Krzys’ Ostaszewski, http://www.math.ilstu.edu/krzysio/, Exercise 169, 8/9/8

Author of a study manual for exam FM available at:

http://smartURL.it/krzysioFM (paper) or http://smartURL.it/krzysioFMe (electronic)

Instructor for online seminar for exam FM: http://smartURL.it/onlineactuary

If you find these exercises valuable, please consider buying the manual or attending our

seminar, and if you can’t, please consider making a donation to the Actuarial Program at

Illinois State University: https://www.math.ilstu.edu/actuary/giving/

Donations will be used for scholarships for actuarial students. Donations are taxdeductible to the extent allowed by law.

Questions about these exercises? E-mail: krzysio@krzysio.net

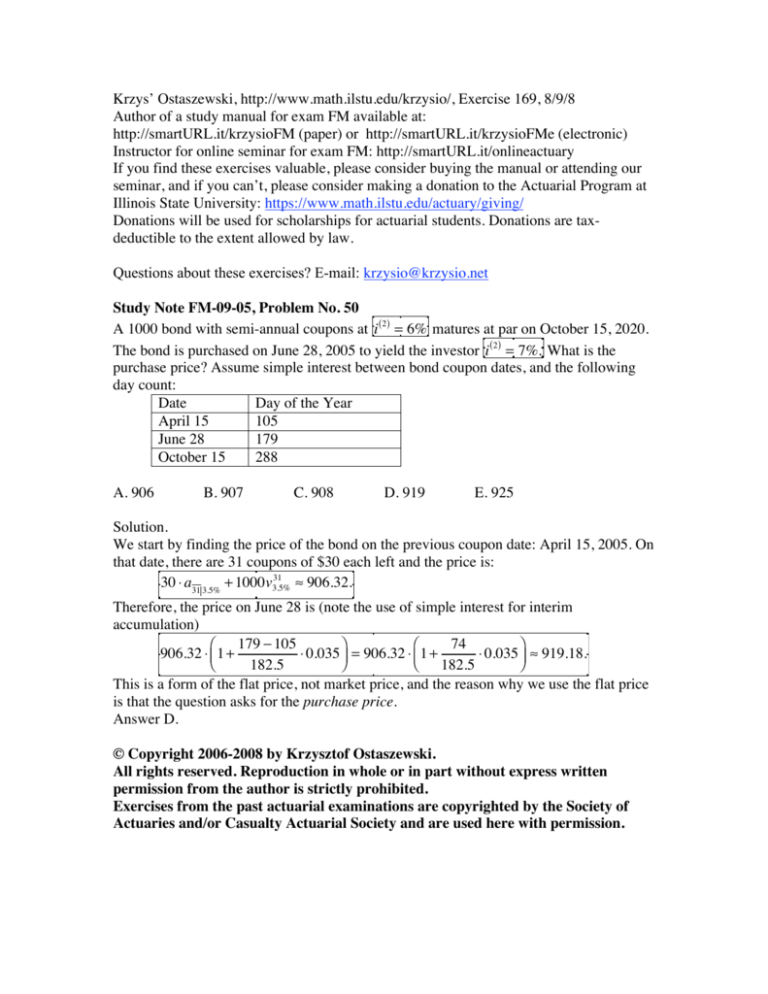

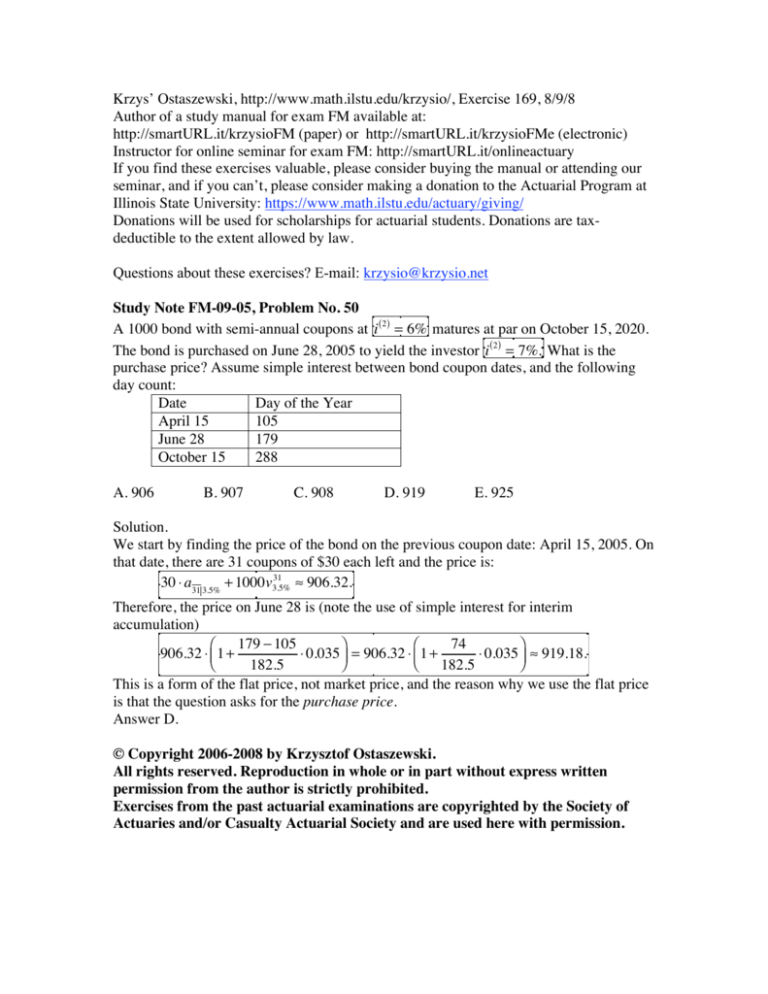

Study Note FM-09-05, Problem No. 50

A 1000 bond with semi-annual coupons at i ( 2 ) = 6% matures at par on October 15, 2020.

The bond is purchased on June 28, 2005 to yield the investor i ( 2 ) = 7%. What is the

purchase price? Assume simple interest between bond coupon dates, and the following

day count:

Date

Day of the Year

April 15

105

June 28

179

October 15

288

A. 906

B. 907

C. 908

D. 919

E. 925

Solution.

We start by finding the price of the bond on the previous coupon date: April 15, 2005. On

that date, there are 31 coupons of $30 each left and the price is:

31

30 ⋅ a31 3.5% + 1000v3.5%

≈ 906.32.

Therefore, the price on June 28 is (note the use of simple interest for interim

accumulation)

74

⎛ 179 − 105

⎞

⎛

⎞

906.32 ⋅ ⎜ 1 +

⋅ 0.035 ⎟ = 906.32 ⋅ ⎜ 1 +

⋅ 0.035 ⎟ ≈ 919.18.

⎝

⎠

⎝ 182.5

⎠

182.5

This is a form of the flat price, not market price, and the reason why we use the flat price

is that the question asks for the purchase price.

Answer D.

© Copyright 2006-2008 by Krzysztof Ostaszewski.

All rights reserved. Reproduction in whole or in part without express written

permission from the author is strictly prohibited.

Exercises from the past actuarial examinations are copyrighted by the Society of

Actuaries and/or Casualty Actuarial Society and are used here with permission.