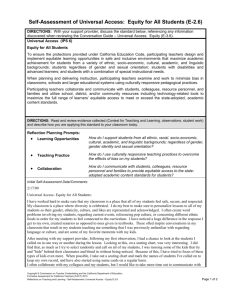

STUDENT TUTORIAL PROGRAM 2014 SKETCH NOTES Property

advertisement

Monash Law Students’ Society STUDENT TUTORIAL PROGRAM 2014 SKETCH NOTES Property Law B Sponsored by: DISCLAIMER – PLEASE READ BEFORE CONSULTING THESE NOTES 1. The following SketchNotes have been prepared and provided by a law student as a skeleton or sketch of the course material for this unit; 2. It is the responsibility of users to make note of any changes to course content; 3. SketchNotes may exclude some topics, cases and legislation and may therefore be inconsistent with current Faculty of Law course content or recent developments in the law; 4. Neither the Law Students' Society nor its sponsors endorse or take responsibility for the quality or accuracy of these SketchNotes; 5. SketchNotes should not be solely relied upon; 6. SketchNotes are to provide users with a basis from which they can create individual and extensive notes for their own assessments; 7. SketchNotes are not to be replicated, either in part or in full, during Faculty of Law assessments for this unit; 8. SketchNotes are designed to be used as a teaching aid in the Student Tutorial Program; 9. For copyright reasons, SketchNotes are not to be printed or altered by users; 10. It is against the Monash Law Students' Society's policy to provide further materials to law students in relation to course content for this subject. Student may not make any such request to the Monash Law Students' Society or it its student tutors; 11. It is against the Monash Law Students’ Society’s policy for students to contact tutors directly via email. Any requests for further assistance outside of tutorials must be made to Geerthana at tutorials@monashlss.com . Questions regarding course content should be made to the relevant Faculty lecturers or tutors; 12. The aim of the Student Tutorial Program is to facilitate collaborative learning and increase student exposure to practice problems. It's role is not to substitute Faculty teaching or provide a way for students to pass assessments without engaging in course content; 13. If you have any questions, please do not hesitate to contact Geerthana Narendren, at tutorials@monashlss.com 2 Tutor: Laura Elliott Year of Study: Semester 2, 2013 Cases included in the 2014 reading that are not included in the tutor’s notes: • Sidhu v Van Dyke • Vedejs v Public Trustee • Van den Heuval v Perpetual Trustees Victoria Ltd • Crampton v French • Farah Constructions Pty Ltd v Say-­‐Dee Pty Ltd 3 TOPIC 1: Equitable Interests Arising by Operation of Law (1) Trusts (a) Express Trusts • Must be evidenced in writing s53(1)(b) PLA • Can be created: Intervivos/Via a will • Created when: Actual transfer to transferee/Declare yourself to be a trustee (b) Resulting Trusts • Definition: circumstances such that equity presumes, despite transfer of legal title to one person, that the transferor’s intention was for some/all of the equitable title to be retained by the transferor. • Presumption of RT: o Arises where a person purchases property and arranges for title to be transferred to another person, who provide no consideration Little v Little OR o Purchase price RT: transferees do not hold legal title in the same proportion to which they contributed Calverly § What makes up PP? Liability under mortgage is part of PP however subsequent contributions to mortgage repayments by a person not joint mortgagor do not give rise to presumption Baumgartner. Also includes home built shortly after buying vacant lot Cummins • Rebutting the presumption: o Intention to the contrary § Evidence of an actual intention (not imputed) to pass a beneficial interest at the time of the transfer or purchase Calverley • Can look at subsequent conduct after the transfer to determined original intent Calverley § Onus on person seeking to rebut the presumption o Presumption of advancement § The transferee is presumed to take beneficial title when the transfer is from: • Husband to wife • Parent to child § Can be rebutted by contrary intention • Effect: If the court finds that a RT exists, X will hold beneficial interest in the property on trust for Y (c) Constructive Trusts • Common Intention Constructive Trust (CICT) o Equity will hold that a person has acquired an interest in property so as to prevent the holder of the legal interest in that property from behaving unconscionably, where the party has acted to their detriment Muschinski o Elements to be satisfied: Ogilvie 1. Actual common intention (not imputed). Meeting of the minds. 4 2. Detrimental Reliance: even if there was no financial loss, the mere loss of bargain is enough. 3. Unconscionability: is it unconscionable to deny the P the right they are claiming? o Timing: the CICT is made out when all elements are satisfied Parsons • Joint Venture Constructive Trust (JVCT) o A JVCT arises where a JV, for which both parties pooled their resources, breaks down, w/out attributable blame Muschinski o Elements to be satisfied: 1. Is there a JV? Business/relationship/family Baumgartner. Does not include simply lending money to another to realise an endeavour. 2. Pooling of resources: P will need to show that the parties pooled their earnings and efforts for the mutual security and benefit of the JV. Direct financial contributions, indirect financial contributions (e.g. sacrifice earnings) Baumgarnter 3. JV breaks down w/out attributable blame Boumelhelm 4. Unconscionable: see Boumelhelm; Baumgarnter; Muschinsky o Timing: arises when elements are made out, however can be backdated by court when appropriate Muschinski (nb: this approach was rejected in Parsons) o Remedies: (equity is discretionary) § Start w/ presumption that the share is equal subject to adjustment to account for different contributions Baumgartner § If TP rights supressed then court may not impose CT Boumelhelm (2) Estoppel • A proprietary estoppel will arise when a RP unconscionably seeks to rely on that title to defeat an expectation they created in another person by a representation and which that other person has relied on to their detriment • Elements to be satisfied: 1. Assumption/expectation that there will be an interest in land § The P must prove that the D made a representation under which he encouraged the P’s expectation that he would receive a property right see Giumelli; Inwards v Baker 2. Reasonable Reliance that leads to detriment § Reliance: P will argue they were induced to rely on the representation and acted in reliance upon it by: altering his/her position; remaining on property; declining to pursue other opportunities; expending money to improve property etc § Detriment: Need not be monetary in nature. See Donis; Inwards 3. Unconscionable: § It must be unconscionable that the person resile from the position • Remedy: o Expectation relief (favoured by courts) Donis. Post Giumelli courts start w/ prima facie fulfilment of the promise, subject to: 5 § § § Injustice to TP Giumelli Proportionality Ramdsen v Dyson Current value of property Donis TOPIC 2: Co-­‐Ownership (1) Types of Co-­‐ownership • Joint Tenants: where two or more persons simultaneously hold an interest in the same parcel of land, where the two distinguishing features are