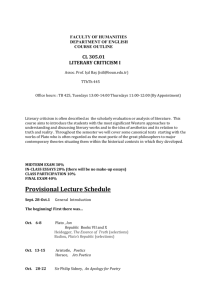

Volume 322

advertisement

MITI in the News

Malaysia to Lead Conversations on ASEAN Economic

Integration at WEF 2015

One of the objectives of Malaysia’s participation

at the forum is to promote Malaysia as the premier

investment location and tourist destination in Asia.

Malaysia’s participation at this year

World Economic Forum (WEF) reflects

its commitment to shape the global

trade agenda, and lead conversations

on ASEAN economic integration,

International Trade and Industry Minister

Dato’ Sri Mustapa Mohamed said.

“This is an important year for

Malaysia and as Chair of ASEAN,

we must be in the forefront in

ensuring the realisation of the ASEAN

Economic

Community

(AEC).

“We must take the opportunity to

engage the international business

community and civil society and lead by

example,” he said in a statement Friday.

It also aimed at promoting Kuala Lumpur as the premier

location for multinational companies regional headquarters;

to showcase Malaysia’s economic transformation success,

and to highlight Malaysia’s role as Chair of ASEAN,

specifically the emphasis on a people-centered ASEAN.

The Prime Minister will be participating in the following

WEF sessions, namely the ASEAN Regional Business

Council; the Informal Gathering of World Economic

Leaders (IGWEL): ‘Defining the Imperatives for 2015’;

and the ASEAN Leader session-Channel NewsAsia-TV

Debate: “Creating the ASEAN Economic Community”.

Najib will be meeting several heads of state and chief

executive officers of prominent global corporations

with

keen

investment

interests

in

Malaysia.

Apart from the meetings and speaking engagements, the

Prime Minister and the ministers will also host roundtables

with business leaders and a special event to promote Malaysia.

Prime Minister Datuk Seri Najib Tun

Razak will be attending the two-day

forum from Jan 23 in Davos, Switzerland.

The WEF is an independent global forum for engagement

and dialogue involving stakeholders from business and

political fraternities, academia and other societal leaders to

shape opinions on the global, regional and sectoral agenda.

Najib, who is also Finance Minister,

will be accompanied by Mustapa

and Minister in the Prime Minister’s

Department Datuk Seri Wahid Omar.

The forum, under the theme “The New Global

Context”,

will

discuss

and

address,

among

others, industry and business related issues in

the context of current global economic scenario.

Source: Bernama, 16 January 2015

MITI Weekly Bulletin / www.miti.gov.my

“DRIVING Transformation, POWERING Growth”

The

delegation

also

includes

several

prominent

Malaysian

business

leaders

as

well as heads of investment-related agencies.

01

Mustapa Meets Counterpart In India

International Trade and Industry Minister Dato’ Sri Mustapa Mohamed met Indian Commerce and

Industry Minister Nirmala Sitharaman and discussed the strong bilateral ties between the two nations.

Among others, India requested Malaysia, which is the current chair of ASEAN, to take up a more proactive

role in the negotiations for the Regional Comprehensive Economic Partnership (RCEP) trade pact.

Mustapa

of the

said Malaysia considered the conclusion of the RCEP negotiations as one

deliverables during Putrajaya’s chairmanship of the 10-member grouping.

There are ample political will to conclude the negotiations, he said during the 15-minutes meeting

held on the sidelines of the Confederation of Indian Industry Partnership Summit 2015 here today.

RCEP is a proposed free trade agreement, which involves the 10 members of ASEAN and

six other nations namely Australia, China, India, Japan, South Korea and New Zealand.

The negotiations for RCEP, which involves 3 billion people and a combined Gross Domestic Product

of US$17 trillion, were formally launched in November 2012 at the ASEAN Summit in Cambodia.

Mustapa was also hopeful that Indian Prime Minister Narendra Modi will visit Malaysia this year.

