect labour 8.00 Other variable overheads 16.00 Fixed overheads 16.00 64.00 10,000 units are normally produced. It is expected that the old machine can be used indefinitely into the future, after suitable repairs, estimated to cost Rs.40,000 annually are Prime/ME/Oct 07 3 carried out. A manufacturer of machinery is offering a new machine with the latest technology at Rs.3,00,000 after trading off the old plant for Rs.30,000. The project cost of the product will then be Per unit Rs. Direct cost 14.00 Indirect labour 12.00 Other variable overheads 12.00 Fixed overheads 20.00 58.00 The fixed overheads are allocations from other department plus the depreciation of plant and machinery. The old machine can be sold for Rs.40,000 in the open market. The new machine is expected to last for 10 years at the end of which, its salvage value will be Rs.20,000. Rate of corporate taxation is 50%. For tax purposes, the cost of the new machine and that of the old machine may be depreciated in 10 years. The minimum rate of return expected is 10%. It is also anticipated that in future the demand for the product will stay at 10,000 units. Advise whether the new machine can be purchased. Ignore capital gain taxes. The present value of Re.1 at 10 % for years 1 – 10 are: 0. 909, 0.826, 0.751, 0.683, 0.621, 0.564, 0.513, 0.467, 0.424, and 0.386 respectively. (12 marks) 6b. What are the limitations of Net present value method (4 marks) 7a. Company X acquires a company Y on share for share exchange basis. The position before takeover was as under: Company X Company Y No.of Shares 10,000 5,000 Total Earnings (Rs) 1,00,000 50,000 Market price of share (MPS) 20 18 The shareholders of company Y are offered 3750 shares of company X for 5000 shares (i.e each shareholder of company Y gets 0.75 share of company X for 1 share of company Y) Calculate the EPS of the amalgamated company( company X + company Y) vis-à-vis before takeover position of the two companies and the gain/loss of the shareholders of the two independent companies consequent to amalgamation. (6 marks) 7b. A company is evaluating its credit policy. The company sells the product on terms of net 30 days. Cost of goods sold is 87% of sales and fixed cost are further 5% sals. The company classifies its customers on a scale of 1 to 4. The experience of the company in the past are as below. Classification Default as% of sales Average collection period in days for non defaulting accounts 1 0 50 2 3 48 3 8 45 4 18 75 The average rate of interest is 16%. What conclusion do you draw about the company’s credit policy? (6 marks) Prime/ME/Oct 07 4 8a. P ltd sells goods at a uniform rate of gross profit of 25% on sales including depreciation as part of cost of production. Its annual figures are as under : Rs. Sales (At 2 months credit) 26,00,000 Materials consumed (Suppliers credit 2 months) 6,50,000 Wages paid(Monthly at the beginning of the subsequent month 4,80,000 Manufacturing expenses(Cash expenses are paid-one month in arrear) 6,00,000 Administration expenses (Cash expenses are paid – one month in arrear) 1,80,000 Sales promotion expenses (Paid quarterly in advance) 60,000 The company keeps one month stock of raw materials and finished goods. A minimum cash balance of Rs.80,000 is always kept. The company wants to adopt a 15% safety margin in the maintenance of working capital. The company has no work in progress. Find out the requirements of working capital of the company on cash cost basis (8 marks) 8b. What are the merits and demerits of equity shares as source of finance? (4 marks) 9a. Sun Ltd gives the following information for the year ended 31st March 2007 (i) Sales for the year totalled Rs.96,00,000. The company sells goods for cash only. (ii)Cost of goods sold was 60% of sales. Closing inventory was higher than opening inventory by Rs.43,000. Trade creditors on 31st March 2007 exceeded those on 31st March 2006 by Rs.23,000 (iii) Net profit before tax was Rs.13,80,000. Tax paid amounted to Rs.7,00,000. Depreciation on fixed assets for the year was Rs.3,15,000 where as other expenses totalled Rs.21,45,000. Outstanding expenses on 31st March 2006 and 31st March 2007 totalled Rs.82,000 and Rs.91,000 respectively (iv) New machinery and furniture costing Rs.10,27,500 in all were purchased (v) A rights issue was made of 50,000 equity shares of Rs.10 each at a premium of Rs.3 per share. The entire money was received with application. (vi) Dividends and corporate dividend tax totaling Rs.4,70,000 were paid. (vii)Cash in hand at bank as at 31st March 2006 totalled Rs.2.13,800. Prepare a cash flow statement for the year ended 31st March 2007 using direct method. ( 8 marks) 9b. Write a note on indifference point Prime/ME/Oct 07 (4 marks) 5 PRIME ACADEMY SUGGESTED ANSWERS PE-II Cost Accounting and Financial Management 1.(a) a) Statement of equivalent production (FIFO method) Output Equivalent production Units Particulars Units Material Labour Overhead Units % Units % Units % Opg.stock Units completed Of WIP 800 From WIP 800 320 40 320 40 New units 7,100 7,100 100 7,100 100 7,100 40 Units Closing WIP 900 900 100 630 70 630 70 Introduced 9,200 Normal loss 800 - Abnormal loss 400 400 100 320 80 320 80 10,000 10,000 8,400 8,370 8,370 Input Particulars b) Statement of cost per equivalent units for each element Particulars Cost Equivalent units Cost per unit Material Rs.36,800 Less: Scrap realization 3,200 33,600 8,400 4.00 Labour 16,740 8,370 2.00 Overheads 8,370 8,370 1.00 c) Statement showing cost of abnormal loss, closing WIP and units transferred to the next process Particulars cost per unit Equivalent unit Total cost Abnormal loss Rs. Material 4.00 400 1,600 Labour 2.00 320 640 Overhead 1.00 320 320 Total 2,560 Clossng WIP Material 4.00 900 3,600 Labour 2.00 630 1,260 Overhead 1.00 630 630 Total 5,490 Units transferred to next process Cost of Opening WIP 4,000 Material 4.00 7,100 28,400 Labour 2.00 7,420 14,840 Overhead 1.00 7,420 7,420 Total 54,660 Prime/ME/Oct 07 6 d) Process Account for March 2007 Particulars Units Amount (Rs) Particulars Units Amount (Rs) To opening WIP 800 4,000 By finished goods 7,900 54,660 To Material 9,200 36,800 By closing WIP 900 5,490 To Labour 16,740 By Normal loss 800 3,200 To Overheads 8,370 By Abnormal loss 400 2,560 10,000 65,910 10,000 65,910 1b. a) Integrated Accounts - In integrated system of accounts both financial and cost accounts are maintained in the same set of books and there will be no separate costing books. - The integrated books of accounts give full information so that Profit & Loss account and Balance sheet can be required according to the requirements of law. Integrated Accounts provide lot of advantages: - No duplication of recording of data in separate books - It facilitates the use of mechanized accounting - There is no need for reconciliation as there is one figure of profit - Costing data are available from original set of books which ensures accuracy and timeliness. - It faciliates centralized accounting leading to economy. 2a. Operating Statement of cost for the month of ----Per month Rs. Depreciation 10,00,000 x 15 12,500 100 x 12 Salary of Driver 5,000 Salary of conductor 5,000 Salary of Accountant 2,500 Insurance 1,500 Token tax 750 Repairs & Maint 3,000 Permit fees 800 Rs. 31,050 Variable charges Diesel Lubricating oil Total cost per month Add: Profit 25% on takings Total net takings Add: Passenger tax 25% Total cost Total passenger kilometer Rate per passenger kilometer Prime/ME/Oct 07 35,100 13,760 7 48,860 79,910 19,978 99,888 24,972 1,24,860 2,98,000 0.42 Charge per passenger Chittor trip = 200 km x 0.42 = Rs.84.00 Mysore trip = 130 km x 0.42 = Rs.54.60 Workings Diesel cost Chittor = 10 days x 400 km = 4,000 km Mysore = 10 days x 260 km = 2,600 km Total = 6,600 km Diesel = (6600/6) x 30 = Rs.33,000 City trips = 4 days x 70 km = 280 km Diesel = (280/4) x 30 = Rs. 2,100 Total Diesel = Rs. 35,100 Lubricating oil (6,880/100) x 200 =Rs. 13,760 Total passenger kilometer = 4000 x 50 x 0.9 = 1,80,000 2600x50xx 0.8 = 1,04,000 280 x 50 = 14,000 Total = Rs 2,98,000 2b. Controllable and Uncontrollable costs - The costs which can be influenced by the action of a specified member of an undertaking is controllable costs whereas the costs which cannot be controlled by the specified member of undertaking is uncontrollable costs. - For a cost centre direct costs like material , labour are controllable by the members of the cost centre where as allocated costs to the cost centre are uncontrollable by the members of the cost centre to which the cost is allocated - Controllable and uncontrollable cost relate to authority of a person in the organization. Cost which cannot be controllable by one person in the organization may be controllable by another person having higher authority. - Controllability or uncontrollability of an item of cost would depend upon the area of managerial responsibility and authority. Example- Expenses incurred by the Machine shop is controllable by the Machine shop manager but the share of any other department apportioned to machine shop is not controllable by the machine shop manager. 