Statement of Demands and Needs

advertisement

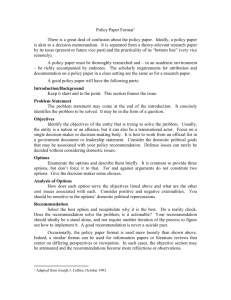

Group Income Protection Statement of Demands & Needs Disclaimer The following document is Friends Provident’s interpretation of the ICOB rules regarding the Statement of Demands and Needs. It is provided for your guidance. It is your responsibility to provide a suitable Statement of Demands and Needs based on your client’s individual circumstances and in accordance with the FSA’s requirements. Index 1. 2. 3. About the ICOB Statement of Demands & Needs 1.1 Background to Statement of Demands & Needs 3 1.2 Overview of a Statement of Demands & Needs 3 1.3 When should a Statement of Demands & Needs be produced? 3 1.4 What makes a good Statement of Demand & Needs? 4 1.5 Record Keeping and the Statement of Demands & Needs 6 Production of a Statement of Demands and Needs 2.1 Group Income Protection needs 7 2.2 Meeting their needs - existing provision 8 2.3 Meeting their needs – future recommended needs 9 2.4 Additional Recommendations 10 2.5 Future review of position and needs 10 2.6 Disclosure Requirements 11 Example letter an IFA could use 12 2 1. About the ICOB Statement of Demands & Needs 1.1 Background to Statement of Demands & Needs Statements of Demands and Needs were introduced as part of the introduction of ICOB regulation in January 2005. The ICOB rules set out requirements relating to the business processes involved in selling and administering non-investment insurance. Examples of some of these processes are: - Administration Marketing; Sales; Providing literature to customers on products; and Handling claims. The ICOB regulations apply to: - 1.2 General insurance contracts such as motor or household insurance; Pure protection contracts such as critical illness and income protection. What is a Statement of Demands & Needs Before the conclusion of a contract, under ICOB rules an intermediary must provide the customer with a statement that: A) Sets out the customer’s demands and needs; B) Confirms whether or not the insurance intermediary has personally recommended that contract; and C) Where a personal recommendation has been made, explains the reason for personally recommending that contract 1.3 When should a Statement of Demands & Needs be produced? Statement of Demands & Needs must be given to all retail customer sales (advised or nonadvised), but not in all cases with regards to commercial business. No statement is needed when an insurer makes a non-advised sale to a commercial customer. For an advised sale made by an insurer no Statement of Demands & Needs is needed, providing the intermediary has obtained the consent of the commercial customer not to receive a statement and has explained the consequences of giving that consent. The diagram below sets out the approach for both retail and commercial customers as to whether a Statement of Demands & Needs is required. 3 Insurer Intermediaries Retail Customers Advised Non Advised Yes Yes Yes Yes Commercial Customers Advised Non advised Yes No Yes Yes Guidelines for Non-Advised Sales For non-advised sales, the ICOB rules allow flexibility as to the format of the Statement Demands and Needs. Examples provided by the FSA as to how to accommodate the demands & needs for non-advised sales are shown below: Incorporating a Statement of Demands & Needs into an application form so that the Statement of Demands and Needs is dependent on the customer providing information on the application form. Producing a Statement of Demands and Needs in product documentation that will be appropriate for anyone wishing to buy the product. For example, ‘This product meets the demands and needs of employers who wish to ensure that staff can be covered against long term sickness or disability’. Giving a customer a record of all his demands and needs that have been discussed with the client. Where a firm has not made a personal recommendation and provides key features as an alternative to a policy summary, that constitutes provision of a Statement of Demands and Needs. Guidelines for Advised Sales / Personal Recommendations Where a personal recommendation has been made the Statement of Demands and Needs will need to record the reasons for the personal recommendation as well as the customer's demands and needs. The Statement of Demands and Needs is the record that the insurance intermediary must maintain to demonstrate that he has given a suitable personal recommendation. Accordingly, the statement will need to contain sufficient information to act as this record. 1.4 What makes a good Statement of Demand & Needs? Introduction When producing a good statement of Demands and Needs it is important to consider both the content and the presentation. Recent research from the FSA has shown that for the sale of some ICOB type products the Statement of Demands and Needs was too generalised and lacking in customer-specific information to be of use to customers. In some cases, it appeared that firms were simply using the Statement of Demands and Needs to list product features. The FSA expects a Statement of Demands & Needs to include: The customer’s demands and needs This should include the adviser’s assessment of whether the customer has other insurance in place that affects their needs, including employer benefits; the need for future flexibility if relevant, and so on. 4 Reasons for recommending the contract This should set out why the particular contract is suitable based on that particular customer’s needs. For example, it should explain why the recommendation is suitable based on the costs of the contract and in the light of the exclusions and limitations of the contract. Demands and needs not met by the recommended contract The Statement of Demands and Needs is the record that firms must keep to demonstrate that they have made a suitable recommendation. So firms should also consider recording the demands and needs of the customer that are not met by their personal recommendation. For