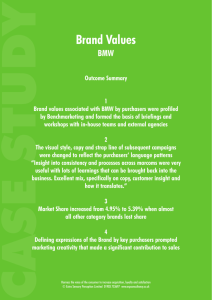

BMW BRAND AUDIT

advertisement

BMW BRAND AUDIT Prepared by: Tim Boylan Brand Management – Rutgers Business School Brand Relevance: BMW’s brand consists of four distinct and separate brands and different product categories within each individual brand. BMW’s four core brands are as follows. BMW Cars and SUV’s Mini Cooper BMW Motorcycles Rolls Royce Each brand and product category targets a specific group of consumers, all with different needs and wants. BMW has been known as a premium brand with consumers since its inception in 1917. BMW boasts over 15 million Facebook “Likes” and its YouTube presence is equally impressive. BMW branded YouTube channels are as diverse as BMW’s product line. Currently there are over 350,000 active YouTube subscribers with BMW YouTube videos averaging over 100,000 views daily and over 68 million total views. BMW “took the gold” in 2012 by becoming the official sponsor of Team USA for the London Summer Olympics and Paralympics. The company provided over 4,000 low emission vehicles to athletes, Olympic officials and organizing committee members during both events. BMW’s aggressive marketing campaign for the Olympics began in 2011 with public relations and media efforts focused on helping Olympic athletes with video analysis to optimize their training with BMW’s proprietary technology, “nigh vision.” BMW continues to innovate in the automotive market with its “Future Retail” program, which focuses on improving the BMW experience when its customers come in contact with the brand. BMW also developed its new product, the “I Series.” This will move BMW into the electric vehicle market, which looks to compete with the likes of other premium automotive brands that have introduced electric or hybrid type vehicles. With BMW generally taking a conservative approach to updating its vehicle lineup the introduction of an electric car will surely resonate with eco-friendly consumers. Product enhancements come in the form of subtle vehicle re-designs that are not physical in nature, but are performance related under the hood. These performance enhancements make BMW what it is known for and why consumers choose BMW over other competitive brands. During 2012 BMW sold over 1.8 million vehicles across BMW cars, Rolls Royce and Mini Cooper brands, which represented a 10.6% year over year increase, the highest in the company’s history. Consumer trends in the automobile market place indicate size no longer matters: luxury automakers like Mercedes Benz are trying to fit more and more luxury and performance components into smaller vehicles. Value based brands like Hyundai and Kia have stepped into the “low end” luxury car market looking to nibble away at BMW’s market share for vehicles like their 3 and 5 series. Lastly, technologies such as vehicles that drive themselves are becoming more and more part of the mainstream. Cars that are equipped with radar, sonar, laser / light based technology and cameras. BMW has recognized these trends as well as other trends and has begun to incorporate them into current and future product lines to address consumer needs. Their biggest up-and-coming competitor is Tesla who has a new an innovative market penetration strategy compared to other automotive manufacturers Overall BMW continues to be a relevant brand in the minds of consumers according to the latest 2013 Consumer Reports Perception Survey, where BMW ranked 8th highest for overall brand perception. In such a highly commoditized industry this is an impressive showing for BMW. BMW also earned high marks from consumers in the Performance, Design/Style and Technology/Innovation categories. Given the turmoil and stabilization the automotive industry has experienced since 2008 manufactures like BMW have been able to maintain their brand position in the minds of consumers. Product Pricing Strategy: BMW has built its reputation and brand an its ability to consistently produce high performance vehicles, reminiscent of its slogan “the ultimate driving machine.” The majority of BMW’s target market consists of upper-middle class males between the ages of 32 – 45. The target market is also un-married men whose gross income in excess of $140,000.00. BMW’s cheapest car enters the market at slightly over $33,000.00, prior to any upgrades or performance enhancements. This provides a low barrier to entry for those consumers who are testing the waters with BMW. While you may have options of more features and function with other brands such as Honda, Ford, Toyota or Chevrolet, these competitors might use cheaper