Christmas & New Year Message

advertisement

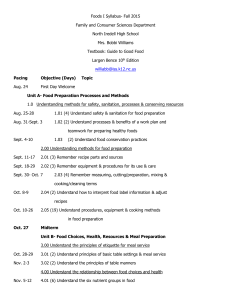

Christmas & New Year Message O n behalf of the MITI family, I wish to extend to all MWB readers in Malaysia and all over the world a Merry Christmas and a Happy Christmas cheer at welfare homes, orphanages, centres for the disabled and hospitals. Indeed, this is a proof that the caring society concept is well and alive in Malaysia. 2016 is a special year for MITI as we will be operating from our new premises, Menara MITI at Jalan Sultan Haji Ahmad Shah which has green building features. I hope this new environment will boost our commitment and further improve our service delivery to better serve the public. Once again, I would like to take this opportunity to wish all MWB readers a wonderful Christmas filled with blessings and a Happy New Year 2016. Thank you Dato’ Sri Mustapa Mohamed Minister of International Trade and Industry Malaysia MITI Weekly Bulletin / www.miti.gov.my “DRIVING Transformation, POWERING Growth” New Year 2016. The same way we celebrate all other religious festivities, Malaysians regardless of faith and background are once again exchanging greetings and celebrating the New Year in the true spirit of harmony. As we usher into the New Year, let us reflect on our performance in 2015. Despite the global economic uncertainties and challenges, our nation has performed well registering a growth of 4.7% in the third quarter of 2015, supported mainly by private sector demand. Total trade expanded by RM15.4 billion to RM377.5 billion, registering a sizeable trade surplus of RM22.2 billion while foreign direct investments of RM9.8 billion was recorded in the third quarter of 2015. These statistics reaffirm the confidence of investors in Malaysia’s economic fundamentals and will further strengthen Malaysia’s position as the preferred investment destination in the world. In 2015, MITI successfully hosted the 47th ASEAN Economic Ministers’ (AEM) Meeting. The establishment of the ASEAN Economic Community (AEC) in 2015 is a major milestone for the regional economic integration agenda in ASEAN, offering opportunities in the form of a huge market of US$2.6 trillion and over 622 million people. The AEC Blueprint 2025, adopted by the ASEAN Leaders at the 27th ASEAN Summit on 22 November 2015 in Kuala Lumpur, Malaysia, provides broad directions through strategic measures for the AEC from 2016 to 2025. On 5 October 2015 Malaysia and the other TPP partner countries’ reached agreement on the TPPA in Atlanta, marking the conclusion of the TPPA negotiations which began in 2010. The TPP will bring higher standards to nearly 40 percent of the global economy. In addition to liberalising trade and investment between member countries, the agreement addresses the challenges that we face in the 21st century, while taking into account the diversity of our levels of development. This historic agreement is expected to promote economic growth, support higher-paying jobs; enhance innovation, productivity and competitiveness; raise living standards; reduce poverty in our countries; and promote transparency, good governance, and strong labor and environmental protections. Let us not forget that peace and harmony that we enjoy today is due to sacrifices of our forefathers who planted seeds of acceptance when they put their differences aside to gain independence for the nation. We must not let their sacrifices be in vain by spreading ethnic sentiments, which not only have a negative impact on race relations, but also the way people outside Malaysia view our country. In celebrating this joyous occasion, let us also remember the less fortunate members of society by doing our