pathfinder - Institute of Chartered Accountants of Nigeria

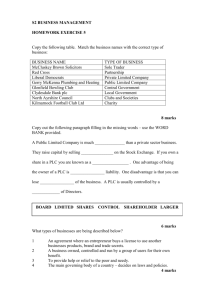

advertisement