English summary of "LFP" by Charles

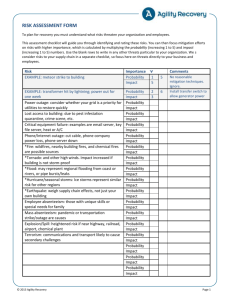

advertisement

English summary of "LFP" by Charles-Edouard Bouée, CEO of Roland Berger, and Isao Endo, Chairman of Roland Berger Japan 1 Preface This book aims to integrate Western knowledge and Eastern wisdom. In today’s new business environment, it is not only impractical to sit around discussing the stereotypes and methodologies of the US, German and Japanese management styles of the past, but it risks causing even more confusion in the process. Given the changes we are currently experiencing, it is fundamental for us to let go of the paradigms we have believed in until now. What we are seeking to do here is reconstruct management in an integrated (holistic) way. However, it is not only the rational (logical) side but also the spiritual and emotional aspects that need to be considered. The title of this book, “LFP” (Light Footprint), might sound unfamiliar to Japanese readers. But for me, working as a consultant for many years in the global arena, I believe LFP to be the key concept for adapting to the new environment. In summary, LFP means being agile enough not to leave “footprints”, and management that is flexible to change. For those of us living in this age of rapid change and unpredictable turbulence, I believe the LFP management model is the answer. As well as being the global CEO of Roland Berger, I have also served for many years as an Asia chief based in China. Having such an up-close look, I was astounded to see the rapid and continuous growth of Chinese private start-up companies. The management model they were using was none other than LFP. In China, the privatization of businesses began to increase in the 1980s. And for these new companies, the same abilities necessary for adapting to this new environment are being used to help them achieve growth. They are remarkably quick, flexible to change and exceptionally dynamic. For them, LFP has become routine. On the other hand, many traditional Western and Japanese companies have lost 2 the ability to respond to these fundamental environmental changes. How to overcome such crises and whether these companies should be transformed are the central themes of this book. However, the knowledge we can draw from Asia is by no means coming from China alone. As a representative player in Asia, Japan has also offered a number of hints that have advanced global management approaches. Over the years, Japanese companies have encouraged the idea of Gemba, (literally on the spot management) and have been focusing on fostering Gemba Power. This idea is a core element of LFP. I published a book entitled Light Footprint Management in 2014. It is well regarded both among managers in Europe and the US and among management scholars. In this book, we introduced the concepts of Gemba and Gemba Power. At a time when rapid changes are not readily apparent, those in the field are on the front line, exposed to these changes and compelled to act, think and make decisions actively and independently. After many lively discussions with Roland Berger Chairman (Japan) and co-author Isao Endo on the topic, we decided to write a book about LFP together, and thus, the book was born. To ensure a practical focus, this book not only contains conceptual stories but also covers six large, traditional companies in Europe and Japan as case studies. The route for implementing LFP differs from company to company. We hope that the examples of transformation in the cases introduced in this book will provide the reader with a wide range of practical suggestions Charles-Edouard Bouée Isao Endo *** 3 1. Arm yourself with extreme agility We have analyzed six large European and Japanese corporations as best practice examples of LFP (Light Footprint) transformation. They are all growing rapidly with substantial profits in dramatically changing environments and come from a diverse range of industrial segments. What all six corporations have in common is that through various management efforts, and despite their sheer size, they have been able to revive their extreme agility and even hone it further. This has ensured that their speed in making decisions and taking action is extremely fast. In a normal corporation this doesn’t happen. If not maintained, a large corporation’s sense of speed will deteriorate, and agility will be lost. However, these six corporations hone their agility to the point that they stand out from the competition. Let’s take a look at each company and what defines their agility. 1) Schneider Electric: M&A is right at the center of their growth strategy, a fact clearly underlined by approximately 50 M&As over ten years. While many corporations expend enormous time and effort on one M&A, achieving 50 is in a different league. Open minded about costs, they place the strategy of “buying time” at their core, from screening potential corporations to the merger process itself, everything is undertaken swiftly, all the while providing total solutions to their clients. On the other hand, in developing countries with expected future growth, they are carefully and gradually working on training and developing the skills of the local staff, thus building a base to accelerate the business quickly when the opportunity strikes. 