3a. Inflated rate is = Rs.0.90 Guaranteed rate = Rs.0.75 Difference = Rs. 0.15 % increase = 0.15/0.75 x 100 = 20% Since the hourly rate is inflated by 20 % , time saved should be 20% Time allowed = 60 hours Time taken = 48 hours Time saved = 12 hours Under halsey plan wages Wages for time taken = 48 x 0.75 = 36.00 Prime/ME/Oct 07 8 Add: Bonus 40 % of time saved 40 x 12 = 4.80 x 0.75 3.60 100 Rs.39.60 Total earnings = Rs.39.60 Hourly rate of wages = 39.60/ 48 = 0.825 3b. 1. Order size 400 500 2. No.of orders 12.5 10 3. Value of order (Rs.000) 480 590 4.Average Inventory Rs.000 240 295 5.Ordering cost 15,000 12,000 6.Carrying cost 48,000 59,000 7.Annual cost of material 60,00,000 59,00,000 8. Total ( 5 to 7) 60,63,000 59,71,000 1,000 5 1,160 580 6,000 1,16,000 58,00,000 59,22,000 2,000 2.5 2,280 1,140 3,000 2,28,000 57,00,000 59,31,000 3,000 1.67 3,360 1,680 2,000 3,36,000 56,00,000 59,38,000 Rs.59,22,000 is the total minimum cost at 1,000 order size is the most economical order level. 4a. If x is the cost of sales , y is the profit , x + y = 1,800 Cost of sales + profit = sales Present cost Anticipated increase Total Structure Materials 50% = 0.5x 7-1/2% of 0.5x = 0.0375x 0.5375x Wages 20% = 0.2x 6-1/4% 0f 0.2x = 0.0125x 0.2125x Overhead 30% = 0.3x 0.3000 x Total cost of sales 100% x 0.0500x 1.0500 x Increase in cost of sales = 0.500x = 1/20 x Reduction in profit 25% of Y = ¼ y Increase in costs is equal to the reduction in the amount of profit (1/20) x = ¼ Y x = 5y Substituting 5y + y = 1,800 y = 300 Profit = Rs.300 original = 20 % of cost of sales Cost of sales original = Rs.1,500 Anticipated increase = 1/20 x = 1500/20 = 75 Present cost of sales = 1,575 To have 20% on cost of sales = 315 Selling price = Rs.1,575 + 315 = Rs.1,890. Now the selling price should be = Rs.1,890 New cost structure Material = 750 + 7-1/2 % = 806.25 Wages = 300 + 6-1/4% = 318.75 Overhead = 450.00 Cost of sales = 1,575 Profit 315 Sales = 1,890 % profit on cost = 20 % Prime/ME/Oct 07 9 4b.- A sense of complacence on the part of the management who may be satisfied with the present level of profits and their reluctance to participate wholeheartedly. - Reluctance to part with data which the management feels to be of extremely confidential in nature - Absense of a proper system of cost accounting so that the costing data supplied may not be relied upon for comparison purpose. - Non-availability of a suitable base for comparison. 5a. Statement showing the profit as per cost accounts Profit as per financial accounts Add: Opening stock of raw material over valued 500 Opening stock of finished goods overvalued 3,000 Loss on machine sold (10,000 – 8,000) 2,000 Less: Closing stock of raw material under valued Closing stock of finished goods undervalued Income not included in cost accounts Dividend Interest Profit as per cost accounts Rs. 50,000 5,500 55,500 1,300 2,000 1,000 8,000 12,300 43,200 5b. i)Employee welfare costs : The welfare costs like canteen, transport subsidy, hospital expenses, washing allowance are some of the welfare expenses paid to employees. These welfare expenses may be collected under a separate cost centre and the cost may be allocated to other cost centres on the basis of number of employees in the respective cost centres. ii) Research and Development Costs Cost may be incurred for finding new products, methods , techniques or plants/equipments. Research cost may be incurred for carrying basic or applied research. Cost of basic research may be charged to the revenues of the concern. If the amount is large it may be spread over number of years and charged as deferred revenue expenditure. Cost of applied research relating to all existing products may be treated as a manufacturing overhead of the period in which it is incurred and absorbed suitably. Applied research relating to finding new product or methods may be treated depending on the outcome. If the research is successful the amount may be charged to product resulted as a outcome of the research. If the research is a failure it may be charged to Costing Profit & Loss Account , if the amount is large the amount may be spread over a number of years. The treatment of Development costs is the same as that of applied research. iii) Depreciation It represents the fall in the value of the machine due to usage and wear and tear. The cost of depreciation is clubbed with other expenses relating to the machines and its cost may be absorbed based on the machine hour rate of the machine worked out. Depreciation is an important element of cost and without depreciation true cost of the product cannot be found out correctly. Prime/ME/Oct 07 10 6a. Cash flows from new machine as well as from old machine Old machine New Machine Production (units) 10,000 10,000 Variable cost per unit – Rs. 48 38 Total variable cost - Rs. 4,80,000 3,80,000 Repairs 40,000 Depreciation – old machine 60000/10 6,000 31,000 New machine Rs.3,00,000+30,000 – 20,000/10 Total 5,26,000 4,11,000 Less tax saving 50% 2,63,000 2,05,500 Less : Depreciation (no cash outflow) 6,000 31,000 Net cash flow 2,57,000 1,74,500 Differential cash out flow (Rs.2,57,500 – Rs.1,74,500) 82,500 Present value of saving of Rs.82,500 in 10 years @1% (Rs.82,500 x 6.145) 5,06,962 Add: present value of sale proceeds from new machine (Rs.20,000) 7,720 Total cash flow (savings) 5,14,682 Total cash outflow now 3,00,000 Net cash flow 2,14,682 Since NPV is positive, it is advisable to purchase the new machine It is presumed that the present book value of old machine will also be written off in next 10 years. The fixed overheads constitute allocation from other departments and hence the same are irrelevant for replacement decision. 6b. - It is difficult to calculate as well understand as compared to ARR method or pay back method - This method may not give satisfactory results where two projects having different effective lives are being compared - This method emphasis the comparison of net present value and disregards the initial investment involved. - Calculation of desired return is problem as it is based on cost of capital the calculation of which itself is complicated. 7a. Statement showing the EPS and P/E ratio of the two companies vis-à-vis Amalgamated companies Before takeover Amalgamated Co. Details Company X Company Y Acquirer Acquiree _____________________ Number of shares 10,000 5,000 13,750 Total earnings (Rs.) 1,00,000 50,000 1,50,000 EPS (Rs) 10 10 10.91 Market share price 20 15 P/E ratio 2:1 1.5: 1________________________ Prime/ME/Oct 07 11 Gain / loss to the share holders of two independent companies 1. The share price of the Amalgamated Co. = EPS x P/E Ratio = 10.91 x 2 = Rs.21.82 2. The share holders of company X will be benefited by Rs.1.82 (i..e Rs.21.82 – 20.00) 3. Company Y gets 0.75 share of company X for 1 share of company Y. Therefore, exchange rate = 0.75:1 4. New EPS = Rs.10.91 x 0.75 = Rs.8.18 5. The shareholders of company Y will lose Rs.1.82 i.e (Rs.10.00 – 8.18) 7b.Assuming the revenue generated from each category as 100 as the basis for assessing company’s credit policy Classs Gross profit Bad debts Interest Total cost Net effect Decision @ 13% Rs. Rs. cost Rs. Rs. Rs. 1 13 1.79 1.79 11.21 Accept 2 13 3 1.72 4.72 8.28 Accept 3 13 8 1.61 9.61 3.39 Accept 4 13 18 2.68 20.68 (7.68) Reject It appears that the company is allowing liberal credit days in spite selling it on terms of net 30 days. For all category it allows above 30 days as credit period on an average. Up to category 3 total cost is favourable and may be accepted. In the case of category 4 it is un favourable as its cost is more than gross profit. The company should try to reduce the bad debts in category 4 at least by 7.68 % so that it can accommodate credit period up to 75 days for increasing the sales. Working for interest cost Interest cost = Avg,rate of interest x cost of goods sold x Avg. collection period 365 days For category 1 = 15% x 87 x 50 = 1.79 365 = 15% x 87 x 48 = 1.72 365 = 15% x 87 x 45 = 1.61 365 = 15% x 87 x 75 = 2.68 365 8a. Working notes Sales Less: Gross profit marging at 25% Total manufacturing cost Less: Materials consumed Wages Manufacturing expenses Less: Cash manufacturing expenses Depreciation Prime/ME/Oct 07 Rs. 26,00,000 6,50,000 19,50,000 6,50,000 4,80,000 8,20,000 6,00,000 