bit to lend a helping hand. I am glad to note that many companies and even individuals are spreading Malaysia Approved Investments in Manufacturing Sector Jan - Sept 2015 Total Capital Investment RM67.7 billion Projects 522 Domestic : RM50.5 billion Foreign : RM17.2 billion Source : Malaysian Investment Development Authority Aprroved Investments in Manufacturing Sector, 2005 - Sept 2015 RM billion 60 50.48 50 40 2006 2007 2013 2014 17.23 39.59 21.56 2008 2009 2010 2011 2012 Domestic Investment Foreign Investment 30.54 20.92 34.15 20.21 21.94 29.06 18.12 10.49 22.14 46.10 16.69 33.43 26.51 25.77 2005 20.23 0 17.88 10 13.17 20 32.26 30 Jan-Sept, 2015 Source : Malaysian Investment Development Authority MITI Weekly Bulletin / www.miti.gov.my “DRIVING Transformation, POWERING Growth” Pontential Employment 50,179 Approved Investments in Manufacturing Projects with Foreign Participation by Major Country, Jan - Sept 2015 Total Foreign Investment RM 17.2billion Hong Kong Singapore No. of Projects: 9 Total Investment:RM4.4bil. No. of Projects: 78 Total Investment:RM1.6bil. Japan No. of Projects: 52 Total Investment:RM2.7bil. China No. of Projects: 12 Total Investment:RM1.2bil. Source : Malaysian Investment Development Authority No. of Projects: 12 Total Investment:RM2.2bil. Germany No. of Projects: 18 Total Investment:RM1.1bil. Approved Investments in Manufacturing Projects by Major Industries, Jan - Sept 2015 Petroleum Products (Incl.Petrochemicals) No. of Projects: 3 Total Investment:RM25.4bil. Natural Gas No. of Projects: 1 Total Investment:RM10.4bil. Electronics & Electrical Products No. of Projects: 62 Total Investment:RM6.4bil. Transport Equipment No. of Projects: 41 Total Investment:RM5.9bil. Non-Metallic Mineral Products No. of Projects: 18 Total Investment:RM3.6bil. Basic Metal Products No. of Projects: 24 Total Investment:RM3.5bil. Source : Malaysian Investment Development Authority MITI Weekly Bulletin / www.miti.gov.my “DRIVING Transformation, POWERING Growth” USA ‘ and You’ University Rankings: Top 10 ASEAN 2015 Ranking University Country National University of Singapore Singapore 2 Nanyang Technological University Singapore (NTU) Singapore 3 University of Malaya Malaysia 4 Mahidol University Thailand 5 Chulalongkorn University Thailand 6 National University of Malaysia Malaysia 7 Universiti Technology Malaysia Malaysia 8 University Putra Malaysia Malaysia 9 University of the Philippines Philippines 10 University of Indonesia Indonesia Source: Quacquarelli Symonds Ranking MITI’s ASEAN Portal can be accessed via http://aec2015.miti.gov.my/ MITI Weekly Bulletin / www.miti.gov.my “DRIVING Transformation, POWERING Growth” 1 International Report Indonesia Trade, January – November 2015 Year-on-Year growth (%) Non-Oil & Gas Imports by Major Country of Origin Non-Oil & Gas Exports by Major Destination Exports USD138.42billion -14.32 % USA USD13.98bil China USD26.45bil Japan USD12.24bil Singapore USD8.17bil China USD12.03bil Japan USD11.91bil Source: Statistics Indonesia Indonesia’s Trade with ASEAN, 2013-2014 US176.3bil US182.6bil US178.2bil US186.6bil US1,053.8bil US1,088.6bil Exports US1,116.3bil Imports Exports Indonesia Other* Indonesia Other* US1,058.1bil Note: Other* include Malaysia, Brunei, Singapore, Thailand, Myanmar, Cambodia,Philippines, Lao PDR and Viet Nam Imports 2014 2013 Source: http://www.asean.org/images/2015/July/external_trade_statistic/table17_asof17June15.pdf Malaysia’s Trade with Indonesia, Jan 2014 - Oct 2015 RM billion 70 60 50 49.34 40 30 25.31 24.03 20 10 0 2005 2006 2007 2008 2009 Exports MITI Weekly Bulletin / www.miti.gov.my 2010 2011 Imports 2012 2013 Total Trade 2014 Jan-Oct 2015 Source: Department of