2) ZARA: Being particular about “making things that sell”, they release new products twice a week. Releasing a constant stream of new items keeps customer fascination for the products high. In a year, they design around 40,000 new items, about 10,000 of which become products. With a direct connection between the storefront and head office, they maintain a high turnover cycle by listening to the customer and utilizing the fresh data straight from the shop floor. The country manager, store managers, designers, and the commercial division’s contact person make up one team, creating an 4 environment in which decisions are made quickly. Many of their manufacturing and distribution centers are consolidated in Europe, and with speed being a priority, they distribute their products by air. 3) BMW: BMW are particular about having “world-first” advanced technologies to support their brand image of The Ultimate Driving Machine. They don’t just develop new technologies but seek to integrate those technologies into new vehicles as quickly as possible, thus ensuring that BMW customers are the first to benefit from such advances. Although they are particular about retaining core technologies within the company, they aren’t fixated on it being 100% in-house. They use in-house capacities, joint development, and outsourcing where appropriate, to divide up management resources strategically and keep the emphasis on speed. They also proactively invest in start-ups and are now incorporating many advanced technologies in IT. 4) Toray: Recognizing the importance of Open Innovation, management has been pushing collaborations with very agile companies like Uniqlo, in turn creating new growth as well as mastering speedy business development practices. On the other hand, they are also very particular about their in-house development of next generation materials such as carbon fiber, which they have carefully developed over half a century, leading to a huge contract with Boeing. They maintain their own unique DNA with beliefs such as “the deeper, the newer” and “long-term continuity”. 5) Toyota Motor Corporation: They have changed to a totally new business model by revising their traditional headquarters centric approach to giving decision-making power to four core “Business Units”. The end goal is an organization that can make decisions quickly and execute plans promptly. They have also left the path of self-containment and have aggressively sought out partnerships with competitors and other companies. Meanwhile, in order to lead the world into becoming a hydrogen society, they embody the spirit of their founding slogan, “be ahead of the times”, by being the first to mass-produce fuel cell vehicles. 5 6) Seven & i Holdings: Under strong leadership from management, they have produced many “firsts” by promoting independent creativity from Gemba. By taking on unprecedented challenges they have continuously redefined the norm. With an emphasis on direct communication, they are superior at being able to quickly embed the direction of the company throughout the organization. They are also refining the “power of thoroughness”, which creates new values by unifying many varied strengths from outside the company. Furthermore, they are undertaking new business model development with partnerships with companies from different industries. Each of the six corporations we listed here operates globally and is truly large-scale. What is surprising is that these colossal corporations use their agility and speed as weapons and are competing with fast paced “LFP natives” at the same speed. The only reason these six are able to demonstrate unparalleled performance is that despite their size, they continue to be extremely agile. Some of them had lost the agility they once possessed yet through later managerial efforts were able to recover it. Some of these corporations strive to maintain the agility they had when the company was first established through hard work and diligence. The loss of agility is a life threatening defect LFP management is simply using extreme agility to manage business at an extremely fast pace in a volatile business environment. Once again, in the new VUCA world “slow” is fatal. Most big companies start to develop so-called “large corporation disease” where bureaucracy runs rampant, decisions are stockpiled, shirking responsibility becomes the norm, valueless redundant processes take root, and authoritarian meetings take place frequently. Put simply, they change into companies that are slow at everything. No matter how good their skill or technology is, or how good their employees are, if there is no agility they are doomed. In reality, when companies are first formed they are all very agile. With a small organization, open-minded culture and overflowing with a start-up mentality, spirited debates occur, and everything is decided on and executed at speed. 