Airports and Airlines Economics and Policy: An Interpretive Review

advertisement

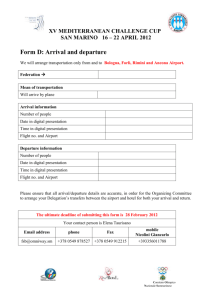

Airport and Airline Economics and Policy: An Interpretive Review of Recent Research Anming Zhang Sauder School of Business, University of British Columbia / Shanghai Advanced Institute of Finance (SAIF), SJTU Achim I. Czerny WHU – Otto Beisheim School of Management May 28, 2012 @ IFSPA 1. Introduction • Research has focused on airline sector • With airports undergoing policy reforms worldwide and the relative maturity of research on airline service, airport sector has recently experienced increased attention • Long tradition of airport research (1960s …) - treat airport like roads: “atomistic” flights Externalities as a Divergence of Social and Private Costs $ SMC H E G PMC t F Q* MB Q Quantity 3 • Distinct characteristic of recent airport research: Explicit recognition of airline markets being oligopoly or other forms of imperfect competition Borenstein (1989), Daniel (1995), Brueckner (2002): airlines at hubs are imperfectly competitive • Central insight: Airport economics (and policy) should incorporate strategic interactions between airlines, and integrate airports and airlines research • “Vertical structure” approach: Airports reach final consumers (passengers) through airlines Input service to carriers Airport Charges, Capacity Airline 1 Airline 2 Airline 3 ….. Airline N Passengers • This survey consists of: Airport congestion and pricing Airport regulation and privatization Airline alliances • New, and important, insights have been derived in these areas • This survey seeks a unifying framework 2. Airport Congestion and Pricing 2.1 Delays and airport congestion 2.2 Congestion toll: Basic model 2.3 Discussion/Extensions Empirical results Internalization or not? Pricing or slots? Capacity investment and cost recovery 2.4 Main insights 2.1 Delays and airport congestion • Air travel delays: a major problem • In United States: - Total cost of delays in 2007 was $31.2 billion (Ball et al., 2010) - Reducing airport congestion is DOT’s No. 2 management challenge (behind safety) • Large traffic volume (relative to airport capacity) is a major cause airport congestion • Add capacity • Demand management: 1) Pricing; 2) Quantity restraint 2.2 Congestion toll: Basic model • Early congestion-pricing models treat flights as atomistic • Unlike roads, congestion pricing has not really been implemented at airports Several (failed) attempts: - too high - uniform charge - resisted by large airlines • Congested airport dominated by only a few carriers, each running a large number of flights • Daniel (1995, Econometrica): first economist to raise possibility of “self internalization”: A large airline consider that scheduling one more flight generates extra congestion costs for its other flights (and its passengers) - Idea demonstrated using queuing models and simulations • Brueckner (2002, AER) referred back to a static congestion model to address the internalization issue, and drew attention of a wider group of researchers • Basic model of airport congestion charge: Passenger quantity q their benefits from flying B(q) per-passenger delay cost vC(q) C(q) = average delay; v = VTTS • At the demand equilibrium, marginal benefits of flying equal the “full price”: • Welfare-optimal airfare is which equals the part of marginal congestion costs that are not internalized by passengers • Airport authority does not directly control airfares; fare decisions are made by carriers • Welfare-optimal airport charge? – Need the “airport demand” function – Same as the “passenger demand for transport”? Implications of the vertical structure: The demand for airport services is a derived demand: There is a consumer demand for air transport (“final demand”), which leads to a demand for airport services Specifically, an airport is an input provider that reaches final consumers (passengers) only through airlines From the equilibrium output of airlines, we obtain the derived demand for the airport: which is a function of airport charge • Welfare-optimal airport charge derived as (1) with being the (positive and endogenous) price elasticity of passenger demand, Equation (1): • “Atomistic charge” is given by the part of congestion costs not internalized: when • Airlines choose the passenger quantity just right from social viewpoint when and , which represents a situation with a monopoly airline that possesses no market power • However, if