Examing the Layers of Lobbying Tax Regulation

Examine the Layers of

Lobbying Tax Regulations

Finance, HR & Business Operations Conference

Washington, DC

June 7-8, 2012

2

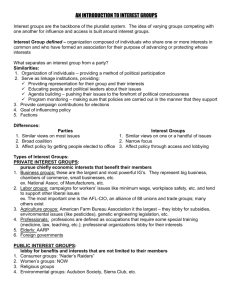

Intro and Overview

Advocacy

Lobbying

Political

Intervention

3

Charity

(legislative)

Lobbying

Intro and Overview

Advocacy

Political

Intervention

Association

Lobbying

Lobbying Definition

5

•

IRC 162(e)(1) disallows deduction for lobbying expenditures

•

IRC 162(e)(3) extends the disallowance to dues or similar amounts paid to tax exempt organizations that are allocable to lobbying expenses

Lobbying Definition

6

•

The disallowance covers three types of activities:

–

Direct lobbying of Congress and state legislatures

–

Indirect lobbying of any legislature through grassroots lobbying and influencing the public through referenda

–

Direct communication with top federal executive branch officials on any official matter

Lobbying Definition

7

•

Direct Federal and State Legislative Lobbying

–

Influencing legislation means “any attempt to influence any legislation through communication with any member or employee of a legislative body, or with any government official or employee who may participate in the formulation of legislation.”

Lobbying Definition

8

•

Direct Federal and State Legislative Lobbying

–

“Legislation” is defined in IRC 4911(e)(2) and includes

“action with respect to Acts, bills, resolutions, or similar items by the Congress, any State legislature, any local council, or similar governing body, or by the public in a referendum, initiative, constitutional amendment, or similar procedure.”

–

“Action” is limited to the introduction, amendment, enactment, defeat, repeal of Acts, bills, resolutions, or similar items

Lobbying Definition

9

•

Direct Federal and State Legislative Lobbying

–

Treas. Reg. Section 162-29 clarifies “influencing legislation”

–

Includes any attempt to influence legislation through a

“lobbying communication” and related activities done to make or support the lobbying communication

–

Such activities include research, preparation, planning and coordination

Lobbying Definition

•

Direct Federal and State Legislative Lobbying

–

“Lobbying communication” includes communication with a member or employee of a legislative body (or other govt. official who may participate in the formulation of legislation)

–

The communication must refer to specific legislation and reflect a view on it or

–

Clarify, amplify modify or provide support for views reflected in a prior lobbying communication

10

Lobbying Definition

•

Direct Federal and State Legislative Lobbying

–

“Specific legislation” includes a specific legislative proposal that has not been introduced in a legislative body

–

Does not include a communication that is compelled by subpoena or by law

–

“Legislative body” does not include executive, judicial, or administrative bodies or local councils

11

Lobbying Definition

•

Grassroots Lobbying

–

IRC 162(e)(1)(C) denies a deduction for grassroots lobbying – influencing the general public with respect to “legislative matters or referendums”

–

Applies to the federal, state and local levels

–

“legislative matters or referendums” is not defined

–

Legislative matters may be broader than legislation

12

13

Lobbying Definition

•

Grassroots Lobbying

–

Trade association’s communication with members may constitute grassroots lobbying

•

Identification of communication as “grassroots lobbying” can be difficult

•

Can be grassroots lobbying if communication attempts to develop a grassroots opinion about pending legislation

Lobbying Definition

•

Direct communication with top federal executive branch officials on any official matter

–

Includes the President, Vice-President, certain members of the Executive Office of the President

–

Other high level executive officials

14

Allocation of Costs

•

Allocation of costs to lobbying must be by a reasonable method (Treas. Reg. Section 162-

28)

•

Reasonable methods include:

–

Ratio method

–

Gross-up method

–

IRC Section 263A

•

Lobbying costs include labor and general and administrative

15

Allocation of Costs

16

•

Ratio method

–

Costs are allocated based on the ratio of lobbying hours to total hours x total costs of operations

–

Add third party labor costs

•

Gross-up method

–

175% of basic lobbying costs

–

Basic lobbying costs are costs of wages or similar labor costs

–

Does not include pension, profit-sharing employee benefits, and similar costs

17

Allocation of Costs

•

IRC Section 263A

–

Can allocate costs using the inventory capitalization method under IRC section 263A

