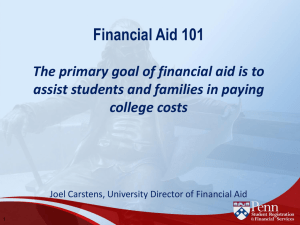

Just the facts - Student Financial Services

advertisement

Just the facts You can afford Penn. financial aid Information 2011-2012 A Few Simple Ideas Benjamin Franklin founded Penn on the idea that all the best minds should have access to the finest education, regardless of their families’ ability to pay. To achieve this, Penn: • Practices need-blind admissions, • Meets 100 percent of demonstrated financial need for four years, and • Provides a no-loan aid package for undergraduates who receive financial aid. Penn stands out as one of a very small number of universities that do not include loans as part of their aid packages. Penn makes it possible to graduate debt-free. Because each family’s situation is unique, it is difficult to know for sure how much financial aid you might be eligible to receive until you actually apply for aid. That being said, here’s what aided freshmen entering in September 2011 are receiving: Aided Freshmen by Family Income: Class of 2015 (entering September 2011) Family Income Number of Aided Students Median Annual Awards Percent of Applicants Offered Aid $0–39,999 165 $57,310 100% $40,000–69,999 182 $51,870 97% $70,000–99,999 176 $46,680 98% $100,000–129,999 168 $37,690 90% $130,000–159,999 145 $30,490 91% $160,000–189,999 80 $28,630 44% $190,000 and up 83 $18,010 29% Many factors other than income are considered. Therefore, individual awards vary based on individual circumstances. Additionally, families with non-typical financial situations (such as business owners, owners of real estate other than their primary home, and divorced parents) are more likely to receive non-typical awards. Penn founder Benjamin Franklin was 17 when he arrived in Philadelphia—penniless but with the intellect and aspiration to improve his life and the community. Now, 288 years later, the University he founded remains dedicated to helping the most promising 17-year-olds make their contribution to the global community. Things You Should Know about Financial Aid at Penn: We Meet Full Demonstrated Need Penn meets 100 percent of the demonstrated need of each family throughout their student’s undergraduate years. This year, Penn is devoting more than $149 million to undergraduate aid. This financial aid budget is entirely dedicated to need-based aid to ensure that all students—regardless of their financial background—are able to attend Penn if admitted. Penn and the other institutions that compose the Ivy League do not award any merit-based or athletic scholarships. Financial Aid Glossary Aid package: The amount of financial assistance you receive. A Penn package includes grants and a work-study job. Educational expense budget (“sticker price”): Also known as the Cost of Attendance, Penn’s is $57,360 for 2011-2012. Expected family contribution (“net price”): The actual amount a family is expected to pay, including contributions from parents and student. Grant: Grants do not require repayment and are available from Penn and both federal and some state governments. Need-based: Financial aid is based on a family’s demonstrated need. Penn meets 100 percent of each family’s demonstrated need for all four years through its no-loan packages. Need-blind: Admissions decisions are not affected by your ability to pay or by your application for financial aid. Net price calculator: An online tool to estimate your annual expected family contribution. Estimates will vary by institution. Payment plan: The Penn Monthly Budget Plan allows you to budget fall and spring semester expenses over a 10-month period. Work-study job: As part of a financial aid package, on-campus work-study jobs allow students to apply their earnings to college expenses. How Aid Is Determined Financial aid is awarded on the basis of financial need, which is the difference between Penn’s educational expense budget (the sticker price) and the amount your family is expected to pay (your expected family contribution). Educational Expense Budget – Expected Family Contribution Financial Need Penn’s Office of Student Financial Services determines the family contribution by individually reviewing each family’s financial aid application and parent and student tax returns. The following items are also considered: •family size •student income and assets •parents’ income and assets (including home equity but not retirement accounts) •the number of children enrolled in college •extenuating family circumstances (such as illness or loss of employment) Penn reviews all aid applications individually, in many cases calculating a lower family contribution than the one determined by federal methodology. Generally, financial information from both parents is used to determine financial need, even if they are divorced or separated. Once the family’s financial contribution has been determined, Penn awards an aid package, a pledge of financial support from Penn that typically includes