Agenda

advertisement

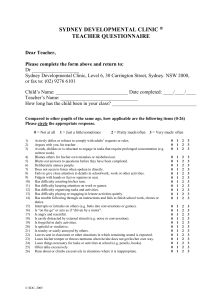

Colonial First State Global Asset Management Commonwealth Property Office Fund (CPA) Leasing and development update September 2007 Charles Moore and John Dillon 14 November 2007 2 2 Agenda  Highlights  Leasing update  Revaluations  Development update  Outlook 1 3 3 Highlights  Record occupancy of 98.9% (by income)  Revaluation increase NTA* from $1.47 to $1.50  Practical completion of 10 Dawn Fraser Avenue#, Sydney Olympic Park  Capital management initiatives implemented *NTA= net tangible asset backing per unit. #Formerly known as Site 5 Dawn Fraser Avenue. 4 4 Delivering on strategy  Buy-back initiated on 26 September, initially funded by cash and debt  To 9 November 2007, Manager has bought back 11,891,066 units or 1% of units on issue  Internalisation of property management well advanced, with a focus on active asset management - FY08 flowback forecast $400,000 10 Shelley Street, Sydney 2 5 5 Leasing update  Occupancy 98.9% by income (97.5% at 30 June 2007)  Portfolio WALE* (by income) 5.3 years (5.4 years at 30 June 2007)  7,280 sqm leased or renewed  36,610 sqm terms agreed  90,516 sqm reviewed at an average increase of 4.0% Key leasing activity – 1 July 2007 to 30 September 2007 Property Tenant Area (sqm)* Term (years) New rent ($psm) 385 Bourke Street, Melbourne Fidelity Information Services 1,287.0 10.0 340.0 (N)# 259 George Street, Sydney Liquid Capital 1,016.7 8.0 725.0 (G)# Expiry Market rents ($) *WALE= weighted average lease expiry #(G) Gross (N) Net 6 6 Leasing focus Property Tenant Area (sqm)* Vacancy 225 George Street, Sydney 840 >1,000 (G)# 385 Bourke Street, Melbourne 2,011 320-340 (N)# 201–207 Kent Street, Sydney 1,698 490-500 (N)# Upcoming expiry 300 Queen Street, Brisbane Suncorp-Metway 2,048 Dec 07 700 (G)# 45 Pirie Street, Adelaide Attorney General of SA 7,889 Aug - Sep 07 365 (G)# 225 George Street, Sydney IPAC 3,866 Jun 08 860-890 (G)# 385 Bourke Street, Melbourne UniSuper 1,975 Feb 08 360-370 (G)# *100% ownership basis #(G) Gross (N) Net 3 7 7 Revaluations  $53.6 million increase over book value  Weighted average cap rate 6.5%, down from 6.6% at 30 June 2007  NTA $1.50 per unit, up 3 cents from $1.47 per unit New valuation $m Increase over book value $m Cap rate movement % 201-207 Kent Street, Sydney* 77.25 7.9 6.75 → 6.50 56 Pitt Street, Sydney 177.0 21.0 6.50 → 6.00 108 North Terrace, Adelaide 82.0 4.5 7.75 → 7.00 53 Ord Street, West Perth 53.5 14.1 7.25 → 6.50 18.75 6.1 7.50 → 6.75 Revaluations – 30 September 2007 16 Parliament Place, West Perth * CPA share 25% 8 8 Asset sale  Expressions of interest closed for 100 King William Street, Adelaide  Part of active asset management to sell non-core assets  Realisation of strong capital return for unitholders  Sale process to be complete prior to year end 100 King William Street, Adelaide 4 9 9 Development update Commonwealth Bank campus , Sydney Olympic Park  10 Dawn Fraser Avenue# – Commonwealth Bank commenced lease Sep 07 – Cost $99.2 million – 23,839 sqm  Site 6 and 7 Dawn Fraser Avenue – Completion late 2008 – 34,000 sqm  7.2% yield on cost 10 Dawn Fraser Avenue, Sydney Olympic Park # Formerly known as Site 5 Dawn Fraser Avenue. 10 10 Development update Commonwealth Bank campus , Sydney Olympic Park 10 Dawn Fraser Avenue, Sydney Olympic Park 5 11 11 Development update Site 4B Olympic Boulevard, Sydney Olympic Park  Planning approval granted  22,000 sqm  Actively marketing for pre-commitments  Estimated project cost of $100 million Site 4B Olympic Boulevard, Sydney Olympic Park 12 12 Development update 175 Pitt Street, Sydney  Commonwealth Bank to vacate Q1 2009  Extensive refurbishment of 23,000 sqm of office space  Timing – available Q2 2010  Estimated project cost $60-$65 million  Marketing commenced 175 Pitt Street, Sydney 6 13 13 Outlook  Robust market fundamentals expected to continue  Positive revaluations anticipated within portfolio  Management will continue to capitalise on leasing opportunities  Strong balance sheet for the development pipeline and investment opportunities 14 14 Disclaimer Neither Commonwealth Bank of Australia (the ‘Bank’) ABN 48 123 123 124 nor any of its subsidiaries guarantees or in any way stands behind the performance of the Commonwealth Property Office Fund ARSN 086 029 736 (CPA) or the repayment of capital by CPA. Investments in CPA are not deposits or other liabilities of the Bank or its subsidiaries, and investment-type products are subject to investment risk including possible delays in repayment and loss of income and principal invested. The information contained in this quarterly update presentation (the ‘presentation’) is intended to provide general advice only and does not take into account your individual objectives, financial situation or needs. You should assess whether the presentation is appropriate for you and consider talking to a financial adviser or consultant before making an investment decision. All reasonable care has been taken in relation to the preparation and collation of the information. Except for statutory liability which may not be excluded, no person, including Commonwealth Managed Investments Limited (the ‘Responsible Entity’) ABN 33 084 098 180, Colonial First State Property Limited ABN 20 085 313 926 or any other member of the Bank’s group of companies, accepts responsibility for any loss or damage howsoever occurring resulting from the use of or reliance on the presentation by any person. Past performance is not indicative of future performance and no guarantee of future returns is implied or given. Copyright and confidentiality The copyright of this presentation and the information contained therein is vested in the Responsible Entity, the Bank and the Bank’s group of companies. This presentation should not be copied, reproduced or redistributed without prior consent. 7