6 As a business grows and the organization develops, there are many possible areas where “invisible walls” can appear, bureaucratic structures become rampant and business and decision-making speed continues to deteriorate. Essentially the arteries of the company become clogged, stopping its blood flow. It’s as if the waters around you are suddenly flowing faster, and even if you’re swimming at the same pace, it feels like you are slowing down, swimming against the current and ultimately drowning. To thrive in the VUCA age, an organization must quickly recover its agility and hone it. Acquiring a fast ticking “biological clock” Every company has a “biological clock” embedded within itself. How fast the business moves from decision, communication, execution to learning is determined by this biological clock. Also, the pace of one company’s biological clock differs greatly from another's. Some companies have biological clocks that spin at dizzying speed, while others move at a snail’s pace. Some are fast, measuring by the minute, hour and day, while others measure by the month, quarter or even year. How fast the biological clock ticks is greatly affected by the characteristics of the business. The fashion industry, which chases and creates trends, and IT firms, at the forefront of technology, are relatively fast, while the biological clocks of energy companies or other infrastructure-based organizations are fairly slow. When competing with similar companies, the biological clock hasn’t required much attention, mainly because most corporations have had similar biological clocks. However, this is about to change drastically. Startups (LFP natives), with different biological clocks, as well as companies in different industries with fast-ticking biological clocks, are expanding over into new industries. These LFP natives and companies from different industries entering new sectors, use their fast moving biological clocks as weapons to compete with the established players. They change the rules of the game with their speed, and those companies that can’t keep up are eventually wiped out. Not only that but there are some companies that are acquiring different biological clocks by continuously conducting business along with being agility-conscious. It will be difficult to survive in this day and age with a slow biological clock that isn’t fit for the times. 7 2. The ten principles for practicing LFP management With the hints that can be taken from the six cases from Europe and Japan, a total of ten principles can be derived from the three different points of view, “strategic”, “organizational” and “operational”. From the strategic point of view the following four principles can be highlighted. These provide a strategic road map showing how to value and acquire extreme agility in order to dominate the competition. Principle 1: Make extreme agility a central issue in management Principle 2: Dynamically buy time Principle 3: Join forces with a company that has a different biological clock from yours Principle 4: Be completely focused on being first From the organizational point of view the following three principles are drawn. These point to how you can acquire extreme agility and include the changes that need to be made to the organization. Principle 5: Divide, delegate and connect Principle 6: Create a task force team Principle 7: Initiate early From an operational point of view the following 3 principles can be stated. These points are essential in creating extreme agility in day-to-day operations as well as achieving high speed. Principle 8: Always start on-site Principle 9: Build intimate relationships Principle 10: Never forget the beginning These ten principles are not independent of one another; rather they are related and influence each other. They are intricately intertwined, making up the biological clock of a company. To achieve extreme agility it is essential to integrate these components into the system of operation. Let’s take a close look at each of these ten principles. 8 Principle 1: Make extreme agility a central issue in management To survive in the new VUCA business world you have to attain extreme agility. No matter how superior your technology or employees are, if you do not have agility that is composed of “speed X accuracy” you will not have the competitive superiority to win. Uber, the LFP native, started up in 2009 and within a mere six years is now established in over 300 cities in 58 countries. This type of speed was virtually unheard of until now. To conservative companies trying to protect their vested interests, this kind of next level speed is nothing but a threat. There is a similar example here in Japan. Within two years of Seven and i Holdings starting Seven Bank Ltd in 2001, they had placed 7,000 ATMs at 7/11 stores around the country. Currently (2015) they have over 21,000 ATMs with over 2 million users a day. At the time, most megabanks did not feel threatened by ATMs at convenience stores. But, in the blink of an eye, going to the convenience store to withdraw money became commonplace in Japan, especially among the younger generation. LFP native companies and organizations are using agility as a weapon to wage war. They know full well that traditional large companies lack agility and will use it to their advantage. To combat them, agility must be made a top priority and meticulously honed, even in a large corporation. Agility is an organizational skill. It is an ability that the organization should internalize and it is enhanced by management effort. However, many large companies don’t place that much emphasis on improving agility, and lack effort. With a want of clear drive to enhance agility and the continuous effort to do so, obtaining a fast biological clock is near impossible. The lead time for a product to hit the shelves at Zara is two to three weeks. New 9 items are continuously released twice a week on specific days. This is an agility that’s on another level when compared to others. To compete in agility they have clustered their manufacturing and distribution centers in Europe as well as effectively used airfreight to create an extremely high-speed operation. They place a greater priority on speed and high turnover