example, if the customer has a need for future flexibility, firms may wish to explain the constraints on this. Content of the Statement of Demands and Needs A good Statement of Demands and Needs provides the best defence against any future customer complaint. It’s also an excellent marketing opportunity allowing you to document existing unmet needs with a view to subsequent review discussions. The statement should explain simply and clearly why the personal recommendation is viewed as suitable, having regard to the customer's demands and needs. An insurance intermediary should take the following into account when constructing a statement following a personal recommendation: The statement should explain why the customer's demands and needs combine to make the recommended contract suitable for the customer. It should not merely state what contract is being recommended with no link to the customer's demands and needs. An insurance intermediary that offers contracts from more than one insurance undertaking should include a statement of why a particular insurance undertaking has been recommended. Reasons that may be given could relate to: - - Contract features not available anywhere else Price Service levels. Strength of insurer Etc The intermediary should also make the customer aware of the demands and needs not met by the recommended contract. For example: - Any exclusions to the policy - Whether or not a client’s existing cover has been taken into account e.g. ill health early retirement pension - Activities required that are not dealt with by the insurance provider e.g. updates to employment contracts. N.B. If an intermediary is aware that the customer’s existing cover is likely to significantly affect the suitability of any personal recommendation, he must not make a personal recommendation until details of the insurance cover are made available to him. If he makes a personal recommendation it must be made clear to the customer that this may not be suitable because he has not taken into account full details of the existing cover. 5 Style and Presentation The style and presentation of the statement is left for the insurance intermediary to decide, so that he can design a statement which works best for the market in which he transacts business. A statement is more likely to be effective if it demonstrates these features: - Simplicity and plain English: when technical terms need to be incorporated, they should be explained if the customer is unlikely to understand their meaning; and - Concise and clear messages: lengthy explanations and extensive statements are likely to reduce the effectiveness of the statement, and make the customer less likely to read the statement properly. 1.5 Record Keeping and the Statement of Demands & Needs If a customer acts on the personal recommendation by concluding the non-investment insurance contract with that insurance intermediary the Statement of Demands & Needs should be kept for three years from the date of the recommendation. If the customer does not act on the personal recommendation, the insurance intermediary need not retain a copy of the statement. For advised cases for commercial customers For advised cases for commercial customers; where no Demands and needs letter has been provided because the clients consent to this has been gained and the consequences explained, a record of the reasons for the recommendation must be made and kept for three years from the date of the recommendation. PAGE 18 6 2. Production of a Statement of Demands & Needs In order to produce a Statement of Demands & Needs you will need to cover the following areas with any communication to your client. The following section covers those needs you would need to consider and provides an introduction to a letter that they could use to incorporate the information discussed below. The employers needs regarding group income protection Meeting their needs - existing needs Meeting their needs – future recommended needs Additional recommendations (if applicable) Future review of position and needs Customer disclosure requirements 2.1 Group Income Protection Needs This section looks to record the identified needs around Group income protection and what the aims of this type of cover are to meet. Suggested wording is as follows: When we (met/spoke) we discussed your Group Income Protection needs. The areas discussed are listed below: Group Income Protection Needs – Individual Needs If a member of your staff was unable to work due to long term accident or sickness you would want <%> of their income to be replaced after a specified time until they could return to work. If a member of your staff was unable to work due to long term accident or sickness you would want <%> of their income to be replaced after a specified time as this would avoid having to pay for both the sick member of staff and any possible replacement member of staff. If a member of your staff was unable to work due to long term accident or sickness you would want <%> of their income to be replaced after a specified time as this would protect your reputation as an employee focused employer. If a member of your staff was unable to work due to long term accident or sickness you would want <%> of their income to be replaced after a specified time as this will avoid issues regarding the payment of long term sick pay and the possible termination of employment. If a member of your staff was unable to work due to long term accident or sickness you would want <%> of their income to be replaced after a specified time as this will help to retain experienced and valued members of staff You want to provide an income replacement plan with an insurer that can provide expert claims support in helping employers manage long-term absence and rehabilitation. Group Income Protection Needs – Company Needs You want to provide an income replacement plan that covers your employer pension contributions and National Insurance contributions for any member who is off due to long-term sickness or absence. 