2014 annual report

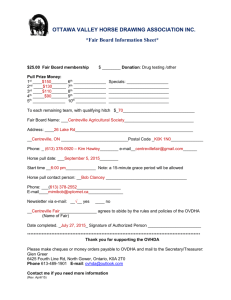

advertisement

2014 ANNUAL REPORT President’s Message In my new role as President and CEO, I am pleased to report that 2014 was another successful year for Centreville Bank. As noted in the Treasurer’s Report, the Bank’s financial strength places us in a unique position among Rhode Island financial institutions, and we plan to leverage this strength going forward. Under Ray Bolster’s stewardship, Centreville Bank has grown and prospered, and we are indebted to him for his tireless efforts to ensure the Bank’s success. Although we will miss seeing Ray on a daily basis, we are grateful for his ongoing involvement with the Bank through the Board of Trustees. As we look ahead to 2015 and beyond, we are extremely excited by the opportunities we see for Centreville Bank. In the past several years, we have put together a strong and determined management team. We are going to work harder than ever to provide outstanding products and services, and enhance the customer experience – not only in our branches, but in all our delivery channels and throughout the organization. “We have been working closely with our staff, customers, and prospects to learn first-hand what we need to do to earn - and keep - their business and support. This feedback has been instrumental in helping us to create a strategic plan to move Centreville Bank forward.” - Tom Lamb While we are proud of all we have accomplished, we know that there is always more that can be done. With increased competition from community banks and credit unions, we recognize that Centreville Bank’s fiscal strength is not enough to effectively compete in our market. To that end, we have been working closely with our staff, customers, and prospects to learn first-hand what we need to do to earn – and keep – their business and support. This feedback has been instrumental in helping us to create a strategic plan to move Centreville Bank forward. I continue to be touched by the dedication of our employees in so many great causes. This support and involvement in the communities we serve remains a big part of what Centreville Bank is about. We live and work here, and we are committed to helping the many organizations that, in turn, help all of us. In closing, I want to thank our Trustees, Corporators, and our staff for their hard work and support. I am truly honored by the opportunity to work with you in our quest to make Centreville Bank the best it can be. Sincerely, Thomas J. Lamb, Jr. President, CEO & Chairman of the Board Treasurer’s Report Financial Highlights The Bank continued to maintain extraordinary capital levels with a 22.8% Tier 1 capital ratio, which far surpassed its peer group as well as the regulatory requirement of 5% to be considered “well-capitalized.” 2014 yielded a return on asset ratio of 79 basis points, the highest in over 5 years. This allowed for balance sheet growth of over $18 million and net income after tax of $7.8 million surpassing 2013 by 22%. From an earnings perspective, the sustained low rate environment and the lagging local economy continued to influence the Bank’s core banking activities. Deposit balances declined $16.7 million as a result of certificate of deposit balances maturing and finding higher returns elsewhere. Loan balances remained stable while the return on loans decreased by 17 basis points from 4.04% to 3.87%. However, contrary to many of its peers, Centreville’s net interest margin rose by 7 basis points due to an increase in the return on investments of 14 basis points, combined with a decrease in the cost to fund earning assets from 63 basis points to 57 basis points. The resulting impact was growth to net interest income of $1.5 million, before the provision for loan losses. Additionally, the Bank benefited from its strong investment returns and improved asset quality. Its yield on the investment portfolio improved from 2.34% to 2.48% and with the continued improvements in the stock market, the Bank was able to realize $3.5 million in gains on security sales as well as record dividend income of $3.5 million. Furthermore, as Centreville continues to strive to maintain the highest credit quality within the loan portfolio, provision for loan losses decreased $591 thousand for the year ended. Financial Condition December 31, 2014 Total Assets $ 997,768,527 December 31, 2013 $ 979,604,432 Cash & Short Term Investments 25,587,555 41,303,441 Securities, at Fair Value 516,855,910 488,460,672 Loans, Net 418,859,193 418,203,319 Customer Deposits 684,740,162 701,392,672 20,000,000 20,000,000 Total Retained Earnings 247,648,050 228,458,047 Risk Based Capital Ratio 50.81% 49.55% Equity to Assets 24.82% 23.32% December 31, 2014 December 31, 2013 Borrowed Funds Operating Results Total Interest & Dividend