and , full internalization cannot always be achieved the optimal charge becomes positive 2.3 Discussion/Extensions Empirical results (for) • Brueckner (2002) finds empirical evidence of the inverse relationship between delays and airline concentration and so self-internalization • Mayer and Sinai (2003) provide further evidence for self-internalization Empirical results (against) • Daniel (1995) found no evidence for internalization of self-imposed delays; indicated the atomistic equilibrium is correct model Daniel and Harback (2008) with a much broader data base confirmed Daniel (2005) • Morrison and Winston (2007) concluded welfare loss would be small if airline market structure were treated as atomistic Internalization or not? • At a theoretical level, argument by Daniel (1995) and Daniel and Harback (2008) for non-internalization is based on behavior of “competitive fringe”, a set of carriers operating a small portion of an airport’s flights • If a large carrier cuts back its flights to reduce selfimposed congestion, fringe carriers will fill the resulting gap, eliminating any benefits of self-internalization by reestablishing the initial combined traffic pattern • Brueckner and Van Dender (2008): Stackelberg model • Consider a Stackelberg leader serving passengers and n Cournot followers serving a total of passengers • Change of when increases is (2) • When homogeneity is given, RHS of (2) -1 when the number of Cournot followers reaches infinity (competitive fringe), so no self-internalization exists • When outputs of the Stackelberg leader and Cournot followers are imperfect substitutes, the absolute value of RHS is reduced room for self-internalization • Czerny and Zhang (2011) provide an alternative explanation based on different passenger types with distinct time valuations, for observation that atomistic tolls may lead to surprisingly good welfare results even though airlines selfinternalize - Czerny and Zhang (2012) relax the assumption of “no price discrimination” by carriers • Silva and Verhoef (2011) consider a differentiated Bertrand duopoly: Airlines internalize little self-imposed congestion relative to Cournot Pricing or “slots” (quantity constraint)? • Complication with pricing: Need for carrier specific tolls and smaller carriers pay higher toll • Airport under a slot system decides on how many slots to make available, then followed with slot trading • Brueckner (2009) shows that slot system can lead to an efficient outcome - Since congestion impacts cease to be a carrier’s concern, need for carrier specific tolls vanishes - Slots distributed for free, or via auction Capacity investment and cost recovery • Well known from road-pricing literature: Atomistic toll exactly covers the cost of welfare-optimal capacity when i) capacity is divisible ii) capacity construction is constant returns to scale iii) C(q, K) is homogenous of degree zero in q and K • Welfare is given by capacity is determined by: , and welfare-optimal (3) • Atomistic toll given by uninternalized part of congestion cost, leading to “optimal” (per passenger) revenues • With the constant returns to scale, “optimal” capacity cost is • C is homogenous of degree zero, ; so cost recovery is achieved by the welfare-optimal toll when capacity reaches the optimal level • Since welfare-optimal congestion toll may be reduced relative to atomistic toll when carriers have market power but capacity choice is independent of the market structure (see (3)), cost recovery may not be achieved 2.4 Main insights • One controversial issue in airport congestion pricing has been whether carriers internalize self-imposed congestion (mixed empirical evidence) theoretical attempts to resolve the issue • Passenger types provide an explanation for why welfare loss could be small if airline market structure were ignored (even though carriers do self-internalize) • Slots can actually provide an effective, and perhaps “fairer” alternative policy, approach relative to congestion pricing – Slots auction generates revenue for capacity expansion • The “infrastructure-operator” vertical structure is relevant for many transport cases: Air cargo terminals – airlines/integrators – shippers Ports (terminals) – shipping lines – shippers Railway tracks – carriers (railway companies) – passengers/shippers • … and other industries: Phone and, more generally, telecom “Platforms”: 4PL; e-Commerce; … 28 3. Airport Regulation and Privatization 3.1 Public vs. private airport behavior 3.2 