Faculty Executive Committee Attention: Michael Meranze, Chair of

advertisement

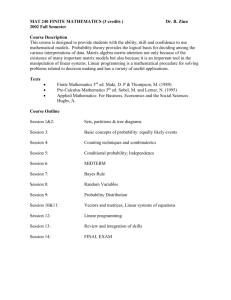

Item 6 Attachment 3A Date: January 3, 2013 TO: Faculty Executive Committee Attention: Michael Meranze, Chair of the College Faculty Executive Committee College of Letters & Science A-265 Murphy Hall FROM: Dimitri Shlyakhtenko, Chair Robert F. Brown, Undergraduate Studies Vice-Chair Department of Mathematics 6356 Mathematics Sciences Building 155505 RE: Establishing the Financial Actuarial Mathematics major from the Actuarial Plan in the Mathematics/Applied Science major. The Actuarial Plan within in the Mathematics/Applied Science major has existed and thrived since 1979. By our estimates, there have been at least 600 students who have taken our actuarial courses since 2000. Our recent graduates have either entered into the work force or continued their education at top financial mathematical programs such as Cornell University, Carnegie Mellon University, New York University and UCLA. As the actuarial field evolves and the demand in the major have increased in recent years, the Mathematics Department requests the FEC to approve this concentration as an official pre-major and major, thus giving the students due credit on their diploma and expanding UCLA’s prominence in this important professional field. The goal of changing the Actuarial Plan into a certified major has been discussed among the department’s faculty for many years. There was a period of hesitation to move forward with the process due to budget cuts and staffing concerns. With the recent surge of student interest in the topic, the eager involvement of professionals in the field, and positive feedback from recent graduates in the current academic plan, the undergraduate vice-chair, Dr. Robert Brown, decided to spearhead the process by first introducing the idea to the Mathematics Department’s Undergraduate Studies Committee in fall 2011. With the committee’s unanimous support, Dr. Robert Brown and Dr. Sorin Popa, the chair of the Mathematics Department at the time, presented the proposal to Dr. Joseph Rudnick, Dean of the Physical Sciences, in winter 2012. Dean Rudnick has expressed his support for the development of this new major to both past and present chairs of the Mathematics Department. The Department of Mathematics is requesting the approval for the application to establish the Financial Actuarial Mathematics premajor and major. We request these changes to be effective in fall 2013. The proposal for establishing the Financial Actuarial Mathematics major was presented and unanimously approved in the annual department’s faculty retreat in September 2012. Page 1 of 24 Item 6 PROPOSAL FOR A NEW UNDERGRADUATE DEGREE PROGRAM Bachelor of Science Program in Financial Actuarial Mathematics Submitted by the Mathematics Department: Dimitri Shlyakhtenko, Chair; Robert Brown, Undergraduate Vice Chair; Loong Kong, Assistant Adjunct Professor and Director of the Actuarial Program on January 3, 2013. PROPOSAL TABLE OF CONTENTS Section Page Number Section 1: Introduction and Rationale for New Degree . . . . . . . . . . . . . . . . . . . 1 Section 2: Program Requirements/Catalog Copy . . . . . . . . . . . . . . . . . . . . . . . 6 Section 3: Academic Staff and Organizational Structure . . . . . . . . . . . . . . . . . 13 Section 4: Proposed Courses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 Section 5: Resource Requirements and Enrollment Plan . . . . . . . . . . . . . . . . . 14 Section 6: Changes in Senate Regulations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 Section 7: Library Support . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 Enclosures: 1. Letter of Support: Dean of Physical Science 2. Letter of Support: Chair of Economics 3. Letter of Support: Chair of Anderson’s School of Management 4. Letter of Support: Chair of Statistics Page 2 of 24 Item 6 Section 1: Introduction and Rationale for New Degree (1) Objectives of the program The Bachelor of Sciences in Financial Actuarial Mathematics will focus on the actuarial field. However, the proposed curriculum will not only give students a solid foundation to pass the first five preliminary exams required to become a certified actuary, but it will also allow them to enter other mathematics related fields that require a strong understanding of economics, mathematics, and/or statistics. The program will offer students a solid, quantitatively oriented background for employment as actuaries or in fields such as Economics, Finance, Applied Mathematics and Statistics. (2) History of the program Ira L. Boyle graduated with honors from UCLA in 1972 with a Bachelor of Science in mathematics. In 1978, he was faced with the difficulty of recruiting actuarial students to work for Occidental Life Insurance Company (now Transamerica) located in downtown Los Angeles. That was when Boyle approached Professor Ronald Meich, the mathematics department’s vice-chair at that time, about offering actuarial science courses at UCLA. Together they began a training program for actuaries using courses offered through the Department of Mathematics in May, 1979 by establishing the Actuarial option under the Mathematics/Applied Sciences major. Upon his death in 1993, Transamerica Life Companies established the Ira Boyle Transamerica Scholarship in 1996 that would annually give an award to an outstanding student in the UCLA Actuarial Program for a period of ten years. In 1997, the Ira L. Boyle Endowment for Actuarial Science and Mathematics was established with income to be used for the purchase of books, periodicals, and other library resources in actuarial studies and related areas in applied mathematics for the Engineering and Mathematical Sciences Library. During the 1990’s, even with the generous monetary support of the Boyle Family, the program was dormant due to the lack of qualified instructors. All that changed in 2000, when Assistant Adjunct Professor Loong Kong, Fellow of the Society of Actuaries, was appointed as Director of the Actuarial Science Program. Under Kong’s tenure, the program has steadily gained strong student interests and has grown substantially in the last few years. Due to the program’s recent popularity and demand for more courses, the Ira and Patty Boyle Endowed Actuarial Science Fund