2,20,000 12 Total cash cost Manufacturing costs Less: Depreciation Cash manufacturing costs Add: Administrative expenses Add: Sales promotion expenses Total Cash Costs 19,50,000 2,20,000 17,30,000 1,80,000 60,000 19,70,000 Statement of working capital requirement Current Assets Debtors (1/6 th of total cash costs (1/6 x 19,70,000) 3,28,333 Sales promotion expenses (prepaid) 15,000 Stock of raw materials (1 month) 54,167 Finished goods (1/12 of cash manufacturing costs) 1,44,167 Cash in hand 80,000 6,21,667 Less: Current liabilities Creditors for goods ( 2 months) 1,08,334 Wages 1 month 40,000 Manufacturing expenses (1 month) 50,000 Administration expenses (1 month) 15,000 2,13,334 Net working capital 4,08,333 Add: Safety margin 15% 61,250 Working capital required 4,69,583 8b. Merits a) It provides a permanent source of finance b) There is no mandatory payment to equity share holders since they are the owners. c) New equity shares can always be issued and thus there remains flexibility with the company regarding choice to be made for raising additional finance. d) The equity base can always be broadend by making a rights issue. Demerits a) The issue of equity shares extends voting rights which could threaten the control over the company by the existing shareholders. b) More ordinary shares issued result in the distribution of profits among a wider group of people. c) The cost of underwriting and distributing new issue of ordinary shares are usually high. d) The overall cost of a company’s capital will be raised, if there is a high proportion of equity finance. e) Dividends are not tax deductible like interest payments which can reduce profits available and can increase the cost of equity. Prime/ME/Oct 07 13 9a. Calculation of cash paid to suppliers and employees: Rs. Cost of sales 60% of Rs.96,00,000 57,60,000 Add: Expenses incurred 21,45,000 Outstanding expenses on 31st March 2006 82,000 Excess of closing inventory over opening inventory 43,000 80,30,000 Less: Excess of closing creditors over opening Creditors Rs.23,000 Outstanding expenses on 31st March 2007 91,000 1,14,000 79,16,000 Cash flow statement for the year ended 31st March 2007 Cash Flow from Operating Activities Rs. Rs. Cash receipts from customers 96,00,000 Cash paid to suppliers and employees (79,16,000) Cash inflow from operations 16,84,000 Tax paid (7,00,000) Net cash from operating activities 9,84,000 Cash flow from investing activities Purchase of fixed assets (10,27,500) Net cash used in investing activities (10,27,500) Cash Flow from financing activities Proceeds from issue of share capital 6,50,000 Dividends and corporate dividend tax paid (4,07,000) Net cash from financing activities 2,43,000 Net increase in cash and cash equivalents 1,99,500 2,13,800 Cash and cash equivalents as at 31st March 2006 Cash and cash equivalents as at 31st March 2007 (Closing balance) 4,13,300 9b. The capital structure of a firm consist of an optimum mix of equity and debt. In attempting an optimum mix, one should compare cost of capital with the expected return from the investment. So long as the cost of financing by debt is less than the rate of return from the investment, add the difference to the earnings per share. In such a case debt finance is more profitable. The indifference point in planning the capital structure is that point at which the after tax cost of acquisition of outside funds is equal to the rate of return from the investment. This point refers to that EBIT level at which EPS remains the same irrespective of debt equity mix. In other words, at this point rate of return on capital employed is equal to the rate of interest on debt Prime/ME/Oct 07 14 25 TH PRIME ACADEMY SESSION MODEL EXAM PE-II Total No. of Questions : 8 Time Allowed : 3 Hours Total No. of Printed Pages: 3 Maximum Marks : 100 IX 1. Discuss the following propositions in the context of Central Sales Tax Act, 1956 a) A certificate of registration once granted cannot be amended? b) Prosecution shall not lie in respect of an offence under certain circumstances? c) In respect of goods, which are exempt from tax can the cost of packing materials be charged to tax? d)The location of goods does not, by itself determine the place, where the sales take place. Discuss? (8 marks) 2. X makes a sale during the year 2006-07, of Rs.20,70, 000 to various buyers. We assume in this question that all the buyers were registered dealers and have obtained form C from their states and sent the same to X. Out of the total sales, Rs.15,60,000 was @ 4% and 5,10,000 was @ 2%. X has filed the return for the year as per the law applicable in his appropriate state. At the time of assessment how will we determine the ‘turnover’? (7 marks) 3. X, of Delhi makes a sale during the year 2006-07, of Rs.20,70,000 to various buyers. We assume in this question that all the buyers were registered dealers. Out of the total sale, Rs.15,60,000 @ 4% and 5,10,000 was 2%. X has field the return for the year as per the law applicable in this appropriate state. Out of the sale of 15,60,000 X could not procure C form from one of the buyers, Z. The amount of such bill (inclusive of CST @4%) is Rs.1,56,000. The goods sold to Z are taxable as per the general sales tax law of the state of Delhi @9%. At the time of assessment how will we determine the ‘turnover’? (10 marks) 4. X’s contract with ABC Ltd, Mumbai is terminated after 6 years 6 months and 1 day. On 1-10-2006 his services with the company are discontinued. He receives a gratuity of Rs.1,33,000. He had joined the company with emoluments including basic pay of Rs.13,000, DA being 40% of Basic Pay (25% enters into for provident fund) Commission @ 1% on purchases made by him during the year amounted to Rs.15,000. He had received a raise of Rs.5,000 in his basic pay on the 1st of March 2006 and an increment of Rs.2,000 in the basic pay on 1st December 2005. On 15th of January 2007 X joined INT Ltd., Ghaziabad, for a monthly salary of Rs.22,000. Assume that ABC Ltd is not covered under the payment of gratuity Act, 1972. All his salary is due on the 7th of the following month. Compute the salary income in the hands of Mr. X for P.Y. 2006-07. (12 marks) 5 (a). From the following information calculate the income of X, a retailer Rs. Total sale made during the year 38,00,000 Sales Tax (not included in the above figure) 1,20,000 Sale of Scrap 1,50,000 Interest on bank deposits 2,00,000 Capital gains on sale of motor car as per Sec.50 (2) 75,000 Goods returned during the year 1,20,000 Expenditure claimed u/s 30-37 31,00,000 Calculate the total income chargeable to tax of the retail trader. Prime/ME/Oct 07 15 (5 marks) 5(b). The assessee, Mr. X has income from House Property (computed u/s 22) of Rs.40,000 and a STCG on the transfer of land computed u/s 48 - Rs.20,000, STCG u/s 111A – Rs.15,000, LTCG on transfer of Jewellery – Rs.20,000, Winnings from lottery 80,000. Calculate the total tax liability of X for the PY 2006-07, assuming that X is a) A Resident assessee b) A Non Resident assessee. (5 marks) 6(a). X transfers cash, Rs.15,00,000 to his wife on 15th April 2006. His wife buys debentures worth Rs.10,00,000. Interest for the debentures is due on the 1st of January every year. In whose hands will the interest income be taxable? (6 marks) 6(b). X lives with his parents in Chennai. X is suffering from a 80% handicap in the eye. During the PY 2006-07 he has won a prize in a TV game show of Rs.41,000. His grandfather had transferred a house in his name on 1-12-2002. Income from such house property during the current PY is Rs.45,000. He has a long term capital gain from the transfer of debentures (gifted to him by his father) of Rs.93,000. X is 17 years of age, is a resident of India for the PY 2006-07. Compute his tax liability for the PY 2006-07. Further information: 1. Medical insurance premium paid for his mediclaim policy by the father – Rs.12,000. 2. Expenditure on his treatment incurred by his father – Rs.32,000. His father wants to claim a deduction u/s 80DD from his total income 3. X deposits a sum of Rs.12,000 as premium for his life insurance policy. 