grants and a work-study job. Unlike most other universities, there are no loans in a Penn aid package. International Students The University provides over $8 million each year in financial assistance to students who are not citizens or permanent residents of the United States, Canada, or Mexico. However, because the offer of admission for non-citizens is directly linked to their ability to meet expenses, candidates whose families have the financial means to afford educational costs are encouraged not to apply for financial aid. Looking Beyond the Sticker Price Because Penn dedicates more resources to aid than most schools, the net price of attending Penn could be no more than what your family would pay to send you to a public university. Note that in the example to the right, the net price to the family is the same at both schools (and is actually lower at Penn when including the other school’s student loan). The Sticker Price: Penn’s 2011-2012 Educational Expense Budget Tuition and fees Housing The Net Price Comparison: Penn vs. Public University This is one example, based on a particular family’s financial situation. Family contributions can range from $0 to more than $50,000, depending on each family’s specific circumstances. Financial aid package: $47,860 Grant: $44,660 Financial aid package: $14,500 $42,098 Grant: $5,800 $7,592 Work study: $3,200 Meals $4,286 Books $1,160 Personal expenses Total $38,584 Average financial aid package for incoming awarded freshmen in 2011. $2,224 $57,360 Student loan: $5,500 Work study: $3,200 Expected family contribution: $9,500 Penn sticker price: $57,360 = Expected family contribution: $9,500 Public U sticker price: $24,000 Four Years of Support Penn commits to meeting your full demonstrated need throughout your undergraduate years. If your family’s circumstances remain stable, financial aid remains relatively constant; if circumstances change during the year (such as a parent losing a job), your financial aid package will be adjusted. The Value of a Penn Education We understand that the cost of an undergraduate education is expensive and a major commitment for you and your family. Given the changing economic landscape, families expect that their student will receive an education that prepares them for tomorrow’s job market. You will need an education that is practical, powerful, and flexible—one that will allow you to adapt and to thrive in any situation. You’ll need an education like the one you’ll receive at Penn. Some Facts to Keep in Mind •92 percent of students graduate from Penn in four years. •14,000+ interviews are conducted annually on campus in Career Services. •75 percent of Penn graduates earn an advanced degree within 10 years. •The average salary for College of Arts and Sciences graduates five years after graduating is $79,743 (Class of 2004). •Penn ranks seventh on Kiplinger’s Best Values in Private Universities. •83 percent of students in the class of 2010 interned during their undergraduate career. What You Might Expect Examples of Aided Students Here are a few case studies of Penn aid packages received by families of varying financial situations. While these examples help provide a sense of what your family might expect, Penn cannot guarantee that every student whose family feels they resemble one of these case studies will receive a similar aid package and pay a similar net price. Nicole Nicole’s father is deceased, and her mother earns a modest income to help support a family of four. Her mother’s total annual income, including social security benefits for the younger children, amounts to $35,000. The total family contribution is $50. Eric Eric lives with his parents and younger sister. His parents’ combined income is $155,000; they own a home with $210,000 in equity and have savings of $25,000. Penn expects Eric’s parents to contribute $29,900 and Eric to contribute $2,400 from his summer earnings. The total family contribution is $32,300. Eric’s sister is uncertain about her college plans for next year. If she attends a school with costs similar to Penn’s, and if the family’s financial situation remains similar, Penn will expect Eric’s parents to contribute $19,250 and Eric, $2,400. The total family contribution would be $21,650. With One Child in College Penn’s sticker price $57,360 $57,360 Eric’s family contribution $32,300 Nicole’s family contribution $50 Eric’s financial aid award $25,060 Nicole’s financial aid award $57,310 Penn’s sticker price Morgan Morgan lives with her parents and younger brother. Her parents’ total income is $88,000. The family has $135,000 in home equity and $12,000 in savings. Penn calculated that Morgan’s parents could contribute $10,800 to her education for the current year. Morgan is expected to contribute $2,400 from her summer earnings. The total family contribution is $13,200. Penn’s sticker price $57,360 Morgan’s family contribution $13,200 Morgan’s financial