was established in 2008 with income to be used for the expansion of the Actuarial Science Program and related high priority needs. It was also around this time that the Actuarial Club (now the Bruin Actuarial Society) gained momentum in developing professional networking relationship with local and national companies. Each year, the Society hosts several events that involve various consulting and insurance companies’ participation. An example is the annual career fair where companies come directly to UCLA to recruit and interview students for employment and internship. To further strengthen the ties between the program and its stakeholders, the Actuarial Advisory Council was formed in 2009 that consists of faculty, donors and various company representatives. (3) Timetable for the development of the program Since all the necessary courses, faculty and staff support are already available within the departments of Mathematics, Economics, Management and Statistics, the program can enroll students as soon as it is approved. The department would like the formal announcement of the degree program to appear in the 2013-2014 UCLA General Catalog. 1 Page 3 of 24 Item 6 (4) Relationship to existing programs At present, there is an “Actuarial Plan” option for the Mathematics/Applied Science major offered by the Mathematics Department that would be replaced by the proposed Financial Actuarial Mathematics degree program. Because this program requires students to learn a fair amount of mathematics, finance, economics and statistics, it should attract a number of students who would have to double or triple major in order obtain a solid foundation in these areas. Students who graduate from this program would be qualified to continue on in a graduate study in Actuarial Science, Economics, Statistics, Business and/or Finance. (5) Opportunities for placement of graduates There has been a lack of qualified employees on the west coast for actuary companies to hire since the late 1970’s. As popular as the field has become, because the west coast does not have major insurance company headquarters, there has been a lack of well-established educational programs west of the central United States. Since the 1990’s, UCLA’s Actuarial Plan has been maybe one of three actuarial programs on the west coast. Though we cannot lay claim to being the first UC to establish the Actuarial major (UCSB beat us to it about two years ago), we can, however, boast that our program is much better established. Our program’s actuarial courses have always been taught by certified actuarial professionals who are either still working as an actuary or recently retired from it. Though our major course proposal gives students the option of exploring their foundational knowledge in other areas of discipline, they also have the option of focusing their courses on those offered by the Mathematics Department. The attendance at our annual career fair is a good indicator of student and local company interests in the field and program. In the last five years, the number of companies who have come to recruit our students have grown from a handful to 16 companies. Non-mathematics majors have joined the Bruin Actuarial Society because of their strong networking opportunities and educational information sessions that are held several times throughout the quarter. We even have records of nonUCLA students attending some of our events because their home institution does not have an established program such as ours or because we offer them more opportunities. It is not just insurance companies or consulting firms that are interested in our actuarial graduates. An important feature of our program is that it does not restrict students to only one industry when they graduate. Many of our students have found employment in the business/financial industry or have moved onto Masters or PhD programs . The preparation provided by this program would also be ideal for students applying to an actuarial or economics Ph.D. program and/or finance programs in management schools. (6) Need for the new program The increased interest in the actuarial field is demonstrated by the graduation statistics for the last five years (Figure 1). Students, however, are not required to be any particular major in order to work in the field as long as they pass the actuarial exams. Hence, a better indicator of student interest in the field is the number of students enrolled in the department’s actuarial classes (Math 172ABC) (Figure 2) because the syllabi of our actuarial courses closely follow those for the underlying actuarial exams. 2 Page 4 of 24 Item 6 Actuarial Plan Graduation Rate (2008-2012) 45 42 40 34 Number of Students 35 30 25 20 16 16 16 2008 2009 2010 15 10 5 0 2011 2012 Year Figure 1 Enrollment in Actuarial Courses (2008-2012) 180 168 Number of Students 160 142 140 120 135 111 100 80 69 60 40 20 52 61 42 39 38 18 20 2008 2009 14 0 172A 2010 2011 2012 Year 172B 172C Figure 2 3 Page 5 of 24 Item 6 As UCLA continues to increase the enrollment of non-California residents, we have observed an interesting trend in our demographic statistics for the major that suggest there is a strong international interest in the program (Figure 3). And even though there are many well-established actuarial programs in the central and eastern United States, students from all around the nation and different countries have chosen the UCLA program. This recent interest in the actuarial program has motivated the department to expand our course offerings in this field this academic year (i.e., Math 173AB - Casualty Loss Models I & II). US Citizen vs. International Students Number of Students who Graduated 25 20 15 10 5 23 22 13 11 5 12 19 12 3 4 2008 2010 0 2008 2011 2012 Year US International Figure 3 (7) Student demand for the program. About 50 students a year graduate in the Mathematics/Applied Sciences major, almost all of them in the Actuarial Plan. When the more popular mathematics based actuary courses (i.e., Math 172 series) are offered by popular instructors, total enrollment can reach more than 140 students. Most of these students are already declared in the Actuarial Plan, Mathematics/Economics or Statistics major. There are many more students who have taken the course and pursued the actuary profession without obtaining a mathematics degree. The student’s interests and demands for the actuarial field are illustrated by the following facts: A.) A few years ago, the Mathematics Department established a reimbursement program that would pay for the cost of the actuarial exams if the students passed. Due to its huge success with respect to the number of students passing the exams (some were even non-mathematics majors and/or graduate students) and requesting the reimbursement, the program had to be discontinued because it was too expensive. B.) As of the 2012 school year, there are 187 members in the Bruin Actuarial Society. 