Statistics, Malaysia “DRIVING Transformation, POWERING Growth” Imports USD130.61billion -20.24% Passenger Car Production in Selected Countries in 2014 Production in million units Japan China 19.92 8.28 5.60 ROK 4.12 India 8.16 Russia 1.68 Czech Republic 1.25 Canada 0.91 1.58 France 1.50 Iran Slovakia 0.99 Turkey 0.78 1.92 UK Indonesia 1.01 Mexico 0.98 Malaysia Thailand 0.74 0.55 Note: Passenger cars are motor vehicles with at least four wheels, used for the transport of passengers, and comprising no more than eight seats in addition to the driver's seat. Source: http://www.statista.com/statistics/226032/light-vehicle-producing-countries/ MITI Weekly Bulletin / www.miti.gov.my “DRIVING Transformation, POWERING Growth” 1.90 4.25 Brazil 2.81 Spain USA Germany Number and Value of Preferential Certificates of Origin (PCOs) Number of Certificates (Provisional data) AANZFTA AIFTA 25 Oct 2015 1 Nov 2015 8 Nov 2015 15 Nov 2015 22 Nov 2015 29 Nov 2015 6 Dec 2015 13 Dec 2015 1,003 802 204 859 1,013 870 683 863 546 736 688 477 652 593 656 732 AJCEP 194 236 238 165 185 175 169 178 ATIGA 4,774 3,817 4,986 3,461 4,675 4,591 4,552 4,782 ACFTA 1,479 1,551 1,607 1,218 1,319 1,611 1,659 1,673 AKFTA 1,001 886 806 642 878 875 935 770 309 314 306 213 316 252 302 280 MICECA MNZFTA 7 7 14 10 2 9 8 18 MCFTA 82 44 76 30 58 69 34 60 MAFTA 560 366 603 287 529 466 424 449 MJEPA 871 807 909 720 860 873 875 674 MPCEPA 172 134 175 130 116 119 122 197 GSP 146 123 150 77 169 81 93 166 MTFTA 209 160 223 124 162 208 222 174 Value of Preferential Certificates of Origin 1,400 600 1,200 500 RM million RM million 1,000 400 300 200 600 400 100 0 800 200 0 25 Oct 1 Nov 8 Nov 15 Nov 22 Nov 29 Nov 6 Dec 13 Dec 25 Oct 1 Nov 8 Nov 15 Nov 22 Nov 29 Nov 6 Dec 13 Dec AANZFTA 106 296 21 102 126 95 85 483 ATIGA 805 613 1,260 602 840 915 902 809 AIFTA 124 174 183 91 130 155 138 170 ACFTA 878 579 1,047 873 653 792 896 483 AJCEP 65 86 76 64 89 66 84 57 AKFTA 1,065 192 176 778 176 383 345 909 200 80 180 70 160 140 50 RM million RM million 60 40 30 120 100 80 60 20 40 10 0 20 0 25 Oct 1 Nov 8 Nov 15 Nov 22 Nov 29 Nov 6 Dec 13 Dec 25 Oct 1 Nov 8 Nov 15 Nov 22 Nov 29 Nov 6 Dec 13 Dec MICECA 45.15 46.96 49.83 27.64 42.75 44.69 49.06 31.11 MJEPA 177 126 148 113 154 151 135 131 MNZFTA 0.66 0.17 0.30 0.19 0.02 0.23 0.11 0.70 MPCEPA 37 24 38 17 23 15 16 66 MCFTA 44.95 6.46 9.09 4.27 5.55 12.11 5.72 7.77 GSP 30 26 27 22 29 15 22 30 MAFTA 55.22 34.41 58.75 68.08 47.18 63.78 37.50 36.28 MTFTA 99 150 100 121 86 139 158 82 Source: Ministry of International Trade and Industry, Malaysia MITI Weekly Bulletin / www.miti.gov.my “DRIVING Transformation, POWERING Growth” Notes: The preference giving countries under the GSP scheme are Liechtenstein, the Russian Federation, Japan, Switzerland, Belarus, Kazakhstan and Norway. MPCEPA: Malaysia-Pakistan Closer Economic Partnership AANZFTA: ASEAN-Australia-New Zealand Free Trade Agreement Agreement (Implemented since 1 January 2008) (Implemented since 1 January 2010) MJEPA: Malaysia-Japan Economic Partnership ATIGA: ASEAN Trade in Goods Agreement Agreement (Implemented since 13 July 2006) (Implemented since 1 May 2010) MICECA: Malaysia-India Comprehensive Economic AJCEP: ASEAN-Japan Comprehensive Economic Partnership Cooperation Agreement (Implemented since 1 July 2011) (Implemented since 1 February 2009) MNZFTA: Malaysia-New Zealand Free Trade Agreement ACFTA: ASEAN-China Free Trade Agreement (Implemented since 1 August 2010) (Implemented since 1 July 2003) MCFTA: Malaysia-Chile Free Trade Agreement AKFTA: ASEAN-Korea Free Trade Agreement (Implemented since 25 February 2012) (Implemented since 1 July 2006) MAFTA: Malaysia-Australia Free Trade Agreement AIFTA: ASEAN-India