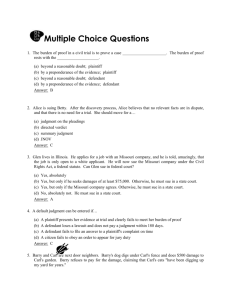

legal dentistry: how attorney's fees and certain procedural

advertisement