60 of these members have passed one or more exams. C.) This past fall, 16 companies participated in our fourth annual career fair. Four years ago, there are only a handful of companies that participated. D.) In the 2009-2010 school year, a second instructor joined the actuarial teaching staff in order to allow the program to grow. In previous years, Professor Kong taught a 4 Page 6 of 24 Item 6 class of more than 60 students by himself, for two to three quarters a year, compared to our normal upper division capacity of 40 students. By the 2012-2013 school year, four additional instructors (all are Fellows of the Society of Actuaries) were recruited to join the teaching staff and two additional courses were offered in order to insure the quality of learning environment by keeping upper division courses to normal size and the topics relevant. (By comparison, in the 1999-2000 school year, only one section of the two actuarial courses were taught by one instructor.) (8) Importance to the discipline The continued development of finance and actuarial science depends on the training of talented individuals, especially those with strong mathematical interests. As natural disasters continue to wreak havoc on our lives and properties annually and presidential administration try to tackle the conundrum of health care and pensions, there is always a need for well-qualified employees. UCLA, with its highly qualified undergraduate body, should be an important source to satisfy such needs with one of the nations’ top faculties and researchers educating the pool of candidates. (9) Meeting the needs of society Mathematically competent actuaries, with bachelor’s and advanced degrees are needed in the industry and government. A well rounded knowledge of econometric techniques, models of pricing of financial assets, actuarial models, and statistical modeling and prediction are skills which are highly valued and useful to society. The proposed degree offers the appropriate education for these purposes. (10) Relationship to research interests of the faculty Our Financial Actuarial Mathematics program can offer many departments well-qualified student for their area of research. With their technical background of mathematics and programming, students in the major can contribute to the Economics and Statistics Department’s faculty. These faculties include members who are interested in mathematical finance, computer simulation of economic phenomena, econometric, statistical modeling and predications, business analysis and other aspects of actuarial mathematics. (11) Plans for assessment and evaluation The Mathematics Department will be actively involved in assessing, evaluating, and improving the operation of the Financial Actuarial Mathematics program. Improving the quality of the courses relevant to the Actuarial profession is a major goal of this program. In addition, the Actuarial Advisory Council, independent of the department, will continue to find new ways to improve the status and relevancy of our program with respect to the standards of the Society of Actuaries and the Casualty Actuarial Society. These two entities are the ones that set the standards in the actuarial industry to recognize individuals as the leading professionals in the modeling and management of financial risk and contingent events. Hence, students who pass through the Financial Actuarial Mathematics program can continue to be given professional designations by the Societies by completing a rigorous system of examinations (topics that cover core mathematics related to actuarial science including probability, statistics, interest theory, life contingencies, and risk models) along with earning credit by passing approved college courses with a B- or better grade. 5 Page 7 of 24 Item 6 On the academic side, the faculty of the Mathematics Department is committed to making sure the Financial Actuarial Mathematics program continues to be in compliance with the learning outcomes that were proposed in 2010: “The Mathematics/Applied Science major is designed for students with a substantial interest in mathematics and its applications to a particular field. [In particular], Students majoring in this [Actuarial] plan often pursue careers in actuarial science. 1.) They should have a strong mathematical content knowledge of single and multivariable differential and integral calculus and differential equations. 2.) They will be familiar with linear algebra, techniques of proof and the foundations of real analysis. 3.) They will be able to perform basic computer programming, especially in C++”. The first three points are in line with the rest of our mathematics majors. To reflect the changes we are proposing to make from the plan to the major, the fourth point will be revised from: “They will be able to pass the Society of Actuary Probability exam and be familiar with basic statistical analysis (probability distributions, random variables, survey sampling, testing, data summary, sums of squares principle, testing general linear hypothesis in regression, inference procedures)” to “They will be able to pass at least the first four preliminary Society of Actuary exams and be familiar with basic statistical analysis (probability distributions, random variables, survey sampling, testing, data summary, sums of squares principle, testing general linear hypothesis in regression, inference procedures)”. This minor change demonstrates our goal of maintaining academic excellence while producing students who are able to meet industry standards above and beyond the minimum requirements. Section 2: Program Requirements/Catalog Copy (1) Preparation for the major The following 12 proposed courses for the preparation of the major