Vasicek Single Factor Model

advertisement

Vasicek Single Factor Model

Vasicek Single Factor Model

Alexandra Kochendörfer

7. Februar 2011

1 / 33

Vasicek Single Factor Model

Problem Setting

I

Consider portfolio with N different credits of equal size 1.

I

Each obligor has an individual default probability.

I

In case of default of the n’th obligor we lose the whole n’th

position in portfolio.

I

What can we say about the loss distribution?

2 / 33

Vasicek Single Factor Model

Contents

Default Correlation

Definition

Why is default correlation important

Independent/perfectly dependent defaults

Modelling Default Correlation

Data sources

Default triggered by firm’s value

Vasicek Single Factor Model

Loss distribution in finite portfolio

Large Homogeneous Portfolio Approximation

Conclusion

3 / 33

Vasicek Single Factor Model

Default Correlation

Definition

Definition Default correlation is the phenomenon that the

likelihood of one obligor defaulting on its debt is affected by

whether or not another obligor has defaulted on its debts.

I

Positive correlation: one firm is the creditor of another

I

Negative correlation: the firms are competitors

Drivers of Default Correlation

I

I

State of the general economy

Industry-specific factors

I

I

I

Oil industry: 22 companies defaulted over 1982-1986.

Thrifts: 19 defaults over 1990-1992.

Casinos/hotel chains: 10 defaults over 1990-1992.

4 / 33

Vasicek Single Factor Model

Default Correlation

Definition

U.S. Corporate Default Rates Since 1920

5 / 33

Vasicek Single Factor Model

Default Correlation

Why is default correlation important

Why is default correlation important?

Consider, for two default events A and B

I

default probabilities pA and pB

I

joint default probability pAB

I

conditional default probability pA|B

I

correlation ρAB between default events

These quantities are connected by

pA|B =

pAB

pB

6 / 33

Vasicek Single Factor Model

Default Correlation

Why is default correlation important

Cov (A, B)

pAB − pA pB

p

ρAB = p

=p

Var (A) Var (B)

pA (1 − pA )pB (1 − pB )

The default probabilities are usually very small pA = pB = p 1

p

pAB = pA pB + ρAB pA (1 − pA )pB (1 − pB ) ≈ p 2 + ρAB · p ≈ ρAB · p

ρAB p

pA|B = pA +

pA (1 − pA )pB (1 − pB ) ≈ ρAB

pB

The joint default probability and conditional default probability are

dominated by the correlation coefficient.

7 / 33

Vasicek Single Factor Model

Default Correlation

Independent/perfectly dependent defaults

Independent Defaults

Consider N independent default events D1 , . . . , DN with

pD1 = · · · = pDN = p ⇒ Number of defaults ∼ B(p, N).For

N = 100, p = 0.05

p (%)

99.9(%) VaR

1

5

2

7

3

9

4

11

5

13

6

14

7

16

8

17

9

19

10

20

8 / 33

Vasicek Single Factor Model

Default Correlation

Independent/perfectly dependent defaults

Perfectly dependent defaults

Consinder default correlation ρij = 1 for all pairs ij.

pD D − p 2

pD1 D2 − pD1 pD2

= 1 2

1= p

p(1 − p)

pD1 (1 − pD1 )pD2 (1 − pD2 )

⇒ pD1 D2 = pD1 = pD2 = p i.e. D1 ∩ D2 = D1 = D2 a.s.

⇒ pD1 D2 D3 = pD2 D3 = p ⇒ D1 ∩ D2 ∩ D3 = D1 a.s. . . .

⇒ D1 ∩ · · · ∩ DN = D1 a.s. ⇒ pD1 ...DN = p

All loans in the portfolio defaults with probability p, none with

probability 1 − p.

9 / 33

Vasicek Single Factor Model

Default Correlation

Independent/perfectly dependent defaults

Perfectly dependent defaults

10 / 33

Vasicek Single Factor Model

Modelling Default Correlation

Data sources

Data Sources

I

Actual Rating and Default Events.

+ Objective and direct.

– Joint defaults are rare events, sparse data sets.

I

Credit Spread.

+ Incorporate information on markets, observable.

– No theoretical link between credit spread correlation and

default correlation.

I

Equity correlation.

+ Data easily available, good quality.

– Connection to credit risk not obvious, needs a lot of

assumptions.

11 / 33

Vasicek Single Factor Model

Modelling Default Correlation

Default triggered by firm’s value

Default triggered by Firm’s Value

The firm value (An,t )0≤t≤1 of each obligor n ∈ {1, . . . , N} is

modelled as in Black-Scholes model, hence at terminal time t = 1

with An,1 = An we have

σn2

+ σn Bn

An = An,0 exp

µn −

2

with some standard normal variable Bn .

The r.v. (B1 , . . . , BN ) are jointly normally distributed with

covariance matrix Σ = (ρij )ij , where ρij denotes the asset

correlation between assets i and j.