4. He makes a donation to national institute for mental retardation for Rs.20,000. (9 marks) 7(a). For Assessment Year 2006-07 the due date of filing the return of income was 31-07-2006 and the return was not filed up to 31-07-2006. The Assessing Officer issues a notice u/s 142(1) and the assessee is asked to file the return by 15-12-2006. The assessee files the return of income on 13-12-2006 declaring a loss of Rs.2,00,000/- from business. The assessee files a revised return on 31-12-2006 declaring a loss of Rs.6,00,000/- from business. Can the assessee carry forward the loss? (7 marks) 7(b) Till when can a valid notice under section 143(2) be served in the following cases a. For PY ending 31-3-07, the due date for filing the return of income is 31-07-07. The return of income is filed on 12-11-07 declaring an income of Rs.1,20,000. b. If in the above example, the notice u/s 143(2) was issued on 30-11-08 and is received by the assessee on 2nd December 2008. (2X4Marks) Prime/ME/Oct 07 16 8. Mr. Nathan, a businessman, submits the following profit and loss account to you for the year ended 31st March 2007:Particulars Rs. Particulars Rs. To Salaries 75,000 By Gross profit b/d 2,50,000 To Traveling expenses 25,800 By Dividend from Indian Cos. 8,500 To Rent and rates 3000 By Discount received 1,500 To Interest on capital 5000 To Administrative charges 25,000 To Depreciation 25,000 To Income-Tax 50,000 To Net Profit 51,200 2,60,000 2,60,000 The following additional information are furnished: i) Salaries include payment of Rs.16,000 to Mrs. Nathan, who is holding technical qualification in equality and acting as supervisor of the quality control department. She does not have any other income during this year. Till February, 2007, she was employed in M/s. Sanvats Ltd in a similar post for 10 years and was drawing a monthly salary of Rs.1,500. ii) Mr. Nathan had gone on a foreign tour in connection with the business. The journey was for 15 days in which he spent 3 days on visiting tourist spots. Total expenses incurred, which were within RBI norms also, in respect of this foreign tour was Rs.20,000. iii) Administrative charges include expenses in respect of donation of Rs.1,000 to the trade association for the purpose of an advertisement in the souvenir published by it. iv) Depreciation allowance as per the Income-tax Rules, 1962 is Rs.45,000 v) Mr. Nathan raised a loan from LIC of India on the security of his life Insurance Policy and use the same for the payment of expenses relating to repairs of machinery. Interest of Rs.2,500 in respect of this loan was paid out of his drawings. vi) Birthday gifts presented to his minor son includes cash of Rs.20,000 which was deposited in Nationalized Bank. Interest accrued up to 31st March, 2007 was Rs.2,500. vii) Mr. Srinivasan, brother of Mr. Nathan is suffering from heart disease. Since he could not earn money for his livelihood, Mr. Nathan takes care of him, in respect of all expenses. Expenses incurred during the year in this connection is Rs.15,000. viii) During the previous year, Mr. Nathan has paid Rs.10,000 by way of cheque towards medical insurance premia of himself, his wife and minor son. From the above particulars, prepare a statement showing the taxable income of Mr. Nathan for the A.Y. 2007-08. (23 Marks) Prime/ME/Oct 07 17 PRIME ACADEMY SUGGESTED ANSWERS PE-II - INCOME TAX AND CENTRAL SALES TAX 1a) The proposition is wrong. According to section 7[4A]. Registration Certificate can be amended by the registration authority on an application by the dealer or after due notice to the dealer for the following reasons:_ Change of name, place or nature of business - Change of class of goods - Any other reason. b) The proposition is correct. According to section 10A, the registration authority can levy penalty (at one and-a-half times the section 8(2) rate) in lieu prosecution for the following offences committed by purchasing dealers:1. Falsely declaring that his purchases are covered by R.C.[Section 10(b)] 2. Falsely declaring that he is a registered dealer [Section 10(c)] 3. Failure to use the purchased goods for the purposes specified in the R.C. [Section 10(d)] c) Supreme Court, in the case of Premier Breweries v. State of Kerala (108 STC 598) held that the rate of tax applicable for containers shall be the same as the rate applicable for the goods sold in the container. In view of this, it can be said that the cost of packing materials in respect of exempt goods should not suffer tax. d) A sale or purchase of goods shall be deemed to take place inside a state if the goods are within the state – (a) in the case of specific or ascertained goods, at the time of contract of sale is made; and (b) in the case of unascertained or future goods, at the time of their appropriation to the contract of sale by the seller or by the buyer. When a sale or purchase of goods is determined to take place inside a state, such sale or purchase shall be deemed to have taken place outside all other states. Thus, location of the goods does not by itself determine the place of sale; but it is relevant to determine the state which has the jurisdiction to levy tax in respect of the inter-state sale. 2. At the time of the assessment the sales tax officer concerned shall determine the sales tax liability as per the provisions of Sec 8 and 8A. To ascertain the correct amount of central sales tax leviable, we will first have to remove the sales tax included in the sale price. 4% tax: Deduction from sale price = 4% /104*15,60,000 = 60,000 2% tax: Deduction from sale price = 2%/102* 5,10,000 = 10,000 Turnover = 20,70,000 – 60,000 – 10,000 = Rs. 20,00,000 On this amount the CST will be levied, after making adjustment as prescribed under section 8A i.e. after adjusting for Prime/ME/Oct 07 18 • • • 3. *Any goods rejected Any goods returned within the time period of 6 months In case where selling dealer is not able to procure any of the forms specified in the act then the rate will be charged as if the selling dealer had made a sale to an unregistered dealer At the time of assessment the sales tax officer concerned shall determine the sales liability as per the provisions of Section 8 and 8A. To ascertain the correct amount of central sales tax leviable, we will first have to remove the sales tax included in the sale price. Deductions from turnover: Rs 4% Tax Deduction from sale price 4%/104*15,60,000 60,000 2% Tax: Deduction from sale price 2%/102*5,10,000 10,000 10% Tax: turnover for which no FORM C 4%/104*1,56,000 is obtained Total tax deposited by X as per returns field 70,000 by him NOTE: No C FORM obtained: when the bill raised the buyer had given the assurance to issue C form thus X had raised the bill with 4% CST and deposited the same with the appropriate sate however at the time of assessment, Z did not issue the C form, in this case the difference or increase in rate will be borne by the selling dealer i.e. X. The rates applicable will be as if the sale is made to an unregistered dealer. Turnover: * 2% - 5,10,000 – 10,000 = 5,00,000 * 4% - 15,60,000 – 60,000 = 15,00,000 * 10% - turnover for which no C form is obtained = 15,60,000 – 60,000 Out of 15,00,000 sales of 1,50,000 are taxable @ 10% since no C form was obtained Final Tax under central sales tax act, 1956 Rs. On 13,50,000 (15,00,000 – 1,50,000)*4% = 54,000 On 1,50,000 *10% = 15,000 On 5,00,000 *2% = 10,000 Total Assed Tax = 79,000 Total tax paid by X during the year As per the return filed by him = 70,000 Balance tax payable = 9,000 4. Name of the assessee : Mr. X Previous year : 2006-07 Assessment year : 2007-08 Prime/ME/Oct 07 19 Computation of Income from salary Amount (Rs.) Sec 15: From ABC Ltd: - Basic Pay -Dearness (D.A.) Allowance From INT Ltd: -Basic Pay Sec 17(1) Less: Less: 20,000 * 7 months and 1 day 8,000 * 7 months and 1 day 1,40,645(WN1) 22,000 * 1 month and 17 days 34,065 For the year given 15,000 1,33,000 (61,050) (WN2) 71,950 56,258(WN1) Commission Gratuity Received Exemption 10(10)(iii) u/s GROSS SALALRY Deductions u/s 16 INCOME FROM SALARY 3,17,918 NIL 3,17,918 Working Notes: WN 1: Salary is chargeable to tax on due or receipt which ever is earlier. As per the facts of the question, salary from ABC Ltd. is due on 7th of the following month. So the salary of March 2006 shall be taxable in April 2006.That salary received in April 2006 WN2: Exemption u/s 10(10) (iii) From the amount of gratuity received – Rs.1,33,000, the least of the following will be allowable as an exemption u/s 10(10)(iii) i. Government ceiling – Rs.3,50,000 ii. Amount received – Rs.1,33,000 iii. ½ month average salary for each completed year of service = ½ * 20,350 * 6 = 61,050 a. Average ‘salary’ – For the purposes of section 10(10)(iii) ‘salary’ for the purpose of computing the amount of exemption has been defined to include Basic Pay and the entire amount of DA(only if it enters into calculation for retirement benefits) and commission only if it is given as a % age of sales effected by the employee. Prime/ME/Oct 07 20 Average salary has to be computed at an average of 10 months salary received during a period of 10 months immediately before the month of retirement. Such period of 10 months need not fall in the relevant previous year for which the taxable salary is being computed. Average