apparent: the right of survivorship and the four unities. o Right of survivorship § The interest of a JT does not form part of his/her estate on death but accrues to the surviving JT(s). Effect: a JT cannot leave his/her interest to another person in his/her will § However, A JT is free to sever the JT, thereby creating a TIC. § If they die at the same time: PLA s184 -­‐ younger is deemed to have survived the elder. o Four Unities § Possession -­‐ Each co-­‐owner is entitled to possession of the whole of the property, not exclusively for himself or herself but to be enjoyed together w/ the other JTs § Interest -­‐ each has an interest of the same nature, extent and duration § Title -­‐ each has acquired title under the same instrument or act § Time -­‐ the interests vested at the same time o Presumption of JT § There is a presumption of a JT if you give land to someone § Can be rebutted through words of severance: words which indicate an intention that the transferee will have distinct shares, eg. Equally; between; among; in equal shares etc. • Tenants in Common: Each TIC is entitled to the possession of the whole of the land (undivided) and is entitled to a distinct share thereof. The shares need not be equal. o No tenant can claim a particular piece of the land o Each TIC’s share is fixed and cannot be enlarged by the death of another TIC o Differences to JR § There is not right of survivorship § The share of a TIC passes to the beneficiary nominated in his/her will § A tenant can alienate his ushare and it may become the subject matter of co-­‐ownership o NB: There must still be unity of possession (2) Creation of co-­‐ownership – the position in law vs equity • Common law: preference for JT where 4 unities are present; and no words of severance are used o TLA s30(2) – where two or more persons are registered as JPs they are deemed to be JTs 6 • o TLA s33(4) – any 2 or more persons named in an instrument are entitled jointly unless a contrary intention exists Equity: Equity normally follows the law and presumes that JTs at law are JTs in equity. However, equity presumes a TIC where two or more persons (these can be rebutted): o Make unequal contributions to the purchase price (subject to a contrary intention and the presumption of advancement) Baumgartner o Advance money as mortgagees (equally or not) Re Jackson o Acquire property for a business venture as partners Lake v Craddock o Hold land for separate business purposes/flexible approach Malayan Credit Ltd v Jack Chia (3) Rights and Duties of Co-­‐Owners • Right of possession: o Each co-­‐owner has the right to possess and enjoy the whole of the land o Consequences: § CO’s cannot bring an action for trespass against another CO § Exception: if CO’s occupation has excluded another CO’s from possession, or where a CO does something preventing common enjoyment of the land Stedman v Smith • Right to receive occupation rent: o 233(3) PLA VCAT must not make an order requiring a co-­‐owner who has occupied the land to pay an amount equivalent to rent to a co-­‐owner who did not occupy the land unless (a) the co-­‐owner who has occupied the land is seeking compensation, reimbursement or an accounting for money expended by the co-­‐owner who has occupied the land in relation to the land; or (b) the co-­‐owner claiming an amount equivalent to rent has been excluded from occupation of the land; or (c) the co-­‐owner claiming an amount equivalent to rent has suffered a detriment because it was not practicable for that co-­‐owner to occupy the land w/ the other co-­‐owner. • No opportunity to use goods: o 233(4) PLA VCAT must not make an order requiring a co-­‐owner who has used goods to pay an amount equivalent to rent to a co-­‐owner who did not use the goods unless (a) the co-­‐owner who has used the goods is seeking compensation, reimbursement or an accounting for money expended by the co-­‐owner who has used the goods in relation to the goods; or (b) the co-­‐owner claiming an amount equivalent to rent has been excluded from using the goods; or (c) the co-­‐owner claiming an amount equivalent to rent has suffered a detriment because it was not practicable for that co-­‐owner to use the goods w/ the other co-­‐owner. • Right to make improvements to the land: o Under s233(2) PLA, VCAT may allow a CO to claim improvements to land or goods. Types of costs available to be claimed: (a) any amount that a co-­‐owner has reasonably spent in improving the 7 • • (b) any costs reasonably incurred by a co-­‐owner in the maintenance or insurance of the land or goods; (c) the payment by a co-­‐owner of more than that co-­‐owner's proportionate share of rates (in the case of land), mortgage repayments, purchase money, instalments or other outgoings in respect of that land or goods for which all the co-­‐owners are liable; (d) damage caused by the unreasonable use of the land or goods by a co-­‐ owner; (e) in the case of land, whether or not a co-­‐owner who has occupied the land should pay an amount equivalent to rent to a co-­‐owner who did not occupy the land; (f) in the case of goods, whether or not a co-­‐owner who has used the goods should pay an amount equivalent to rent to a co-­‐owner who did not use the goods. o Orders VCAT may make 233(1)(a-­‐c) PLA § Compensation or reimbursement § Account to the other co-­‐owners in accordance w/ s 28A § Adjustment made to a co-­‐owners interest in land to take account of amount payable Right to receive rents and profits s28A(1-­‐2) PLA o A co-­‐owner (either a JT or TIC) is liable to account to the other CO/s where they have had more than their just proportionate share. o EXCEPT: Henderson v Eason – if a person uses their own money and labour to greatly exceed the value of rent/compensation for mere occupation of land, then it will not be sufficient to mount a claim o Procedure: o Application made to VCAT: 234B PLA o VCAT will make an order it thinks fit to ensure just and fair accounting of the amounts received by co-­‐owners 234B(1) o Types of orders VCAT can make: 234B(2)(a-­‐b) PLA o Order a CO to account for that rent to other CO’s; and o Make any order it considers just and fair for the purposes of an accounting by a CO who has received more than their just and proportionate share Co-­‐owners and adverse possession o It is possible for a co-­‐owner to extinguish the title of another CO by adverse possession Wills v Wills o General rule is that time begins to run when one co-­‐owner takes possession of more than his or her share of the land, rents or profit o See Limitations of Actions Act s 14(4) (4) Severance of a Joint Tenancy • When severance occurs, JT’s can sell • Methods of severance: 8 o Unilaterally • Alienation by a JT at equity or in law. Can be to: • a stranger (JT is severed and the alienee becomes a TIC to an undivided share of the land Wright v Gibbs) • to each other • or to one’s self PLA s 72(3) -­‐ a person may convey land to or vest land in herself or himself. • Can a co-­‐owner deal w/ his or her interest in the land? • Mortgaging: A mortgage of TS land by a JT did not sever the JT Lyons v Lyons • Lease: o A lease ‘suspends’ the tenancy, and severs it for a period of time. For that period the lessee becomes a TIC w/ the