requirements total 54.0 units (all courses are 4.0 unless otherwise specified). Students must: (1) achieve grades of C or better in all premajor mathematics sequenced courses (Mathematics 31A, 31B, 32A, 32B, 33A, 33B, Program in Computing 10A) with a minimum 2.5 grade-point average and no more than two repeats and (2) achieve grades of C or better in all premajor economics courses (Economics 1, 2, 11, Management 1A, 1B,) with a minimum 2.5 grade-point average and no more than one repeat. Mathematics Sequenced Courses: Mathematics 31A (Differential and Integral Calculus) Mathematics 31B (Integration and Infinite Series) Mathematics 32A (Calculus of Several Variables - Differential Calculus) Mathematics 32B (Calculus of Several Variables - Integral Calculus) Mathematics 33A (Linear Algebra and Applications) Mathematics 33B (Differential Equations) Programming in Computing 10A (Introduction to Computers and Computing) – 5.0 units 6 Page 8 of 24 Item 6 Economics Courses: Economics 1 (Principles of Economics – Microeconomics) Economics 2 (Principles of Economics – Macroeconomics) Economics 11 (Microeconomic Theory) Management 1A (Principles of Accounting) Management 1B (Principles of Accounting) (2) Major The following 11 proposed courses for the major requirements total 45.0 units. To graduate, the eight mathematics courses must be completed with an overall grade-point average of 2.0, with grades of C– or better in Mathematics 115A and 131A, as must the three courses from the economics courses. Mathematics Courses: Mathematics 115A (Linear Algebra) – 5.0 units Mathematics 131A (Analysis) Mathematics 170A (Probability Theory) or Statistics 100A (Introduction to Probability) Mathematics 170B (Probability Theory) or Statistics 100B (Introduction to Mathematical Statistics) Mathematics 174A (Financial Economics for Actuarial Students) or Mathematics 174E (Mathematics of Finance for Mathematics/Economics Students) or Economics 141 (Topics in Microeconomics: Mathematical Finance) or Statistics C183 (Statistical Models in Finance) Mathematics 172A (Introduction to Financial Mathematics) One two-term actuarial sequence chosen from: Life Contingency Actuarial Models: Mathematics 172B (Actuarial Models I) Mathematics 172C (Actuarial Models II) Or Casualty Loss Models: Mathematics 173A (Casualty Loss Models I) Mathematics 173B (Casualty Loss Models II) Economics Courses: Three upper division actuarial, statistics or economics courses chosen from Mathematics 172B – Mathematics 173B, Statistics 100C, Economics 101 – 199B 7 Page 9 of 24 Item 6 (3) Catalog Copy UCLA General Catalog 2012-13 strikethrough to be deleted Undergraduate Majors Proposed changes to the text in the next catalog underlined to be added Undergraduate Majors The department offers five majors: Mathematics, Applied Mathematics, Mathematics of Computation, Mathematics/Applied Science, and Mathematics for Teaching. The department also participates in the Mathematics/Economics Interdepartmental Program, which offers a Mathematics/Economics major, and in the Mathematics/Atmospheric and Oceanic Sciences Interdepartmental Program, which offers a Mathematics/Atmospheric and Oceanic Sciences major. The department offers six majors: Mathematics, Applied Mathematics, Mathematics of Computation, Financial Actuarial Mathematics, Mathematics/Applied Science, and Mathematics for Teaching. The department also participates in the Mathematics/Economics Interdepartmental Program, which offers a Mathematics/Economics major, and in the Mathematics/Atmospheric and Oceanic Sciences Interdepartmental Program, which offers a Mathematics/Atmospheric and Oceanic Sciences major. The Mathematics major is designed for students whose basic interest is mathematics; the Applied Mathematics major for those interested in the classical relationship between mathematics, the physical sciences, and engineering; the Mathematics of Computation major for individuals interested in the mathematical theory and the applications of computing; the Mathematics/Applied Science major for those with substantial interest in the applications of mathematics to a particular outside field of interest; and the Mathematics for Teaching major for students planning to teach mathematics at the high school level. As part of the Mathematics/Applied Science major, the department offers programs for students interested in the fields of actuarial science, mathematics/history of science, and medical and life sciences. The Mathematics major is designed for students whose basic interest is mathematics; the Applied Mathematics major for those interested in the classical relationship between mathematics, the physical sciences, and engineering; the Mathematics of Computation major for individuals interested in the mathematical theory and the applications of computing; the Financial Actuarial Mathematics for students interested in working in the actuarial field or the application of mathematics, finance, and statistics; the Mathematics/Applied Science major for those with substantial interest in the applications of mathematics to a particular outside field of interest; and the Mathematics for Teaching major for students planning to teach mathematics at the high school level. As part of the Mathematics/Applied Science major, the department offers programs for students interested in the fields of mathematics/history of science and medical and life sciences. Each course taken to fulfill any of the requirements for any of the mathematics majors must be taken for a letter grade. Each course taken to fulfill any of the requirements for any of the mathematics majors must be taken for a letter grade. The Mathematics for Teaching major is a designated capstone major. In their senior year students complete a year-long course sequence The Mathematics for Teaching major is a designated capstone major. In their senior year students complete a year-long course sequence 8 Page 10 of 24 Item 6 that culminates in a model lesson presentation, paper, and portfolio. Through their capstone work, students demonstrate their familiarity with research and current issues in mathematics education, as well as their capacities to problem solve; reason quantitatively, geometrically, and algebraically; construct viable arguments; critique others’ reasoning; and use tools strategically. that