Tutorial 3

advertisement

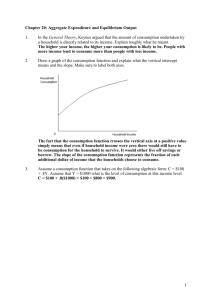

ECON2123 (Spring 2012) 22 & 23.2.2012 (Tutorial 3) Chapter 3: The Goods Market Composition of GDP GDP = Y = C + I + G + X – IM Consumption (C): purchases of goods and services by consumers Investment (I): purchases of new capital goods (residential and nonresidential investment) Government spending (G): purchases of goods and services by the government. (Government transfers are not included) Export (X): purchases of domestic good and services by foreigners Import (IM): purchases of foreign good and services Inventory investment: difference between production and sales Consumption function The consumption function shows the relationship between consumption and disposable income Disposable income: YD = Y – T ( T = taxes – transfers) C = C (YD) C = c0 + c1YD c0: Autonomous consumption: the amount of consumption which is independent of Y Example: Y = 0, C = 200, then 200 is the autonomous consumption c1: Marginal propensity to consume (MPC): the effect of an additional dollar of disposable income on consumption Example: Y =1000, C = 800, then MPC = 0.8 Graphical representation of consumption function Suppose a = 0, MPC = 1, then C = Y (Consume all income) Suppose a = 0, MPC = 0.8, then C = 0.8Y (Consume 80% of income) Suppose a = 200, MPC = 0.8, then C = 200 + 0.8Y C C C = Y (45) C = 200 + 0.8Y C = 0.8Y C = 0.8Y 200 Y Slope = MPC = 0.8 Y The consumption function is a linear function. The consumption function is upward sloping, meaning that Y and C are positively related The slope of the consumption function is MPC and it is constant at different level of Y. When MPC changes, the slope of the consumption function will change. 1 Saving function The saving function shows the relationship between the amount of saving and disposable income. Y=C+S S = Y – C – T = YD – C S = S(YD) S = –c0 + (1 –c1) YD (1 –c1): Marginal propensity to save (MPS): the effect of an additional dollar of disposable income on saving The determination of equilibrium output Assumption: price is fixed (SR assumption), which implies supply responds to demand passively, i.e. any quantity demanded would be supplied. The equilibrium GDP is achieved when Production = Demand, i.e. Y = Z Aggregate demand : Z = C + I + G (c0 I G c1T ) c1Y Y-intercept of the demand curve is (c0 I G c1T ) and slope is c1 Algebraic representation The equilibrium GDP is achieved when Y = Z Y c0 c1 (Y T ) I G Y c0 c1Y c1T I G (1 c1 )Y c0 I G c1T 1 1 [c0 I G c1T ] where Y is the multiplier 1 c1 1 c1 Graphical representation The equilibrium GDP is achieved when. Y = Z (point E) ZZ / Y 45 (Production) Y2 Excess Supply AD2 ZZ = C + I + G E AD1 Excess Demand Y1 Y Y1 Y* Y2 2 Suppose Y = Y1 Excess demand (AD1 > Y1) The price is fixed and the producer would response to the demand and increases production Y increases and then AD increases This process continues until point E is reached. Suppose Y = Y2 Excess supply (Y2 > AD2) The price is fixed and the producer would response to the demand and reduces production Y falls and AD falls This process continues until point E is reached. The Multiplier effect (1) Change in autonomous spending An increase in autonomous demand (autonomous G, I or C) would rise Y by more than the original increase in demand. Multiplier: the ratio of the change in Y to a change in the government expenditure, i.e. Y G Period 1 Period 2 Period 3 Period 4 Period N G by 200 Y by 200 Y by (200 MPC) Y by (200 MPC2) Y by (200 MPCn-2) AD by 200 C by (200 MPC) C by (200 MPC2) C by (200 MPC3) C by (200 MPCn-1) Y by 200 AD and Y by (200 MPC) AD and Y by (200 MPC2) AD and Y by (200 MPC3) AD and Y by (200 MPC n-1) Y G (G MPC ) (G MPC 2 ) (G MPC n1 ) 1 Y G 1 MPC Y 1 Multiplier G 1 MPC The size of the multiplier (i.e. Y/G) depends on the size of MPC: the higher (lower) the value of MPC, the larger (smaller) the multiplier effect. (2) Change in Tax (assuming lump-sum tax) Y (T MPC ) (T MPC 2 ) (T MPC n1 ) MPC Y T 1 MPC Y MPC Multiplier T 1 MPC 3 Examples and Problems Question 1 Consider an economy in which tax collections are always $200 GDP 480 540 600 660 720 Taxes 200 200 200 200 200 DI C 210 255 300 345 390 I 100 100 100 100 100 G 215 215 215 215 215 I 100 100 100 100 100 G 215 215 215 215 215 (a) Fill in the column for DI, disposable income GDP 480 540 600 660 720 Taxes 200 200 200 200 200 DI 280 340 400 460 520 C 210 255 300 345 390 AD 525 570 