7 You want to provide an income replacement plan that covers your employer pension contributions and which protects the life cover provided as part of this arrangement for any member absent due to long term sickness or disability. You want to provide an income replacement plan that covers the members employee pension contributions for any member who is off due to long term sickness or absence. If a member of your staff was unable to work due to long term accident or sickness you would want <%> of their income to be replaced after a specified time as this will reduce the effect that their absence may have on the company’s future profits. You want to meet requirements of employment legislation such as the Disability & Discrimination Act (2005). This product will help to meet the requirements to assess objectively and rationally a disabled member of staff … to work in your business. You will need to select a provider who can help in the assessment of the nature and scope of the impairment, suggest reasonable adjustment and alternative suitable work and finance any shortfall in earnings. You want to provide an income replacement benefit plan for your staff that is an allowable business expense for your business You want to be able to budget more accurately for sick pay costs knowing that a Group Income protection policy is in place and will pay out after a specified time. Needs that have not been discussed If any need areas haven’t been discussed, the following sentence may need to be considered: I offered to review your <enter need area not discussed>. However, you chose not to discuss <this area / these areas> at this time. 2.2 Meeting their needs – Existing Provision Once a customer’s needs have been identified, the customer’s existing cover circumstances need to be identified. Suggested wording is as follows: Your existing provisions You currently hold the following policy/policies OR You advised me that you do not have any existing policies to meet your needs stated above. Existing Policies Where the client has an existing policy but the information is not available or accessible, it is suggested that you insert the following warning sentence: The information you provided in respect of your existing <insert name of policy/ies> policy/ies is based on your recollection, as <insert reason, e.g. the full details were not available / not readily accessible>. Therefore, my recommendation(s) may not be suitable if the information you provided is inaccurate. You explained that you wished to proceed on this basis. 8 Where the client has an existing policy but will not provide the information, we suggest that you insert the following warning sentence: You were not <willing/able> to provide any information in respect of your existing <type of policy >. Therefore my recommendation(s) may not be suitable, as I cannot determine if your existing <type of policy > meet your need(s) stated above. You explained that you wished to proceed on this basis. Recommendation to replace or cancel an existing policy Enter paragraph where a recommendation to replace or cancel an existing policy has been made: I have recommended that the <insert policy that is being cancelled> policy should be cancelled as <I have been able to provide a policy with the cover you require at the same /a lower price / free text other reason, e.g. comparison of applicable excess / limitations / options that the client said were important to them >. Recommendation NOT to replace or cancel an existing policy Enter paragraph where a recommendation has been made to the client(s) not to cancel or replace an existing policy: I have recommended that the <insert policy that client(s) insists should be cancelled> policy should not be cancelled as <enter details>. However, against my advice, you have decided to proceed with the cancellation. Enter sentence where there is to be no change to the existing policy/ies: All my recommendations assume that your existing policy/ies will remain in place. You have confirmed that you understand that your existing cover should not be cancelled until the new cover is in place and that there is no guarantee that the new products will be underwritten on similar terms as your existing cover. 2.3 Meeting their needs – Future Recommended Needs This section looks to identify what has been recommended and why. It should be linked to the customer needs, outline the features and options, any relevant exclusions or limitations, affordability issues and confirmation of the company chosen. Suggested wording is as follows: You have accepted the following group income protection policy that I recommended for the following categories of membership outlined below: Categories of membership Group Income Protection Policy Type Term of plan or what ceasing age 9 Benefit level <% of salary> <Sum Insured> Premium and frequency Meeting your needs and consequences of inadequate provision: Set out the recommendation, linked to client needs. Take into account: - whether level of cover is sufficient, - relevance of any exclusions, - limitations or conditions in the contract, - current provisions not included. For example, entitlement of benefit for different categories of membership, Explain clearly why the recommendation meets the clients’ requirements. 1. 2. Features and options: Outline details of features and options recommended and the client’s response if not taken up. 1. 2. Relevant exclusions and /or limitations: Outline details of any exclusions or limitations relevant to the client’s needs and preferences. For example e.g. a back exclusion on an IP policy for a client with a history of back problems. In this case, this section will be completed in the reissue of the Suitability Statement to ensure that the contract is still suitable and meets the client’s needs. 1. 