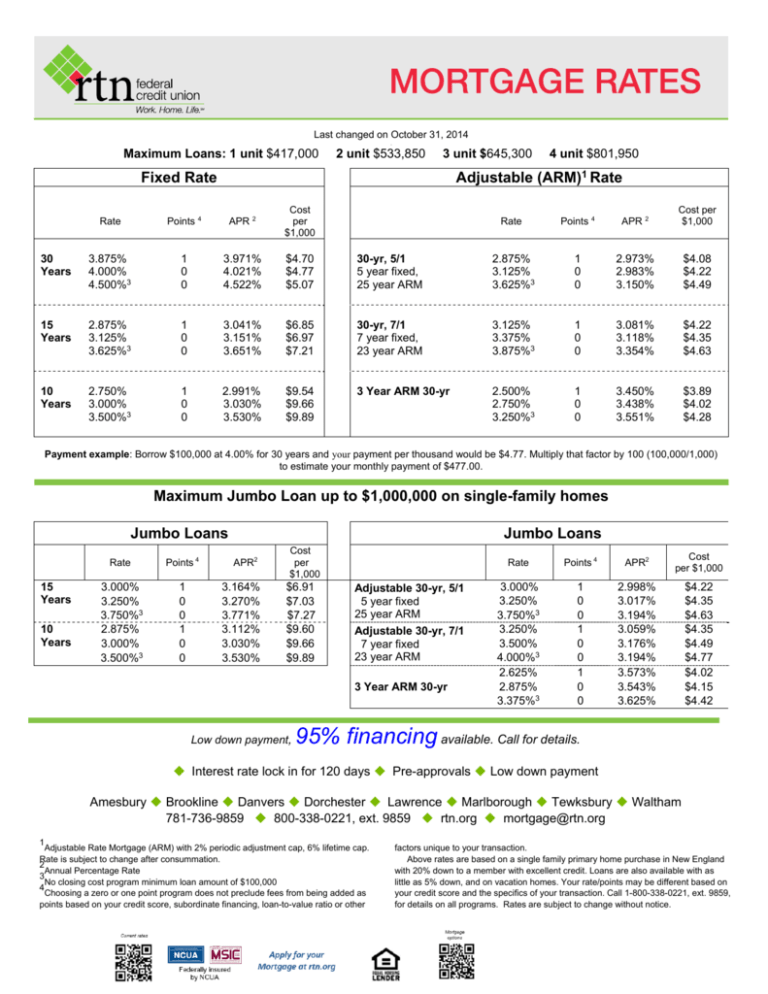

Fixed Rate Adjustable (ARM)1 Rate Maximum Jumbo Loan up to

advertisement

Last changed on October 31, 2014 . Maximum Loans: 1 unit $417,000 2 unit $533,850 3 unit $645,300 4 unit $801,950 x. Adjustable (ARM)1 Rate Fixed Rate Rate Points 4 APR 2 Cost per $1,000 Rate Points 4 APR 2 Cost per $1,000 30 Years 3.875% 4.000% 4.500%3 1 0 0 3.971% 4.021% 4.522% $4.70 $4.77 $5.07 30-yr, 5/1 5 year fixed, 25 year ARM 2.875% 3.125% 3.625%3 1 0 0 2.973% 2.983% 3.150% $4.08 $4.22 $4.49 15 Years 2.875% 3.125% 3.625%3 1 0 0 3.041% 3.151% 3.651% $6.85 $6.97 $7.21 30-yr, 7/1 7 year fixed, 23 year ARM 3.125% 3.375% 3.875%3 1 0 0 3.081% 3.118% 3.354% $4.22 $4.35 $4.63 10 Years 2.750% 3.000% 3.500%3 1 0 0 2.991% 3.030% 3.530% $9.54 $9.66 $9.89 3 Year ARM 30-yr 2.500% 2.750% 3.250%3 1 0 0 3.450% 3.438% 3.551% $3.89 $4.02 $4.28 Payment example: Borrow $100,000 at 4.00% for 30 years and your payment per thousand would be $4.77. Multiply that factor by 100 (100,000/1,000) to estimate your monthly payment of $477.00. Maximum Jumbo Loan up to $1,000,000 on single-family homes Jumbo Loans 15 Years 10 Years Rate Points 4 3.000% 3.250% 3.750%3 2.875% 3.000% 3.500%3 1 0 0 1 0 0 Jumbo Loans APR2 3.164% 3.270% 3.771% 3.112% 3.030% 3.530% Cost per $1,000 $6.91 $7.03 $7.27 $9.60 $9.66 $9.89 Adjustable 30-yr, 5/1 5 year fixed 25 year ARM Adjustable 30-yr, 7/1 7 year fixed 23 year ARM 3 Year ARM 30-yr Low down payment, Rate Points 4 APR2 Cost per $1,000 3.000% 3.250% 3.750%3 3.250% 3.500% 4.000%3 2.625% 2.875% 3.375%3 1 0 0 1 0 0 1 0 0 2.998% 3.017% 3.194% 3.059% 3.176% 3.194% 3.573% 3.543% 3.625% $4.22 $4.35 $4.63 $4.35 $4.49 $4.77 $4.02 $4.15 $4.42 95% financing available. Call for details. . ◆ Interest rate lock in for 120 days ◆ Pre-approvals ◆ Low down payment Amesbury ◆ Brookline ◆ Danvers ◆ Dorchester ◆ Lawrence ◆ Marlborough ◆ Tewksbury ◆ Waltham 781-736-9859 ◆ 800-338-0221, ext. 9859 ◆ rtn.org ◆ mortgage@rtn.org 1 Adjustable Rate Mortgage (ARM) with 2% periodic adjustment cap, 6% lifetime cap. Rate is subject to change after consummation. 2 Annual Percentage Rate 3 No closing cost program minimum loan amount of $100,000 4 Choosing a zero or one point program does not preclude fees from being added as points based on your credit score, subordinate financing, loan-to-value ratio or other factors unique to your transaction. Above rates are based on a single family primary home purchase in New England with 20% down to a member with excellent credit. Loans are also available with as little as 5% down, and on vacation homes. Your rate/points may be different based on your credit score and the specifics of your transaction. Call 1-800-338-0221, ext. 9859, for details on all programs. Rates are subject to change without notice.