Case Study

Major European Central Bank

Consolidates Risk, Reserves

and Treasury Management

with Calypso

Central Bank

The Firm:

Central Bank in Europe with over $140B in reserves.

Background:

The central bank had concerns about the stability of their

incumbent treasury system, which started to show signs of

aging and lacked the innovation to keep up with the times.

The bank’s reliance on manual processes slowed its ability to

expand into new markets.

Increases in foreign reserves in recent years highlighted an

opportunity cost in the bank’s investment management

practices. The bank saw the potential to expand into higher

yielding instruments that complied with their investment

mandate, but was limited by their existing system’s inability to

price, trade capture and risk manage beyond vanilla treasury

products.

Poor integration between trading and operations led to

inefficient manual processes throughout the trade lifecycle.

Spreadsheets were created from the trading system, manually

adjusted, and then imported back into the legacy system,

making for a slow and unwieldy process. The bank needed a

major overhaul of its entire treasury and portfolio systems in

order to properly address these challenges.

BENEFITS SUMMARY

•

•

•

•

•

Operational efficiency and control

Comprehensive reserve management

Complete financial instrument coverage

Robust, scalable, future-ready platform

Dedicated Professional Services team

Call to Action:

With the legacy system nearing the end of its serviceable life, the

bank set out to find a replacement which would resolve these

immediate issues:

Consolidate disparate trading, risk and reserve management

- This would enable a stable platform for real-time position

management and improve reaction to market shifts.

Modernize risk management capabilities - The bank was

seeking to improve and integrate pre-trade and post-trade

analytics for improved decision support.

Automate Workflows - Proliferation of spreadsheets and

manual systems had resulted in frequent breaks in operations.

The bank wanted to implement automated workflows that

ensured all transactions were processed in strict accordance

with their control policies.

Expand product coverage - Price, capture and process FX, fixed

income, repo, derivatives, and gold.

Minimize customization - The bank wanted a system that

could accommodate their needs using configurable off-the-shelf

functionality rather than extensive custom development.

www.calypso.com

Major European Central Bank Consolidates Risk, Reserves and Treasury Management with Calypso

Improved Market Operations - We provide full front-to-back

processing for all asset classes including:

• FX and money markets

• Fixed income

• Repo, reverse repo, sec lending

• Gold, including co-location deposits, operations and

inventory management

• Equities

• Derivatives

Real-Time Risk Management - Real-time risk management

capabilities allow different groups within the bank to see

critical information as soon as it is updated. Our out-of-the-box

analytics integrate with third party risk systems, providing the

bank with the coverage they needed.

Why Calypso

After reviewing several trading and treasury systems, the bank

selected Calypso because of its comprehensive functionality and

configurable architecture. Our solution addressed each of their

critical pain points with minimal customization, meaning it would

be easier to deploy initially and would remain more flexible over

time.

