Agricultural Policy, Gravity and Welfare

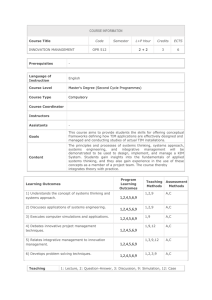

advertisement