Free Trade Agreement (Implemented since 1 January 2013) (Implemented since 1 January 2010) MTFTA: Malaysia-Turkey Free Trade Agreement (Implemented since 1 August 2015) Malaysian Ringgit Exchange Rate with Japanese Yen and Singapore Dollar JPY100 = RM SGD = RM JPY100 = RM 3.52 3.70 3.10 SGD = RM 3.05 3.60 3.00 3.50 3.40 2.90 3.30 2.80 3.20 3.10 2.70 3.00 2.60 2.90 2.80 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov 2014 2.50 2015 Source : Bank Negara, Malaysia Gold Prices, 14 August - 18 December 2015 Gold US$/Gram 39.0 37.0 36.0 36.0 35.0 34.0 18 Dec 11 Dec 4 Dec 27 Nov 20 Nov 13 Nov 6 Nov 30 Oct 23 Oct 16 Oct 9 Oct 2 Oct 25 Sep 18 Sep 11 Sep 28 Aug 21 Aug 14 Aug 33.0 4 Sep 34.2 Source : http://www.gold.org/investments/statistics/gold_price_chart/ Silver and Platinum Prices, 14 August - 18 December 2015 Silver US$/Oz 16.5 1,050.0 16.0 1,000.0 15.3 15.0 950.0 14.5 900.0 14.0 854.0 13.9 14 Aug 21 Aug 28 Aug 4 Sep 11 Sep 18 Sep 25 Sep 2 Oct 9 Oct 16 Oct 23 Oct 30 Oct 6 Nov 13 Nov 20 Nov 27 Nov 4 Dec 11 Dec 18 Dec 13.5 13.0 990.0 850.0 800.0 http://online.wsj.com/mdc/public/page/2_3023-cashprices.html?mod=topnav_2_3023 MITI Weekly Bulletin / www.miti.gov.my 14 Aug 21 Aug 28 Aug 4 Sep 11 Sep 18 Sep 25 Sep 2 Oct 9 Oct 16 Oct 23 Oct 30 Oct 6 Nov 13 Nov 20 Nov 27 Nov 4 Dec 11 Dec 18 Dec 15.5 Platinum US$/Oz “DRIVING Transformation, POWERING Growth” 38.0 Commodity Prices Commodity Crude Petroleum (per bbl) Crude Palm Oil (per MT) Sugar (per lbs.) Rubber SMR 20 (per MT) Cocoa SMC 2 (per MT) Coal (per MT) Scrap Iron HMS (per MT) 18 Dec 2015 (US$) 34.7 560.0 15.1 1,157.5 1,987.8 47.5 190 (high) 170 (low) % change* 2.5 0.3 3.6 1.4 2.6 0.2 unchanged unchanged 2014i 54.6 - 107.6 823.3 352.3 1,718.3 2,615.8 59.8 370.0 2013i 88.1 - 108.6 805.5 361.6 2,390.8 1,933.1 .. 485.6 Highest and Lowest Prices, 2014/2015 Crude Petroleum (18 Dec 2015) US$34.7 per bbl Highest (US$ per bbl) Lowest (US$ per bbl) 2015 29 May 2015: 60.3 2015 18 Dec 2015: 34.7 2014 13 June 2014: 107.6 2014 26 Dec 2014: 54.6 Average Domestic Prices, 18 Dec 2015 Billets (per MT) RM1,200 - RM1,300 Crude Palm Oil (18 Dec 2015) US$560.0 per MT Highest (US$ per MT) Lowest (US$ per MT) 2015 16 Jan 2015: 701.0 2015 4 Sep 2015: 500.5 2014 14 Mar 2014: 982.5 2014 26 Dec 2014: 664.0 Steel Bars (per MT) RM1,450 - RM1,550 Sources: Ministry of International Trade and Industry Malaysia, Malaysian Palm Oil Board, Malaysian Rubber Board, Malaysian Cocoa Board, Malaysian Iron and Steel Industry Federation, Bloomberg and Czarnikow Group. MITI Weekly Bulletin / www.miti.gov.my “DRIVING Transformation, POWERING Growth” Notes: All figures have been rounded to the nearest decimal point * Refer to % change from the previous week’s price i Average price in the year except otherwise indicated n.a Not availble Commodity Price Trends Crude Palm Oil Rubber SMR 20 600 1,300 590 1,280 586.0 584.0 580 1,240 566.5 560 561.5 558.5 553.5 560.0 552.5 1,200 1,197.0 1,180 543.5543.0 540 1,231.5 1,243.5 1,220 565.0 US$/mt US$/mt 1,262.5 580.0 570 550 1,279.5 1,280.5 1,260 1,183.5 1,160 1,158.0 530 1,157.5 1,140 520 1,120 510 1,100 9 Oct 16 Oct 23 Oct 30 Oct 6 Nov 13 Nov 20 Nov 27 Nov 4 Dec 11 Dec 18 Dec 2 Oct 9 Oct 16 Oct 23 Oct 30 Oct 6 Nov 13 Nov 20 Nov 27 Nov 4 Dec 11 Dec 18 Dec Black Pepper Cocoa 2,150 8,500 7,967 8,000 2,100 7,822 2,084.1 7,894 2,050 2,056.7 2,058.6 2,034.5 2,020.2 2,030.2 2,009.8 2,000 7,707 7,500 2,052.6 2,040.8 1,987.8 USD/ tonne 2,064.3 2,052.5 7,591 7,296 7,286 7,267 7,148 7,063 7,000 6,940 7,029 7,022 6,963 6,864 6,469 6,500 6,000 1,950 7,853 7,806 6,742 6,515 6,245 5,740 5,779 5,843 5,500 1,910.4 1,900 25 Sep 2 Oct 9 Oct 16 Oct 23 Oct 30 Oct 6 Nov 13 Nov 20 Nov 27 Nov 4 Dec 11 Dec 18 Dec