Source: Bernama, 16 January 2015

Malaysian Businessmen Told to Gear Up for

ASEAN Competition

Local companies, both big and small,

need to “up their game” and gear up for

competition with the upcoming ASEAN

Economic Community (AEC) this year.

“With the market liberalisation, we’re talking

about an economic community,” said International

Trade and Industry Ministry ASEAN Economic

Cooperation Division, Senior Director P.

Ravidran at a media roundtable yesterday on

the impact of the ASEAN Free Trade Area on

the commercial vehicle and logistics industry.

“The Government has put in place

movements to remove barriers to trade,

so it’s up to the private sector to take

advantage and adjust their business models.”

“If you want to grow, you have to ensure that there’s

more trade taking place and logistics has to be

efficient.” He added that the long term target was to

grow intra-ASEAN trade to 34%. “Logistics is one

of the 12 priority integration sectors in ASEAN. You

have to move cargo efficiently and that saves cost

for businesses. “So logistics shall and will remain

an important component of international trade.”

The

upcoming

AEC

is

expected

to

promote

the

harmonisation

of

rules

and

ease

trading

within

the

region.

“We need harmonisation of rules. We can’t have 10

different standards,” he said. “If I were a company

and I had to manufacture a product conforming

to 10 different standards, it’s not economical.”

He added that local companies could not just rely

on the domestic market for growth. “You have to

export and with the removal of barriers to trade,

it’s not just for the big companies to benefit,

but also small and medium-sized enterprises.”

The roundtable was organised by Asian Trucker

magazine and featured speakers from the

logistics industry. Asian Trucker magazine

editor Stefan Pertz noted that the Malaysian

Government had an important role to play

when it came to providing clear guidelines on

cross border land transportation to the industry.

According to reports, the 10-member ASEAN has

completed over 83% or 366 out of 436 economic

integration measures under the AEC. About

90% of the integration measures are expected to

“This is to ensure there will be no confusion

and hiccups for companies which are

operating in their respective countries when

goods

are

transported

across

borders.”

MITI Weekly Bulletin / www.miti.gov.my

“DRIVING Transformation, POWERING Growth”

be achieved by the end of this year. The AEC will

be announced in November this year during the

27th ASEAN Summit. Ravidran noted that the local

logistics sector could benefit significantly from

the AEC. “As at 2013, intra-ASEAN trade is 24%

but logistics is an important component of trade.

Source: Bernama, 15 January 2015

02

Malaysia

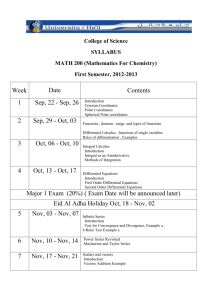

Manufacturing Sector Performance

Manufacturing Indicators, Jan - Nov 2014

Exports

Imports

IPI*

Sales

RM535.1 bil.

RM538.3 bil.

122.3

5.9%

RM600.1 bil.

6.2%

Jul

Aug Sep Oct Nov

49.6

45.9

49.2

52.1

46.6

49.2

50.4

49.4

49.8

47.9

44.4

41.6

48.3

48.3

49.6

49.1

47.4

46.2

Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun

47.9

49.7

49.8

50.8

51.9

49.5

Jul

48.1

47.5

48.6

48.4

43.4

44.3

43.4

45.0

42.2

47.0

45.0

48.2

46.8

50.5

40

38.9

38.4

42.8

45.6

50

49.9

55.3

6.1%

Monthly Trade Value

60

RM billion

RM31.3 bil.