than on cost. Of course, the product quality as well as the quality of service in the stores is important too, but ZARA’s high-speed model will beat a competitor, even one offering the same quality, every time. Obtaining extreme agility means creating new organizational ability and establishing a new business model as well. It is of the utmost importance for the executives of the company to clearly convey that they are going to compete by being agile. For the new endeavor to be successful, people will need to be both tenacious and resolute in their reform of the business model. Principle 2: Dynamically buy time Becoming extremely agile involves being competitive by using time. To beat fierce competition, seeing time as a competitive advantage and having the mindset of buying time must always be at the forefront. Mergers and acquisitions are classic examples of buying time. M&A means acquiring assets and businesses to enable a company to save time and be efficient. For a long time many Japanese firms were against M&A. They prized being self-contained, procuring everything in-house, and controlling every part of the business was standard procedure and was even thought of as the best way to function. M&As were seen as a bad way of taking over a company, and an unspoken rule that a “proper company” would never engage in M&A was prevalent. In recent years, Japanese corporations have lost their distaste for M&A. Some 10 companies have even appeared on the market that aggressively pursue M&As. However, many Japanese companies are passive in terms of M&A. An attitude of waiting is very apparent, with lengthy consideration and very careful decisions. Japanese companies still have room to improve in the realm of M&A. On the other hand, corporations like Schneider Electric put M&A right at the core of their long-term strategies. With an emphasis on the value of time, they have no hesitation in buying time. That is why they have completed over 50 M&As over a short ten-year span. The experience and know-how accumulated in doing so is not easy to copy. Like Schneider Electric, the Japanese firm Nidec Corporation is one of the few to have achieved success by placing M&As firmly at the center of their long-term strategies. Since 1984, they have successfully managed 43 M&As, 20 of which were completed in the period since 2010. It isn’t all roses, however. Although not a particularly large firm, the prototype and metal mold company ARRK repeatedly acquired or merged with many small to medium-sized firms, rapidly increasing in value. In a single year they completed 30 to 40 M&As, and by 2008 had 180 subsidiaries under their corporate umbrella. As a result, their net sales of 38 billion yen as of the end of the 2002 fiscal year had grown to a staggering 380 billion yen as of 2008. Within barely six years they’d expanded tenfold. But the Lehman Shock in the fall of 2008 instantly plunged them into crisis. The Industrial Revitalization Corporation of Japan, or IRCJ (currently: Regional Economy Vitalization Corporation of Japan), ended up having to bail them out, with the complete management team forced to resign. What was the difference between Schneider Electric, Nidec Corp. and ARRK? It came down to whether their M&As were strategically completed in order to produce potential synergies within the clearly delineated domain of business. Although ARRK had been specialized in molds and prototyping, from one second to the next it changed to the high-risk business model of an EMS (electronics manufacturing service), manufacturing products such as motherboards and other 11 parts. This became their Achilles heel and in the wake of the Lehman crash they very quickly fell into dire straits. They have since refocused on their original strengths of prototyping and mold making and are driving hard to recover. Expansion is different from growth. Expansion by reckless M&As as in the case of ARRK will lead to downfall. That said, it doesn’t pay to be afraid of conducting M&As either. As global competition heats up, every industry will face territorial conflict. More mature industries will experience this more intensely and it will become almost like a game of Othello: Even if a company is in a good position now, that can be reversed in the blink of an eye with a well-executed M&A. To acquire extreme agility, clearly outline the area in which you are going to compete, use M&A as an offensive strategy and dynamically move forward. It is impossible for a company bad at buying time to acquire extreme agility. Principle 3: Join forces with a company that has a different biological clock from yours M&A is one way of using the strengths of others but it isn’t the only option. Creating new value fast by cooperating with other companies through partnerships is an important theme for any company. For LFP natives, using the strengths of others comes naturally and is commonplace. They will partner with anyone based on a need, and if the need disappears so does the partnership. Google and Twitter partnering and splitting multiple times is not a rarity, but an everyday occurrence in the fast-changing world of IT. The need or rationality for using the strengths of others isn’t something restricted to the IT world. As the executives at Toray say, “the age of when a single company can take on a large job by itself is gone, the age of fusion is here,” so if you don’t jump the hedges between traditional industries you cannot have new innovations. 