report on food donations - EESC European Economic and Social

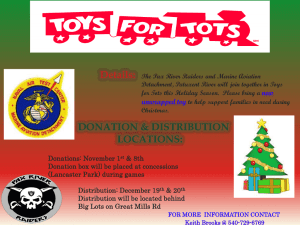

advertisement