1,030,383

persons

1.5%

49.1

48.0

5.4%

7.3%

Employment Salaries & Wages

30

20

10

Jan Feb Mar Apr May Jun

2014

Exports

Imports

Monthly Employment and Salaries & Wages

1,055

3.10

3.03

2.90

2.86

1,045

1,040

2.78

1,035

1,025

2.74

2.67

2.65

1,030

2.68 2.68

2.62

2.66

3.00

2.86

2.77

2.69

2.86 2.87 2.85

2.82

2.82 2.84 2.84

2.90

2.80

2.70

2.72

2.60

2.58

1,030

1,029

1,031

1,033

1,031

1,033

1,029

1,027

1,025

1,021

1,029

1,018

1,015

1,014

1,015

1,016

1,018

1,022

1,010

1,026

2.40

1,024

1,015

1,025

2.50

1,016

1,020

1,023

Employment ('000 persons)

1,050

2.30

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov

2013

2014

2013

Note: *IPI = Industrial Production Index

% refers to y-o-y growth

MITI Weekly Bulletin / www.miti.gov.my

2014

129.0

123.4

126.1

123.4

Aug

125.9

124.1

Jul

124.3

119.9

122.1

111.1

115.9

121.0

119.0

125.0

120.4

114.9

120.3

115.3

2013

Oct

Nov

Sep

Jun

Apr

May

Mar

Feb

Jan

Dec

Nov

Oct

Sep

Aug

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov

Jul

44

Jun

46.1

May

51.4

115.1

54.3

114.8

53.3 53.1 53.3

114.1

53.5

Apr

46

49.4

53.0

Mar

48

50.0

50.3

53.8

Monthly IPI

110.6

50

51.3

53.1 53.2

55.6

135

130

125

120

115

110

105

100

95

90

101.1

RM billion

54

55.1

55.8 55.5

55.1

54.8

Jan

54.0

55.9

Industrial Production Index (2010=100)

Monthly Sales

56

52

Salaries & Wages

Feb

Employment

58

“DRIVING Transformation, POWERING Growth”

2013

Salaries & Wages (RM billion)

0

2014

Source: Malaysia Department of Statistics

03

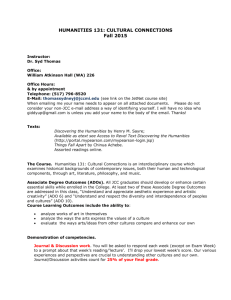

Trade of Manufacturing Products, Jan-Nov 2014

Export in Manufacturing

2013: RM548.1 billion

Jan-Nov 2014: RM535.1 billion

Import in Manufacturing

2013: RM559.8 billion

Jan-Nov 2014: RM538.3 billion

Employment

IPI

IPI (2010=100)

Employment (persons)

313,426

317,434

E&E

125,584

128,721

Chemicals

Metal

86,855

86,565

Wood And Wood Products

Transport Equipment

74,726

74,852

Transport Equipment

59,029

59,478

Non-Metallic Minerals

Products

Textiles & Apparel

38,552

41,686

Machinery & Equipment

132.6

124.0

127.8

113.4

Palm Oil

Rubber Products

41,396

43,254

118.4

Metal

74,138

76,969

Processed Food And

Beverages

115.0

E&E

103,337

101,905

Wood And Wood Products

113.4

Chemicals

122.0

103.9

108.8

129.7

148.6

112.9

Processed Food And Beverages

Jan-Nov 2013

Jan-Nov 2014

121.9

114.2

Non-Metallic Minerals Products

121.8

123.8

Rubber Products

22,454

22,566

“DRIVING Transformation, POWERING Growth”

Select Indicators in Manufacturing Sector by Major Industries,

Jan-Nov 2014

122.3

109.9

Machinery & Equipment

115.9

Jan-Nov 2013

Jan-Nov 2014

Sales

Source: Malaysia Department of Statistics

MITI Weekly Bulletin / www.miti.gov.my

04

“ASEAN and You”

Save the Date...

ASEAN-OECD Conference And Meetings On Good Regulatory Practice

The government of Malaysia, as the 2015 Chair of ASEAN together with the Organisation for

Economic and Co operation Development (OECD) as its knowledge partner will host three events

on 9-12 March 2015 to assist embedding Good Regulatory Practice (GRP) across ASEAN in 2015:

Hosted by the Chief Secretary to the Government of Malaysia, this high level meeting

will focus on the role of GRP to drive more responsive public administration. The meeting

will bring together the Heads of Public Administrations, Prime Minister’s Offices, Cabinet

Secretaries, and Secretaries-General of the Government from across ASEAN and OECD

countries.