–

Can be a complex methodology

Lobbying Definition

•

IRC 501(c)(3) Definition (Treas. Reg. Section 1.501(c)(3)-

1(c)(3) )

–

Applies to organizations not electing under 501(h)

–

Can’t qualify for 501(c)(3) status if an action organization

–

Action organization is one where a substantial part of its activities is attempting to influence legislation by propaganda or otherwise

–

Lobbying does not include nonpartisan analysis, study or research and making the results available to the general public

18

Lobbying Definition

•

IRC 501(c)(3) Definition

–

Attempting to influence legislation includes contacting or urging public to contact members of a legislative body for purpose of proposing, supporting or opposing legislation or

–

Advocates the adoption or rejection of legislation

19

Lobbying Definition

•

IRC 501(c)(3) Definition

–

Legislation includes action by Congress, any state legislature, any local council or similar governing body, or

–

Action by the public in a referendum, initiative, constitutional amendment or similar procedure

20

Lobbying Definition

•

IRC 501(c)(3) Definition

–

Definition of what constitutes lobbying can be vague

–

How much is “substantial” is unclear

–

Measure of substantiality is not just by expenditures but can include things like volunteer hours and other resources devoted to the activity

–

There are no statutory exceptions to lobbying

21

501(h) Election

•

IRC section 501(h) is an expenditure test as an alternative to the substantial part test

•

Organizations eligible to elect include colleges, hospitals, 509(a)(1), 509(a)(2) and 509(a)(3) organizations

•

IRC section 4911 defines lobbying expenditures and imposes a 25 % tax on excess lobbying expenditures

22

501(h) Election

•

Allowable lobbying expenditures are determined on sliding scale based on the organization’s exempt purpose expenditures

•

Maximum allowed is $1,000,000

•

Grass roots nontaxable amount is 25% of total

(maximum of $250,000)

•

If nontaxable amount over a four year period is exceed by 150%, the organization loses it exempt status

23

24

501(h) Election

•

IRC section 4911 defines lobbying expenditures as those made for the purpose of “influencing legislation”

•

Defined as any attempt to influence legislation through:

–

An attempt to affect the opinion of the general public or segment thereof (grass roots) or

–

Communication with a member or employee of a legislative body or with a government official or employee who may participate in the formulation of legislation (direct)

25

501(h) Election

•

Legislation is defined to include:

–

Actions with respect to Acts, bills, resolutions, or similar items by Congress, a state legislature, or local counsel or

–

By the public in a referendum, initiative or constitutional amendment

•

“Action” is limited to introduction, amendment, enactment, defeat or repeal of

Acts, bills, resolutions, or similar items

26

501(h) Election

•

Expenditures include all costs of preparing direct or grass roots lobbying communications including current and deferred compensation, administrative overhead and other general expenses

•

In general, all costs of researching, drafting, reviewing, copying, publishing, and mailing communication are included as well

What is Lobbying?

27

Direct Lobbying

Communication

Expressing a View

Specific Legislation

Legislator

Grassroots Lobbying

Communication

Expressing a View

Specific Legislation

General Public

Call to Action

28

501(h) Election

•

Statutory Exceptions to lobbying definition:

–

Examination and discussion of broad social, economic or similar problems

–

Response to a written request from a government body

–

“Self-defense” communications

–

Nonpartisan analysis, study and research

29

Lobbying Exceptions: Invited Testimony

•

Written request

•

Government body

Caution!

Not for grassroots lobbying

Lobbying Exceptions: Self Defense

Responding to legislation that affects the organization’s:

– existence

– powers and duties

– tax-exempt status

– deductibility of contributions

Caution!

Not for grassroots lobbying

30

Lobbying Exceptions:

Nonpartisan Analysis, Study or Research

•

“Full and fair” discussion of the issue

–

Sufficient to allow independent conclusion

–

OK to advocate a position

•

Public distribution

–

Not just to allies

•

No direct call to action

31

Lobbying

33

•

“Too Much” Lobbying

–

(c)(6) – None

–

(c)(3) Statute – loss of exemption

•

No substantial part

Lobbying

34

•

“Too much” con’t.