other JT’s Frieze v Unger o If Landlord dies: after the lease has ended the RoS will operate. During the lease, the other CO is bound by the lease and must observe the terms of it. o A licence does not sever a JT o Issue of payment during lease: § A and B (JT’s) must share in the receipts of rent § If A (LL) leases his interest, then A’s estate gets the rent during the lease § If B (non-­‐LL) tenant dies then non-­‐LL JT’s estate is entitled to rent during the lease • Servitudes (easements) o Easements operate like a mortgage Hedley v Roberts o You can grant an easement so long as it doesn’t interfere w/ the rights of another Hedley • Severance by merger • Can occur where one JT acquires a further estate in the land that is different from the existing estate and breaks one of the four unities • Example: A grants a life estate to B and C as JT’s. A is left w/ the remainder. If A transfers the remainder to B, the interest merges. This constitutes severance as the interests aren’t equal and there is no unity of interest. o By Agreement to sever • A JT will be severed if the COs agree to sever Williams v Hensman • The agreement will sever the JT so that the COs will be TIC in equity; however, their status as JTs at law will continue until the requisite statutory formalities have been met Abela v Public Trustee (NSW) • You need an oral or written agreement Calabrese v Miuccio • Don’t have the agree on precise money amount or shares Abela 9 Can be effective immediately even if subject to contingencies that haven’t occurred Pfeiffle • Parties must evince a common intention to immediately sever the JT Pfeiffle o Course of Dealings (Conduct) • Severance will only occur when the parties’ conduct indicates that they treated themselves as TIC Williams v Hensman • Negotiations exploring the termination of a JT was not enough Magill v Magill o Other • Bankruptcy: An order declaring a JT bankrupt will sever the JT. • Homicide: • Equity: imposes a CT • Exceptions: suicide pact; or defence or extreme provocation • Court order: Taking the JT’s interest in execution under a court judgment severs the JT Mitrovic v Koren • (5) Severance of a Joint Tenancy • Application for sale and division of land s225 PLA • Parties to the proceedings s226 • Adjournment of proceedings s227 • Order that can be made: s228(2)(a-­‐c) o Sale division of proceeds of land/goods o Physical division of land/goods • Consider s229 PLA • Use of land/good • Whether land/good can be divided and the practicality of doing it • Whether land/goods are unique or have a special value to one or more co-­‐owners o Combination of first two • Consider s229 PLA • Other considerations when making orders: s230 PLA o Land or goods may be physically divided into parcel/shares that differ from entitlement of co-­‐owner o Compensation paid by specified co-­‐owner to compensate for any differences in value of parcels or shares land/goods • VCAT can appoint trustees s231 PLA • Other orders VCAT can make: s232 o Sale at private sale or auction o Co-­‐owners may purchase land/goods o Fair market price for independent valuer o Auction; reserve price set by VCAT o Independent valuation takes place 10 o o o o o Sale is completed in a specified time frame Costs of sale met by one or more co-­‐owners or proceeds of sale VCAT can impose conditions in sale and division of proceeds Land: deed or instrument be produced to make transfer effective Complying w/ TLA 2958 requirements where necessary TOPIC 4: The Torrens System & The Principle of Indefeasibility • Principle of IDF: o The principle of IDF is a convenient description of the immunity of attack by adverse claim to the land or interest in respect of which is registered. • Different types of interests: • Registered interest • Unregistered paramount interest e.g. adverse possession • Unregistered non-­‐paramount – equitable interests under the general law o Sterility provisions s40 TLA • Unless the instrument is registered under the TLA, nothing shall vary/extinguish/pass any estate or interest in land (or any encumbrance in or over land) (1) • Every instrument when registered shall be the same as if it was under seal (2) o Conclusive evidence provisions s41 TLA • If you have a certificate of title or crown grant this is conclusive evidence that the person named on the certificate or grant has possession of that interest in land o Paramountcy/IDF provision s42(1) TLA • RP Interest is held subject to: encumbrances that are recorded on the relevant folio i.e. easements • But is also subject to (2) o Any reservations in the crown grant of the land o Any adverse possession claims o Any public rights of way o Any easements o The interest of a tenant in possession of a land o Any unpaid land tax or unpaid rates o Limitations (except in the case of fraud) • RP will hold their interest free from all other encumbrances • Limitations: o Estate or interest of a proprietor claiming the same land under a prior folio of the register (1)(a) 11 • • • o Because of a wrong description of boundaries in the folio (1)(b) o Notice provision 43TLA • Once RP you are not affected by any notice, actual or constructive of any trust or unregistered interest • NB: knowledge of an unregistered interest or trust is NOT regarded as fraud o Protection of purchaser provision 44TLA • Fraudsters: shall not benefit from their actions. Any part of the register procured or made by fraud shall be void as against any person defrauded and thereby no party privy to the fraud will get any benefit 44(1) TLA • Bona fide purchaser: shall not be punished for the wrongdoer of a fraudster 44(2) TLA Deferred and immediate IDF: o Deferred IDF: title of purchaser who registers forged instrument is defeasible, i.e. it can be set aside by the court at the suit of the registered owner • Exception: if the purchaser sell the land to P2, before his title is set aside, then P2’s title is indefeasible provided it was registered in good faith o Immediate IDF: confers good title on P immediately upon registering a forged instrument. Thus P’s title cannot be set aside, even though it was procured by registration of a forged instrument provided that P has acted w/out fraud Fraser v Walker o Victoria has adopted the doctrine of immediate IDF Priority Disputes: o Situations of two competing registered interests s34TLA • Instruments are distributed based on date of lodgement: s34(1) • What if there are two identical instruments signed by the same proprietor s34(2) • Registrar will register the instrument lodged by the person submitting the certificate of title • What if multiple instruments are lodged for the same land? s34(3) • Registrar will register instrument in order which will give effect to the intentions of all parties, as expressed in or apparent to the registrar for those instruments • Same rules apply for electronic lodgement s44E o Situation of unregistered and registered instruments: • Right of a RP: See above to s42(1) under IDF • What unregistered interests will prevail over RP s42(2): See above under IDF provision Scope of IDF: o Leases: 12 Scope: only covenants which are effectively part of the estate or interest in the land or are intimately connected (touch and concern or run w/ the land) w/ the