Income Total Interest Expense Net Interest Income Before Loan Losses Provision for Loan Losses $ 28,980,254 $ 27,807,463 5,495,805 5,779,950 23,484,449 22,027,513 649,250 1,240,000 The Bank maintained its customer commitment and recognized the need to ensure customer service fees are a minimal source of income. As such, the ratio of non-interest income to assets stands at .21% compared to the national rate of 3.03%. Management also made a concerted effort to manage operating costs and thereby decreased non-interest expenses by $97 thousand or .47% in a period of increasing regulations and an ever-changing complex banking environment. Net Interest Income 22,835,199 20,787,513 Non-Interest Income 6,640,683 6,647,943 Non-Interest Expense 20,271,080 20,367,690 Provision for Income Taxes 1,418,573 671,438 With an outstanding capital position, sound credit quality and strong management oversight, the Bank is well positioned for responsible growth and reinvestment in 2015. Net Income 7,786,229 6,396,329 Return on Average Assets 0.79% 0.67% Net Interest Margin 2.47% 2.40% Jillian J. DeShiro, CPA Senior Vice President Chief Financial Officer and Treasurer Thank You Ray Our Leadership Team For the past nine years, Centreville Bank President, CEO and Chairman of the Board Ray Bolster has been at the helm, successfully steering the Bank through one of the most difficult economic environments in history. With Ray’s leadership, Centreville Bank has grown to become one of the area’s strongest financial institutions. Centreville Bank is fortunate to have a talented group of hard-working individuals on the leadership team. Every member of our team has extensive experience in banking and their respective fields, and all share a common vision for the future of Centreville Bank. area that will work with the branches to ensure consistency and compliance across the Bank. The area will also concentrate on appropriate training and coaching for the branch staff. This will help to ensure that our customers receive the same excellent service across the branch network. Here are just a few highlights from the past year: Consumer Lending – Mortgage loans continue to play a significant role in the growth of Centreville Bank and we have added even greater depth to our retail lending team to ensure future success. The Bank will be focused on improving the loan process for our customers, and we are planning the launch of several new products in 2015. Over and above Ray’s contributions towards the Bank’s success are his efforts, both personally and on behalf of the Bank, to helping others. Ray – or “Chip” as he is known to friends and family – is much beloved by the many organizations and individuals who have benefited from his generosity, warmth, and genuine concern for the well-being of others. Centreville Bank is very fortunate to be highly regarded in the communities we serve. We’re known for our support of the many not-for-profit organizations that serve the needs of our communities, and for the kindness and respect we show customers, colleagues, business and community leaders. These are the values that Ray lives by, and ones that he instilled at Centreville Bank. While Ray has officially retired as President, CEO and Chairman of the Board, we are grateful that he will continue to be involved with Centreville Bank through our Board of Trustees. We wish Ray much happiness and wonderful adventures in the years ahead. Commercial Lending – In 2014, Centreville Bank made a significant commitment to growing our commercial loan portfolio and brought a strong team of experienced professionals on board to meet these goals. Products and Services – This division was created to focus on the enhancement of product offerings, improving the customer experience, and elevating the Bank’s brand awareness. Through customer analytics and consumer research, the Bank has gained a deeper understanding of our current customer base and prospects, and has outlined numerous opportunities for growth. We have created a branch operations The Bank is grateful for the contributions of our many dedicated employees who have helped make Centreville Bank one of Rhode Island’s strongest community banks. Centreville Bank’s leadership team shown (front row, left to right): Jill DeShiro, Karen Flynn, Yokota Strong, Pam Stenberg; (back row, left to right); Hal Horvat, Nancy Ferrara, Julie Casey, Tom Lamb, Brian McGinnis, Maureen Terranova and Richard Denio. Centreville Bank and Community Spirit We recently conducted a survey among colleagues, customers and area residents to ask them what comes to mind when they hear of Centreville Bank. An overwhelming majority stated “the Bank’s community involvement.” We couldn’t be more pleased with this response! Supporting our local cities and towns is one of our core