Dec Oct Nov Sep Jul Aug Jun Apr May Mar Jan Feb Dec Oct 2015 Sugar Crude Petroleum 54 52 15.5 15.5 14.5 14.5 14.3 14.0 14.3 14.5 49.6 15.1 15.0 48 14.3 48.6 49.6 47.3 45.7 44 50.5 48.1 46 14.6 US$/bbl 15.0 52.7 50 15.3 15.0 US$/lbs Nov 2014 * until 18 December 2015 16.0 13.5 Sep Jul Aug Jun Apr May Mar Jan 1,850 Feb 5,000 48.0 46.6 47.4 45.5 44.6 44.3 44.7 44.9 43.6 43.0 42 41.7 40 13.5 40.7 38 13.0 40.4 40.0 37.9 36.9 36 35.6 12.5 34 32 12.0 2 Oct 9 Oct 16 Oct 23 Oct 30 Oct 6 Nov 13 Nov 20 Nov 27 Nov 4 Dec 11 Dec 18 Dec Crude Petroleum (WTI)/bbl 25 Sep 2 Oct 9 Oct 16 Oct 23 Oct 30 Oct 6 Nov 13 Nov 20 Nov 27 Nov 4 Dec 11 Dec 18 Dec Sources: Ministry of International Trade and Industry Malaysia, Malaysian Palm Oil Board, Malaysian Rubber Board, Malaysian Cocoa Board, Malaysian Pepper Board, Malaysian Iron and Steel Industry Federation, Bloomberg and Czarnikow Group, World Bank. MITI Weekly Bulletin / www.miti.gov.my 34.7 Crude Petroleum (Brent)/bbl “DRIVING Transformation, POWERING Growth” 2 Oct US$/mt 1,176.0 1,174.5 1,172.5 Commodity Price Trends Copper Aluminium 7,500 2,200 7,300 1,774 1,751 1,804 1,695 1,705 6,042 5,940 6,100 5,900 1,640 5,833 5,831 5,700 1,688 1,600 6,295 5,729 5,457 5,500 1,590 5,217 5,127 5,216 5,300 1,516 4,900 1,468 2014 2015 2014 Jul Jun Apr May Mar Jan Feb Dec Oct Nov Sep Jul Aug Jun Apr May Jan Oct 4,800 4,700 Nov Sep Jul Aug Jun Apr May Mar Jan Feb Dec Oct Nov Sep Jul Aug Jun Apr May Mar Jan Feb 1,400 Mar 1,500 5,100 Feb 1,548 Oct 1,815 1,727 6,446 6,300 Nov 1,819 1,818 1,800 1,700 6,500 1,909 1,839 US$/ tonne US$/ tonne 1,811 6,737 Sep 1,946 1,900 6,713 6,821 6,650 6,674 6,700 1,990 1,948 6,891 6,900 2,000 7,113 7,002 6,872 7,149 7,100 2,056 2,030 7,291 Aug 2,100 2015 48.0 20,000 19,401 19,118 18,600 18,629 18,000 18,035 17,374 15,812 15,807 15,678 47.0 14,574 14,849 14,101 14,204 13,756 US$/mt US$/ tonne 47.5 47.4 15,962 16,000 14,000 47.5 13,511 12,831 12,825 12,000 46.5 46.6 46.6 46.4 11,413 46.4 10,317 10,386 10,000 46.4 46.3 46.2 46.2 46.0 9,938 46.5 46.0 9,244 2014 Nov Oct Sep Aug Jul Jun May Apr Mar Feb Jan Dec Nov Oct Sep Aug Jul Jun May Apr Mar Jan Feb 8,000 2015 45.5 2 Oct 9 Oct 16 Oct 23 Oct 30 Oct 6 Nov 13 Nov 20 Nov 27 Nov 4 Dec 11 Dec 18 Dec Scrap Iron Iron Ore 140.0 280 130.0 128.1 121.4 120.0 110.0 74.0 68.0 70.0 195.0 190.0 195.0 82.4 190.0 190.0 190.0 180 63.0 68.0 50.0 24 Jul 7 Aug 14 Aug 28 Aug 11 Sep 25 Sep 9 Oct 30 Oct 6 Nov 20 Nov 27 Nov 18 Dec 53.0 52.0 47.0 2014 Mar Feb Jan Dec Nov Oct Sep Aug 160 57.0 40.0 Jul 170.0 Jun 170.0 May 170.0 Apr 170.0 56.0 52.0 Mar Scrap Iron/MT(Low) 175.0 Jan Scrap Iron/MT (High) 63.0 60.0 58.0 60.0 2015 Sources: Ministry of International Trade and Industry Malaysia, Malaysian Palm Oil Board, Malaysian Rubber Board, Malaysian Cocoa Board, Malaysian Pepper Board, Malaysian Iron and Steel Industry Federation, Bloomberg and Czarnikow Group, World Bank. MITI Weekly Bulletin / www.miti.gov.my Nov 210.0 200 81.0 80.0 Oct 210.0 92.7 Sep 210.0 90.0 Aug 220.0 96.1 92.6 Jul 230.0 220 100.6 Jun 230.0 230.0 Feb US$/mt 230.0 111.8 100.0 May 240.0 240 230.0 114.6 250.0 Apr 250.0 US$/dmtu 260 260.0 “DRIVING Transformation, POWERING Growth” Coal Nickel LEVERAGING ON INNOVATION “I don’t like doing paper presentations says Encik Khairil Adri Adnan, the Chief Executive Officer of DreamEDGE” MITI Weekly Bulletin / www.miti.gov.my “DRIVING Transformation, POWERING Growth” So when asked to take part in a pitch to meet Mr. Barack Obama, the President of the United States, he brought Nao along. Not only can Nao excite her audience with impressive dance moves, she can hold their undivided attention when she gives presentations. Thanks to Nao’s successful pitch, DreamEDGE was one