interest attract IDF Mercantile Credits • Just because a covenant is contained in a registered document does not make it indefeasible i.e. personal covenants • Factors to consider to determine if intimately connected Mercantile • Unjust and inconvenient: In Mercantile, the right to renew a lease attracted IDF because it would be unjust and inconvenient if a subsequent mortgage registered could defeat a renewal clause in a registered lease o Mortgages: • What is it: a charge on land, which secured performance of personal obligations, usually arising for a K of loan or guarantee e.g. home loan • Types of mortgages: • Traditional: o Specified amount to be lent and the interest o Contains acknowledgment advance received by borrowed • All moneys mortgage: o No specific amount lent o No specific acknowledgment receipt of advances o Attempts to secure all current and future debts owed by borrowed to lender o To determine the amount of a debt you must look to the loan agreement • Note: the personal covenant to pay may be contained in the registered mortgage or may be located in a separate loan agreement (likely to be the case for an all moneys mortgage) • Does an IDF registered mortgage validate an off register loan agreement which is forged? Different views, it will depend on the construction of the document and whether the off registered loan agreement is somehow incorporated and is thus IDF too. • Traditional mortgage Tsai o If the mortgage document contains a statement of the sum lent, the production of the mortgage constitutes prima facie evidence of the existence of the debt. • All money mortgage: o Loan agreement unregistered but mortgage registered § Tsai: When the mortgage secures all money but doesn’t incorporate an extrinsic loan agreement, it won’t be enforceable (unless they can prove moneys have been advanced) o Reference to off register documents Solak • 13 Mortgage was indefeasible because the ‘you’ referred to in the unregistered loan document was the same ‘you’ referred to in the mortgage agreement § NB: criticised heavily because it means you need to look outside of the register to determine the real security interest in the land Does the IDF of the covenant to pay in a forged mortgage make the landowner personally liable for the debt, entitling the mortgagee to recover from the landowner’s other assets if a sale of the property does not realise enough money to pay the mortgage debt. • Grgic – NSW: not liable for additional moneys secured under the mortgage, where the mortgaged land is insufficient CF Pyramid (obiter) – VIC: The IDF of a mortgage extended to the mortgagor’s personal covenant to pay. However, in this case there was no suggestion that the property could not cover the debt. • English: A personal covenant in a registered forged mortgage will not cover the debt where it exceeds the value of the property. What remedies can we have against the forger? English • Equitable mortgage can be made against the forger via estoppel • The courts imply an agreement between the forger and mortgagee for the forger to mortgage his/her interest as security for the loan AND an estoppel arises from the representation made by the forger, relied on by the mortgagee, that the spouse’s signature is genuine § • • TOPIC 5: Exceptions to Indefeasibility (1) Fraud • The two types of fraud: o Fraud against the previous RP o Fraud against the holder of a prior unregistered interest • Effects of fraud: o 42(1)(a-­‐b) TLA title is indefeasible except in the case of fraud o 44 TLA Any part of the Register or amendment to it procured by fraud is void and nobody who is party to the fraud shall take any benefit therefrom. o 43 TLA Nobody will be affected by notice actual or constructive of any trust or unregistered interest, except in the case of fraud • Is there fraud? o Fraud means actual fraud, ie personal dishonesty of some sort o Presenting a fraudulent document is not regarded as fraud if you honestly believed it to be a genuine document which can be properly acted upon Assets o Fraud must be brought home to the RP o Mere carelessness or lack of vigilance does not constitute fraud, but wilful blindness or reckless indifference as to the truth or falsity of statements may be fraud Assets 14 • o Notice of unregistered interest or trust is NOT regarded as fraud Bahr v Nicolay; s43 TLA • However, see Loke Yew where there was an intention to deprive unregistered interest o The fraud must be operative in the sense that it operated on the mind of the person said to be frauded and induced detrimental action by that person Bank of SA v Ferguson Timing of fraud: It can occur after registration and is not limited to transferring/securing registration: Bahr v Nicolay minority. Wilson and Toohey JJ in Nicolay disagreed w/ this. (2) Fraud by agent or employee • Are they an agent? • Did they act fraudulently? (see above for normal fraud and below for false attestation) • Can the fraud be brought home to the principal? o Test: Did the acts of the agent fall w/in the actual or apparent authority. If so, the principal is responsible (principle of respondent superior applies) Schultz v Corwill • Actual authority: What acts was the agent authorised to do? Includes: express and implied • Apparent authority: did it fall w/in their apparent authority: Dollar & Sense • It is so connected w/ those acts that it can be regarded as a mode of performing them? Dollars & Sense • Is it a materialisation of the risk inherent w/in the task? • NB: it does not matter if the act is for the exclusive benefit of the agent Dollars o However, principal can introduce evidence to rebut the presumption if agent acted for his own benefit • Principal will argue they were unaware of the participation by the agent in the fraudulent scheme. If the matter is the agent’s own fraud or if the agent was party to a scheme, then the principal is permitted to give evidence to rebut the above presumption Schultz • The mere fact an agent has knowledge of fraud won't necessarily bring it home to the principal • There must be additional circumstances so that the agent’s knowledge is imputed to the principal. • Constructive notice is not enough. • However ignorance can’t be used as a shield Dollars • False Attestation o Where a person witnesses a signature. Usually an employee of a bank o What will NOT be regarded as false attestation/fraud 15 When they didn’t act w/ conscious knowledge of the fraud nor w/ reckless indifference to the truth or falsity of what was signed Grgic o If knowledge is needed: • Russo outlines a three part test for knowledge to apply: 1. Whether the agent knowingly put the mortgage forward on the path to registration. Consider: training and experience 2. Significance of attestation as representation to land office. Consider: training and experience 3. Appreciation that the lodging of the mortgage would convey a representation to the contrary • Can we aggregate the knowledge of two employees? Russo • In some circumstances there could be situations that the acts and knowledge of two employees could be aggregated e.g. senior employee knows a more junior employee attested falsely o NB: De jager – did NOT consider knowledge. The mere act of falsely attesting was