2. Confirmation of affordability: Detail the affordability check carried out and discussed with client Confirmation of Company chosen: One paragraph giving background information on the chosen company. For example Friends Provident has been selected due to its excellence in customer service and been awarded the Cover Magazine Group Income Protection provider of the Year. 2.4 Additional Recommendations This section could cover any additional recommendations that have been made and that may need discussing in the future. Suggested wording is as follows: If other recommendations have been made, detail this in a free text paragraph e.g. referral for absence management advice / programme 2.5 Future review of position and needs This section should cover future reviews of the customer’s position and needs. Suggested wording is as follows: I have offered a review of your <group income protection> needs and you have agreed that I may contact you <insert defined period or date, e.g. in 12 months time / by December 2006 etc.> 10 OR I have offered a review of your <insert details of area(s) to be reviewed> needs. However, you have declined this offer and do not wish to be contacted. Should your circumstances change, this may affect the suitability of the policy I have recommended. Please do not hesitate to contact me if you would like me to review your arrangements. 2.6 Disclosure Requirements This section reminds the customer about the need to fully disclose information regarding their application for insurance and the consequences of failing to do so. Suggested wording is as follows: It is important to disclose all material information asked for in the application form, and that failure to do so could mean that benefits are not paid under the group income protection policy recommended. 11 3.0 Example Demands & Needs letter <CLIENT NAME(S) 1ST LINE CLIENT ADDRESS 2ND LINE CLIENT ADDRESS 3RD LINE CLIENT ADDRESS CLIENT POST CODE> <IFA NAME 1ST LINE IFA ADDRESS 2ND LINE IFA ADDRESS 3RD LINE IFA ADDRESS <POST CODE> <IFA TELEPHONE NO. IFA FAX NO.> <INSERT DATE> Dear <insert client(s) name(s)> Group Income Protection Statement of Demands & Needs If face-to-face meeting: Further to our meeting(s) on <insert date(s)>, this letter confirms the details of our discussions and the personal recommendations I have made. If distance contact: Further to our <insert details of how contact was made, e.g. telephone correspondence> on <insert date(s)>, this letter confirms the details of our discussions and the personal recommendations I made. If face-to-face and one client not at presentation meeting: Unfortunately <insert client name> could not attend our meeting on <insert date>. This means that <insert consequences>. If the contract concluded over the phone or the client required immediate cover: As you required immediate cover I disclosed to you verbally the content of this letter during our <meeting/ telephone conversation, etc>. Link to documents – face to face I strongly recommend that you read and understand the <Technical Guide / Policy Conditions>, which I have provided separately. This explains the policy/ies in greater detail, in particular the features and any exclusions and limitations. I also gave you a copy of the quotation which details the cover we have discussed for your Group Income Protection Plan. It is important that you read these documents in conjunction with this letter. If you have any questions about any of these documents, or you feel this suitability statement is an inaccurate record of our discussions, please contact me as soon as possible. Link to documents – non face to face I strongly recommend that you read and understand the <Technical Guide / Policy Conditions>, and a copy of the quotation which details the cover we have discussed for your Group Income Protection Plan. These documents should be read in conjunction with this letter. If you have any questions about these documents or the advice and recommendation service I provided, or you feel this suitability statement is an inaccurate record of our discussions, please contact me as soon as possible. You will then need to consider what you wish to include from the following sections: 12 See section 2 for examples of what could be included. The employers needs regarding group income protection Meeting their needs - existing needs Meeting their needs – future recommended needs Additional recommendations (if applicable) Future review of position and needs Customer disclosure requirements This section you wish to use to conclude your letter. I have offered a review of your <insert details of area(s) to be reviewed, e.g. Group Life etc.> needs and you have agreed that I may contact you <insert defined period or date, e.g. in 12 months time / by October 2005, etc.> OR I have offered a review of your <insert details of area(s) to be reviewed> needs. However, you have declined this offer and do not wish to be contacted. Should your circumstances change, this may affect the suitability of the policy/ies I have recommended. Please do not hesitate to contact me if you would like me to review your arrangements. Paragraph on annual review I will contact you on an annual basis before your policy anniversary to request updated information regarding the annual review of your policy. This information will ensure your benefits are kept up to date and reflect the membership and benefit levels at that time. Paragraph on Guaranteed Review Period I will contact you every other year before your policy anniversary to discuss the unit rate which is used to calculate your Group Income Protection Plan premium. This will be reviewed every two years by the provider of your plan. I have advised you that cover will not be in force until your application has been fully underwritten, accepted and cover has commenced. I explained to you the importance of disclosing all material information asked for in the application form, and that failure to do so could mean that benefits are not paid under the policy/ies I have recommended. Yours sincerely, <IFA NAME> 13