Salary = salary for months of September’ 06, to Dec’ 05. Month Basic D.A (Rs) Total Pay(Rs) (Rs) September 2006 20,000 2,000 22,000 August 2006 20,000 2,000 22,000 July 2006 20,000 2,000 22,000 June 2006 20,000 2,000 22,000 May 2006 20,000 2,000 22,000 April 2006 20,000 2,000 22,000 March 2006 20,000 2,000 22,000 February 2006 15,000 1,500 16,500 January 2006 15,000 1,500 16,500 December 2005 15,000 1,500 16,500 Total for 10 months 2,03,500 Average (÷ 10) 20,350 * Commission is based on a % age of purchases and not on sales, so it is not considered for calculating the exemption u/s 10(10) (iii). * While calculating the 10 months average salary, we do not consider the date the salary becomes due. We will take the salary for the month in which the services were rendered. Thus where the salary is increased in the month of March 2006, while computing income under the head salaries, it will be taken as income of the PY 2006-07 as it becomes due on the 7th of April 2006. However while computing the exemption under section 10(10) (ii), it shall be taken as the salary for the month of March 2006. b. Completed years of service = Completed years = 6 years 6 months and 1 day, the completed years for section 10(10) (iii) are 6 years. Part of the year is to be ignored for the purposes of calculation u/s 10(10) (iii). 5(a) Computing Turnover/ Gross receipts for Section 44AF Rs. Sales 38,00,000 (+) Sales Tax 1,20,000 (+) Scrap 1,50,000 (-) Goods returned 1,20,000 39,50,000 X 5% = 1,97,500 Since turnover is < 40,00,000 assessee may opt for 44AF OPTION 1 : Assessee opts for Section 44AF Rs. Business Income 1,97,500 Other Sources 2,00,000 Short Term Capital Gains 75,000 Gross Total Income 4,72,500 Prime/ME/Oct 07 21 OPTION 2 : Assessee does not opt for 44AF Business Income Rs. Sales 39,50,000 Less: Expenses u/s 30 – 37 31,00,000 Rs. 8,50,000 Income from other sources 2,00,000 Short Term Capital Gains 75,000 Gross Total Income 11,25,000 • The assessee should opt for section 44AF as it is more beneficial for him. i.e Option 1. 5(b) Computation of total tax liability for P.Y 2006-07: If Mr. X is a Resident If Mr. X is a Non resident Rs. Rs. Income from House 40,000 40,000 Property STCG u/s 111A 15,000 15,000 Winnings from lottery 80,000 80,000 STCG on land 20,000 20,000 LTGG 20,000 20,000 Total Income 1,75,000 1,75,000 Tax: (WN 1) 24,000 29,500 Add: Surcharge Nil Nil 24,000 29,500 Add: Education cess @ 2% 480 590 24,480 30,090 Working Note: WN 1 : Income taxable at normal rate = 60,000 On first 60,000 = Nil For a resident assessee: Balance unutilized amount of minimum exemption slab (Rs.40,000) will be set off from STCG u/s 111A and LTCG but not from income covered by section 56(2)(ib). STCG u/s 111A Rs.15,000 – 15,000 = NIL LTCG – Rs.20,000 – 20,000 = NIL Winnings from lottery Rs.80,000 x 30% = 24,000 For a Non resident assessee: Balance unutilized amount of minimum exemption slab (Rs.40,000) will not be set off from STCG u/s 111A and LTCG or from income covered by section 56(2)(ib). STCG u/s 111A Rs.15,000 x 10% = 1,500 LTCG – Rs.20,000 x 20% = 4,000 Winning from lottery – Rs.80,000 x 30% = 24,000 29,500 Prime/ME/Oct 07 22 6.(a) Gifts of Rs.15,00,000 is not covered by the provisions of Section 56(2)(vi), since a wife is a ‘relative’ for the purpose of the said section, Rs.15,00,000 will not be taxable as income of the wife. Further the provisions of section 64 (1) (iv) are applicable to the interest earned as the relationship of husband and wife existed on the date of ‘transfer of the asset’, as well as the date of accrual of income. Thus the interest income is taxable as income of X as per the provisions of section 64(1)(iv). 6(b) Calculation of tax liability of X for the PY 2006-07: House property Rs.45,000 Capital Gains LTCG Rs.93,000 Other Sources u/s 56(2)(ib) Rs.41,000 GTI 1,79,000 Less: deductions Sec 80C Rs.12,000 Sec 80G Rs.20,000 Sec 80U (Balancing figure) Rs.13,000 45,000 Total Income 1,34,000 Tax on total Income Tax on LTCG – 93,000 – min exemption 93,000 = Nil Tax on winnings @ 30% = 41,000 @ 30% = Rs.12,300 Total tax payable = Rs.12,300 Add: education cess = Rs. 246 Total payable = Rs.12, 546 Working Notes: ¾ Income of X is taxable in his hands only and is not clubbed in the hands of either of his parents u/s 64(1A), because as per the provisions of section 64(1A) income of minor handicapped child is taxable in the hands of the minor only. ¾ Provisions of section 27(i) do not apply as the house was transferred by the grand father and not the father. ¾ Expenditure incurred by the father • On the mediclaim policy is allowed as a deduction to the father u/s 80D • On the treatment of X as per the provisions of section 80DD, a deduction can be claimed either u/s 80U or u/s 80DD and not both, since X has claimed a deduction u/s 80U, his father cannot claim a deduction u/s 80DD. ¾ Deduction in the hands of X cannot be more than the GTI excluding LTCG and winnings from lotteries etc i.e. cannot be more than 45,000 ¾ Since X is a resident individual, while calculating tax the set off for minimum exemption is allowed from LTCG but is not allowed from winnings from lotteries, thus minimum exemption of Rs.93,000 is set off against LTCG, the balance minimum exemption of Rs.7,000 is not allowable from winnings from lotteries. Prime/ME/Oct 07 23 7(a) Since the return of income filed on 13-12-2006 is a return u/s 142(1)(i), it can be revised. Thus the return of income filed on 31-12-2006 is a valid revised return u/s 139(5). As per judgment in CIT v Dhampur Sugar Mills - it was held that the revised return substitutes the return it is revising and is deemed to have been filed on such date. Thus the return actually filed on 31-12-2006 shall be deemed to have been filed on 13-12-2006 and the first return will be deemed never to have been filed. Thus for the assessment year 2006-07 the assessee no longer has loss of Rs.2,00,000 but has a loss of Rs.6,00,000. However since the return is deemed to have been filed on 13-12-2006 it is still filed after the due date (i.e. 31-07-2006), it does not fulfill the provisions of section 80 and thus the business loss cannot be allowed to be carried forward. 7(b) (a) For a notice u/s 143(2) to be valid it must be served on the assessee within one year from the end of the month in which the return was filed. Thus, the return was filed on 12-11-2007, end of this month is 30-11-2007, 12 more months is 30-11-2008. Thus the notice must be served on or before 30-11-2008 for it to be valid. (b)This notice is time barred or invalid, this is because it should have been served on the assessee on or before 30-11-2008. Even if the notice was issued before the expiry of the time period, it is invalid, as the condition u/s 143(2) is for service of notice. 8. Computation of Total Income Name of the Assessee: Mr. Nathan A.Y. 2007-08. Rs. I. Profits and Gains of Business or Profession - As per working note 1 79,200 II Income from Other Sources - As per working note 2 1,000 Gross total Income 80,200 Less: Deductions under chapter VI-A i) u/s.80D – Medical insurance premia paid ii) u/s.80DDB–Medical expenses on dependent brother 10,000 15,000 25,000 55,200 NET TOTAL INCOME Prime/ME/Oct 07 Rs. 24 Working note 1 – Profits and Gains of Business or Profession Net profit as per profit and loss a/c Add: Inadmissible expenses 1. Traveling expenses – proportionate expenses for Days not connected with business 20,000 x 3/15 2. Interest on capital 3. Depreciation charged to P&L a/c 4. Income tax Rs. Rs. 51,200 4,000 5,000 25,000 50,000 84,000 1,35,200 Less: Admissible expenses & items considered under other heads: 8,500 45,000 2,500 1. Dividend from Indian companies 2. Depreciation as per IT Rules, 1962 3. Interest on borrowing from LIC Income from Business 79,200 Working note 2 – Income from Other Sources 1. Dividend from Indian companies Rs. 8,500 Less: Deduction u/s. 10(34) 8,500 2. Bank interest of minor son, clubbed by virtue of se. 64(1A) 2,500 Less: exempt u/s. 10(32) 1,500 Rs. NIL 1,000 1,000 Taxable Income from Other Sources Prime/ME/Oct 07 56,000 25 PRIME ACADEMY 25 TH SESSION MODEL EXAM PE-II Total No. of Questions : 7 Time Allowed : 3 Hours Total No. of Printed Pages: 2 Maximum Marks : 100 IY Question No.1 is compulsory; Answer any four from the rest 1(a) Convert the following from one system to another along with the working notes (i) (ii) (iii) (iv) (v) (9876) 10 (A2B4 ) 16 (7523) 8 = ( ) = ( ) = ( (592F) = ( = ( 16 (11011010.1101)2 8 8 ) 16 ) 10 )10 (5x1=5 Marks) 1(b) Describe briefly the following terms with reference to information technology (i) (ii) (iii) (iv) Accumulator File Allocation Table Packet Switching Routers (v) Bandwidth (5x1=5 Marks) 1(c) Give one or