enough • (3) Relief in Personam • The right to bring an action against the RP who, by their words or actions, has created rights in other o NB: this is NOT denied by IDF Frazer • Requirement: a known legal or equitable cause of action that is enforceable against the RP Grgic o The cause of action must arise from the conduct of the RP or someone to who he or she is responsible Grgic o Can arise due to conduct of the RP either before or after becoming registered as a proprietor • Examples of legal or equitable causes: o An undertaking to be bound: where a RP has notice of prior unregistered interests and agrees expressly or by implication to take subject to it Bahr v Nicolay • Mere notice of an unregistered interest will NOT defeat IDF and does not amount to fraud 43 TLA • However, if a party formally acknowledges an antecedent right in property in a contract it may give rise to an in personam right Bahr • What may it create? o Express trust through conduct: Bahr as per Mason and Dawson JJ o Constructive trust: Bahr as per Wilson and Toohey JJ o Breach of a party’s obligations as custodian of the CoT Gosper • When there is an obligation to use a CoT in a certain way, an unauthorised use of it may result in awarding a personal equity. The personal equity may be regarded as an in personam exception: Gosper • Steps to analogise: Gosper 16 o The bank was in custody of X’s CoT o X was an established customer of the bank o Placed X and bank in fiduciary relationship under which the bank was obliged to act in his interests o The bank breached its obligations to X by using his CoT w/out authority to facilitate the registration of the forged document • NB: Vassos sought to confine Gosper to its facts. Therefore, it is only persuasive. • It requires conduct or circumstances which would make it unconscionable for the RP to assert IDF Vassos e.g. Misuse of power, misrepresentation, improper reliance on a legal right, knowledge of wrongdoing o Misleading and Deceptive Conduct • Court was willing to hear arguments about MaDC in Grgic but only obiter o Negligence • It may be possible to have an in personam action arise through negligence Grgic however, Pyramid disagrees. o Property acquired by unconscious dealings • If there is unconscionability there can be action in personam Vassos. Requirements: • Misrepresentation; or • Misuse of power; or • Improver attempt to rely upon legal rights; or • Knowledge of the wrongdoing by any other party (4) Paramount Interests • Section 42 sets out paramount interests notwithstanding that they are not specifically recorded as encumbrances on the relevant folio of the register o Reservations in the Crown grant – s42(2)(a) o Rights of adverse possession – s42(2)(b) o Public rights of way – s42 (2)(c) o Easements – s42(2)(d) o Unpaid rates and taxes – s42(2)(f) o Tenants in possession – s42(2)(e) • “Tenant” construed widely and can include any of the following Bianco • Person in actual occupation of the land • Tenant to a life estate • Someone who has purchased land, but not completed the sale Robertson v Keith • Meaning of “in possession” • An option to renew is covered, but not an option to purchase • Can include a right to have the lease fixed (equity of rectification) Downie 17 • • • What if the lease predates the mortgage? • Interest of a TIP does not merely by virtue of being a TIP, take priority over a subsequent RP: Perpetual Trustee v Smith. Operates negatively to deny the RP the ability to rely on the registered title to defeat the interest of a TIP. • RP cannot rely on IDF of title that would, were it not for s42(2)(e) otherwise accrue to the RP: Perpetual trustee v Smith What if a lease is created after the mortgage? • Subsequent purchaser has the right to a discharged interest UNLESS there is a lease which has been consented to in writing by mortgagee and they are party to it: s77(4) • Mortgagee can enter into possession of land or receive rent and profits of land or bring an action for ejectment: s78(1) TLA • It makes good commercial sense, otherwise the mortgagee is at the mercy of a subsequent tenant of the mortgagor: Bianco Effect of paramount interests: • Will NOT automatically provide the person w/ the property. It just strips the other registered holder of the benefit of IDF (5) Registrar’s power to correct errors • An error occurs when information recorded in the register does not accord w/ the instrument on which the entry was based. NB: this is NOT used to correct fraud. Administrative only Frazer • Electronic network malfunctions o Registrar may amend register if the entries were because of the lodgement network s44H(1) TLA • Must keep record of this s44H(2) TLA • Effect: the new entry will clear the old entry as if it never happened s44(h)(3) TLA • General provisions for corrections o Court judgment: registrar will amend registrar to give effect to judgment s103(1) o VCAT judgments: Registrar will make any amendments to reflect the direction s103(1AA) o How to deal w/ amendments s103(2)(a): Any corrections are to be: Dated; and Original entries shall NOT be erased/deleted/rendered illegible • Other rights of the registrar o Registrar can also where necessary to give effect to this Act or another act s106(e) TLA • Delete a folio • Create a new folio • Make amendment of the register 18 (6) Inconsistent legislation • Subsequent legislation may override the TLA either expressly or by necessary implication • Rule: later legislation prevails if it is inconsistent and all else equal Calabro o What is inconsistent? • It must be on the same subject matter: • K vs ownership rights: Doubtful that IDF would be abrogated by an act that is obviously designed to deal w/ mischief of a completely different kind Calabro • Public rights prevail over private rights • NB: there is still a presumption that parliament does not intend to contradict itself and that both Acts operate w/in their given spheres. The legislation must be so inconsistent w/ the essential provisions of the earlier act that it must prevail. Won’t prevail unless absolutely necessary Horvath (7) Volunteers • Who is a volunteer? A volunteer is a person who has taken an interest in property w/out consideration, such as a beneficiary under a will or a person who is given a gift of land or chattels • Volunteers are not indefeasible in Victoria: Smail upheld in Rasmussen o However: Smail was decided at a time when deferred IDF was the preferred approach o Bogdanovic disagrees w/ Smail on the basis of Frazer o However Rasmussen is critical of Bogdanovic (8) Compensation • When will you NOT get access to the consolidated fund s109(2) TLA (a) For any loss damage or deprivation occasioned by the breach of any trust, whether express implied or constructive (b) Where the same land has been included in two or more Crown grants (c) Where any loss damage or deprivation has been occasioned by any land being included in the same folio of the Register w/ other land through misdescription of boundaries or parcels of any land, unless it is proved that the person liable for compensation or damages is dead or has absconded or has been found bankrupt (d) for any loss or damage arising out of the registration by the Registrar of a plan under the Subdivision