•

(c)(3) w/ (h) election:

– annual limits

• excise tax

–

4-year cumulative limits

• loss of exemption

Lobbying

•

501(h) election:

–

History

–

Process (Form 5768)

–

Implications

–

Pros/Cons

35

36

Lobbying

Lobbying Disclosure Act

38

•

Has its own definitions – different from tax code

•

Associations covered by proxy tax rules

(162(e) and electing public charities (under

501(h)) may use tax definitions measuring expenditures

Lobbying: Tax vs. LDA

LDA

•Federal only

•No grassroots

•Includes executive branch actions

•Slightly different exceptions

501(c)(3)

(IRC § 4911)

501(c)(4), (5), (6)

(IRC § 162(e))

•Includes federal, state, and local

•Includes grassroots

•No non-legislative actions

•Slightly different exceptions

• Includes federal, state, NOT local

• Includes grassroots

• Includes executive branch actions by specific officials

• Very limited exceptions

39

LDA Covered Executive Officials

•

President and Vice President

•

Employees of the Executive Office of the

President

•

Any official in Executive Level I through V position

•

Any member of the uniformed services at grade 07 or above

•

Schedule C employees

40

162(e) Covered Executive Officials

•

President and Vice President

•

Employees of the Executive Office of the

President

•

The 2 most senior officials at each of the other

Executive agencies

•

Any individual serving in a Level I position of the Executive Schedule and his/her immediate deputy

•

Any Cabinet head and his/her immediate deputy

41

FECA

“Electioneering Communications”

•

Broadcast ad

•

Identifies candidate

•

Viewable by electorate

•

30/60 day pre-election window

42

Political Activity Spectrum

501(c)(3)

Activity

“Soft”

527s

Super

PACs

Traditional

PACs

501(c)(6)

Activity

Primary Secondary

43

Purely

Nonpartisan

Activity

Campaign

Intervention

Express

Advocacy

Contributions &

Coordination

•

Two sides of the same coin…

527(e)

“Exempt Function”

44

45

The IRS Test

“Facts and Circumstances”

Based on analysis of all the facts and circumstances, did the organization intervene in a political campaign?

Policy Advocacy or Electioneering

•

Same test for 501(c)(3)/501(c)(4)/527

–

Minor exceptions in scope

•

Rev. Rul. 2004-6

–

Activity by social welfare/labor/trade association that triggers 527(f) tax (“exempt function”)

•

Rev. Rul. 2007-41

–

Permissible 501(c)(3) activity versus campaign intervention

46

What is Electioneering?

47

Electioneering

•

Expressly support or oppose candidates

•

Endorse candidates

•

Contribute to candidates

•

Rate or score candidates on the issues

•

Compare organization’s position to candidate’s

•

Provide other assistance to candidates

Not Electioneering

•

Register voters

•

Educate voters about candidates

•

Take positions on issues

•

Educate candidates

•

Get out the vote

“All the Facts and Circumstances”

48

Good Facts

•

No reference to candidate or elections

•

External factor driving timing

•

Broad range of issues

•

History of similar work on issue

Bad Facts

•

Reference to candidate

•

Timing motivated by election

•

Politically motivated targeting

•

Compare preferred position to candidate position

•

“Wedge issues”

Issue Advocacy

Key Risk Factors

•

Comparing organization’s preferred position to candidate’s position

•

Advocacy on issues known to divide candidates for a particular office

•

Timing close to an election

–

Unless driven by external event outside of the control of the organization (e.g. a legislative vote)

49

Example

• http://coalitionforamericanjobs.com/2011/08/watch

-the-new-coalition-for-american-jobs-tvadvertisement/

Ad run by c6 Coalition for American Jobs spent

$56,650 near the Ames straw poll in mid-August on several stations in Iowa

50

Political Intervention

•

Candidate identified

•

Timing coincides with electoral campaign

•

Targets voters

•

Identifies the candidate’s position on an issue

•

Wedge issue in the campaign

•

Not part of an ongoing series

•

Identifies specific legislation, or an event outside the

•

Timing driven by event outside the organization’s

•

Candidate identified solely as a government official in a

•

Candidate identified solely in the list of key or principal

51

52

Whatever you call electioneering…

•

501(c)(3)s must not do it

•

501(c)(4)s, 501(c)(5)s, and 501(c)(6)s must not do too much of it (> 50%)