12 For traditional large corporations, using the strengths of others isn’t just an opportunity for open innovation. It is the perfect chance to destroy their rusty, old and slow biological clock and obtain a new one. The example of Toray and Uniqlo’s partnership is a great one. Toray at the time couldn’t keep pace with Uniqlo, which had a much faster biological clock. However, Toray’s frantic efforts to keep up with them meant that they in essence received a “biological clock transplant” from Uniqlo. By joining forces with a player that has a different biological clock to yours, you can acquire extreme agility. Team MD, run by Seven Eleven, has the same type of effect on the companies they are partnered with. Seven Eleven is a company with a very fast moving biological clock. The level of quality required by Seven Eleven, in terms of product quality, cost, and especially speed, is very high. However, by clearing these hurdles, outside companies also improve their own biological clocks. It is very difficult to reform one’s biological clock by oneself. One way to acquire extreme agility is by using outside strengths, which will change the biological clock to evolve into a newer, faster model. Principle 4: Be completely focused on being first We have mentioned how extreme agility can be obtained through M&A and using the strengths of others. For Japanese companies who have a strong tendency to keep things in-house, using time as a weapon to use the outside strengths wisely is an unavoidable topic. However, the simplest method – until now and going forward – for Japanese companies to increase their value is by raising their creativity, and improving it to generate new value. But even with this simple method, time is something you can’t ignore. No matter how good your technology or know-how is, if it isn’t formed into something tangible and put to market faster than anyone else is doing it, then that value 13 quickly diminishes. For this reason, companies who possess extreme agility are permanently obsessed with being first. Being number one in Japan, or in the world, is always at the back of their minds, and they are extremely driven to beat the competition to the punch and be the first to market. In other words, because of their obsession with being first, their sense of speed is raised, which directly correlates with extreme agility. “If you’re not number one there is no reason to exist and 2nd and 3rd are meaningless” is the mentality that permeates throughout those companies, and that leads to faster decisions and executions at an individual level. BMW has advanced technologies that are “world first”. But just being advanced is meaningless. Every company is trying to create something advanced. Putting these advanced technologies on the market before anyone else is extreme agility put into practice. This is the brand value of BMW. The mass production fuel cell “MIRAI”, which Toyota created as a world first, is the same story. To lead a hydrogen society, “MIRAI” had to be a world-first technology. That is what inspired the development team to utilize their extreme agility and overcome the many technical hurdles they faced. The effect of obsessing over being first isn’t only applicable to products such as cars, which have long development cycles. The only reason Seven Eleven has a much faster biological clock than others is because they are permanently obsessed with being first. Seven Eleven’s extreme agility itself isn’t the reason why they have created 13 world firsts and 38 Japanese firsts. They continuously refused to accept the status quo and focused solely on those firsts, which is what eventually enabled them to attain their extreme agility. By clearly identifying how they were going to be first, and being obsessed with making that a reality, their biological clock had no option but to get faster. The obsession with being first links directly with extreme agility. 14 Principle 5: Divide, delegate and connect To attain extreme agility, there are three keywords that must be taken into account on the organizational side: divide, delegate and connect. Large corporations are inherently heavy and slow. In order to shave something off the weight of heavy companies, the first measure that comes to mind is “divide”. By dividing, each business unit is made smaller and thus more agile, ultimately enabling it to become fast again. The purpose of Google becoming a holdings group for their “second launch” or Toyota becoming a “small Toyota” is to divide and revive their agility. The second keyword is “delegate”. Simply dividing the organization won’t make it faster. Each separate business unit needs to be have full responsibility delegated to it, in other words it must be empowered. Under highly fluid conditions, the most accurate decisions can only be made by business units that are facing up to the change and those units that are at the Gemba. Those boots on the ground have to be able to analyze the situation, consider what to do, decide and act. To do this, each business and Gemba has to have the right amount of decision-making power delegated to it. Having to ask the head office what to do or wait for their direction or approval will leave organizations behind in this changing environment. Uber, which has established business operations in over 50 countries in a mere four years, leaves the majority of the decisions in each area to the business set up in that area. They’ve even gone so far as to ban approval