Act 1988 unless the damage arose from an act or omission of the registrar or any other officer after the date of apparent certification. (a) Any loss or damage arising out of the registration by the registrar of a plan under the subdivision act under s 22(1AC) • When an amount is paid out of the consolidated fund the Registrar may bring a claim against the person actually responsible 109(3)(a) 19 • • o What type of person: 109(4) included a legal practitioner who negligently or fraudulently fails to disclose o If the person cannot be found the registrar may sign judgment against the person immediately for the amount paid together w/ the costs of the application 109(3)(b) Who can seek indemnification, anyone who has suffered loss or damage by reason of 110(1) o (a) the bringing of any land under this Act under Division 2 of Part II or by the creation of a provisional folio under Division 3 of Part II; o (aa) a legal practitioner's failure to disclose in a legal practitioner's certificate a defect in title or the existence of an estate or interest in land; o (b) any amendment of the Register; o (c) any error, omission or misdescription in the Register or the registration of any other person as proprietor o (d) any payment or consideration given to any other person on the faith of any recording in the Register; o (e) the loss or destruction of any document lodged at the Office of Titles for inspection or safe custody or any error in any official search; o (f) any omission mistake or misfeasance of the Registrar or any officer in the execution of his duties; o (g) the exercise by the Registrar of any of the powers conferred on him in any case where the person sustaining loss or damage has not been a party or privy to the application or dealing in connexion w/ which such power was exercised Where there will be no indemnity: s110(3) (a) where the claimant his legal practitioner, conveyancer or agent caused or substantially contributed to the loss by fraud neglect or wilful default or derives title (otherwise than under a disposition for valuable consideration which is registered in the Register) from a person who or whose legal practitioner, conveyancer or agent has been guilty of such fraud neglect or wilful default (and the onus shall rest upon the applicant of negativing any such fraud, neglect or wilful default); • Contribution must be considerable, large, or big Fairless • Neglect includes a failure to take reasonable care for one’s own interest Fairless (b) on account of costs incurred in taking or defending any legal proceedings w/out the consent of the Registrar, except any costs which may be awarded against the Registrar, except any costs which may be awarded against the Registrar in any proceedings in which the Registrar is a party; (c) in consequence of the Registrar's not inquiring as to whether a power of attorney was in force when anything purporting to have been done under the power and falling w/in its scope was done; (d) where the Registrar, under section 22(1AC) of the Subdivision Act 1988, has treated a consent or request made on behalf of the person whose consent to the 20 • • • • registration of the plan is required as being the consent of that person, in consequence of that consent being given or that request being made w/out lawful authority. How much will be paid: o The amount shall not exceed 110(4) TLA • If the register is not amended: value of estate or interest at the time of mistake • If the register is amended: value of estate or interest immediately before the time of amendment o Where does the money come from? 110(5) TLA • Purpose: provide compensation to person deprived of an interest because of IDF Bringing an Action o Accessing funds w/out bring an action 111 TLA • An action can be brought w/out proceedings commencing. You must apply to the Registrar in writing supported by affidavit or stat dec 111(1) • The registrar must approve this and the amount certified shall be paid from moneys appropriated by parliament for this purpose 111(2) o The Registrar can be a nominal defendant for recovery of damages and they may join any other person as a co-­‐defendant in any action 110(2) • Can only bring if you weren’t able to succeed or an action against the defendant is impossible Limitation of actions: o There is a 6 year limit on bring an action, regardless of whether the claimant becomes aware the they have a claim 5(1)(d) LAA Plaintiff discontinues proceedings: o If the P discontinues the proceedings or a judgment is given in favour of the Registrar, the P shall be liable to pay the full costs of the Registrar in the action 110(5) TLA TOPIC 6: Caveat System (1) Caveat System • A caveat acts as an injunction to the Registrar by restraining the Registrar from registering any dealing except w/ the caveator’s consent • Who can lodge a caveat? o Any person who is claiming an estate or interest in land under [an] unregistered instrument or dealing or by devolution in law or otherwise s89(1) TLA o What is not caveatable? A mere personal right; a claim to set aside a transfer on the ground of fraud is not caveatable until such claim is successfully established • Recording a caveat o Must be recorded in the register s89(2) TLA • Notice to the RP 21 • o Registrar is required to give notice of the caveat and a copy of the caveat to the RP s89(3) TLA Removal of a caveat o It can be w/drawn by the caveator s89(1) • W/drawn application: s90(4) TLA • The registrar shall reinstate any recording of the caveat in the relevant part of the Register to which the caveat related o An inconsistent dealing is lodged s90 • Caveator is notified by the Registrar • They have 30 days to: • Consent to registration s90(1)(b) • Commence court proceedings s90(2) • Or caveat lapses • unless it is lodged by the Registrar s90(1) TLA • BUT if the transfer or dealing lodged does not dispose of the whole of the interest then the caveat will only lapse to the extent necessary to permit the registration • Exceptions: see s90(1)(a-­‐e) o An application for removal is made to the Registrar s89A • Any person interested in the land may make application to the registrar to have a caveat removed s89A(1) • Application must specify the land and the estate or interest in respect of which it is made; and be supported by certificate by a legal practitioner which states that, in the practitioner's opinion, the caveator does not have the estate or interest claimed s89A(2) • Registrar when satisfied gives notice of the application to the caveator s89A(3) • 30 days (or caveat lapses) s89A(5) for caveator to: • Abandon the caveat by notice in writing; or s89A(3)(c) • Commence court proceedings to substantiate the caveator’s claims s89A(3)(b) • Level of substantiation: s89A(7)(a) TLA o Application to the court s90(3) • Any person who is adversely affect by [a] caveat may bring proceedings in a court against the caveator for the removal of the caveat and the court may make such order as the court thinks fit • Piroshenko v Grojsman: application considered in accordance w/ the principles applied to interlocutory injunctions • Need to establish it's a serious question to be tried, and must show a prima facie case only • Balance of convenience factors favours