In re U.S. Aggregates, Inc., Securities Litigation 01-CV

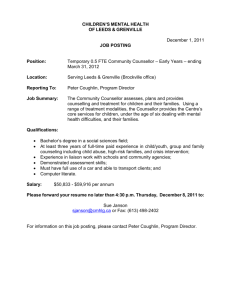

advertisement