Tuesday 10 – Wednesday 11 March 2015: ASEAN-OECD GRP

Conference

The conference will provide a high-level platform to initiate a broader agenda on GRP

within ASEAN that can support closer intra- and inter-regional connectivity and economic

integration. The conference will bring together government officials and regulators from

AMS and OECD countries, representatives of business and civil society, academia, regional

and international organisations.

“DRIVING Transformation, POWERING Growth”

Monday 9 March 2015: ASEAN OECD Centres of Government

Meeting (by invitation)

Thursday 12 March: ASEAN OECD Good Regulatory Practices

Network Meeting (by invitation)

Chaired by Malaysia and New Zealand, this meeting will provide a government-togovernment discussion on advancing the GRP agenda nationally as well as regionally. The

meeting will bring together senior officials responsible for GRP initiatives in individual AMS,

with the support of OECD peers.

More detailed information, including an agenda, invite and registration forms will be forthcoming

in early 2015. For further information please contact: 2015GRPConference@oecd.org

MITI Weekly Bulletin / www.miti.gov.my

05

International Report

US Trade Performance

US Trade, Jan - Nov 2014

US Trade in Goods and Services,

Jan - Nov 2014

US$ billion

Exports

Imports

Total

Trade

270

1,500.9

2,173.1

3,674.0

250

Goods

Services

Goods & Services

649.7

437.5

1,087.2

2,150.7

2,610.5

4,761.2

Imports

US$11.9 bil.

US$28.2 bil.

242.2

242.3

246.5

239.7

230

245.1

238.6

234.8

225.6

231.3

Trade Balance: Export - Imports

US Bilateral Trade in Goods

with Malaysia, Jan - Nov 2014

Exports

253.3

Imports

210

206.5

211.3

201.4

199.1

190

194.3

198.6

198.4

193.8

196.0

193.4

Exports

188.0

181.3

170

150

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Source: CEIC Database

Top 10 Richest

Nations in the

World

3

7

UAE

4

1

Qatar

Luxembourg

GDP per capita

US$91,379

Norway

GDP per capita

US$57,774

GDP per capita

US$56,920

Switzerland

Netherlands

GDP per capita

US$46,424

2

8

GDP per capita

US$42,447

5

Singapore

GDP per capita

US$56,797

9 Ireland

GDP per capita

US$39,999

GDP per capita

US$89,862

6

USA

“DRIVING Transformation, POWERING Growth”

Do you know?

GDP per capita

US$47,084

10

Austria

GDP per capita

US$39,711

Source: www.worldatlas.com

MITI Weekly Bulletin / www.miti.gov.my

06

Number and Value of Preferential Certificates of Origin (PCOs)

Number of Certificates

23 Nov 2014 30 Nov 2014

7 Dec 2014

14 Dec 2014

21 Dec 2014 28 Dec 2014

4 Jan 2015

11 Jan 2015

AANZFTA

966

915

919

602

879

746

766

819

AIFTA

503

513

601

458

589

416

441

498

AJCEP

206

138

285

191

188

173

134

325

ATIGA

4,899

4,138

4,749

3,925

4,731

3,336

4,021

3,967

ACFTA

1,514

1,477

1,664

1,405

1,638

1,336

1,167

1,231

AKFTA

930

640

741

750

840

633

597

585

MICECA

316

253

274

251

305

223

314

267

MNZFTA

0

9

6

12

11

4

9

10

MCFTA

80

59

89

65

79

42

48

61

MAFTA

489

409

336

328

379

322

341

375

MJEPA

926

790

967

773

713

702

741

948

MPCEPA

106

157

143

151

113

122

124

157

GSP

100

158

122

93

162

136

94

144

Notes: The preference giving countries under the GSP scheme are Japan, Switzerland, the Russian Federation, Norway, Cambodia and Kazakhstan.