maintenance of the caveat on the register until trial 22 o Delaying registration s90(2) • Court can delay registering any dealing w/ the land for a further period specified in the order, or make any order it thinks just • When? Caveator provides security/lodges such sum sufficient to indemnify every person against any damage that may be sustained by reason of any disposition of the property being delayed o A person who lodges a caveat w/out reasonable cause is liable to pay compensation to any person who sustains damage as a result s118 TLA o s90(5): Section 90 has no application where, the lodgement of registration or dealings is to pass to the caveator upon being registered. • • The effect of a caveat o No recordings shall be made in the register relating to proprietorship of or any dealing purporting to affect the estate or interest in respect of the caveat lodged, UNLESS it related to s90(1)(a-­‐c): • A transfer or dealing referred to in section s90(1)(a)(b)(c)(d) or (e) • A transfer of dealing referred to in section s90(5); or • A transfer or dealing in respect of which the caveat has lapsed o If you lodge a caveat AFTER an instrument has been lodged it will not affect that instrument s91(2) o If you are lodging a caveat after a mortgagee exercised their power of sale, the caveat will not have any effect IF the caveat: s90(2A) • Was lodged after the mortgage or charge was lodged; and • Claims an estate or interest in the land transferred by virtue of an unregistered mortgage or charge or other unregistered document intended to create a security for the payment of moneys o Exercising power of sale under mortgage, a caveat will lapse if: s91(2B) • It was lodged after the mortgage or charge was lodged; and • Claims an estate or interest in the land transferred by virtue of an unregistered mortgage or charge or other unregistered document intended to create a security for the payment of moneys o A caveat that has lapsed or been removed by an order of a court cannot be renewed by the caveator for the same claim s91(4) RPs and caveating o In most cases the RP must have another interest that is being caveated, other than legal title. Generally they cannot lodge a caveat against your own title. o When will this arise? • It will arise when the RP becomes aware of a situation that a new transfer is about to be lodged • This often comes up w/ an improper mortgagee exercising a power of sale o There needs to be a separate and distinct interest in the land: Swanston 23 The court held in this case that a mere equity did not give rise to a proprietary interest in the land capable of supporting a caveat. However, this was argued to be wrong in Capital Finance Australia • Until a court makes an order setting aside a voidable sale by mortgagee, the RP has a ‘mere equity’ which is not a caveatable interest. • They relied on Latec arguing that a mere equity was not a proprietary right. However, Latec was not dealing w/ caveats, but a priority dispute • However, as a matter of practice a registrar will accept a caveat if a CoT is lost. o Types of interests • Mere equity: cannot be caveated. As it is not a proprietary right. Swanston • However Vasiliou stated that it was never shown that in Latec that they were dealing w/ caveats • Legal interest: mortgagor remains legal holder, but this cannot be caveated Swanston • Equity of redemption: this is caveatable Latec and Breskvar which did not in fact specifically state which interest was held, but gave the impression it was a full equitable right • This has been heavily criticised because Latec was a priority dispute, and dealt w/ proprietary rights. • (2) Competing equitable interests under the Torrens System (equitable vs equitable) • Identify what interests each party has o Equitable interest and a specifically enforceable contract o Equitable interest o Legal interest o Mere Equity: • Equity of rectification • Equity to set aside fraudulent transaction • Estoppel • When was each created? • Notice Provision Test: Preliminary test o The first equitable interest must prevail if the second equitable interest took w/ notice of the existence of the first Moffett v Dillon • Notice is not just a consideration in determining which is the better equity, it is determinative, no need to make any further enquiries o Situations of when you go to the merits test even w/ notice: • It might be a situation where the second interest holder has been induced to believe that the first won’t enforce the interest against them o What is sufficient for notice s199 PLA • If there is actual knowledge; or 24 If it would have come w/in his knowledge if such inquiries and inspections had been made as ought reasonably to have been made; or • It has come to the knowledge of his legal practitioner or other agent, or would have come to the knowledge of his legal practitioner or other agent, if such inquiries and inspections had been made as ought reasonably to have been made by the legal practitioner or other agent. o If this is not satisfied move on to merits test Merits Test: There are two formulations of this test, however the following is the preferred in Victoria: o Prima Facie First in Time: The earlier equity in time will take prima facie priority over the later interest, UNLESS there is some act or neglect of the prior equitable owner (postponing conduct): Abigail v Lapin • Burden of proof: Second interest holder bears the burden of proving postponing conduct • Factors for postponing conduct. List what each party has/hasn’t done • Whether a caveat has been lodged by the first interest holder o This can be postponing conduct even if the subsequent owner doesn’t search the register Abigail o However according to J & H Holdings a failure to caveat is only one thing to take into account. (This was dissented in Black v Garnock by Callinan) • Whether possession of the CoT has been taken o Not necessarily decisive but very material • Whether or not the land is in possession of somebody • Why should [insert conduct] be classified as postponing conduct in this particular case? What makes it inequitable that the first party takes priority? • Estoppel theory (works well for arming cases) o The holder of the first equitable interest should be estopped from asserting the priority of his/her interest because his/her words/conduct have induced the holder of the second equity to act to his/her detriment o Example: § the failure to caveat may have induced a party to act to their detriment and acquire an interest in land Butler v Fairclough; Heid § Handing over a transfer and CoT Heid, Lapin o Applies better w/ agency cases, not cases like Jacobs v Platt • Agency/Arming theory: o Have you voluntarily armed someone w/ the means of dealing w/ the estate as the absolute legal and equitable owner, free from every shadow of encumbrance or adverse equity Rice • • 25 • • o Given someone signed transfers or CoT Lapin • Negligence theory/reasonable foreseeability approach (works well for inconsistent interest cases) o Was it reasonable foreseeable that A’s actions would lead to a second interest being created in ignorance of the prior equitable interest? Heid; Jacobs v Platt o Had the prior interest holder taken or failed to take all