Employment Law Principles Applicable to Claims by Low

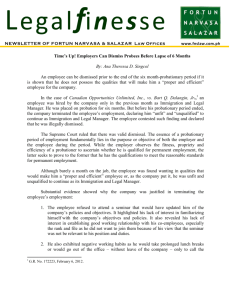

advertisement