two uses for each of the following: (i) (ii) (iii) (iv) (v) Cache Memory in a processor Integrated Circuits are used for primary memory and not for secondary storage Disk formatting Boot strap loader Need of hub in a network (5x1=5 Marks) 1(d) Write True or False for each of the following: (i) (ii) (iii) (iv) (v) The Clock speed is the speed at which the processor executes instruction A dumb terminal has an inbuilt processing capability A Modem provides the connection between server and work station In Word Processing , header and footer can be selected from the view menu A graph created in Excel can be copied and linked to a Power point presentation slide (5x1=5 Marks) Prime/ME/Oct 07 26 2. Distinguish between the following: answer any four a. b. c. d. Transaction and Master File Dynamic RAM and Static Ram PROM and EPROM System Software and Application Software e. Local Area Network and Wide Area Network (4x5=20 Marks) 3. a. Explain the Concept of communication protocols b. Write briefly on Program Library management Systems c. Define an operating System and discuss various functions (5+5+10=20 Marks) 4. a) Communication software is an essential requirement of data communication System. Explain the various functions of this data communication software b) Write short note on Storage Area Network c) Draw a flow chart to accept three given numbers A,B,C and calculate their average and print the result (5+5+10=20 marks) 5(a). Define the following functions used in MS-EXCEL (i) FV (ii) IRR (iii) SUM (iv) COUNT(range) (v) DB 5(b). Explain briefly the various language tools available in MS-WORD 5(c). Explain the uses of using a power point package for making a presentation (5+10+5=20 Marks) 6. a) What is Generalised Audit Package(GAP).Describe the various facilities to be provided by the GAP b) What do you understand by audit around the computer and audit through the computer c) Write short notes on Digital Certificate d) Explain the applicability of the Information Technology Act 2000 (4x5=20 Marks) 7. Write Short notes on the following: Answer any four a. b. c. d. e. f. Computer Output Microfilm(COM) Distributed Databases Teleconferencing Webcasting or Push Technology Multiplexer Check Digit Prime/ME/Oct 07 (4x5=20 Marks) 27 PRIME ACADEMY SUGGESTED ANSWERS PE-II - INFORMATION TECHNOLOGY 1(a) (vi) 9876 1234 154 19 2 8 8 8 Thus, (9876) 10 (ii) (iii) = = = = = = (v) = ( 23224 )8 3 2 1 0 10x16 +2x16 +11x16 +4x16 40960+ 512+176+4=41652 Hence (A2B4) 16 = (41652)8 = = = (iv) Remainder 4 2 2 3 = = = = Prime/ME/Oct 07 111 101 010 011 1111 0101 0011 ( F53)16 3 2 1 0 5X16 +9X16 +2X16 +15X16 5X16+256+9X256+2X16+15 20480+2304+32+15 ( 22831)10 1X27+126+1X24+1X23+1X21+1X2-1+1X2-2+1X2-4 128+64+8+2+0.5+0.25+0.0625 218+0.8125=218.8125 ( 218.8125 )10 28 1 (b) (vi) Accumulator: It refers to a storage area in memory used to accumulate totals of units or of amounts being computed (vii) File Allocation Table: It is a log that records the location of each file and the status of each sector. When a file is written to a disk, the operating system checks the FAT for an open area, stores the file and then identifies the file and its location in the FAT. The FAT solves common filing problems with respect to updation of the files on the disk. (viii) Packet Switching : It is a sophisticated means of data transmission capacity of networks. In packet switching, all the data coming out of a machine is broken upto chunks. Each chunk has the address of the location it came from and also the address of the destination. This technique is used to move data around on the Internet. (ix)Routers : Routers are hardware devices used to direct messages across a network. They also help to administer the data flow by such means as redirecting data traffic to various peripheral devices or other computers by selecting appropriate routes in the event of possible network malfunctions or excessive use. (x) Bandwidth: Represents the difference between the highest and lowest frequencies that can be used to transmit data. In other words, it refers to a channel’s information carrying capacity. It is usually ,measured in bits per second(bps) 1 (c) (vi)Cache Memory in a processor : Processors incorporate their own internal memory called cache. The cache acts as temporary memory and boosts processing power significantly. The cache that comes with the processor is called level one or L1 cache. It runs at the processor’s clock speed, and therefore is very fast. (vii) Integrated Circuits are used for primary memory and not for secondary storage The integrated circuits also called silicon chips do lose their contents when the computer’s power is shut off. These chips provide volatile storage. Due to this reason, they are not used for secondary storage since secondary storage serves as a means of permanent storage device. Prime/ME/Oct 07 29 (viii) Disk formatting A new diskette is nothing more than simple coated disk encased in plastic. Before the computer can use it to store data, it must be magnetically mapped into tracks and sectors called formatting so that the computer can go directly to a specific point on the diskette without searching through data. (ix)Boot strap loader When a Computer is first turned on or restarted, a special type of absolute loader called a bootstrap loader is executed. This bootstrap loads the first program to be run by the computer- usually an operating system. Since no program can be executed without OS, hence bootstrap loader is the most essential system software without which the computer cannot be started. (x) Need of hub in a network A hub is hardware device that provides a common wiring point in a LAN. Each node is connected to the hub by means of simple twisted pair wires. The hub then provides a connection over a higher speed link to other LANs, the company’s WAN or the internet. 1 (d) (vi) True (vii) False (viii) False (ix) True (x) True 2 f. Transaction and Master File : Transaction files are temporary files and are created from source documents for recording events and/or transactions. Typical source documents from which transaction files are created mare purchase orders, job cards, invoices, etc. These are detail files and information stored in records of transactions files are normally used for updating Master files Master files on the other hand contains relatively permanent records for identification and summarizing statistical information. The information in the master file may include product code, product description, specifications etc. Prime/ME/Oct 07 30 Some of the examples of master file are student file, employees file, customer file, inventory file, etc. these files are used with the transaction files for the purpose of processing and updation of master records. If the processing is of batch type, transactions are accumulated for a specified period of time and transaction file is created. The same is sorted in accordance to the master file. Later on, the transaction file is used to update the master file. Once the master file is updated, transaction file may not be required. g. Dynamic RAM and Static Ram The memory system constructed with MOS elements that can be changed is called RAM. The purpose of RAM is to hold programs and data while they are in use. Dynamic RAM is the most common type of main memory. It is dynamic because each memory cell loses its charge so it must be refreshed hundreds of times each second to prevent data from being lost. The most popular DRAM used in desktop systems are Extended Data Out DRAM and Rambus DRAM. RDRAM sends data down at high band width channel. Static RAM on the other hand is a lot faster, larger and more expensive. It is static because it need not be continually refreshed . because of it s speed it is mainly used in cache memory. The static RAM retains the stored data as long as power remains on whereas in dynamic RAM the stored information is to be recharged before it disappears. The power consumption of dynamic RAM is less than static RAM. In DRAM, the computer does the refreshing process taking time out from other chores every millisecond. Dynamic RAM is the most common type of main memory whereas static RAM is faster larger and more expensive than DRAM. Static RAM is used mainly in a special area of memory called a cache. h. PROM and EPROM Prime/ME/Oct 07 31 Programmable Read only memory is one sort of Read Only Memory which can be programmed as per user requirements. It is a non-volatile and allows the user to program the memory chip with a PROM writer. The chip can be programmed only once thereafter the contents of the program stored on it cannot be altered. Erasable Programmable Read Only Memory, chip can be electrically programmed with