MPCEPA: Malaysia-Pakistan Closer Economic Partnership

Agreement (Implemented since 1 January 2008)

ATIGA: ASEAN Trade in Goods Agreement

(Implemented since 1 May 2010)

AJCEP: ASEAN-Japan Comprehensive Economic Partnership

(Implemented since 1 February 2009)

ACFTA: ASEAN-China Free Trade Agreement

(Implemented since 1 July 2003)

AKFTA: ASEAN-Korea Free Trade Agreement

(Implemented since 1 July 2006)

AIFTA: ASEAN-India Free Trade Agreement

(Implemented since 1 January 2010)

MJEPA: Malaysia-Japan Economic Partnership

Agreement (Implemented since 13 July 2006)

MICECA: Malaysia-India Comprehensive Economic

Cooperation Agreement (Implemented since 1 July 2011)

MNZFTA: Malaysia-New Zealand Free Trade Agreement

(Implemented since 1 August 2010)

MCFTA: Malaysia-Chile Free Trade Agreement

(Implemented since 25 February 2012)

MAFTA: Malaysia-Australia Free Trade Agreement

(Implemented since 1 January 2013)

200

10,000

180

9,000

160

8,000

140

7,000

120

6,000

RM miliion

RM million

Value of Preferential Certificates of Origin

100

80

5,000

4,000

60

3,000

40

2,000

20

1,000

0

23 Nov

30 Nov

7 Dec

14 Dec

21 Dec

28 Dec

4 Jan

11 Jan

AANZFTA

95

81

82

43

73

66

80

115

AIFTA

82

112

150

99

123

77

178

110

AJCEP

91

41

100

87

78

50

34

136

0

30 Nov

7 Dec

14 Dec

21 Dec

28 Dec

4 Jan

11 Jan

2,630

698

755

590

9,561

2,489

790

561

ACFTA

621

648

927

764

852

414

451

306

AKFTA

192

929

875

538

245

137

126

656

300

90

80

250

70

200

60

50

RM million

RM million

23 Nov

ATIGA

40

30

150

100

20

50

10

0

“DRIVING Transformation, POWERING Growth”

AANZFTA: ASEAN-Australia-New Zealand Free Trade Agreement

(Implemented since 1 January 2010)

0

23 Nov

30 Nov

7 Dec

14 Dec

21 Dec

28 Dec

4 Jan

11 Jan

23 Nov

30 Nov

7 Dec

14 Dec

21 Dec

28 Dec

4 Jan

11 Jan

MICECA

38.94

38.97

37.51

30.00

60.61

31.94

53.02

44.94

MJEPA

155

274

159

128

125

93

179

145

MNZFTA

0.00

0.22

0.40

0.14

0.12

0.07

0.07

0.31

MPCEPA

12

18

13

42

14

14

11

34

MCFTA

9.44

9.84

37.71

7.43

14.55

9.35

14.10

12.17

GSP

14

19

14

16

19

17

14

20

MAFTA

78.68

58.87

29.20

24.05

33.37

24.97

47.84

28.88

Source: Ministry of International Trade and Industry, Malaysia

MITI Weekly Bulletin / www.miti.gov.my

07

Malaysian Ringgit Exchange Rate with British Pound Sterling

and Singapore Dollar, January - December 2014

British Pound Sterling (GBP)

Singapore Dollar (SGD)