values. Annually, we help dozens of non-profit organizations statewide, not only in financial support through the Centreville Savings Bank Charitable Foundation, but in the hundreds of volunteer hours from our employees. While the list of those we support is long, we chose to highlight in this year’s report four organizations that were the beneficiaries of Centreville Bank’s support. We would also like to recognize the time, energy and enthusiasm from our many employees that help keep this community spirit alive. Pictured below (l-r) are Lou Giancola, President/CEO of South County Hospital; Brenda Owren, Area Branch Manager; Matt Owren; and Raymond Bolster, Centreville Bank. South County Hospital Cancer Care Center – Centreville Bank has pledged $250,000 to the Hospital’s “The Campaign for Cancer Care” initiative, the largest gift yet to this effort. For Centreville Bank Area Manager Brenda Owren, this donation hit close to home. Brenda’s brother Matt is a cancer survivor who was treated at South County Hospital. Matt is not only thriving today, but is also working as a physical therapist at the Hospital. Meals on Wheels - Centreville Bank donated $20,000 to the Meals on Wheels Emergency Meal Program, which allowed the organization to deliver 1,350 “shelf-stable” meals this past winter to recipients throughout the state. Without this donation the program was in jeopardy. Wickford Art Festival – Centreville Bank was the title sponsor for this much-beloved event, attended by thousands who stroll through this charming village seeking exceptional artwork. Pictured above (l-r) are Domenica Santilli, Area Branch Manager; Tom Lamb, Centreville Bank; and Heather Amaral, Executive Director of Meals on Wheels of Rhode Island. South Kingstown Animal Rescue League – With a $25,000 contribution from the Bank, the Animal Rescue League is in the final construction phase of a state-ofthe-art facility in Peace Dale. One of the few Rhode Island shelters with a strict “no kill” policy, the rescue league will also be home to one of the country’s first K9 training centers. Corporate Directory Executive Officers Corporators Thomas J. Lamb, Jr. President – CEO & Chairman of the Board Stephen D. Alves Dr. Paul E. Barber Cecile G. Benoit Richard A. Bernard Robert A. Bjorklund Raymond J. Bolster, II Kevin A. Breene Arthur J. Brown John S. Brunero, Jr. Ronald J. Caniglia Henry G. Caniglia Philip Casacalenda, III James W. Coogan Dr. B. Gerard Coppolelli Thomas J. Cronin Mark Cullion Alfred R. D’Ambrosca Thomas Deangelis Craig J. Delfino Albert A. DiFiore Michael R. Durand Jonathan K. Farnum Stacy B. Ferrara John P. Gallogly G. John Gazerro, Jr. John Golomb Brian Harbour R. George Henault Robert J. Holmes Andrea M. Hopkins James A. Hopkins Robert A. Iannotti Robert A. Iannotti, Jr. James E. Joly Kenneth Jones Arthur Joyal John E. Keenan Earl P. Knight Dr. Patricia Koch, OD Roy A. LaCroix, Sr. Jillian J. DeShiro, CPA Senior Vice President – CFO & Treasurer G. John Gazerro, Jr. Secretary Trustees Dr. Paul E. Barber* Raymond J. Bolster, II* John S. Brunero, Jr.† Henry G. Caniglia* Craig J. Delfino† G. John Gazerro, Jr.* R. George Henault Honorary Trustee Robert J. Holmes* Andrea M. Hopkins† James A. Hopkins* Robert A. Iannotti* Dr. Patricia Koch, OD† Thomas J. Lamb, Jr. Robert O. Pare* Walter F. Richardson, III† * Board of Investment † Audit Committee L. Stephen Lamb Thomas J. Lamb, Jr. Normand Lemay Robert H. Lodge, Sr. David G. Lussier Vincent A. Martucci Gerald J. McGraw Susan P. Moore Thomas F. Morgan, Jr. Peter D. Nolan Lionel A. Nunes Richard A. Padula Robert Padula Anthony J. Paliotta Herman Paolucci Robert O. Pare Alfred F. Pare Lester A. Parente Fred T. Perry Glen S. Petit Antonio D. Pezza Robert C. Reynolds, DDS Walter F. Richardson, III Gerald M. Roch John P. Roch Raymond J. Roch Geoffrey E. Rousselle John L. Ruzzo David J. Skurka Noel A. St. Germain Mark D. Tourgee William F. Varr James M. Vesey Anthony J. Vessella Thomas A. Vessella Thaylen H. Waltonen S. Keith White, Jr. Adrien Zarlenga “Under Ray Bolster’s stewardship, Centreville Bank has grown and prospered, and we are indebted to him for his tireless efforts to ensure the Bank’s success. Although we will miss seeing Ray on a daily basis, we are grateful for his ongoing involvement with the Bank through the Board of Trustees.” - Tom Lamb MAIN OFFICE West Warwick 1218 Main Street West Warwick, RI 02893 401-821-9100 Coventry 777 Tiogue Avenue Coventry, RI 02816 401-823-9100 Cranston 193 Comstock Parkway Cranston, RI 02921 401-464-9100 East Greenwich 495 Main Street East Greenwich, RI 02818 401-886-9100 Narragansett 1115 Boston Neck Road Narragansett, RI 02882 401-783-9300 West Greenwich 834 Victory Highway West Greenwich, RI 02817 401-397-9300 Wickford 234 West Main Street Wickford, RI 02852 401-295-7100