EPROM programmer. Unlike ROM and PROM , EPROM chips can be erased and reprogrammed by the user number of times. Exposing the EPROM chip to ultra violet light erases contents of the EPROM. Due to this facility, EPROM are mostly used for R&D applications i. System Software and Application Software (a) System Software comprises of those programs , which directs the computer; Application Software is the software developed for solving business problems a. System Software varies from computer to computer; Application software varies from organization to organization b. System software is written in low level language; Application software are usually written in High level language c. Detailed knowledge of hardware is required; Application software requires detailed knowledge of organization d. System software is used to improve the performance and maximum utilization of system resources; Whereas application software programs are used to improve the speed and quality of a business activity e. System software is usually supplied by the manufacturers whereas application software is developed by individuals or supplied by software vendors as generalized application software j. Local Area Network and Wide Area Network In a LAN, multiple user computers are connected together which are spread over a small geographic region. The communication channels which are privately owned are relatively high capacity and error free. It enables multiple users to share software , data, devices and physical media. In a WAN , multiple users computers are connected together, which are spread over a wide geographic region. Communication channels such as long distance telephone service, satellite transmission are provided by third party. Prime/ME/Oct 07 32 Channels are relatively low capacity and error prone. WAN operates at lower link speed, usually 1 Mbps but does not allow sharing of resources 3 a. Communication protocols are sets of rules or conventions that must be adhered to by both communicating parties to ensure that the information being exchanged between them is received and interpreted correctly. A protocol defines the following three aspects of digital communication (i) Syntax – The format of data being exchanged, character set used , type of error correction used, type of encoding scheme being used. (ii) Semantics - Type and order of messages used to ensure reliable and error free information transfer. (iii) Timing Define data rate selection and correct timing for various events during data transfer Communication protocols are defined in layers, the first of which is the physical layer or the manner in which node in a network are connected to one another. Both the network software and network interface card have to adhere to a network protocol. The RS-232C connector is a standard for some protocols. Subsequent layers , the number of which vary between protocols, describe how messages are packaged for transmission, how messages are displayed. A number of different protocol codes are in use. The set of most common protocols used on the internet is called TCP/IP b. Program Library Management System (PLMS) is the database of application and system software used by the organization. It May include a. Application and system software program code b. Job Control statements that identify the following which manage processingResources used; Processes to be performed; and Processing parameters PLMS provide several functional capabilities to facilitate effective and efficient management of the data centre software inventory PLMS Capabilities: Prime/ME/Oct 07 33 Integrity: Each source program is assigned a modification number and version number. Security over libraries is provided through passwords, encryption data compression and back-up creation Update: It facilitates the addition, deletions, resequencing, editing and updating of library members. For example, by creating an automated backup copy prior to changes being made and maintaining an audit trail of all library activities Reporting: List of additions, deletions, modifications, library member attributes can be prepared for management and auditor review Interface: library software packages may interface with the operating system, job scheduling systems, access control systems and online program management c. An operating system is defined as an integrated system of programs which(i) supervises the operation of CPU; (ii) Controls of the input/output functions of the computer system; (iii) Translates programming languages into machine lanaguages (iv) And provides various support services Operation system is a master control program of a computer that manages its internal function, provides means to control the computer’s operations and file system Programs are held in the computer memory, freeing thereby the operator from inputting a program for each application. The codes of the operating system of a computer are stored externally in a series of program files on the computer’s hard disk or external memory The operating systems are based on the concept of modularity The operating systems are usually the creation of computer manufacturers, who design the OS to suit the capabilities of that particular system. Functions of an operating system include (a) Scheduling jobs (b) Managing hardware and software resources c. Maintaining System security d. Enabling multiple user resource sharing e. Handling interrupts and f. Maintaining usage records 4 a) Communication software manages the flow of data across a network. They are written to work with a wide variety of protocols which are rules and procedures of exchanging data. Following functions are performed by the communication software Access Control: i. Linking and disconnecting different devices ii. Automatic dialing and answering telephones iii. Restricting access to authorized users Prime/ME/Oct 07 34 iv. Establishing parameters like speed mode and direction of transmission Network Mangement: v. vi. vii. viii. ix. Polling devices to see whether they are ready to send or receive data queuing input and output determining system priorities Routing messages Logging network activity use and errors Data and File transmission: Controlling the transfer of data, files and messages among the various devices Error Detection and control: Ensuring that the data sent is indeed the data received Data Security: Protecting data during transmission from unauthorized access b) Storage Area Network (SAN) is a dedicated centrally managed secure information infrastructure which enables any-to-any interconnections of servers and storage system. Features (i) Facilitates universal access and sharing of resource (ii) Supports unpredictable, explosive information technology growth (iii) Provides Continuous service (iv) Improves information protection and disaster tolerance (v) Enhances security and data integrity of new computing architecture The need for SAN is more because E-business, Globalization , Zero latency and the need to transform –the ability to continually adapt , while immediately accessing and processing information to drive successful business decisions Benefits of SAN include x. increase in overall efficiency xi. improved system administration xii. improved availability of resources at lowest cost and xiii. increased business flexibility c) START INPUT A, B,C Prime/ME/Oct 07 35 S=A+B+C AVG=S/3 PRINT AVG STOP STOP 5 a) (vi) FV: It is a financial function, which calculates the future value for a series of equal investments also called annuity earning a fixed periodic rate of interest (vii) IRR:This function gives the internal rate of return for a series of cash flows (viii) SUM: It is a mathematical function which calculates the sum of values in a list (ix) COUNT(range):It is a statistical function which counts the number of arrangement values in the specified list. Empty cells are ignored or not counted Prime/ME/Oct 07 36 (x) DB :It returns the depreciation of an asset for a specified period using the fixed declining balance method b) MS-WORD Offers several useful tools to aid writing and increase efficiency. Following language tools are most common: (i) Auto correct (ii) Auto text (iii) Spelling and grammar (iv) Thesaurus (v) Find and replace text c) 6 a) 1. Effective communication : Using a power point to make a presentation enhances the effectiveness of the communication between the speaker and the listeners. 2. Effective Presentation: Various audio and visual tools like graphics, charts , animation , movies etc present in power point makes the presentation more effective. 