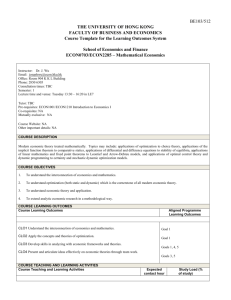

Mathematical Economics - the School of Economics and Finance

advertisement

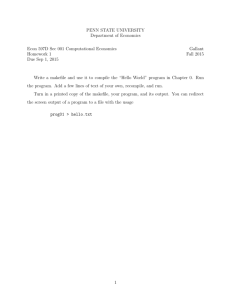

ECON 0703 Mathematical Economics FAQ Dr. J. Wu - Sept/2007 Office hours: 9:00 – 9:30 a.m. Tues. & Thurs Room 903 KKL Building email address: josephwu@econ.hku.hk Telephone: 2850-6305 (off campus) Q: Are there any math prerequisites for this course? A: No! All the mathematics required will be taught in the course! All explanations will be on an intuitive level. Q: Is the course only for math-econ or math students to see how economists do math; or just a course to help econ students learn some math tools? A: The course is for ANY student who wants to learn how to interconnect economics and mathematics. (This is the Course Objective as well as the Course Outcome: learning and understanding the interconnection of econ and math). Course Goal: The course covers static and dynamic optimization which is the cornerstone of all modern economic theory. Assessment: 1. Class grade including tutorial discussion and mid-term tests 30% 2. Final examination grade 70% Q: Textbook for the course? A: Lecture notes for the whole course will be handed out at the beginning of the semester. Q: Reference textbooks? A: Hoy, M., Livernois, J., McKenna, C., Rees, R., Stengos, T., Mathematics for Economics 2ed. (2001) Baldani, J., Bradfield, J., Turner, R.W.. Mathematical Economics, 2ed (2005) Takayama, A., Mathematical Economics 2ed (1985) Takayama, A., Analytical Methods in Economics (1993) Q: Timetable for the course (Please see OUTLINE below)? A: Week 1 : 2-4 : 4-7 : 7-10 : 10-12: Chapter 0 of the lecture notes. Chapter I. Chapter II. Chapter III. Chapter IV. and Chapter V. COURSE & LECTURE NOTES OUTLINE (7/2007) Chapter 0. Introduction and Development of Mathematical Economics A. A philosophical example in calculus of variations to illustrate the interconnection between nature, mathematics and economics through optimization. B. Historical Development of Mathematical Economics Within General Economic Theory Chapter I. Optimization in Mathematics & Economics and Matrix Algebra (with economic applications as illustration) A. Review of mathematics (S & D curves) B. Integral calculus: (consumer surplus and economic rent extraction) C. Unconstrained optimization of univariate functions (profit maximization, optimal timing in Econ of Finance) D. Unconstrained optimization for multivariate functions. (revenue maximization) E. Constrained Optimization (Utility maximization subject to budget constraint) F. Economic Modeling (S & D functions in a market, Keynesian Cross in Macroeconomics). G. Linear (Matrix) Algebra - Gaussian method (Keynesian Cross solution); determinants; Inverse matrix; - Cramer’s Rule (Leontief Input-Output Model) H. Special determinants and matrices: Jacobian, Hessian I. Unconstrained optimization of multivariate functions using Hessian J. Constrained optimization of multivariate functions with one equality constraint using bordered Hessian. (Derivation of Demand function). K. Constrained optimization of univariate functions with 1 inequality constraint; and of multivariate function with m inequality constraints (cost minimization using KuhnTucker condition) L. Nonlinear programming (NLP) of multivariate functions with m inequality constraints: concave programming with saddle point characterization. (KuhnTucker-Uzawa Theorem) Chapter II. Main Micro Econ Issues within Math Framework A. Microeconomics: Pure Theory of static competitive markets Importance of market vs. planned economy; Competitive Equilibrium and Pareto Optimality; Rigorous proof of Adam Smith’s Invisible Hand Theorem using vector maximum and NPL framework; Welfare implications and Existence of C.E. B. Market dynamics of adjustment processes and stability in Micro Econ. (not covered) Chapter III. Intertemporal & Dynamic Economic Systems in Micro and Macro Econ. A. Homogeneous Functions, Euler’s Theorem & Implicit functions (Cobb-Douglas production & demand functions). Implicit functions (Production Possibility Frontiers). B. Eigenvalues, Eigenvector and Markov matrix. C. Difference equations One-dimensional 1st order linear autonomous difference equation (Cobweb Market Adjustment Model in Micro Econ; Harrod Growth Model in Macro Econ; Derivation of FV formula in Finance); Recursive methods 2nd order difference equations. Two-dimensional and m-dimensional first order linear difference equation (discrete stochastic dynamic models; restaurant survival) D. Differential equations. (econ growth; Micro price elasticity of demand ; Macro 2sector income determination model.) General formula and solution methods 2nd order linear differential equation (market price adjustment model with inventory) Bernoulli nonlinear differential equation; phase diagram (Simple Solow Model and Solow Model with Cobb-Douglas aggregate production function solved by Bernoulli nonlinear differential equation) nth order differential equations and Cauchy-Peano Theorem 2-dimensional differential equations (Micro econ stock market price trend and momentum models). E. m-dimensional linear and nonlinear differential equation (continuous dynamic systems). F. Dynamic optimization using Calculus of Variations; Euler’s equation with proof; dynamic optimization subject to functional constraints (dynamic monopolistic pricing model; minimization of cost stream subject to dynamic constraints.) G. Macro Growth Theory: adjustment process, growth paths, equilibrium stability & dynamic optimization. i) Simple Macro Growth models: growth models using power functions; Keynesian cross and Harrod growth models. ii) Neoclassical growth models (Solow) with derivation of golden age and golden rule paths; AK growth models. iii) Macro optimal growth model using Calculus of Variations, phase diagram. iv) Macro optimal growth model using Pontryagin’s Optimal Control H. Bellman’s Dynamic programming i) Recursive multistage optimization (min budget expenses for economic development; dictator’s tax revenue maximization) ii) Macro optimal stochastic growth model using Bellman’s dynamic programming with recursive methods. Chapter IV. Economics of information, risks & uncertainty. A. Brief introduction of stochastic concepts and probability theory (stochastic models in Econ of Finance). B. Von Neumann-Morgenstern (VNM) Expected Utility Theorem C. Arrow-Debreu State-contingent commodities Model to extend the Fundamental Theorem of Welfare Economics to include risks. D. Insurance models. Alternative statement of Arrow-Debreu State-of-nature model. Asymmetrical information, moral hazard and adverse selection. E. Game theory: pure- & mixed-strategy static games; Nash Equilibrium (Duopolist sales strategies; 2-country international trade model). Existence theorems. (management-union bargaining; oligopolists’ output decision) Chapter V. (Optional) Goedel’s “Incompleteness” (1931) Theorem in math logic to “complete” our course. Hofstadter’s fascinating linkage of mathematician Goedel’s theorem, lithographer M. C. Escher’s drawings and baroque composer J. S. Bach’s fugues and canons. Self-reference in Goedel’s Theorem; nonlinear dynamics; Chaos Theory. General causality, determinism and predictability of systems in nature, economics and mathematics