reasonable steps to prevent the RP dealing w/ the land w/out notice of the prior interest? Butler o Solicitors and CoT: § Entitled to leave CoT and documents w/ them provided they are independent. o Caveats are important when the interest holder has no other way to protect their interests. But look at the circumstances: Jacobs v Platt § Not common practice to lodge a caveat for an option to purchase § Wasn’t settled practice to search the title for prior interests before entering into a contract (purchaser’s rely on vendor’s statement) § It is Registrar’s practice not to accept things w/out CoT, and since the bank was holding this, it acted as sufficient protection Perpetual Trustees v Smith § Family arrangements are relevant, different from an arm’s length commercial transaction Jacobs V Platt § Perhaps failure to caveat is immaterial when somebody has possession of the property Consider if your answer would be different if you applied the better equity test? o Better Equity Test: Priority of time will only operate where the equitable interests are equal. It will be first necessary to consider the following to determine who has a better equity, or it all the equities are equal Rice v Rice. Look at: 1. Nature and condition of the interests 2. Circumstances and the manner of their acquisition 3. Conduct of each of the two parties – encompasses the first two elements somewhat o Conclude: Because of [conduct] (explained above under postponing conduct), the second equity is better than the first equity thus it will prevail. o If they are equal, use first in time. What does the outcome of the priority dispute mean for the party or parties you are advising? (3) Competing between prior equity and a subsequent equitable interest (equity vs equitable) • What are the types of ‘mere’ equity: 26 • o Equity of rectification: Gives a person a right to have a written agreement rectified to correct a mistake or to reflect an alteration that has been agreed to by the parties Downie v Lockwood o Equity to set aside a fraudulent transaction: Only a mere equity Swanston but in Breskvar it was regarded as a full equitable interest o Equity arising out of an estoppel: Inward v Baker based on estoppel imposed to prevent unconscionable behaviour or perhaps a Baumgartner type CT o NB: if an interest is mere equity but is devised by a will, it will become a full equitable interest Stump v Gaby The general rule if there is a conflict between a prior equity and a FULL equitable interest, priority is awarded to the bona fide purchaser of an equitable interest who takes notice for value and w/out notice of the prior equity. The mere equitee can’t do anything, can’t lodge a caveat. (4) Priority disputes between a mortgagor and a purchaser from a mortgage • Where the purchaser is already registered (prior equitable interests vs legal interest) o s77(4) and s42(1) TLA will give the purchaser IDF of the estate or land. They will have a legal interest. o Unless there is an EXCEPTION to IDF (see exceptions above) and: • s77(4)(a) TLA a lease easement or restrictive covenant to which the mortgagee has consented in writing • s77(4)(ab) A mortgage charge easement or other right that is for any reasons binding upon the mortgagee o Or if the PURCHASER improperly exercised the power of sale • Right of the mortgagor • The mortgagor will have to show that there was fraud under s42(2) • This may allow the mortgagor’s equity of redemption to exist in which case the mortgagor may restore his legal estate by paying the balance • Rights of the purchaser: • All they will get is the mortgagee’s interest in the land, not the fee simple of the mortgagor. They will have to give it back when the mortgagor has paid o What if the mortgagee improperly exercised their power of sale (the purchaser is innocent and now has legal title) • The mortgagor will have no rights against the purchaser. However, the mortgagor can take action in damages against the person exercising the power of sale (mortgagee) and will have to follow this up s77(4) TLA • Where the purchaser is unregistered (legal interest vs subsequent equitable interest) o s77(4) will have no role to play and the mortgagor will still be the RP of the land and will wish to prevent the registration of the property in the purchaser’s name 27 by lodging a caveat or seeking an injunction. Here the mortgagor is the legal title holder and the purchaser has an equitable right for completion of the contract. o Mortgagor will argue that the sale was improperly exercised under s77 TLA and this breach of statutory duty gives them certain rights. • If a mortgagor defaults in payment of a principal or interest and it continues for one month, the mortgagee can serve on the mortgagor a notice to pay under s76(1) and if the default is not remedied w/in a month they can exercise their power of sale under s77(1) • When selling they must act ‘in good faith and having regard to the interests of the mortgagor’ s77(1) o Options for the mortgagor: • Lodge a caveat (unlikely to be successful) • A party would want to lodge a caveat in order to maintain the status quo until an injunction could be obtained • To lodge a caveat you need a claim for an estate or interest in land TLA s89. Just because the mortgagor has legal title of the land, this is NOT enough to be a caveatable interest. It must be separate and distinct from the legal interest. Something else is required Swanston o The right to set aside an improper sale is only a mere equity. According to Swanston (based on Latec) this cannot be caveated as it is not a proprietary right. § Kitto and Menzies in Latec argue it the right is proprietary and supports a caveat even if it is mere equity, though this is not followed § However Vasiliou argued that it was never shown that Latec was dealing w/ caveats o If they had an equitable interest there is nothing stopping them from lodging a caveat • Seek an injunction Forsyth v Blundell (Likely to be successful) • There are two requirements before an interlocutory injunction will be awarded (it is a discretionary power) o There must be a prima facie case giving rise to a serious question to be tried o There must be a serious question to be tried: § There is a probability on the evidence that he/she will be found to have asserted equitable rights; and § That probability is sufficient to justify the practical effect which the caveat has on the ability of the RP to deal w/ the property in question o Balance of convenience must favour the granting of an injunction 28 The mortgagor must tender the money in the court for the amount owed to the mortgagee For a permanent injunction, the mortgagor must demonstrate priority over the purchaser. The RP must argue that they have a legal interest AND they have an equitable interest that arises through an equity of redemption (this is a full equitable interest) o Legal interest vs subsequent equitable interest § The first party is still the RP thus the mortgagor’s interest would prevail and defeat the subsequent equitable interest due to s42. o Equitable interest (equity of redemption) v subsequent equitable interest § Use normal tests. If there is no postponing conduct the equity of redemption will prevail Forsyth § • 29