5.60

2.70

1 GBP = RM 5.44

5.40

2.65

5.20

2.60

5.00

2.55

1 SGD = RM 2.65

4.80

2.50

4.60

2.45

4.40

2.40

4.20

2.35

4.00

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2013

2.30

2014

Source : Bank Negara Malaysia

Gold and Silver Prices, 31 October 2014 - 16 January 2015

Gold

41.1

41.0

US$/Oz

18.0

Silver

17.5

17.2

17.0

40.0

16.5

39.0

38.0

16.2

16.0

37.4

15.5

37.0

16 Jan

9 Jan

2 Jan

26 Dec

19 Dec

12 Dec

5 Dec

28 Nov

21 Nov

14 Nov

31 Oct

16 Jan

9 Jan

2 Jan

26 Dec

19 Dec

12 Dec

5 Dec

28 Nov

21 Nov

14.0

14 Nov

35.0

7 Nov

14.5

31 Oct

36.0

7 Nov

15.0

Source : http://www.gold.org/investments/statistics/gold_price_chart/

“DRIVING Transformation, POWERING Growth”

US$/Gram

42.0

Aluminium, Nickel and Copper Prices, January - December 2014

US$/mt

20,000

17,500

15,962

15,000

12,500

10,000

6,446

7,500

5,000

1,909

2,500

Jan Feb Mar Apr May Jun

Jul

Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun

2013

Jul

Aug Sep Oct Nov Dec

2014

Aluminum

Copper

Nickel

Source : http://econ.worldbank.org

MITI Weekly Bulletin / www.miti.gov.my

08

Commodity Prices

Crude

Commodity Petroleum

(per bbl)

Crude

Palm Oil

(per MT)

Raw

Sugar

(per MT)

Rubber

SMR 20

(per MT)

Cocoa

SMC 2

(per MT)

Coal

(per MT)

Scrap Iron

HMS

(per MT)

n.a (high)

n.a (low)

16 Jan 2015

(US$)

48.7

701.0

335.3

1,396.5

2,187.8

51.6

% change*

0.7

0.7

11.1

3.9

3.3

3.6

n.a

n.a

2014i

54.6 - 107.6

823.3

352.3

1,718.3

2,615.8

59.8

370.0

2013i

88.1 - 108.6

805.5

361.6

2,390.8

1,933.1

..

485.6

Notes: All figures have been rounded to the nearest decimal point

* Refer to % change from the previous week’s price

i Average price in the year except otherwise indicated

n.a Not availble

Source : Ministry of International Trade and Industry Malaysia, Malaysian Palm Oil Board, Malaysian Rubber Board, Malaysian Cocoa Board,

Malaysian Iron and Steel Industry Federation, Bloomberg and Czarnikow Group

Crude Petroleum

(16 January 2015)

US$48.7 per bbl

Highest

(US$ per bbl)

Lowest

(US$ per bbl)

2015

2 Jan 2015: 53.8

2015

9 Jan 2015: 48.4

2014

13 June 2014: 107.6

2014

26 Dec 2014: 54.6

Average Domestic

Prices, 9 Jan 2015

Billets

(per MT)

RM1,600 - RM1,700

“DRIVING Transformation, POWERING Growth”

Highest and Lowest Prices, 2014/2015

Crude Palm Oil

(16 January 2015)

US$701.0 per MT

Highest

(US$ per MT)

Lowest

(US$ per MT)

2015

16 Jan 2015: 701.0

2015

9 Jan 2015: 696.1

2014

14 Mar 2014: 982.5

2014

26 Dec 2014: 664.0

MITI Weekly Bulletin / www.miti.gov.my

Steel Bars

(per MT)