materials or lag in technology/performance innovation which are the brand characteristics a BMW brand loyalist craves. BMW’s performance differentiators are a result of engine technology but also the car’s handling and complete package as a high performance vehicle. Other medium luxury car manufactures focus on other aspects of their vehicles such as hand stitched Italian leather seats, torque and speed statistics such as fastest car from 0-60 mph. BMW’s performance positing as “the ultimate driving machine,” however this is what separates them from the competition. BMW was able to increase its market share from 2006 through 2011 by a total of 33%. BMW’s ability to introduce new products, such as the “i8” to capture the electric sports car markets enable it to compete with upcoming electric car manufactures like Tesla which are looking to capture the high-end electric performance car markets. BMW is also know for shying away from hiring unskilled labor force and hires highly specialized German mechanics to work on and build its performance machines. This element while not directly seen or touched by the customer adds to BMW’s reputation as a performance leader and expert in producing high performance automobiles and vehicles. Brand Positing: BMW has one of the best customer retention ratings according to J.D. Power customer retention ratings. BMW ranked 4th among automotive manufacturers at 59% retention. BMW was only 5% behind the industry leader, Hyundai at 64% and outperformed the industry average of 49%. Mentioned above was BMW’s new worldwide program titled “Future Retail,” which aims to create additional touch points for consumers for the BMW brand as well as trying to achieve a more exclusive ambience in BMW dealerships. These Future Retail programs provide dealers with targeted brand support that will help them focus on customer needs and requirements. These additional touch points take the form of the following: Apparel: Men’s, Women’s and Kid’s Accessories (watches, sunglasses, wallets, key rings, umbrellas, cups, etc.) Travel Accessories (luggage, backpacks and bags) Sporting Accessories (golf, yacht sport, bikes, motorsport and general athletic apparel) Miniatures (die cast replicas of BMW’s) While BMW currently operates over 300 dealerships, during 2012 BMW added 25 MINI and 82 BMW dealerships. With competitors like Tesla entering the retail market and changing the way consumers purchase cars, this is a serious consideration from a brand delivery standpoint. BMW must continue to adjust and adapt its brand offering to compete with competitors like Tesla. However, Tesla has not yet proven itself as a performance titan like BMW. The below figure details out BMW’s Points of Parity and Differentiation. Fig.1 Points of Parity: - Luxury Image - Social Status - Integration Points of Difference: - Performance - Style - Technology High End Luxury Vehicles: Overall Brand Position - Mercedes - Audi - Tesla Integrated Marketing Activities: BMW continues to pursue its target markets and appeals to a variety of consumer groups. While many brands maintain a social media presence, YouTube is the largest online social media video entertainment platform. BMW uses YouTube as a vehicle to introduce customers to new products, innovation reports and special BMW events specific to the brand. The online campaign uses keywords sold through an auction where brand performance is based on cost-per-click. BMW optimized the keyword searches resulting in 6 million impressions, with a 45% brand increase compared to prior levels. BMW also introduced its “Joy” campaign, which is focused on consumers who are looking to love life and are not necessarily driving enthusiasts’. J.D. Power conducted a research study focused on the effectiveness of this campaign in the minds of BMW’s target consumer market. Within 60 days of the campaign launch the “Joy” campaign experienced a 13% lift with women and a 5% lift with Gen-Yers, indicating a demographic shift in feelings about the brand and potential new brand loyalties being built. Internet Marketing: BMW’s main website, www.bmw.com is used as the main marketing vehicle to reach consumers. BMW found that 85% of consumers visit BMW.com prior to making a purchase decision. BMW Applications: strategic use of tablet, smartphone and PC based applications to reach consumers. Existing applications include; BMW Mobile Configurator, BMW Magazine, BMW Connected and multiple BMW branded games. SEO Marketing: BMW’s payment to companies likes Google, Bing or Yahoo so that BMW specific ads pop up as current and potential consumers enter