12 / 33

Vasicek Single Factor Model

Modelling Default Correlation

Default triggered by firm’s value

The obligor n defaults if the asset value falls below a

perspecified barrier Cn (debts)

Dn = 11{An <Cn }

The default probability of the n’s debtor is

pDn = P(Dn = 1) = P(An < Cn ) = P(Bn < cn ) = Φ(cn )

with default barrier

cn =

n

− µn

log ACn,0

σn

We can assume the individual default probabilities pDn as given

and compute cn = Φ−1 (pDn ) and vice versa.

13 / 33

Vasicek Single Factor Model

Modelling Default Correlation

Default triggered by firm’s value

The joint distribution of Bi determines the dependency

structure of default variables uniquely

P(D1 = 1, . . . , DN = 1) = P(B1 < c1 , . . . , BN < cN )

= ΦN (Φ−1 (pD1 ), . . . , Φ−1 (pDn ); Σ)

In case with two assets with correlation ρ1,2 = ρ2,1 , the default

correlation can be computed via

P(D1 = 1, D2 = 1) − pD1 pD2

ρ= p

pD1 (1 − pD1 )pD2 (1 − pD2 )

=

Φ2 (Φ−1 (pD1 ), Φ−1 (pD2 ); ρ1,2 ) − pD1 pD2

p

pD1 (1 − pD1 )pD2 (1 − pD2 )

14 / 33

Vasicek Single Factor Model

Modelling Default Correlation

Default triggered by firm’s value

We need

I

N(N − 1)/2 asset correlations of Σ

I

N individual default probabilities

I

Additional assumptions on the structure of Bi to reduce the

number of parameters.

15 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Vasicek Single Factor Model

Assume, that the logarithmic return Bn can be written as

p

√

Bn = ρ · Y + 1 − ρ · n

with some constant ρ ∈ [0, 1] and N + 1 independent standard

normally distributed r.v. Y , 1 , . . . , N .

Interpretation

I

Y is a common systematic risk factor affecting all firms (state

of economy)

I

n are idiosyncratic factors independent across firms

(management, innovations)

I

Corr (Bi , Bj ) = ρ controls the proportions between systematic

and idiosyncratic factors, empirically around 10%.

16 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Conditional on the realisation of the systematic factor Y

I

the logarithmic returns Bn are independent ( for a constant y

√

√

variables ρ · y + 1 − ρ · n are independent)

I

default variables Dn = 11{Bn <cn } are independent as function

of Bn

The only effect of Y is to move Bn closer or further away from

barrier cn .

17 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Loss distribution in finite portfolio

Theorem

For ρ ∈ (0, 1) and same default probabilities p = pD1 = · · · = pDN

the conditional default probability is given by

−1

√

Φ (p) − ρ · y

√

p(y ) := P[Bn < c | Y = y ] = Φ

.

1−ρ

P

The number of defaults L = N

i=1 Di has the following

distribution

m Z ∞

X

N

P(L ≤ m) =

·

p(y )k · (1 − p(y ))N−k · φ(y )dy

k

−∞

k=0

18 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Loss distribution in finite portfolio

Proof

The probability of k defaults is

Z

∞

P(L = k) = E(P({L = k} | Y )) =

P(L = k | Y = y )φ(y )dy ,

−∞

where φ is density of Y . The defaults Dn are independent

conditional on Y , hence

N

P(L = k | Y = y ) =

· p(y )k · (1 − p(y ))N−k

k

Thus, for m ∈ {1, . . . , N} we have

m Z ∞

X

N

P(L ≤ m) =

p(y )k · (1 − p(y ))N−k · φ(y )dy

·

k

−∞

k=0

19 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Loss distribution in finite portfolio

Loss Distibutions for different ρ

20 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Loss distribution in finite portfolio

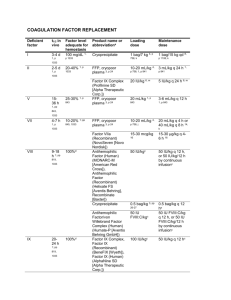

VaR Levels for different ρ with N = 100 and p = 5%

ρ(%)

0

1

10

30

50

99.9(%)VaR

13

14

27

55

80

99.(%)VaR

11

12

19

35

53

Independent defaults

p (%)

99.9(%) VaR

1

5

2

7

3

9

4

11

5

13

6

14

7

16

8

17

9

19

10

20

21 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Large Homogeneous Portfolio Approximation

Large Homogeneous Portfolio Approximation

Definition (Large Homogeneous Portfolio LHP)

I

pD1 = · · · = pDN = p

I

portfolio is weighted with ω1 , . . . , ωN ,

such that

N

X

(N)

lim

(ωn )2 = 0

(N)

N→∞

(N)

(N)

n=1 ωn

PN

= 1,

n=1

The portfolio is not dominated by few loans much larger then the

rest.