culminates in a model lesson presentation, paper, and portfolio. Through their capstone work, students demonstrate their familiarity with research and current issues in mathematics education, as well as their capacities to problem solve; reason quantitatively, geometrically, and algebraically; construct viable arguments; critique others’ reasoning; and use tools strategically. Financial Actuarial Mathematics B.S. Financial Actuarial Mathematics Premajor Students entering UCLA directly from high school or first-term transfer students who want to declare the Financial Actuarial Mathematics premajor at the time they apply for admission are automatically admitted to the premajor. Current UCLA students need to file a petition with the Undergraduate Advising Office in 6356 Math Sciences. All students are identified as Financial Actuarial Mathematics premajors until they satisfy the following minimum requirements for the major: (1) achieve grades of C or better in all premajor mathematics sequenced courses (Mathematics 31A, 31B, 32A, 32B, 33A, 33B, Program in Computing 10A) with a minimum 2.5 grade-point average and no more than two repeats, (2) achieve grades of C or better in all premajor economics courses (Economics 1, 2, 11, Management 1A, 1B) with a minimum 2.5 grade-point average and no more than one repeat, and (3) file a petition to declare the major before completing 160 quarter units. Preparation for the Major Required: Mathematics 31A, 31B, 32A, 32B, 33A, 33B, Program in Computing 10A, Economics 1, Economics 2, Economics 11, Management 1A, Management 1B. Each course must be taken for a letter grade. The economics preparation for the major courses (Economics 1, 2, 11, Management 1A, 1B) are calculated 9 Page 11 of 24 Item 6 separately from the mathematics preparation for the major courses (Mathematics 31A, 31B, 32A, 32B, 33A, 33B, Program in Computing 10A). The economics preparation courses must be completed with a minimum overall 2.5 gradepoint average and a grade of C or better in each course, as must the mathematics preparation courses. Repetition of more than one economics preparation course, more than two mathematics preparation courses, or of any economics or mathematics preparation course more than once results in automatic dismissal from the major. Freshman Students Students must petition to declare the Financial Actuarial Mathematics major and can do so once they have complete all of the mathematics sequenced courses, all of the economics preparation courses and submit an application to enter the major before completing 160 quarter units. Admission into the major is based on student academic performance on the minimum requirements. Transfer Students Transfer applicants to the Financial Actuarial Mathematics major with 90 or more units must complete as many of the following introductory courses as possible prior to admission to UCLA: two years of calculus for majors, one C++ programming course, one microeconomic theory course, one macroeconomics course and two quarters of accounting principle. Transfer credit for any of the above is subject to department approval; consult an undergraduate counselor before enrolling in any courses for the major. Refer to the UCLA Transfer Admission Guide at http://www.admissions.ucla.edu/prospect/adm_t r.htm for up-to-date information regarding transfer selection for admission. 10 Page 12 of 24 Item 6 The Major Required: Eight mathematics/statistics courses, including 115A, 131A, 170A or Statistics 100A, 170B or Statistics 100B, 174A (or 174E or Economics 141 or Statistics C183), 172A; one two term sequence from the following categories: Life Contingency Actuarial Models – courses 172B and 172C, or Casualty Loss Models – courses 173A and 173B; three courses from 172B through Math 173B, Statistics 100C, and Economics 101 through 199B. Each course must be taken for a letter grade. Transfer credit is subject to department approval; consult an undergraduate counselor before enrolling in any courses for the major. To graduate, the eight Mathematics Department courses must be completed with an overall grade-point average of 2.0, with grades of C– or better in Mathematics 115A and 131A, as must the three courses from the Economics Department. It is strongly recommended that students take Mathematics 115A as one of their first upper division courses for the major. Mathematics/Applied Science B.S. Mathematics/Applied Science B.S. The Mathematics/Applied Science major is designed for students with a substantial interest in mathematics and its applications to a particular field. It is an individual major in that students, in consultation with a faculty adviser, design their own program. They may also select one of the established programs: actuarial plan, mathematics/history of science plan, or medical and life sciences plan. In the past, Mathematics/Applied Science majors have combined the study of mathematics with fields such as atmospheric and oceanic sciences, biochemistry, biology, chemistry, economics, geography, physics, psychology, and statistics. The Mathematics/Applied Science major is designed for students with a substantial interest in mathematics and its applications to a particular field. It is an individual major in that students, in consultation with a faculty adviser, design their own program. They may also select one of the established programs: mathematics/history of science plan or medical and life sciences plan. In the past, Mathematics/Applied Science majors have combined the study of mathematics with fields such as atmospheric and oceanic sciences, biochemistry, biology, chemistry, economics, geography, physics, psychology, and statistics. Students interested in designing an individual program should meet with the undergraduate adviser, 6356 Math Sciences, during their Students interested in designing an individual program should meet with the undergraduate adviser, 6356 Math Sciences, during their 11 Page 13 of 24 Item 6 sophomore year. A proposed program is drawn up, then forwarded to the mathematics/applied science curriculum committee for approval. All programs must include the following preparation for the major and major courses. sophomore year. A proposed program is drawn up, then forwarded to the mathematics/applied science curriculum committee for approval. All