relevant key words. Public Relations: BMW provides its updates for its corporate media, press releases and third party media coverage via BMW PressClub, bmwwebcast.com and press.bmwgroup.com. Television (including online): BMW invests in TV ads to enhance its core brand values; performance, technology and innovation. BMW also broadcasts its commercials via MSNBC, Bravo and NBC whose consumers make up over 20% of BMW’s income bracket. Online Advertisements: BMW North America spends 15% of its annual budget on it marketing including Internet, mobile apps that is critical to its marketing strategy. Social Media: BMW utilizes this medium largely due to the cost benefits on frequency and reach, which can be achieved at a relatively low cost. Online Magazines: BMW is able to deliver content via iPad’s or via other electronic medium at a relatively low cost compared to print. The information provides readers the ability to connect to the brand via pictures, articles and information. Games: BMW provides licensing of its vehicles to various gaming companies to attract new buyers and allow them to experience the brand at a fraction of a cost of what it would cost to purchase a new car. BMW’s main priority is to create a lasting emotional connection with its brand. This connection is the best marketing tool, BMW must focus on the human aspect of brands and the connection people feel with it. “Brand loyalty can only be established if a brand is able to connect with its consumers on an emotional level. From a brand management perspective, we see ourselves not only as a car manufacturer, but also as a creator of emotion.” Dr. Uwe Ellinghaus – Director of Brand Management at BMW. Brand Portfolio: BMW’s product growth strategy focuses on releasing its various product lines in a series of extensions within the same category. For example a 3 series will be available as a 2-door version, a wagon and as a sedan in different years. This allows BMW to vary its production and product lifecycle all while keeping consumer interest and consumers coming back for additional products. Outside of the traditional automobile market that BMW is know for there are additional products and brand components that BMW is trying to resonate with customers. These categories include BMW’s product portfolio has 4 key brands all satisfying different consumer types and price points. Rolls Royce: Phantom (limousine), Ghost (sedan) and Wraith (coupe) BMW: 1,2,3,4,5,6 and 7 Series (Sedans), Z Series (coupe), M Series (Sports Coupe), X Series (SUV), and I Series (electric Hybrid and Sports) Mini: Hardtop, Couple, Convertible, Roadster (all 2 door models), and Clubman, Paceman, and Countryman (4 door mini-sedan) BMW Motorcycles: Sport, Tour, Roadster, Enduro and Urban Mobility (Vespa Variation) BMW has worked on its product stretch strategy, moving its brand in both directions. With the acquisition of Rolls Royce the brand is able to attract the ultra premium consumer who is looking for complete luxury. The current BMW brand portfolio of core automobiles satisfies the middle market or aspirational buyer looking for prestige. Lastly BMW’s extension of its brand category into the Mini Cooper allows BMW to attract and capture the lower end market of consumers who need fewer barriers to entry but still want to experience the BMW brand of performance and status. Adding additional product lines within the current brand portfolio could create confusion with current and prospective BMW customers and create “shopper paralysis” as these consumers would struggle with brand loyalties at different price points and could create a cannibalism effect on current product lines. The below figure details a perceptual map of Price vs. Quality and the competitive landscape in the current automobile market. Fig. 2 Price HIGH Cadillac Lexus Ferarri Porsche Mercedes BMW Audi Lincoln LOW Ford Toyota Chevy Nissian Honda HIGH Volvo Quality Saab Volkswagon LOW Scion Recommendation: BMW has done a tremendous job in building the global brand that exists today. Current plans on Future Retail environments should be pursued heavily in the U.S. The majority of these stores are located in Europe and China. However with the U.S. consuming the majority of BMW’s production adding additional brand components that allow consumers to connect with the brand even further will increase brand salience and will ultimately increase brand loyalty. This can also be viewed as a way to attract newer customers through alternate channels such as apparel and move those purchased toward other product lines like automobiles. BMW can learn from