Bibliografia sulla conformità fiscale

advertisement

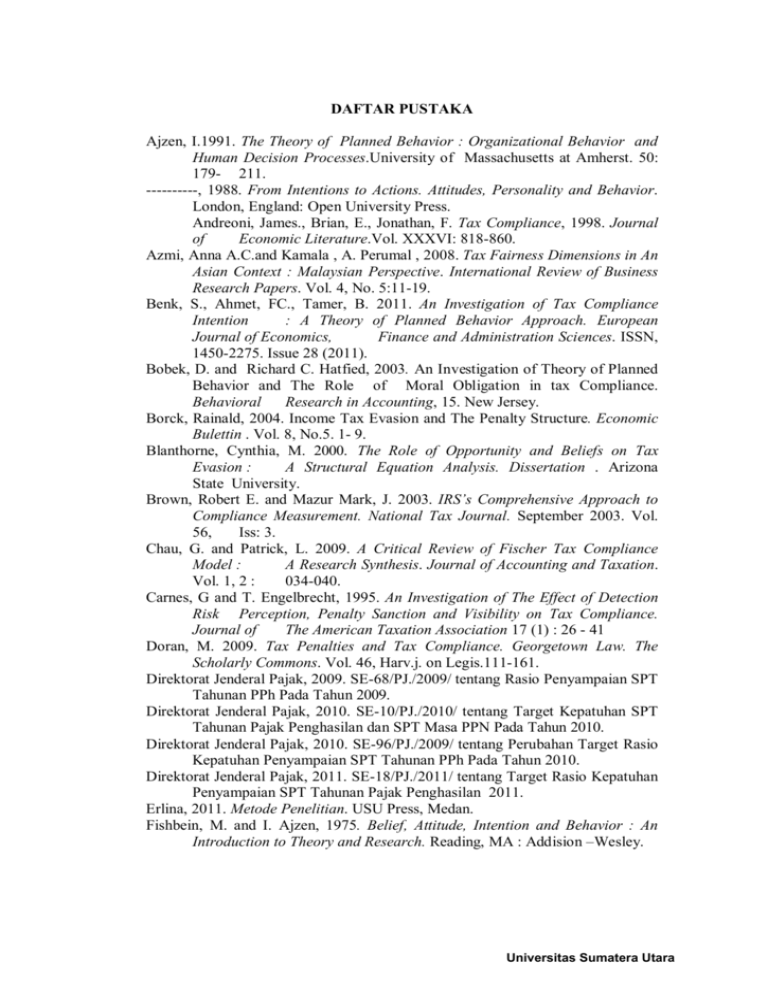

DAFTAR PUSTAKA Ajzen, I.1991. The Theory of Planned Behavior : Organizational Behavior and Human Decision Processes.University of Massachusetts at Amherst. 50: 179- 211. ----------, 1988. From Intentions to Actions. Attitudes, Personality and Behavior. London, England: Open University Press. Andreoni, James., Brian, E., Jonathan, F. Tax Compliance, 1998. Journal of Economic Literature.Vol. XXXVI: 818-860. Azmi, Anna A.C.and Kamala , A. Perumal , 2008. Tax Fairness Dimensions in An Asian Context : Malaysian Perspective. International Review of Business Research Papers. Vol. 4, No. 5:11-19. Benk, S., Ahmet, FC., Tamer, B. 2011. An Investigation of Tax Compliance Intention : A Theory of Planned Behavior Approach. European Journal of Economics, Finance and Administration Sciences. ISSN, 1450-2275. Issue 28 (2011). Bobek, D. and Richard C. Hatfied, 2003. An Investigation of Theory of Planned Behavior and The Role of Moral Obligation in tax Compliance. Behavioral Research in Accounting, 15. New Jersey. Borck, Rainald, 2004. Income Tax Evasion and The Penalty Structure. Economic Bulettin . Vol. 8, No.5. 1- 9. Blanthorne, Cynthia, M. 2000. The Role of Opportunity and Beliefs on Tax Evasion : A Structural Equation Analysis. Dissertation . Arizona State University. Brown, Robert E. and Mazur Mark, J. 2003. IRS’s Comprehensive Approach to Compliance Measurement. National Tax Journal. September 2003. Vol. 56, Iss: 3. Chau, G. and Patrick, L. 2009. A Critical Review of Fischer Tax Compliance Model : A Research Synthesis. Journal of Accounting and Taxation. Vol. 1, 2 : 034-040. Carnes, G and T. Engelbrecht, 1995. An Investigation of The Effect of Detection Risk Perception, Penalty Sanction and Visibility on Tax Compliance. Journal of The American Taxation Association 17 (1) : 26 - 41 Doran, M. 2009. Tax Penalties and Tax Compliance. Georgetown Law. The Scholarly Commons. Vol. 46, Harv.j. on Legis.111-161. Direktorat Jenderal Pajak, 2009. SE-68/PJ./2009/ tentang Rasio Penyampaian SPT Tahunan PPh Pada Tahun 2009. Direktorat Jenderal Pajak, 2010. SE-10/PJ./2010/ tentang Target Kepatuhan SPT Tahunan Pajak Penghasilan dan SPT Masa PPN Pada Tahun 2010. Direktorat Jenderal Pajak, 2010. SE-96/PJ./2009/ tentang Perubahan Target Rasio Kepatuhan Penyampaian SPT Tahunan PPh Pada Tahun 2010. Direktorat Jenderal Pajak, 2011. SE-18/PJ./2011/ tentang Target Rasio Kepatuhan Penyampaian SPT Tahunan Pajak Penghasilan 2011. Erlina, 2011. Metode Penelitian. USU Press, Medan. Fishbein, M. and I. Ajzen, 1975. Belief, Attitude, Intention and Behavior : An Introduction to Theory and Research. Reading, MA : Addision –Wesley. Universitas Sumatera Utara Fischer, Carol, M., Wartick, Martha, Mark , Melvin, M. 1992. Detection Probability and Taxpayer Compliance : A review of Literature. Journal of Accounting Literature.Vol. 11. Ghozali, Imam, 2006. Aplikasi Analisis