documents. To compete with LFP natives, the complex and obscure management styles and systems from traditional large corporations have to be broken down and removed. How Schneider Electric, with more than 180,000 employees and operations in 15 190 countries, retains its extreme agility is by giving each center of business its own independent decision-making capabilities. CEO Jean-Pascal Tricoire emphasizes that “delegation of power and division is our culture”. For them, decentralization isn’t a system but a culture. To increase agility, Japanese companies are starting to decentralize. Seven & i Holdings’ Ito-yokado has moved away from a chain store model, and is beginning to allow individual stores that have unique sales floors, products, and services individually designed to meet the needs of each area. It takes a relatively long time for decentralization to take root and flourish. Allowing the Gemba to make decisions they previously weren’t allowed to make doesn’t mean they will always make the right decisions. On the road, mistakes can and do happen. But in order to acquire extreme agility, the Gemba staff have to be trained to think and decide things on their own. Where a situation in which “the head office lacks information and the Gemba staff have no say” continues unchecked, survival rates in the VUCA age are virtually zero. The final keyword is “connect”. To keep up with the constant pace of change, the business unit exposed to the changes must be entrusted to make decisions, but this in itself leads the individual business unit and the Gemba to become isolated from one other. The merit of being a large organization is that many business units and various Gemba are tied together. The well of organizational knowledge gleaned from the many experiences and wisdom collectively gained can be shared and added to, to create first-class players in the market. To do that, it is important for each business unit or Gemba to be organically connected. Achieving independence & conjunction is what produces extreme agility. 16 Principle 6: Create a task force team One element that is absolutely necessary in acquiring extreme agility is to utilize a task force team. President Obama, as an LFP practitioner, sent a small, elite ten-man team into Afghanistan to eliminate Osama Bin Laden. America is well versed in sending task force teams like this into war zones around the world. The existence or lack of a small, elite team with a clearly defined mission, high morale and skills can make or break LFP operations. Google’s skunkworks team, “Google X”, creates small teams of experts based on each theme, which go deep and work on rapid development. Their sense of speed and their trial and error process are highly effective, as can be seen in their ability to prototype something that was first discussed before lunch that very same day. There are limits to agility if a company is traditionally mammoth sized. By using the strengths of others and decentralizing, not only is it possible for them to become agile but it is also essential for such efforts to be undertaken. However, to really tackle the challenges central to the business when imagining the future, a special task force team separate from the larger organization is the most efficient way to proceed. An excellent example of this is Toyota’s “BR (Business Reform) Structure”. Toyota forms these specially tasked teams with a specific delivery date based on the theme and the problem at hand. The world’s first hybrid car, the Prius, was rapidly developed through this BR structure. At Toyota there are dozens of these BR structures working behind the scenes at any given time. These BR structures are the reason why Toyota is able to stay so flexible for such a big organization. Task force teams are mission-driven organizations. These teams are designed to quickly accomplish very clearly defined and focused missions, which must be 17 separated from the day-to-day operations of the company. Task force teams report directly to the executives, and have a considerable say in how they complete their tasks. Members of such teams are highly professional and extremely committed to completing the mission. The task force must necessarily have a different biological clock from the organization in order to acquire extreme agility. Principle 7: Initiate early When trying to attain extreme agility, you can’t help but be focused on speed. The surrounding environment is changing fast, so your pace needs to match. However, speed is not the only factor in keeping up with the changing environment. There is also the important element of timing. Judge the flow of major changes and start working toward the future as quickly and as early as you can. If you start preparations early, you can spare that much more time for those preparations. It is easy to just want to speed everything up, but if you time things right and start preparing early you won’t have to rush. Google has “Google X” looking into over 100 different future themes. They are challenging themselves to pioneer unknown areas, which is what makes the impossible possible, like landing on the moon. Google X uses two temporal elements, “timing X speed”, to try and achieve extreme agility. At times, though, it is necessary to take your time when doing futuristic R&D, and you shouldn’t skimp on spending the proper amount of time. Ripening takes time. But to do that you need to start before anyone else and make sure you have the time required. If