Canada Revenue Agency Performance Report

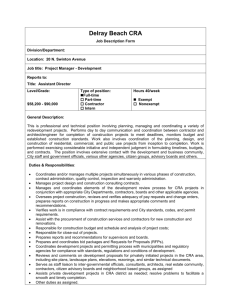

advertisement