programs must include the following preparation for the major and major courses. Actuarial Plan Preparation for the Major Required: Mathematics 31A, 31B, 32A, 32B, 33A, 33B, Economics 1, 2, 11, Program in Computing 10A. Each course must be taken for a letter grade. The economics preparation for the major courses (Economics 1, 2, 11) are calculated separately from the mathematics preparation for the major courses (Mathematics 31A, 31B, 32A, 32B, 33A, 33B, Program in Computing 10A). The economics preparation courses must be completed with a minimum overall 2.5 grade-point average and a grade of C or better in each course, as must the mathematics preparation courses. Repetition of more than one economics preparation course, more than two mathematics preparation courses, or of any economics or mathematics preparation course more than once results in automatic dismissal from the major. The Major Required: Seven mathematics courses, including Mathematics 115A, 131A, 170A, 170B, 172A, 172B, 172C; four outside courses, including Mathematics 174A (or 174E or Economics 141 or Statistics C183), Statistics 100B, 100C, and one course from Economics 101 through 199B. Each course must be taken for a letter grade. Transfer credit is subject to department approval; consult an undergraduate counselor before enrolling in any courses for the major. The seven Mathematics Department courses must be completed with a minimum overall grade-point average of 2.0, with grades of C- or 12 Page 14 of 24 Item 6 better in Mathematics 115A and 131A, as must the four courses from the Economics and Statistics Departments. It is strongly recommended that students take Mathematics 115A as one of their first upper division courses for the major. Section 3: Academic Staff and Organizational Structure The proposal of the new major will not impact the Mathematics Department since the Actuarial Concentration already exists. The program will be directly overseen by the department’s undergraduate vice-chair. The Director of the Actuarial Program will oversee the curriculum of the actuarial courses to make sure that the topics are current and relevant to the industry as it changes over time. The Director will also be the one to recommend and oversee the instructors of the actuarial mathematics courses since he or she is the resident expert in this field. Substantial changes in the program will require approval of the full faculty in the Department of Mathematics. Section 4: Proposed Courses Course Number Mathematics 31A Mathematics 31B Mathematics 32A Mathematics 32B Mathematics 33A Mathematics 33B Programming in Computing 10A Economics 1 Economics 2 Economics 11 Management 1A Management 1B Mathematics 115A Mathematics 131A Mathematics 170A Or Statistics 100A Mathematics 170B Or Statistics 100B Mathematics 174A Or Course Title Differential and Integral Calculus Integration and Infinite Series Calculus of Several Variables - Differential Calculus Calculus of Several Variables - Integral Calculus Linear Algebra and Applications Differential Equations Introduction to Computers and Computing Units 4.0 4.0 4.0 Instructor Mathematics Faculty Mathematics Faculty Mathematics Faculty 4.0 Mathematics Faculty 4.0 4.0 5.0 Mathematics Faculty Mathematics Faculty Mathematics Faculty Principles of Economics – Microeconomics Principles of Economics – Macroeconomics Microeconomic Theory Principles of Accounting Principles of Accounting Linear Algebra Analysis Probability Theory Or Introduction to Probability Probability Theory Or Introduction to Mathematical Statistics Financial Economics for Actuarial Students Or 4.0 4.0 Economics Faculty Economics Faculty 4.0 4.0 4.0 5.0 4.0 4.0 Economics Faculty Management Faculty Mathematics Faculty Mathematics Faculty Mathematics Faculty Mathematics Faculty Or Statistics Faculty Mathematics Faculty Or Statistics Faculty Mathematics Faculty Or 4.0 4.0 13 Page 15 of 24 Item 6 Mathematics 174E Or Economics 141 Or Statistics C183 Mathematics 172A Mathematics 172B And Mathematics 172C Mathematics 173A And Mathematics 173B Mathematics of Finance for Mathematics/Economics Students Or Topics in Microeconomics: Mathematical Finance Or Statistical Models in Finance Introduction to Financial Mathematics Actuarial Models I And Actuarial Models II Casualty Loss Models I And Casualty Loss Models II Mathematics Faculty Or Economics Faculty 4.0 4.0 Or Statistics Faculty Mathematics Faculty Mathematics Faculty 4.0 Mathematics Faculty The generic notation of “(Department) Faculty” is used in the instructor column because the courses are taught by various faculty members throughout the year. Only mathematics courses and core course requirements are listed. The descriptions of the required and alternative courses for the program are appended to this proposal as Attachment #1 in the appendix. Since it is not expected that the proposed program will have a major impact on the enrollment of these courses, staffing will continue as at present. Once the major is in place, courses will be modified over time to enrich the set of topics covered. Section 5: Resource Requirements and Enrollment Plan (1) Funding As mentioned in Section 3 of the proposal, the new major will not impact the Economics, Statistics, and Mathematics Department since the Actuarial Concentration already exists, as well as the courses. Staff and advising resources will also remain the same. A.) Management 1A and Management 1B “Fellow of the Society of Actuaries" and "Associate of the Society of Actuaries” are two designations the Society of Actuaries use to convey a person’s professional standing. Part of the process of obtaining the Fellowship or Associate status requires the completion of specifically approved educational requirements. Management 120A, 120B and 130A have been sanctioned by the Society of Actuaries as demonstrating mastery in the topic of corporate finance for the past several years. Though it is not required by the Actuarial Plan, many students choose to take these courses, and their respective prerequisites (i.e., Management 1A and 1B), on their own to meet the requirement. If the major is established, we anticipate an additional 25 students enrolling into Management 1A and 1B annually because it is now a major requirement. Whether the student chooses to progress further into the management