RM1,900 - RM2,000

09

Commodity Price Trends

Rubber SMR 20

Crude Palm Oil

760

1,600

748.0

740

1556.5

720

1,550

716.0

700.5

710.5

699.2

696.1

669.0

660

1525.0

1,500

681.5

680

1541.0

701.0

US$/mt

1,520.5

1,513.0

1,481.0

1,481.0

1482.0

1,470.5

1,450

664.0

1,453.0

1,436.5

640

1,400

1,396.5

620

1,350

600

31 Oct 7 Nov 14 Nov 21 Nov 28 Nov 5 Dec 12 Dec 19 Dec 26 Dec 2 Jan

31 Oct 7 Nov 14 Nov 21 Nov 28 Nov 5 Dec 12 Dec 19 Dec 26 Dec 2 Jan

9 Jan 16 Jan

Cocoa

2,559.9

2,500

Raw Sugar

350

2,529.0

330

2,400

2,352

2,300

2,326.7

2,288.1

2,326.7

US$/mt

2,280.4

2,280.4

2,200

328.5

335.3

332.5

322.0

324.0

320

319.8

2,187.8

2,117.5

301.8

290

280

31 Oct 7 Nov 14 Nov 21 Nov 28 Nov 5 Dec 12 Dec 19 Dec 26 Dec 2 Jan

9 Jan 16 Jan

31 Oct 7 Nov 14 Nov 21 Nov 28 Nov 5 Dec 12 Dec 19 Dec 26 Dec 2 Jan

Crude Petroleum

Coal

54.0

77.9

76.7

74.4

75

53.5

70

53.3

53.0

53.1

66.4

65

60

US$/mt

58.1

59.1

55

56.4

54.6

53.8

50

52.0

52.0

51.8

48.4

48.7

9 Jan

16 Jan

31 Oct 7 Nov 14 Nov 21 Nov 28 Nov 5 Dec 12 Dec 19 Dec 26 Dec 2 Jan

170.0

154.6

355.0

150.0

345.0

330.0

320.0

320.0

320.0

320.0

320.0

310

110.0

114.8

111.8

100.6

90.0

300.0

Scrap Iron/MT (High)

Scrap Iron/MT(Low)

31 Oct 7 Nov 14 Nov 21 Nov 28 Nov 5 Dec 12 Dec 19 Dec 26 Dec 2 Jan

70.0

74.0

68.0

9 Jan 16 Jan

2013

Apr

May

Mar

Jan

Feb

Sep

Jan

50.0

Jul

300.0

Aug

300.0

Jun

300.0

Apr

300.0

May

300.0

Mar

300.0

81.0

92.6

82.4

Feb

300.0

290

96.1

92.7

Dec

320.0

Oct

320.0

Sep

320.0

135.8

132.6

134.2 136.3

121.4

128.1

127.2

114.6

Jul

320.0

137.1

124.0

Aug

330

137.4

139.9

130.0

US$/dmtu

345.0

150.5

Jun

355.0

350

US$/mt

9 Jan 16 Jan

Iron Ore

Scrap Iron

270

51.6

51.0

370

280

51.8

51.7

50.5

31 Oct 7 Nov 14 Nov 21 Nov 28 Nov 5 Dec 12 Dec 19 Dec 26 Dec 2 Jan

300

52.8

51.5

45

320

52.8

52.5

Oct

US$/bbl

53.5

53.3

53.0

68.7

340

9 Jan 16 Jan

“DRIVING Transformation, POWERING Growth”

300

2,000

360

314.0

309.3

2,218.8

2,100

80

314.8

314.5

310

Dec

US$/mt

337.8

340

2,513.6

Nov

2,600

9 Jan 16 Jan

Nov

US$/mt

700

720.0

732.0

2014

Source : Ministry of International Trade and Industry Malaysia, Malaysian Palm Oil Board, Malaysian Rubber Board, Malaysian Cocoa Board,

Malaysian Iron and Steel Industry Federation, Bloomberg and Czarnikow Group.

MITI Weekly Bulletin / www.miti.gov.my

10

SUCCESS sTORY

MARRYBROWN, winner of numerous domestic and

international franchise industry awards, is proudly Malaysianowned and has over 30 years of franchise experience under its

belt. The homegrown fast food chain is currently the world’s

largest Halal Quick Service Restaurant (QSR) brand originating

from Asia. MARRYBROWN has a strong international presence

with outlets operating in Malaysia, China, Indonesia, India,

Sri Lanka, Maldives, Africa, the Middle East and Myanmar.

