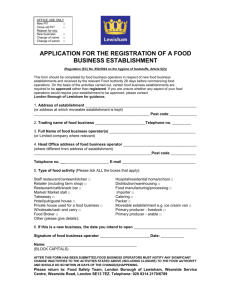

The Delhi Shops and Establishments Act, 1954 Arrangement of

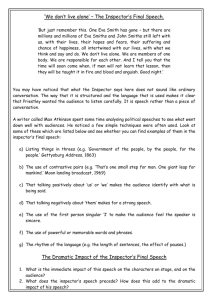

advertisement