Multivariate dengan Program SPSS. Badan Penerbit Universitas Diponegoro, Semarang. Hamonangan, T. dan Imam, M. 2012. Dimensi Ekonomi Perpajakan Dalam Pembangunan Ekonomi. Penerbit Raih Asa Sukses, Jakarta Israel, Glenn.D., 1992. Determining Sample Size, University of Florida. James, Simon and Clinton, Alley.,1999. Tax Compliance, Self Assessment and Tax Aministration. Journal of Finance and Management in Public Service. Vol. 2, No. 2 : 27 - 42. Kirchler, E., 2007. The Economic Psychology of Tax Behaviour. Cambridge University Press, Cambridge. Majalah Berita Pajak, November 2011. Sadar Pajak, Mau Mulai Kapan?. Penerbit Koperasi Pegawai Kantor Pusat DJP, Jakarta. Mardiasmo, 2011. Perpajakan. Edisi revisi. Penerbit Andi, Yogyakarta. Marti, Lumumba O., Migwi, SW., Peterson , OM., John, MM. 2010. Tax Payers’ Attitudes and Tax Compliance Behaviour in Kenya. African Journal of Business and Management. Vol. 1, 1-11. Mustikasari, Elia, 2007. Kajian Empiris tentang Kepatuhan Wajib Pajak Badan di Perusahaan Industri Pengolahan di Surabaya. Simposium Nasional Akuntansi X, Makassar. Napitupulu, Krisman, 2008. Analisis Faktor-Faktor Yang Mempengaruhi Kepatuhan Wajib Pajak Badan di Kantor Pelayanan Pajak Pratama Medan-Belawan. Tesis. Universitas Sumatera Utara, Medan. Palil, Mohd Rizal, and Ahmad . F. Mustapha , 2011. Determinants of Tax Compliance in Asia : A Case of Malaysia. European Journal of Social Sciences.Vol. 24, No. 9 : 7-32. Posner, Eric A., 2009. Law and Social Norms : The Case of Tax Compliance. Virginia Law Review, Vol. 86, 1781-1819. Rubin, D., 1978. Bayesian Inference for Causal Effects : The Role Of Randomization. The Annals Statistics. Vol.8, No. 1 :34-58. Saad, Natrah., 2009. Fairness Perceptions and Compliance Behaviour. The Case of Salaried Taxpayers in Malaysia After Implementation of the Self Assessment System. E.Journal of Tax Research. Vol. 8, No. 1: 32-63. Sarker, TP., 2003. Improving Tax Compliance in Developing Countries Via Self Assessment System – What Could Bangladesh Learn from Japan? AsiaPacific Tax Bulletin. Vol. 9 No. 6: 1-34. Schwarz, Norbert and Gerd, Bohner, 2001. The Construction of Attitudes. Intrapersonal Processes ( Blackwell Handbook of Social Psychology. Oxford. UK : Balkwell, 436-457. Sugiyono, 2008. Metode Penelitian Bisnis. Penerbit Alfabeta, Bandung. Thomkins, C., Packman ,C., Russel,S. and Colviele , I. 2001. Managing Tax Regime : A Call For Research, Public Administration, 79 (3) : 751758. Trivedi, Viswanath Umashanker., Mohamed ,S., and Bernadette, L. 2003. Impact of Personal and Situasional Factors on Taxpayer Compliance : An Experimental Analysis. Journal of Business Ethics.47 : 75-197. Universitas Sumatera Utara Trivedi, VU., Mohamed ,S., and Stuart, M. 2005. Attitudes, Incentives and Tax Compliance. Canadian Tax Journal .Vol. 53 No. 1 : 30-58. Wenzel, M., 2004. An Analysis of Norm Processes in Tax Compliance. Journal of Economic Psychology. 25 : 213-228 Universitas Sumatera Utara