3.Used at all places: Power point can also be used for corporate communications, boardroom discussions , professional seminars and symposiums other business meets etc 4.Easy to create: The package is simple to handle and the presentation easier to create in power point. Generalised Audit Package(GAP) are standard packages developed by software companies specifically for the purpose of auditors for auditing data stored on computer. These are standard packages available off the shelf , which can be used by auditor for audit through the computer. GAP should have the following facilities: Should be able to able to run over a wide platform of hardware , operating systems and database environment Wide access to various types of databases Extract and analyse data s per set of parameters as defined by the auditor Should be able to footings and cross footing of any specified data field Able to do random selection and classification of data as required Should be able t pick up exceptional data based on a pre-defined criteria Should be able to compare current version of a file with the previous year’s version Should be able to print various reports as required by the auditor Prime/ME/Oct 07 37 Typical operations which can be performed using GAPs include sampling , extraction, totaling of items meeting selection criteria, aging of data, calculations, file comparisons and production of circularization letters b) Auditing around the Auditing through the computer Computer(black box approach) (White box approach) Computers are treated as mechanical Computers are used as live and book keeping aids under this dynamic devices which add value to approach the process of auditing. They are the target of auditing The focus of audit is to take The focus of audit is to peruse the voluminous reports and outputs, and accounting system and software compare input vouchers with system used- to ensure that they provide outputs to obtain audit assurance audit assurance on the various aspects of control Computers are only considered as Computers are used to check systems which provide legible calculations, to compare the contents printouts of the accounting of two files to examine files for transactions. Auditors traced missing amounts and to analyse transactions to black box and picked accounting data by funding ratios, etc up the trail on the other side by examining printouts No regard is paid to the CAATs and audit software tools are transformation of data that takes used to analyse transformation of place inside the computer data c) Digital certificate means a digital signature certificate u/s35(4) issued by a certifying authority. The controller shall be the repository of all digital signature certificates issued under this Act. The Controller shall make use of hardware, software and procedures that are secure from the intrusion and misuse Observe such other standards to ensure assurance of secrecy and security of the digital signatures The controller shall maintain a computerized database of all public keys in such a manner that such data base and the public keys are available to any member of the public Prime/ME/Oct 07 38 d) The Information Technology Act 2000 shall extend to the whole of India unless otherwise provided in this Act, it applies also to any offence or contravention there under committed outside India by any person It came into force on 17th October 2000. Different dates may be appointed for different provisions of this Act. The provisions of this ACT shall have effect notwithstanding anything inconsistent therewith contained in any other law for the time being. The Act shall not apply to the followingA Negotiable instrument as defined in section 13 of the Negotiable Instrument s Act 1881 A Power of attorney as defined in section 1a of the Powers of Attorney Act 1882 A Trust as defined in section 3 of the Indian Trusts Act 1882 A will as defined in section 2(h) of the Indian Succession Act 1925 including any other testamentary disposition by whatever name called Any contract for the sale or conveyance of immovable property or any interest in such property Other documents or transactions as notified by the Central Government in the official Gazette 7 a. Computer Output Microfilm(COM): Computer Output Microfilm is an output technique that records output froma computer as microscopic images on roll or sheet film. The images stored on COM are the same images, which would be printed on paper. It reduces characters 24,42, 0r 48 times smaller than the normal size. The data to be recorded is displaced on CRT and a camera takes a picture of it and places it on the film. The film is then processed either in the recorder unit or separately. After it is processed, it can be retrieved and viewed by the user. It has the following advantages: Data can be recorded at a speed of 30,000 lines /minute Cost of recording is very less compared to printed output Huge size data can be recorded Recording space requirement is less It provides easy access to data, using indexing techniques b. Distributed Databases: Under the distributed data processing system, the processing is distributed hence the data to be processed must be located at the processing site, This means that the data base or parts of the database must be distributed, There are basically two ways to distribute a data base . The first is to provide duplicates of all data at all sites, This approach is called a replicated database. If it is necessary for every location to have frequent access to the same data, replication of the database may be recommended. However replication of a database is very expensive in terms of computer system resources and it difficult Prime/ME/Oct 07 39 to maintain consistency for each data element. Even then, replication provides some measure of security by providing duplicates of database in case of failure at one location. The approach is partitioning of data wherein partitioning is achieved either along geographical lines of segmenting data based on locations Distributed databases usually reduce the costs for an organization ; they also provide faster response time but suffer from problems of security , data redundancy , loss of control resulting in danger to data integrity. c. Teleconferencing: Refers to electronic meeting that involves people who are physically at different sites. Telecommunication technology allow members of the meeting to interact with one another without traveling to the same location. Three types of teleconferencing namely audio, video teleconferencing and computer teleconferencing exist. Audio teleconferencing is the use of voice communication equipments to establish audio link between geographically dispersed persons and to conduct a conference. This does not require a computer but requires two way communication facilities. Video conferencing is the use of television equipments to link geographically dispersed participants. Both audio and video is available .it allows for two way communication. Lastly computer conferencing is the use of networked computers that allow participants with some common characteristics to exchange information concerning a particular topic. It can be used within a single geographic site d. Webcasting or Push Technology: It allows users to passively receive broadcasted information rather than actively search the web for information. Push technology allows users to choose from a menu of sources, specifying what kind of information they want to receive. Once selected , the information is automatically forwarded to the user. Internet news services, which deliver the day’s activities the user’s desktop are examples of push technology. Users can also download software, select the frequency with which they will receive services and subscribe to a variety of information source. There is very little cost to the user for push services because information is delivered with advertising and users view their custom-tailored news offline. Push technology is having a major impact on the internet probably the biggest impact since the emergence of the web Prime/ME/Oct 07 40 e. Multiplexer: It is a device that combines a large number of low speed transmission lines into high speed line It permits a single transmission link to perform as if it were several separate links Multiplexing is a form of data transmission in which one communication channel carries several transmissions at the same time f. Check DigitaIs: A digit associated with a word or part of word for the purpose of checking the existence of the certain class of errors. It is a software control used by a programmer to ensure the accuracy of the data fed in the computer The Check digit the becomes a part of the code and the same arithmetic procedure is used to check the correctness of the code in all subsequent processing operations Prime/ME/Oct 07 41