one of its main competitors in the high-end electric car market, Tesla. Currently, Tesla has fundamentally changed the consumer buying experience and what it means to buy a car and the experience behind it. Tesla sales consultants help guide consumers through the fully customizable car design and purchase process. In addition to Tesla’s highly customizable product lines their channels of distribution are strategically placed in malls around the U.S. that meet key demographic and psychographic criteria. Furthermore Tesla branded charging stations is located along major US Highways and Interstates to allow ease of use by the customer. BMW should learn from this and adapt their channel delivery process, especially for their electric product lines. In recent news retail car purchases can create barriers to entry for some US customers, most notably in New Jersey where the automotive industry clings to its old ways. BMW should continue to leverage its position as a performance engine and vehicle manufacturer. Looking into the possibility of competing with its indirect competitors in the marine industry such as creating engines for speedboats or yachts. Currently there is some brand positioning around BMW’s apparel line for sailing and nautical activities. This would also allow BMW to expand its brand portfolio and attack markets where indirect competitors might take share away. BMW should take a more focused look on internal marketing, especially in US based dealerships and ensure that the brand experience for customers is not only positive but consistent across the board. Employees at these locations should also wear some of the BMW branded apparel to convey the “lifestyle” component BMW is trying to convey. Success Metrics: Success can and should be measured from a traditional sense of market share increase versus decreases. These metrics provide a direct relationship between product sales and marketing activities. Value is key to success of a brand. BMW should ensure that anywhere there is a value exchange, such as; initial purchase experiences, maintenance visits, lease purchases, re-buy and modified re-buy are looked at and the brand experience is consistent across these areas. Survey’s can also be used to measure the level of purchase intentions associated with the above activities so that brand experiences can be modified. The use of social media should also be explored through the “Joy” campaign. BMW can encourage users to post photos or videos on how or why they feel “joy” with their BMW to create additional brand awareness and build equity. Likes, re-Tweats, clicks, views and comments will help build and measure program success. Sources: Consumer Reports. “2013 Brand Perceptions Survey.” Feb 2013. Web. March 2014. http://www.consumerreports.org/cro/2013/02/2013-car-brand-perceptionsurvey/index.htm http://www.bmw.com/com/en/newvehicles/i/i3/2013/showroom/index.html StealingShare. “BMW: Newness and the Product Life Cycle.” 2013. Web. March 2014. http://www.stealingshare.com/pages/BMW%20Brand%20Study.htm Jason Piers. “BMW and the Brand Promise.” Feb 2010. Web. March 2014. http://adifferentmind.com/2010/02/18/bmw-and-the-brand-promise/ Lacy Plache. “Auto Industry Trends” Dec 2013. Web. March 2014 http://www.edmunds.com/industry-center/commentary/auto-industry-trends-for2014.html Michael Liu. “Automotive Industry Trends.” 2014. Web. March 2014. https://www.franchisehelp.com/industry-reports/automotive-franchise-industry-report/ Ann-Christine Diaz. “Honda Earns Double Nods, BMW and Toyota Earn Experimental Inovators.” January 2014. Web. March 2014. http://adage.com/article/news/honda-bmw-toyota-car-ads-2013/291069/ J.D. Power and Associates.” 2012 Retention Survey.” January 2012. Web. March 2014. http://autos.jdpower.com/content/press-release-auto/KF8DyKD/2012-customer-retentionstudy.htm J.D. Power and Associates.” How BMW’s Story of Joy Advertising Campaign is Reaching New Customers.” Dec 2010. Web. March 2014. http://images.dealer.com/jdpa/pdf/10-US-BMW-CS.pdf Giselle Tsirulnik. “BMW Introduces Mobile App to Compliment Joy Campagin.” Jan 2011. Web. March 2014. http://www.mobilemarketer.com/cms/news/content/8664.html Katie Fehrenbacher. “New Jersey Blocks Tesla Sales, as Auto Industry Clings to Old Ways.” March 2014. Web. March 2014. http://money.cnn.com/news/newsfeeds/gigaom/articles/2014_03_11_new_jersey_blocks_ direct_tesla_sales_as_auto_industry_clings_to_old_ways.html Horatiu Boeriu.” BMW NA Marketing to Focus on TV Advertising.” April 2011. Web. March 2014. http://www.bmwblog.com/2011/04/17/bmw-na-marketing-to-focus-on-tv-advertising