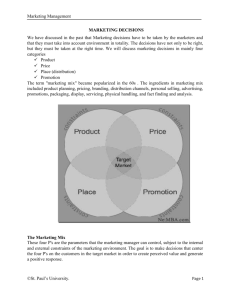

Identifying the essential factors in the marketing mix design (The

advertisement