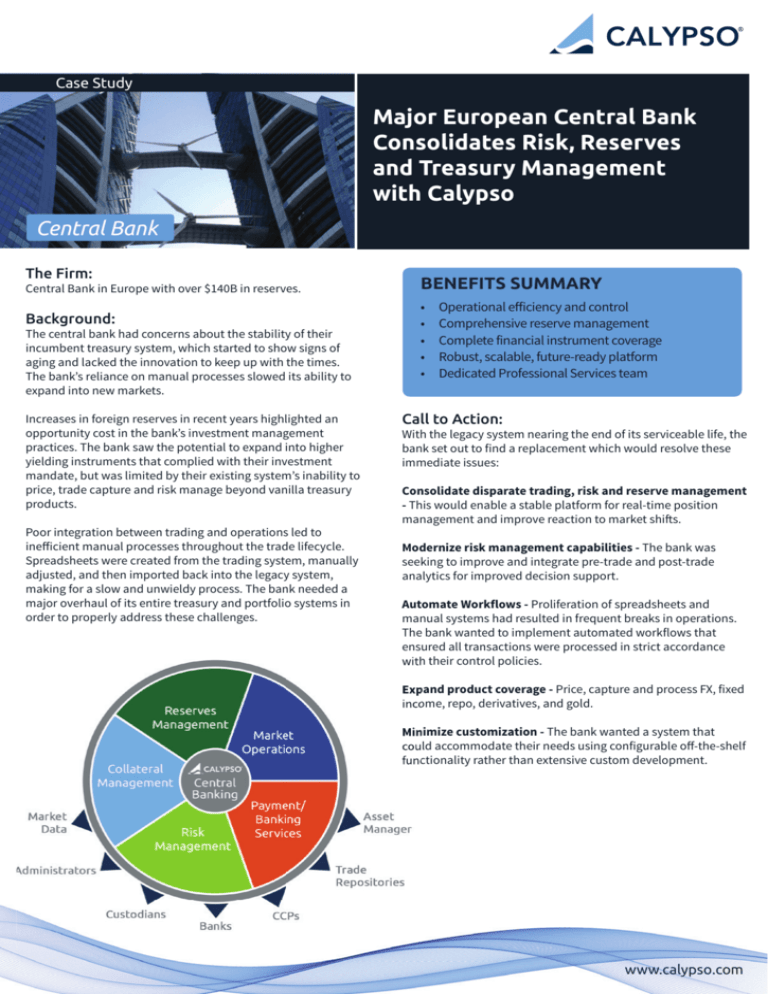

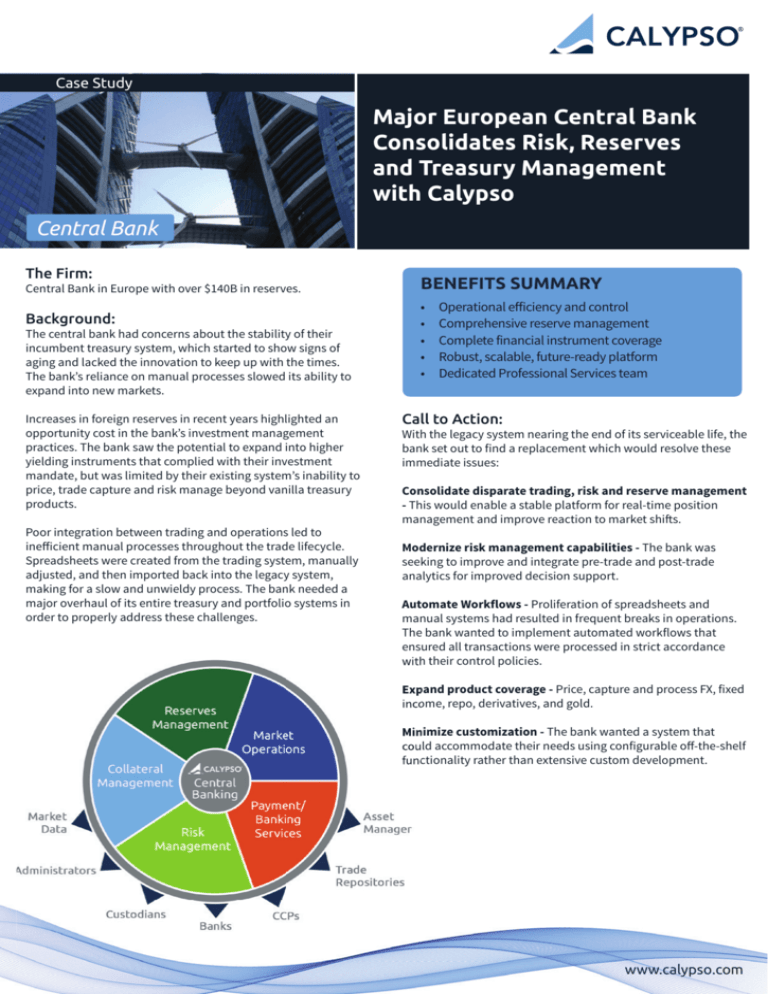

Calypso Solution

Calypso’s modern central banking solution enables the bank to

conduct monetary activities, manage reserves and control risks on

a single automated platform. The solution is configured to meet the

bank’s operational needs across a full range of functions including

trading, reserves management, risk management, and collateral

management.

Our solution yields a range of benefits, some addressing immediate

challenges and others providing long term value to the bank:

Automation and Control - The solution provides the bank with

improved operational efficiency and increased control. Using our

flexible workflow, we automate a wide range of bank-specific tasks,

including confirmations, payments, settlements, SWIFT messaging

and more.

Collateral Management - Our solution allows fully automated

collateral management across cleared, non-cleared, repo and

securities borrowing/lending activities. A central collateral pool

of cash, securities and precious metals supports all position

monitoring, exposure calculations, dispute management,

agreement management, advanced analytics, collateral

allocation and optimization.

Accounting - Calypso’s flexible accounting framework adapts

to local accounting rules and existing accounting systems,

incorporating regional standards such as ESCB accounting

guidelines in Europe.

Dedicated Professional Services - The Calypso Professional

Services project plan includes a dedicated, on-site team of

consultants and project managers from inception to go-live.

Our expertise combined with our understanding of the Bank’s

unique business requirements ensured a successful outcome.

Results

Once the implementation is complete, the bank will have

greater control, auditability, and automation of their

management of reserves – all on one platform.

Replacement of the legacy system will improve operational

efficiency while providing a foundation for more sophisticated

trading, portfolio management, and risk.

One-Touch Reserve Management - Our Portfolio Workstation

provides the bank with real-time reserve management that

supports both internal and third-party portfolios, delivering

superior visibility on a single, multi-asset platform. The Workstation

also allows them to conduct pre and post trade compliance

checks, performance measurement, benchmarking, and limits

management.

www.calypso.com

© 2016 Calypso Technology, Inc. All rights reserved. Calypso is a registered trademark of Calypso Technology, Inc., in the United States, European Union and other jurisdictions. All products and services referenced herein are either trademarks or registered trademarks of their respective companies