- AviAlliance

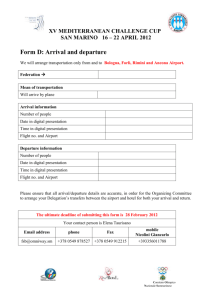

advertisement