of the three companies given the chance of a lifetime to have a face-to-face session with Mr. Barack Obama during his short visit to Malaysia last year. However, Nao had to be programmed to perform all the functions mentioned because she is a robot. “I purchased Nao to develop local talent in programming,” says Encik Khairil who paid over RM50,000 for the female sounding android. He considers the robot a worthwhile investment, foreseeing a future where automation will be in demand. When that happens, he knows he will need experts who can do programming. His forward thinking approach is what has gotten DreamEDGE this far where it is now on the verge of making the transition from being an engineering based company to one that is focused on offering solutions through innovation. As an engineering service provider, the company has worked for clients in various industries including automotive, heavy industries, precision equipment, and railway, among others, both locally and abroad. In fact, DreamEDGE has a subsidiary in Japan and has successfully completed jobs for clients from the United Kingdom, Austria, Brazil, India, Australia, Indonesia, and Thailand. “Things were going well, but I thought it is risky to concentrate on one type of business. So in 2013, we started developing our own products to mitigate the risk. If we develop 10 to 20 products and at least one of them takes off, it could become the company’s main source of revenue in the future,” says Encik Khairil, recalling the company’s first move to diversify its business. After careful study and consideration, the company decided to venture into the production of electric vehicles. The business involves mechanical, electronic, and programming expertise, all of which they have in-house expertise. The company’s range of electric vehicles to date includes the Future Friendly Eco Commuter, Electrifying Three Wheeler, and Green Community Bus. These socially conscious forms of transportation are energy efficient, have low carbon emissions, and are disabled access friendly. Aside from vehicles, the company is also developing its own robots. They may not be as charming as Nao, but they are designed and programmed to fulfil specific functions. The Automated Guided Vehicle (AGV) for example, according to Encik Khairil, is able to haul a complete car on its own and would be useful in automotive manufacturing plants. The company has been recognised as one of the Top 10 Fast Growing Companies at the SME Award in 2012 and was a recipient of the 1-InnoCERT Best Innovation Award in Engineering and Industrial Design in 2014. However, one of its most memorable achievements is the establishment of its Digital Engineering Design Centre (DEDC) in Taiping, Perak. DEDC serves as a platform to coordinate collaborations between universities and the industry. Now in its third year, the Centre has hired and developed more than 200 local graduates as engineers. In fact, Encik Khairil is proud that DreamEDGE is able to give many young people a leg up in the field of engineering and innovation. “Growing up, I used to watch enviously as my cousins played with remote control cars, Game Boy, and PlayStation as I could not have one. So now I want to create opportunities for those who have passion for gadgets and technology like I do. I want them to turn their imagination and creativity into endless possibilities,” concludes Encik Khairil. MITI Programme Meeting of ASEAN Economic Ministers in Nairobi 16 December 2015 “DRIVING Transformation, POWERING Growth” MITI Weekly Bulletin / www.miti.gov.my Media Release Announcement ASEAN COMMITTED TOWARDS PRESERVING CENTRALITY AND MEETING THE 2016 DEADLINE OF REGIONAL