curriculum with upper division courses is strictly their choice. (2) Projected Enrollment Section 1.6, Figure #2 of the proposal illustrated an exponential growth in the major two years ago; however, we anticipate the graduation rate to remain around 50-60 students a year for the next 14 Page 16 of 24 Item 6 five years once the major is established. This translates to slight increases in enrollment for economics, management, mathematics, and economics courses but it would be a minor impact since students are currently exploring these courses for the Actuarial plan and our proposal for the new major is only requiring two additional lower division courses that already exists (Management 1A and Management 1B). Section 6: Changes in Senate Regulations No changes are required. Section 7: Library Support The Ira and Patty Boyle Endowed Actuarial Science Fund has been very generous in supporting the program by purchasing study manuals for students to check out at the Science and Engineering Library. As the program expands, so will the need of manuals which the donors have stated that they are happy to continue to support. 15 Page 17 of 24 Item 6 Appendix Proposed Courses (Attachment #1) Mathematics 31A. Differential and Integral Calculus (4) Lecture, three hours; discussion, one hour. Preparation: at least three and one-half years of high school mathematics (including some coordinate geometry and trigonometry). Requisite: successful completion of Mathematics Diagnostic Test or course 1 with grade of C- or better. Differential calculus and applications; introduction to integration. P/NP or letter grading. Mathematics 31B. Integration and Infinite Series (4) Lecture, three hours; discussion, one hour. Requisite: course 31A with grade of C- or better. Not open for credit to students with credit for course 3B. Transcendental functions; methods and applications of integration; sequences and series. P/NP or letter grading. Mathematics 32A. Calculus of Several Variables (4) Lecture, three hours; discussion, one hour. Enforced requisite: course 31A with grade of C- or better. Introduction to differential calculus of several variables, vector field theory. P/NP or letter grading. Mathematics 32B. Calculus of Several Variables (4) Lecture, three hours; discussion, one hour. Enforced requisites: courses 31B and 32A, with grades of C- or better. Introduction to integral calculus of several variables, line and surface integrals. P/NP or letter grading. Mathematics 33A. Linear Algebra and Applications (4) Lecture, three hours; discussion, one hour. Enforced requisite: course 3B or 31B or 32A with grade of C- or better. Introduction to linear algebra: systems of linear equations, matrix algebra, linear independence, subspaces, bases and dimension, orthogonality, least-squares methods, determinants, eigenvalues and eigenvectors, matrix diagonalization, and symmetric matrices. P/NP or letter grading. Mathematics 33B. Differential Equations (4) Lecture, three hours; discussion, one hour. Enforced requisite: course 31B with grade of C- or better. Highly recommended: course 33A. First-order, linear differential equations; second-order, linear differential equations with constant coefficients; power series solutions; linear systems. P/NP or letter grading. Mathematics 115A. Linear Algebra (5) Lecture, three hours; discussion, two hours. Requisite: course 33A. Techniques of proof, abstract vector spaces, linear transformations, and matrices; determinants; inner product spaces; eigenvector theory. P/NP or letter grading. Mathematics 131A. Analysis (4) Lecture, three hours; discussion, one hour. Requisites: courses 32B, 33B. Recommended: course 115A. Rigorous introduction to foundations of real analysis; real numbers, point set topology in Euclidean space, functions, continuity. P/NP or letter grading. Mathematics 170A. Probability Theory (4) 16 Page 18 of 24 Item 6 Lecture, three hours; discussion, one hour. Requisites: courses 32B, 33A. Not open to students with credit for Electrical Engineering 131A or Statistics 100A. Probability distributions, random variables and vectors, expectation. P/NP or letter grading. Mathematics 170B. Probability Theory (4) Lecture, three hours; discussion, one hour. Enforced requisite: course 170A. Convergence in distribution, normal approximation, laws of large numbers, Poisson processes, random walks. P/NP or letter grading. Mathematics 172A. Introduction to Financial Mathematics (4) Lecture, four hours. Requisites: courses 32B, 33B. Designed to provide understanding of fundamental concepts of financial mathematics and how those concepts are applied in calculating present and accumulated values from various streams of cash flows as basis for future use in reserving, valuation, pricing asset/liability management, investment income, capital budgeting, and valuing contingent cash flows. Letter grading. Mathematics 172B. Actuarial Models I (4) Lecture, four hours. Requisites: courses 170A and 170B (or Statistics 100A and 100B), 172A. Designed to provide understanding of theoretical basis of certain actuarial models and application of those models to insurance, pensions, and other financial risks. Letter grading. Mathematics 172C. Actuarial Models II (4) Lecture, four hours. Enforced requisite: course 172B. Theoretical basis of certain actuarial models and application to insurance, pensions, and other financial risks. Letter grading. Mathematics 173A. Casualty Loss Models I (4) Lecture, four hours. Enforced requisites: courses 170A and 170B (or Statistics 100A and 100B), 172A. Designed to provide understanding of various casualty loss models. Coverage of steps involved in modeling process and how to carry out these steps in solving business problems. Letter grading. Mathematics 173B. Casualty Loss Models II (4) Lecture, four hours. Enforced requisite: course 173A. Construction of parametric loss models and introduction to credibility theory that provides tools to utilize collected information, such as past loss information, to predict future outcomes. Use of simulation to model future events. Letter grading. Mathematics 174A. Financial Economics for Actuarial Students (4) Lecture, four hours. Enforced requisites: courses 170A and 170B (or Statistics 100A and 100B), 172A. Not open for credit to students with credit for course 174E, Economics 