22 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Large Homogeneous Portfolio Approximation

Definition (Loss Rate)

The portfolio loss rate is defined by

(N)

L

=

N

X

(N)

ωn Dn ∈ [0, 1]

n=1

Lemma

Following holds for the LHP

(N)

E(L

| Y ) = p(Y ) = Φ

Var (L(N) | Y ) =

√

Φ−1 (p) − ρ · Y

√

1−ρ

N

X

(N)

(ωn )2 · p(Y ) · (1 − p(Y ))

n=1

23 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Large Homogeneous Portfolio Approximation

Proof

Linearity of conditional expectation yields

(N)

E(L

| Y) =

=

N

X

n=1

N

X

(N)

ωn E(Dn | Y )

(N)

ωn P(Dn | Y ) = p(Y )

n=1

N

X

(N)

ωn

= p(Y )

n=1

Dn are independent conditional on Y , thus

Var (L(N) | Y ) =

=

N

X

(N)

(ωn )2 Var (Dn | Y )

n=1

N

X

(N)

(ωn )2 · p(Y ) · (1 − p(Y ))

n=1

24 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Large Homogeneous Portfolio Approximation

Theorem

The portfolio loss rate in LHP converges in probability for N → ∞.

−1

√

Φ (p) − ρ · Y

P

√

L(N) → p(Y ) = Φ

1−ρ

Proof

For the large portfolio the variation of loss rate given Y tends to 0

Var (L(N) | Y ) =

≤

N

X

(N)

(ωn )2 · p(Y ) · (1 − p(Y ))

n=1

N

X

1

4

(N)

(ωn )2 −−−−→ 0

n=1

N→∞

25 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Large Homogeneous Portfolio Approximation

This provides convergence in L2 :

E((L(N) − p(Y ))2 ) = E((L(N) − E(L(N) | Y ))2 )

= E(E((L(N) − E(L(N) | Y ))2 | Y ))

= E(Var (L(N) | Y )) −−−−→ 0

N→∞

Convergence in L2 implies convergence in probability i.e. for all

> 0:

lim P L(N) − p(Y ) > = 0

N→∞

The law of L(N) converges weakly to the law of p(Y ), i.e.

P(L(N) ≤ x) −−−−→ P(p(Y ) ≤ x)

N→∞

for all x, where the distribution function of p(Y ) is continuous.

26 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Large Homogeneous Portfolio Approximation

Theorem (Approximative Distribution of Loss Rate in LHP)

√

P(p(Y ) ≤ x) = Φ

1 − ρ · Φ−1 (x) − Φ−1 (p)

√

ρ

,

x ∈ [0, 1]

Proof

−1

√

Φ (p) − ρ · Y

√

P(p(Y ) ≤ x) = P Φ

≤x

1−ρ

√

1 − ρ · Φ−1 (x) − Φ−1 (p)

=P Y ≤

√

ρ

√

1 − ρ · Φ−1 (x) − Φ−1 (p)

=Φ

√

ρ

27 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Large Homogeneous Portfolio Approximation

Approximative density of loss rate with p = 2%, ρ = 10%

28 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Large Homogeneous Portfolio Approximation

Properties of Loss Rate Distribution

(N)

E(p(Y )) = lim E(L

N→∞

) = lim

N→∞

N

X

(N)

ωn p = p

n=1

Because of convergence we can easily compute α-Quantiles of loss

rate distribution for large N

√

1 − ρ · Φ−1 (α) − Φ−1 (p)

(N)

P(L

≤ α) ≈ Φ

√

ρ

29 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Large Homogeneous Portfolio Approximation

I

When ρ → 1

P(L(∞) ≤ α) = 1 − p = P(L(∞) = 0) for all α ∈ (0, 1)

P(L(∞) = 1) = p

All loans default with prob. p, none with 1 − p.

I

When ρ → 0

P(L(∞) ≤ α) = 0 for α < p

P(L(∞) ≤ α) = 1 for α ≥ p ⇒ P(L(∞) = p) = 1

With the Law of Large Numbers the loss in Binomial model tends

almost surly to

N

1 X

Di → p

N

i=1

30 / 33

Vasicek Single Factor Model

Vasicek Single Factor Model

Large Homogeneous Portfolio Approximation

Simulated Loss Distibution

31 / 33

Vasicek Single Factor Model

Conclusion

Conclusion

The Vasicek Single Factor Model provides a closed form Loss Rate

Distribution

(N)

lim P(L

N→∞

√

≤ x) = Φ

1 − ρ · Φ−1 (x) − Φ−1 (p)

√

ρ

for a Large Homogeneous Portfolio, which depends only on two

parameters p and ρ and gives a good fit to market data.

32 / 33

Vasicek Single Factor Model

Conclusion

Bibliography

Vasicek : The Distribution of Loan Portfolio Value, Risk

(2002).

Martin, Reitz, Wehn : Kredit und Kreditrisikomkodelle,

Vieweg, (2006).

Schönbucher : Faktor Models: Portfolio Credit Risks When

Defaults are Correlated, Journal of Risk Finance (2001).

Elizalde : Credit Risk Models IV: Understanding and pricing

CDOs, discussion paper (2005).

33 / 33