615 660 705 (b) Find the equilibrium level of GDP for this economy Equilibrium = 660 when Y = AD (c) What is the marginal propensity to consume? MPC = ¾ (d) What is the simple multiplier for the economy? Multiplier = 1/(1-MPC) = 4 4 Question 2 Giving the consumption function, C = 200 + 0.8Y (a) Derive the saving function. Y=C+S S = Y – C S = Y – 200 – 0.8Y S = – 200 + 0.2Y (b) Graph the saving function (Try to derive it from the consumption function!). How much is saving/ dissaving when Y = 400 and Y = 2000 C 45 2000 1800 Saving = 200 C = 200 + 0.8Y 520 400 200 Dissaving = 120 Y 400 1000 2000 S S 200 Y –120 1000 2000 –200 At Y = 0, C = 200, which means S = –200 At Y = 400, C = 520, which means S = –120 At Y = 1000, C = 1000, which means S = 0 At Y = 2000, C = 1800, which means S = 200 The saving function is a linear function. The saving function is upward sloping, meaning that Y and S are positively related. The slope of the saving function is MPS and it is constant at different level of Y. When MPS changes, the slope of the saving function will change (c) Identify the autonomous saving and the marginal propensity to save (MPS). What is the relationship between MPS and MPC? Autonomous saving = –200 (borrowing) and MPS = 0.2 (MPS = S/Y). MPC + MPS = 1 5 Question 3 Suppose the economy is characterized by the following equations: C = 160 + 0.6 YD I = 150 G = 150 T = 100 Solve for the following questions and put your answers in a graph. 45 (a) Equilibrium output (Y) AD’’ ZZ/ Y AD Y = 160 + 0.6 (Y – 100) + 150 +150 Y* = 1000 E AD’ E (b) Disposable income (YD) YD = Y – T = 1000 – 100 = 900 E 440 400 360 (c) Consumption spending C = 160 + 0.6 (900) = 700 Y**=900 (d) Suppose now G falls to 110. Solve for the new equilibrium. ’ ’Y Y**=1100 ’ Y*=1000 1 1 2.5 1 MPC 1 0.6 G = 40, Y = -40 Multiplier = -40 2.5 = -100 Y** = Y* + Y = 900 Multiplier (e) Suppose the government increases taxes and government expenditure by 100 at the same time. Solve for the new equilibrium. Y = 160 + 0.6 (Y – 100-100) + 150 +250 Y*** = 1100 Alternatively, Y = 100 [1/(1 – MPC) – C1 /(1– MPC)] = 100 Y*** = Y* + Y = 1100 6 Example 4: Taxes and Transfers Recall that we define T as net of transfers. In other words, T = taxes – transfer payments. (a) Suppose that the government increases transfer payments to private households, but these transfer payments are not financed by tax increases. Instead, the government borrows to pay for the transfer payments. Show in the diagram (like Figure 3-2) how this policy affects equilibrium output. Explain. AD 45 (Production) ZZ’ Y* ZZ E’ Y’ Disposable income and hence consumption both increases for any level of Y, so the ZZ curve shifts up, and equilibrium output increases. E Y Y* Y’ (b) Suppose instead that the government pays for the increase in transfer payments with an equivalent increase in taxes. How does the increase in transfer payments affect equilibrium output in this case? There is no effect on equilibrium output, since T does not change. (c) Now suppose that the population includes two kinds of people, those with high propensity to consume and those with low propensity to consume. Suppose that transfer policy increases taxes on those with low propensity to consume to pay for the transfers to people with high propensity to consume. How does this policy affect equilibrium output? The ZZ line shifts up and output increases. The reduction in demand due to the tax increase on low MPC group is smaller than the increase in demand due to the increase in transfers on high MPC group. Therefore, this policy increases equilibrium output. Effectively the income transfers increases the propensity to consume for the economy as a whole. (d) The propensity to consume is likely to be higher for low-income taxpayers. Do you think tax cuts will be more effective at stimulating output when they are directed toward high-income or toward low-income taxpayers? People with high wealth probably have a lower propensity to consume than people with low wealth. At the extreme, those in poverty may spend most of any additional dollar on basic needs. Since wealth and income are usually related, people with high income probably have a lower propensity to consume than people with low income. Therefore, tax cuts are likely to be more effective at stimulating output when they are directed toward people with low income, who are likely to spend more of the extra disposable income. 7