COMPREHENSIVE ECONOMIC PARTNERSHIP (RCEP) NEGOTIATIONS I chaired an informal gathering of ASEAN Ministers and Heads of Delegation in Nairobi, Kenya on 15 December 2015 to discuss the way forward for Regional Comprehensive Economic Partnership (RCEP). This meeting is a follow-up to the decision made by ASEAN leaders in KL during the recently held ASEAN Summit in November 2015 to conclude RCEP negotiations by the end of 2016. The meeting reiterated the centrality of ASEAN in the negotiations. Ministers agreed to direct their officials to step up the work in the next few weeks to ensure that the next round of negotiations in Brunei scheduled from 15-19 February 2016 will produce a good outcome. At the meeting in Nairobi, every ASEAN member state shared the challenges they are facing in areas involving goods, services and investment under the RCEP negotiations. By doing so, it is hoped that we will have a better understanding of the challenges faced as we seek to conclude the negotiations by the end of next year. It was also agreed that all member states will support Mr. Iman Pambagyo, the Trade Negotiating Committee Chair and RCEP coordinator for ASEAN. If need be, our officials will meet before the upcoming round of negotiations in Brunei. The last Round between negotiators is scheduled for September 2016. As this is also the month during which the next ASEAN Summit will be held, it was decided that the Round will be brought forward so that substantive conclusion of the agreement could be done by September 2016. For Trade in Goods, I am pleased to note that RCEP has made good progress especially with all RCEP Participating Countries (RPCs) agreeing to the Basic Concept of Initial Offers (BCIO). It is also encouraging to note that 15 RPCs have submitted their initial offers. For Trade in Services, we are encouraged with the submission of the revised offers with value add elements. In this regard we hope that the other ASEAN countries who had not so will follow suit. MALAYSIA IS COMMITTED TOWARDS STRENGTHENING OUR ECONOMIC TIES WITH KENYA I hosted a roundtable session with some 15 representatives from the Kenyan business community on 16 December 2015.During that one and a half hour session, I explained the economic outlook and policies undertaken by the Malaysian Government to promote trade and attract investments into our country. Kenya has a population of 46 million with income per capita of USD3,100. The country has recorded average annual economic growth of around 6% over the past 5 years. This impressive performance was partly due to its improved political stability and good growth recorded by the agriculture and services sectors. Malaysia and Kenya enjoy close bilateral ties. The total trade between the two countries had increased by more than double from USD283 million in 2013 to USD742 million in 2014. Despite the strong trade figures last year, it should be noted that our exports to Kenya worth USD737 million far exceeded our imports from the country which stood at only USD5.5 million. This very large trade gap needs to be narrowed but it presents a big challenge because Kenya does not produce the products which have a high demand in Malaysia, such as electrical & electronics products. Nairobi and Kenya are now experiencing a construction boom and there is a string interest to source building materials from Malaysia. I met with Suraya Properties Group, one of the largest property developers in Kenya. In view of this strong interest, MATRADE which has an office in Nairobi will bring a number of Malaysian companies to Nairobi in order to promote Malaysian products. The Kenya Commercial Bank Group is planning to bring a delegation of Kenyan