141, or Statistics C183/C283. Specifically designed to prepare students in actuarial science program to take Society of Actuaries Models for Financial Economics (MFE) examination. Introduction to basic concepts of financial economics, including interest rate models, rational valuation of derivative securities, and risk management. Letter grading. Mathematics 174E. Mathematics of Finance for Mathematics/Economics Students (4) (Formerly numbered 174.) Lecture, three hours; discussion, one hour. Enforced requisites: courses 33A, 170A (or Statistics 100A), Economics 11. Not open for credit to students with credit for course 174A, Economics 141, or Statistics C183/C283. Modeling, mathematics, and computation for financial securities. Price of risk. Random walk models for stocks and interest rates. No-arbitrage 17 Page 19 of 24 Item 6 theory for pricing derivative securities; Black/Scholes theory. European and American options. Monte Carlo, trees, finite difference methods. P/NP or letter grading. Statistics 100A. Introduction to Probability (4) Lecture, three hours; discussion, one hour. Requisites: Mathematics 32B, 33A. Not open to students with credit for Electrical Engineering 131A or Mathematics 170A; open to graduate students. Students may receive credit for only two of following: course 100A, former course 110A, Biostatistics 100A. Probability distributions, random variables, vectors, and expectation. P/NP or letter grading. Statistics 100B. Introduction to Mathematical Statistics (4) Lecture, three hours; discussion, one hour. Requisite: course 100A or Mathematics 170A. Survey sampling, estimation, testing, data summary, one- and two-sample problems. P/NP or letter grading. Statistics 100C. Linear Models (4) Lecture, three hours; discussion, one hour. Requisite: course 100B. Theory of linear models, with emphasis on matrix approach to linear regression. Topics include model fitting, extra sums of squares principle, testing general linear hypothesis in regression, inference procedures, Gauss/Markov theorem, examination of residuals, principle component regression, stepwise procedures. P/NP or letter grading. Management 1A. Principles of Accounting (4) Lecture, three hours; discussion, one hour. Not open to freshmen. Introduction to financial accounting principles, including preparation and analysis of financial transactions and financial statements. Valuation and recording of asset-related transactions, including cash, receivables, marketable securities, inventories, and long-lived assets. Current liabilities. P/NP or letter grading. Management 1B. Principles of Accounting (4) Lecture, three hours; discussion, one hour. Requisite: course 1A. Not open to freshmen. Completion of balance sheet with emphasis on debt and equity, including in-depth introduction to time value of money concepts. Introduction to partnership and individual income tax accounting. P/NP or letter grading. Programming in Computing 10A. Introduction to Programming (5) Lecture, three hours; discussion, two hours; laboratory, eight hours. Recommended requisite for students with no prior computing experience: course 1. No prior programming experience assumed. Basic principles of programming, using C++; algorithmic, procedural problem solving; program design and development; basic data types, control structures and functions; functional arrays and pointers; introduction to classes for programmer-defined data types. P/NP or letter grading. 18 Page 20 of 24 Item 6 Page 21 of 24 Item 6 UCLA UNIVERSITY OF CALIFORNIA, LOS ANGELES BERKELEY • DAVIS • IRVINE • LOS ANGELES • RIVERSIDE • SAN DIEGO • SAN FRANCISCO SANTA BARBARA • SANTA CRUZ DEPARTMENT OF ECONOMICS 8283 BUNCHE HALL BOX 951477 LOS ANGELES, CALIFORNIA 90095-1477 (310) 825-1011 FAX (310) 825-9528 January 18, 2013 Professor Michael Meranze Chair of the College Faculty Executive Committee College of Letters & Science A-265 Murphy Hall Dear Professor Meranze: The Department of Economics is pleased to support the Department of Mathematics with its new Financial Actuarial Mathematics Major. We understand that the new major will include the following courses as part of the pre-major: Economics 1, Economics 2, and Economics 11, and will allow students to take upper division courses in economics as electives in the new major. We are happy to welcome the actuarial science students to our classes. We do not anticipate that the new major will result in significant increases in the enrollments in economic courses as the pre-major courses were already required by the current concentration in actuarial sciences. We extend our best wishes to the Department of Mathematics as they launch this exciting new major. Sincerely, Professor Kathleen McGarry Vice Chair, Department of Economics Page 22 of 24 Item 6 Date: January 3, 2013 TO: Faculty Executive Committee Attention: Michael Meranze, Chair of the College Faculty Executive Committee College of Letters & Science A-265 Murphy Hall Dear Dr. Meranze: I am writing to confirm that the following courses Management 1A - Principles of Accounting and Management 1B - Principles of Accounting, to the best of our ability, will be regularly offered by my department and that they will be open to the students in the new Financial Actuarial Mathematics pre-major or major who have satisfied the appropriate prerequisites. However, please be advised that if we need to add sections because of enrollment growths beyond our present capacity, we cannot do this without added university support. Sincerely, Professor David Aboody Page 23 of 24 Item 6 UCLA DEPARTMENT OF STATISTICS 8125 Math Sciences Bldg. Box 951554 Los Angeles, CA 90095-1554 Phone: (310) 825-8430 Fax: (310) 206-5658 email: frederic@stat.ucla.edu http://www.stat.ucla.edu/~frederic Dimitri Shlyakhtenko Chair, UCLA Department of Mathematics Jan 25, 2013 Dear Dima, The UCLA Department of Statistics approves the inclusion of our Department's courses in the proposed undergraduate Financial Actuarial Mathematics Major, as outlined in your recent proposal. This seems to be a promising new offering and we fully support it. I hope this will lead to further positive collaborative projects between our two Departments and look forward to working with you on other collaborations. Sincerely, Frederic Paik Schoenberg Chair, UCLA Statistics Page 24 of 24