Covenants to Individuals

advertisement

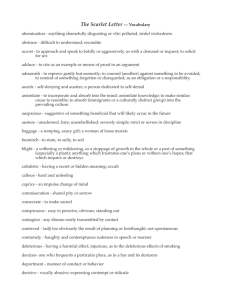

Ver. 11.12 RPC001569_EN_WB_L_2 IT 7 Covenants to Individuals What is a Deed of Covenant? A Deed of Covenant is a legally binding written agreement made by an individual to pay an agreed amount to another individual, without receiving any benefit in return. To be legally effective, it must be properly drawn up, signed, witnessed, sealed and delivered to the individual receiving the payments. Any amount can be paid under a Deed but only covenants in favour of certain individuals qualify for tax relief. The person who makes the payment is called a covenantor. The person who receives the payment is called a covenantee or beneficiary. What should the duration of the Covenant be to qualify for tax relief? A deed must be capable of exceeding a period of 6 years to qualify for tax relief. It is therefore recommended that the period provided be for a minimum of 7 years. To whom can a Deed of Covenant be paid? The following covenants in favour of certain individuals, qualify for tax relief: Covenants to Minors lUnrestricted tax relief can be claimed on covenants in favour of permanently incapacitated minors except on covenants from parents to their own minor incapacitated children. A minor is an individual under 18 years of age and unmarried. Covenants to Adults l Unrestricted tax relief can be claimed on covenants in favour of permanently incapacitated adults. l Tax relief can be claimed on covenants in favour of adults aged 65 or over but is subject to a 5% restriction. 1 i.e. The amount of tax relief available on one or more covenants cannot exceed 5% of the covenantor’s total income (Total Income = Gross Income less certain deductions such as expenses, capital allowances etc.) How can I make a Deed of Covenant? Simply complete the Deed of Covenant form. Alternatively, you can consult your professional adviser. Remember: l You should enter into the Deed before you make any payments. Make sure all payments are capable of being made before the Deed ends. l Payments made before the Deed is taken out or after it ends cannot be treated as payments under the terms of the Deed. l A Deed can only be effective from a current date - so you cannot backdate a Deed. l A Deed to an individual must be capable of lasting more than 6 years. l Payments under the Deed must be paid on the date(s) stated and for the amount(s) specified. Payments cannot be altered during the period of the Deed. Payments under a Deed must be made without any benefit being received from the covenantee in return, either directly or indirectly. l l The covenantee must have a PPS number. If they do not hold one, one can be obtained by contacting their local Department of Social Protection Office. 2 What must a Covenantor do when making a payment under a Deed of Covenant? The covenantor must deduct tax at the standard rate from the gross payment and account for it to Revenue. Information Leaflet IT 1 ‘Tax Credits, Reliefs and Rates’ will give the current rates of tax. Individuals paying tax under PAYE can account for the tax deducted by having their tax credit certificate and standard rate band amended. Individuals taxed under Self Assessment should account for it in their annual assessment. The covenantor must also give details of the payment and tax deducted on a Form R185 to the covenantee each time a payment is made. What tax savings arise under a Deed of Covenant? The exact tax saving depends on the amount of tax paid by the covenantor and on the amount of the covenantee’s income, if any. l If the Covenantor is liable to tax at the higher rate he or she will receive tax relief at the difference between the standard rate and the higher rate l There is no tax benefit to a covenantor who pays tax at the standard rate only l A covenantee whose total income (including the income received under the deed of covenant) is less than the exemption limit qualifies for a refund of the standard rate of tax deducted by the covenantor. 3 How is tax relief claimed? Covenantee The covenantee should send the claim to his or her own Revenue Office. It is important that covenantees quote their PPS number. Covenantor The covenantor should send the claim to his or her own Revenue office and likewise quote his or her PPS number. What documents should be sent with the claim? Covenantee First Claim l Completed claim form l Original Deed of Covenant l Form 54 Claims l Form R185 completed by covenantor l Evidence of payment Subsequent years claims l Form R185 completed by covenantor l Form 54 Claims Covenantor First Claim l The covenantor should send with their Return of Income, a copy Deed of Covenant and a copy of Form R185 Subsequent years claims l The covenantor should complete a Form R185 on or after the designated date of payment and forward a copy of it to their Revenue office. The necessary adjustment to the liability will be made and any repayment due will be dealt with. A Covenantor who pays tax under PAYE can have his or her tax credit certificate and standard rate band adjusted, as soon as payment has been made. 4 Further information This leaflet is for general information only. For further information you can visit www.revenue.ie or contact your Regional LoCall Service whose number is listed below (within the Republic of Ireland only). l Border Midlands West Region 1890 777 425 Cavan, Monaghan, Donegal, Mayo, Galway, Leitrim, Longford, Louth, Offaly, Roscommon, Sligo, Westmeath l Dublin Region Dublin (City and County) l 1890 333 425 East & South East Region Carlow, Kildare, Kilkenny, Laois, Meath, Tipperary, Waterford, Wexford, Wicklow l South West Region Clare, Cork, Kerry, Limerick 1890 444 425 1890 222 425 Please note that the rates charged for the use of 1890 (LoCall) numbers may vary among different service providers. If you are calling from outside the Republic of Ireland, please phone + 353 1 7023011 Information Leaflet IT 1 ‘Tax Credits, Reliefs and Rates’, Form R185 and Form 54 Claims are available from the Revenue Forms and Leaflets Service at LoCall 1890 306 706 (within the Republic of Ireland only) or from Revenue’s website at www.revenue.ie 5 Revenue Office Address If you are a PAYE employee, your tax affairs are dealt with in the region where you live. However, if you are self-employed, your place of business dictates the region where your tax affairs are dealt with. Any Revenue correspondence that you have received will show the contact details and address of your local Revenue office, or visit www.revenue.ie and enter your PPS number into our Contact Locator, the name, address and contact details of your local Revenue office will be displayed. 4-year time limit: A claim for tax relief must be made within 4 years after the end of the tax year to which the claim relates. Accessibility: If you are a person with a disability and require this leaflet in an alternate format the Revenue Access Officer can be contacted at accessofficer@revenue.ie This leaflet is intended to describe the subject in general terms. As such, it does not attempt to cover every issue which may arise in relation to the subject. It does not purport to be a legal interpretation of the statutory provisions and consequently responsibility cannot be accepted for any liability incurred or loss suffered as a result of relying on any matter published herein. Revenue Commissioners March 2015 6