you mistime it, no matter how fast you move, getting that time back will be difficult. Toray’s carbon fiber development started over half a century ago. Even though competitors gradually fell away or shrank, they stuck to it with amazing tenacity 18 and are now the world leaders. Seven Eleven brought the convenience store business model to Japan over 40 years ago. They built up their unique know-how in shop management through considerable trial and error. The difference of 100,000 yen in daily sales per store compared to the competition results from their high-quality repetition of hypothesis & verification. Being careful should not be confused with being slow. Just because you have time, you should not do things slow otherwise you will waste the benefit of starting early. Careful and fast is characteristic of extreme agility. Principle 8: Always start on-site Gemba is where change happens regularly. While various risks can occur here, there are opportunities to be had as well. Acquiring extreme agility involves building a high-cycle system that starts with Gemba. If the “Gemba sensitivity” that senses minute changes isn’t heightened, the agility of the organization can’t be heightened either. Delegate decision making on what needs to be handled to the Gemba in order to respond faster. However, all problems cannot be solved by Gemba alone. Close cooperation with the head office is crucial to operating as a team to solve problems and create value. To accomplish this, it is key to raise the level of sensitivity not only within the Gemba but within head office too. If the head office is not sensitive, it won’t matter how good the Gemba sensor is at recognizing problems or opportunities. The head office’s sensitivity to the voices from the front line is a key part of attaining extreme agility. For ZARA, with their motto of “make things that sell”, everything starts with the storefront, which is where they can connect with the customers. That’s why they are completely obsessed about the freshness of data from the stores. 19 They suggest many fittings to the customer and gauge their reactions to the many products, and test them at the Gemba. This kind of finely detailed information is reported by the store manager to the country manager daily at corporate level. Though the country managers are at the head office in Spain, they are connected to each Gemba through the store manager. In addition, the design and commercial divisions organize a team and they discuss the direction of product supply and sales on a daily basis. With the store being the Gemba as the center point, the high-speed cycle spins non-stop. One of the secrets to Seven Eleven’s rapid progress is the fact that taking the customers’ point of view to hypothesize & verify is firmly established. It definitely isn’t meant for the customer’s satisfaction. Stand in the customer’s shoes, think and draw a hypothesis. Then try that at the Gemba, and check the result. This is obvious when explained, but by persistently continuing this cycle Seven Eleven has been able to raise their Gemba power. It is difficult to grow in the VUCA age when the cycle is started and dictated by the head office. It is absolutely essential to spread the mindset throughout the organization that it’s at the Gemba where opportunities and hints to the future can be found, just as it’s essential to build systems to take advantage of them. Principle 9: Build intimate relationships It goes without saying that the agility of an organization is heavily influenced by the scale of operations. As the scale gets larger it takes longer for directions to be decided on, information to be transferred or interests to be adjusted, all of which slows things down. This is a typical symptom of “large corporation disease”. However, there are companies out there that have become large scale but have nevertheless retained their agility. These companies continuously raise the level of “density” of their organization. Irrespective of growth, if the organizational density is high, the adverse effects of growing can be kept to a minimum. Organizational density is the physical distance between the executives and the 20 Gemba, between divisions, and between individual employees. If the organization is successful in not having space or gaps and is tightly knit, direction and information spread quickly and thoroughly. Increasing organizational density leads to extreme agility. The basis of organizational density is the relationship between people. Google is obsessed about having a comfortable, yet cramped office environment. They believe that by having a space so cramped that if a person swings their arms they will hit the person next to them, it will decrease the space between people and get people talking, therefore creating new ideas. The open-plan arrangement that Japanese corporations have treasured is also a way to increase organizational density. By having one large room, and spending time together regardless of division, people start to get to know each another, connect with one other, thus creating intimate communication. These small efforts ultimately lead to a high organizational density. Organizational density can be the root of a problem between management and the boots on the ground. The larger a company is, the more often the direction management is taking doesn’t reach those at the Gemba, leading to the message not completely being absorbed by the company as a whole. If there is a “temperature difference” (or enthusiasm difference) between those at the Gemba and management, it is virtually impossible to execute a directive. The way Seven Eleven works to eliminate that threat is by having an “FC (Franchisee) Meeting”. Every 2 weeks, all 2,500 OFC (Operation Field Councilors or store management advisors) from around Japan come to the head office to take part in a 3,000 person meeting with the management and staff at the head office. FC Meetings were held right from the start of the business and have continued for the last 40 years despite having grown to 3,000 people. They are a forum for realizing “direct communication”, which President Suzuki holds in high regard. At these meetings, policies are decided, which are gradually put into practice on the front line. 21 Communication has become more efficient by taking advantage of IT. However, to build relationships and attain considerable unity, some raw effort and ingenuity is essential. The cost of these FC Meetings is over 2 billion yen. But the value of the resulting extreme agility is immeasurable. Principle 10: Never forget the beginning One element that is needed for a traditional large company to regain their extreme agility is to recover their entrepreneurial spirit. Every company starts business with high hopes. In the beginning, there is an abundance of startup spirit, frequent debate, a strong sense of solidarity and a powerful sense of speed. Initially, the only tools available to enable to company to be competitive are a strong sense of passion, a lot of teamwork, and agility. A good sense of speed and maneuverability are the best ways to fight against the downsides of large corporations. However, as organizational growth progresses, the dreams and thoughts of the startup phase begin to exist in name only and fade away. Bloated organizations start to become the norm, with internal bureaucracy spreading like a virus. In order to keep the extreme agility polished or to revive it, there has to be constant effort by the entire organization to get the entrepreneurial spirit back. Mr. Ortega, the founder of ZARA, has maintained, for 40 years since founding the company, that “the brand’s protagonist isn’t the owner or the designer, but the customer”. There are many systems and mechanisms to keep that mentality reflected in the day to day. The CEO of Toyota, Akio Toyota, is trying to saturate the organization with the mentality of the “Toyota Principles” created 80 years ago. By shining a light on the startup spirit of their predecessors, he is addressing the importance of “swimming 22 ahead of the current” to the present generations of employees. “Large corporation disease” takes root when people become dependent on others and the mentality that “the organization will probably do something” or “someone else will do it” starts to spread. Each person in the organization has to have ownership and a sense of responsibility in order to become a group of go-getters, which will definitely raise the extreme agility of the organization. To acquire the basis for extreme agility, you have to return to the entrepreneurial spirit of the company, be passionate and speak enthusiastically, mirroring the mentality of the original founders. 23 AUTHOR Charles-Edouard Bouée CEO of Roland Berger Charles-Edouard Bouée is CEO of Roland Berger He joined Roland Berger in 2001 as Senior Partner in the Paris office. He became President & Managing Partner of Roland Berger for Greater China in 2006. Since 2009, he has led the Asian Leadership Team. Prior to joining Roland Berger, he was Vice President of A.T. Kearney from 1997 to 2001. He started his career as an investment banker at Société Générale. He has been working globally on strategy, mergers and acquisitions and large-scale performance improvement projects. His industry focus is financial services. Charles-Edouard Bouée has an MBA from Harvard Business School in addition to a Master of Science from Ecole Centrale de Paris (ECP). He also has a Master’s degree in Law from Paris University (Université Paris Sud XI). He is regularly asked to join discussion panels and give speeches at events such as the annual World Economic Forum (Davos Forum). His latest book on “Light Footprint Management” has attracted tremendous interest in Europe, the U.S. and China. Isao Endo Chairman (JAPAN) Isao Endo is Chairman of Roland Berger Japan and a professor at the Waseda University Business School. Before joining Roland Berger in 2000, he worked as Vice President and Director for an American strategy consulting firm in Tokyo. At Roland Berger he successfully reorganized the Tokyo office, starting with only five consultants. Possessing a wealth of experience in business strategy development he provides a range of support for Japanese companies seeking to become globally competitive. He was the first Asian to become a member of the Supervisory Board of Roland Berger worldwide in 2006, staying on the board for 5 years. 24 Isao Endo studied international economics at Waseda University and subsequently earned an MBA from Boston College. He started his professional career with Mitsubishi Electric in the Factory Automation Division. Isao Endo is also a board member of Ryohin Keikaku, a corporate auditor (external) of Yamaha Motor, independent director of Sompo Japan Nipponkoa Holdings and a director of Nisshin Steel. He is a well-known author of several popular books, such as “Cultivating Gemba Power” and “Visualization”. 25