The halal menu features a wide variety of tasty meals

including Crispy Chicken, Delicious Satay Burger, Nasi

Marrybrown, Speciality Wrap, Fish ‘n’ Chips, Mi Kari,

Chicken Porridge, finger foods, salads, fun fries and a range

of hot and cold beverages and desserts – the only one of its

kind in town and really “ something different “ for everyone.

The founder of Marrybrown, Datin Nancy Liew had a clear vision

of what shewanted Marrybrown to be when she started the first

restaurant in Johor Bahru. With firm conviction and commitment,

she built a brand name that can offer good food at a great price, in

a fun, friendly and comfortable atmosphere. This was the business

concept upon which Marrybrown was founded. Building one of

the most successful franchise chains in the country and globally,

Liew relentlessly worked to ensure that the company continued its

winning streak to become a global food service organisation and a

worldwide brand that resonates with excellence and high quality.

When speaking of the future, the awardwinning Marrybrown

seeks to grow aggressively as an international franchise chain.

Contact Us..

Today, Marrybrown offers a broad selection of

distinctive, innovative products targeted at the

fast-food consumer. Chicken represents the core

of the menu, including the signature Lucky Plate,

Chicken Porridge, Nasi Marrybrown the 100%

Black Pepper Chicken-A-Licious. And, because

value is important to fast-food customers, the

company also offers value-priced products on

“All-Time snacks,” including muffins, burgers.

“DRIVING Transformation, POWERING Growth”

Marrybrown, was founded in 1981, as a restaurant company

that operates and franchises Marrybrown restaurants, through

15 countries throughout Asia, Middle East, and Africa.

Marrybrown is among the nation’s leading fast-food chains,

with more than 130 quick-serving restaurants in Malaysia

and more than 350 international restaurants. As the first

major fast-food chain to develop and expand the concept of

“Something Different”experiences. Marrybrown has always

emphasized on halal products serving millions of guests worldwide.As a winner of numerous awards, Marrybrown is fast

expanding internationally ensuring that Marrybrown becomes

a global food service organization and a worldwide brand.

Our company vision is “To be a national

restaurant company of most admired brand –

through the power of our people and our culture”.

Marrybrown Sdn. Bhd. (166331-X)

Headquaters:

No.3 & 5, Jalan Dewani 3

Kawasan Perindustrian Dewani

81100 Johor Bahru

Johor, Malaysia.

+607 331 6590

+607 333 7899

mbcare@marrybrown.com

MITI Weekly Bulletin / www.miti.gov.my

11

MITI Programme

MITI Brainstorming 2015,

Cyberview Lodge & Resort Cyberjaya, 16 - 17 January 2015

MITI Weekly Bulletin / www.miti.gov.my

“DRIVING Transformation, POWERING Growth”

Syndication Session on Coordination of National Investment

Agenda and National Export Strategies, 17 January 2015

12

MITI Cycling Team at the 2nd Car Free Morning, 18 January 2015

“DRIVING Transformation, POWERING Growth”

MITI Weekly Bulletin / www.miti.gov.my

13

Name

: Mohd Shahar Md Sabri

Designation

Job Description

: Administrative Assistant

: Responsible to assist

maintenance matters for

MITI building and handling

damage complaints

: Logistics and

Administration Unit

: shah@miti.gov.my

: 03-62000236

Division

Email

Contact No.

: Hashimah Abu Kasim

Designation

Job Description

: Administrative Assistant

: Responsible for

logistics and building

maintenance in MITI

: Logistics and

Administration Unit

: hashimah.kasim@miti.gov.my

: 03-62000232

Division

Email

Contact No.

Comments & Suggestions

“DRIVING Transformation, POWERING Growth”

Name

Dear Readers,

Kindly click the link below for any comments in this issue. MWB reserves the right to edit and to republish

letters as reprints.

http://www.miti.gov.my/cms_matrix/form.jsp?formId=c1148fbf-c0a81573-3a2f3a2f-1380042c

MITI Weekly Bulletin / www.miti.gov.my

14