investors and traders to Kuala Lumpur in the first half of next year. It is hoped that this visit will strengthen the business relationship between the two countries. Africa has enormous economic potential. A number of countries in the continent are experiencing impressive rate of economic growth. The region is on the rise. As a trading nation and an open economy, Malaysia will continue to diversify its business relations with the African continent. MITI will continue to ramp up and promote investment opportunities in East Africa. In fact, there are a number of Malaysian companies currently operating in Kenya. Among them is Golden Africa Kenya Limited which recently completed its USD50 million palm oil refinery plant in Athi River, which is 42 kilometers from Nairobi. Another Malaysian company in Kenya is Probase Manufacturing, which possesses unique construction technology suitable for the Kenyan market. This company has already completed two 10-kilometer road projects in Meru and Samburu counties, and this week has signed the MoU to implement a similar project in Embu county which could involve the construction of 100-kilometers of rural road, beginning with 10-kilometer pilot project. Malaysia and Kenya has many similarities as both countries gained independence around the same time. Education could be the key to help strengthen the relationship between the two nations as there are currently 900 Kenyan studying at our local universities. In fact, many of the Kenyan alumni are currently holding key positions in the Kenyan Government and private sector. Dato’ Sri Mustapa Mohamed Minister of International Trade and Industry Malaysia MITI Weekly Bulletin / www.miti.gov.my “DRIVING Transformation, POWERING Growth” For Investment, we commend the good progress made in the Investment Chapter notably the efforts of all RPCs to table their Initial Reservation Lists during the last Round in Busan, Korea. All RPCs are urged to keep up the good momentum and to ensure progress by resolving the key issues in investment.It is important for ASEAN to continue leading the process in the Investment Chapter. The meeting also noted that China and India had demonstrated commitment to achieve progress in RCEP negotiations.Completing the RCEP negotiations by 2016 has become more urgent with the conclusion of Trans-Pacific Partnership negotiations in October 2015. RCEP which involves ASEAN and 6 FTA partners, accounts for 30% of world trade and will provide a big boost towards closer economic integration among the countries involved as well as with other countries around the globe. @ YOUR SERVICE Name Designation Job Description Division Contact No Email : Sufian Saihon : Senior Assistant Administrative Officer : Reviewing and approving certificate of origin (COO) online application for scheme of AKFTA, ACFTA, AIFTA and MICECA. : Trade and Industry Support : 603-6208 4738 : sufian.saihon@miti.gov.my Name Designation Job Description Division Contact No Email : Nora Sulaiman : Senior Assistant Administrative Officer : Reviewing and approving certificate of origin (COO) online application for scheme of AKFTA, ACFTA, AIFTA and MICECA. : Trade and Industry Support : 603-6208 4736 : nora.sulaiman@miti.gov.my The Editorial Board of the MWB wishes everyone a Merry Christmas and a Happy New Year 2016 “DRIVING Transformation, POWERING Growth” “The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back” Abigail Van Buren Comments & Suggestions Dear Readers, Kindly click the link below for any comments in this issue. MWB reserves the right to edit and to republishl letters as reprints lhttp://www.miti.gov.my/index.php/forms/form/13 MITI Weekly Bulletin / www.miti.gov.my