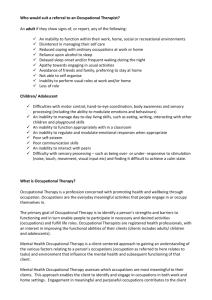

Occupational Skills Shortage Analysis

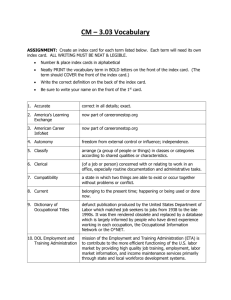

advertisement