•

527s must not do too little of it (< 50%)

Reporting

•

Lobbying – statutory (c)(3)

–

Schedule C, Part II-B reporting

55

Reporting

•

Lobbying – (c)(3) w/ (h) election

–

Schedule C, Part II-A reporting

•

Line 1 – Annual Grassroots and Overall Limitations

•

Line 2 – 4-year Averaging Period

Reporting

•

Calculation - “Exempt Purpose Expenditures”

–

Regulations: Included expenditures

•

Charitable purposes

•

Deferred compensation

•

Allocable overhead

•

Lobbying, including lobbying rule exclusions (nonpartisan analysis, broad social/economic problems examination, technical advice, self-defense)

57

Reporting

•

Calculation - “Exempt Purpose Expenditures”

58

–

Regulations: Excluded expenditures

•

Separate fundraising unit, including non-employees

–

Two or more persons spending majority of time

•

UBI or PF excise taxes

•

Expenses incurred for production of income, such as endowment manager

•

Transfer to affiliated group member

•

IRS-determined limit-inflating expenditures

Reporting

•

Lobbying – (c)(6)

–

Choice of:

•

Taxed at highest marginal rate; or

•

Notice to members

–

Benefits of notice over paying tax

•

No follow-up w/ members required

•

No asking members for more dues

•

Tax consequences likely at lower overall rates

59

Reporting

•

(c)(6) Dues

Disallowance

–

Exceptions:

•

Substantially all

(90%) nondeductible

•

Only in-house lobbying < $2,000

•

No prior year carryover

60

Reporting

Reporting

•

Dues notices:

– applies to dues or “similar” amounts

– lobbying deemed to be paid first out of dues

–

“reasonable estimate” of % of current year dues

– carryover to following taxable year:

•

Statute only refers to excess of expenditures

•

Too late for following taxable year

63

64

Reporting

Reporting

65

Dues

Estimated Lobbying 20

Carryover 0

Total Estimated

6033(e) Lobbying

Dues Notice %

Dues Disallowed

Actual Lobbying

Under/Over

Notification

Year 1

200

20

10%

20

30

10

20%

40

35

-5

Year 2

200

30

10

40

10%

20

15

-5

Year 3

200

25

-5 ???

20

Cumulative

80

80

0

990 Reporting

•

Political Intervention- 501(c)(6)

–

Form 990 Part IV, question 3

–

Schedule C, Part I-A

–

Schedule C, Part I-C

•

Amount expended

•

Amounts contributed to other organizations

•

List of payments made to 527 organizations

•

Description of direct and indirect political campaign activities, total expenditures and volunteer hours

67

990 Reporting

•

Political

Intervention-

501(c)(6)

–

Complete Form

1120-POL

–

Taxed at 35%

990 Reporting

•

Political Intervention- 501(c)(3)

–

Form 990 Part IV, question 3

–

Schedule C, Part I-A

•

Description of direct and indirect political campaign activities, total expenditures and volunteer hours

–

Schedule C, Part I-B

•

Amount of excise tax under IRC section 4955 incurred by the organization and organization managers

•

Whether Form 4720 was filed

•

Whether correction was made

69

LDA Reporting

•

Quarterly (Form LD-2)

–

Due 4/20, 7/20, 10/20, and 1/20

–

Report:

•

Lobbyist names

•

Issue areas (both general and specific)

•

Expenditures (nearest $10,000)

•

Semi-Annual (Form LD-203)

–

Separate filings for organization and lobbyists

–

Report political contributions and other info

71

Contact Information

Elizabeth Kingsley, JD

Attorney

Harmon, Curran, Spielberg

+ Eisenberg, LLP

Phone: 202-328-3500

Email: bkingsley@harmoncurran.com

Richard J. Locastro, CPA, JD

Nonprofit Tax Principal

Gelman, Rosenberg & Freedman CPAs

Phone: 301-951-9090

Email: rlocastro@grfcpa.com

Stephen J. Kelin, CPA, JD

Nonprofit Tax Principal

Gelman, Rosenberg & Freedman CPAs

Phone: 301-951-9090

Email: skelin@grfcpa.com