aid award $44,160 Net Price Calculator Beginning in October 2011, Penn will provide a net price calculator at www.sfs.upenn.edu. Penn reviews all aid applications on an individual basis rather than using a calculator, so the estimate provided by the net price calculator may differ from your actual award. The best way to know how much aid you will receive is to apply. With Two Children in College Penn’s sticker price $57,360 Eric’s family contribution $21,650 Eric’s financial aid award $35,710 Eric’s Family’s Options: Educational Loans and Payment Plans Even though Penn’s aid packages do not include loans, parents and students may still choose to borrow from programs such as the federal Direct Loan Program to help manage their expected family contribution. These programs can help spread costs over a longer time period. Some students choose to take out loans to help build their credit ratings. See “Loans” at www.sfs.upenn.edu for details. The Penn Monthly Budget Plan allows you to budget fall and spring semester expenses over a 10-month period. You decide how much to budget each year. Payments begin in May and end in February. HOW TO APPLY The chart below lists the forms and applications you need when applying for Penn financial aid, as well as submission deadlines. Deadlines Forms and Applications Early Decision Regular Decision Transfers Penn Financial Aid Supplement (PFAS) 11/1/2011 2/1/2012 4/15/2012 CSS/PROFILE 11/1/2011 2/1/2012 4/15/2012 Noncustodial PROFILE 11/1/2011 2/1/2012 4/15/2012 Parents’ and student’s 2010 federal tax returns—all pages, schedules, and W-2s, and/or a Tax ID Form 11/1/2011 2/1/2012* N/A Parents’ and student’s 2011 federal tax returns—all pages, schedules, and W-2s, and/or a Tax ID Form 3/1/2012 3/1/2012 4/15/2012 FAFSA 4/15/2012 4/15/2012 4/15/2012 * Note to Regular Decision Applicants: if your and your parents’ 2011 tax returns will be available by March 1, you do not need to submit your 2010 tax returns. TO LEARN MORE Go to www.sfs.upenn.edu for more information, including application instructions, forms, and deadlines. Click on the “Prospective Undergraduates” button. Or, type your question directly into askBen at the top of the page. Starting in October 2011, look for Penn’s new Net Price Calculator on the Student Financial Services website. contact us Student Financial Services University of Pennsylvania 100 Franklin Building 3451 Walnut Street Philadelphia, PA 19104-6270 Office of Admissions 1 College Hall, Room 1 Philadelphia, PA 19104-6376 Phone: (215) 898-1988 Fax: (215) 573-5428 Email: sfsmail@sfs.upenn.edu Website: www.sfs.upenn.edu Phone: (215) 898-7507 Email: info@admissions.upenn.edu Website: www.admissions.upenn.edu Cover Photo: Tradition and celebration mark Hey Day at the end of each spring semester. Members of the junior class wear “straw” skimmers and carry canes as they march together down Locust Walk to College Hall, where Penn’s president officially declares them seniors. The University of Pennsylvania values diversity and seeks talented students, faculty and staff from diverse backgrounds. The University of Pennsylvania does not discriminate on the basis of race, color, sex, sexual orientation, gender identity, religion, creed, national or ethnic origin, citizenship status, age, disability, veteran status or any other legally protected class status in the administration of its admissions, financial aid, educational or athletic programs, or other University-administered programs or in its employment practices. Questions or complaints regarding this policy should be directed to the Executive Director of the Office of Affirmative Action and Equal Opportunity Programs, Sansom Place East, 3600 Chestnut Street, Suite 228, Philadelphia, PA 19104-6106; or (215) 898-.6993 (Voice) or (215) 898-7803 (TDD). The Jeanne Clery Disclosure of Campus Security Policy and Campus Crime Statistics Act is a federal law that requires all colleges and universities to provide information on their security policies and procedures and specific statistics for criminal incidents and arrests on campus to students and employees and to make the information and statistics available to prospective students and employees upon request. The Uniform Crime Reporting Act requires all Pennsylvania colleges and universities to provide information on their security policies and procedures to students, employees, and applicants; to provide certain crime statistics to students and employees; and to make those statistics available to applicants and prospective employees upon request. Federal law, the Higher Education Opportunity Act, also requires institutions that offer oncampus housing to provide certain fire statistics and other information about fire safety. This information is available from the Division of Public Safety at 215.898.7297, or at http://www.publicsafety.upenn.edu/clery_report.asp. NCSDO U37040 7/11 Cover Photo Credit: Dave Toccafondi