Regulation forms 3.3 Concessions 3.4 Single-till vs. dual-till 3.5 Empirical studies 3.6 Main insights Regulation, Privatization, and Airport Charges: Panel Data Evidence from European Airports Volodymyr Bilotkach, Newcastle Business School Joseph Clougherty, UIUC Juergen Mueller, HWR-Berlin Anming Zhang, Sauder School of Business, UBC Introduction • Airports have traditionally been viewed as an essential transportation infrastructure, and owned/managed by governments • Yet, over last two decades, increasingly recognized as business enterprises: – Should private or public entities own/manage airports? – How do we contain potential market power of airport? -- A ‘local monopoly’ candidate? -- By regulation; if so, which form? 31 Airport literature -1 • Consists of mainly descriptive studies on the evolution of airport regulation • Emerging theoretical work on airport regulation – Czerny (2006, JRE): non-congested airports – Yang & Zhang (2011, JRE): congested airports • Empirical ‘benchmark studies’, started in late 1990s: airport (technical) efficiency and its determinants 32 Airport literature -2 • Yet, very little has been done on analysis of relationship between ownership/regulation and airport pricing - Striking in view of vast literature on airline pricing • Two studies: - van Dender (2007, JUE) - Bel & Fageda (2010, JRE) 33 Airport literature -3 • van Dender (2007): 55 US passenger-oriented airports - Simultaneous-equations model of charges, concession revenue, airfares, departures, passenger volume, delays - Airport charge defined as aeronautical revenue per aircraft movement (a landing or a take-off) 34 Airport literature -4 • US airports are publicly owned, and forced to do cost-based charges via ‘Airport Improvement Program’ grants • Our study differs from van Dender’s, as we look at airports subject to various regulation regimes and ownership types European airports 35 Airport literature -5 • Bel & Fageda (2010): study of charges at 100 largest European airports – Cross-section 36 This study • Uses data from the German Airport Efficiency Project (an airport efficiency study) • Unbalanced panel, with 61 airports and up to 18 years deep (1990-2007); annual observations • First study looking at relationship between ownership, regulation, and charges in the panel data setting - van Dender’s data spanning 1998-2002, but unable to fully employ panel-data econometric techniques due to nonvariation in key variables 37 Dependent variable • Airport charge – Defined as aeronautical revenue per aircraft movement (a landing, or a take-off) – Same as one used by van Dender (2007) – Shortcomings • It lumps together different aircraft types, and we don’t have data of aircraft mixes for our sample airports • It lumps together passenger and cargo flights • Some airports differentiate between origin-destination and transfer passengers 38 Hypotheses -1 • ‘Single till’ vs. ‘dual till’ regulations - Aeronautical service: runway; aircraft parking; terminal - Non-aeronautical (commercial) service: e.g. dutyfree shops; other concessions; car parking; car renting • Single-till regulation leads to lower airport charges, owing to ‘cross subsidization’ 39 Hypotheses -2 • Privatization and charges: – Private airport: market-power effect (+) – Private airport: efficiency effects (-) -- more cost efficient -- stronger incentive to attract traffic due to more profitable commercial activities – Complex relationship, and an empirical one 40 Hypotheses -3 • Regulation and charges – Sample airports with cost-based regulation or “price cap” – Sample airports with ex post regulation – Ex post regulation ≠ no regulation: • Ex post regulation Lower charges: more operational freedom and efficient (no ex ante regulation, but threat of re-regulation) • Ex post regulation Higher charges, owing to less monitoring 41 List of Airports IATA Code Airport / Country IATA Code Airport / Country ABZ Aberdeen, UK LHR London Heathrow, UK AHO Alghero, Italy LIL Lille, France AMS Amsterdam, The Netherlands LJU Ljubljana, Slovenia ATH Athens, Greece LPL Liverpool, UK BFS Belfast, UK LTN London Luton, UK BHX Birmingham, UK LYS Lyon, France BLQ Bologna, Italy MAN Manchester, UK BRE Bremen, Germany MLA Malta International, Malta BRS Bristol, UK MME Durham Tees Valley, UK BRU Brussels, Belgium MRS Marseille, France BTS Bratislava, Slovakia MUC Munich, Germany CAG Cagliari, Italy NAP Naples, Italy CGN Cologne/Bonn, Germany NCE Nice, France Newcastle, UK CPH Copenhagen, Denmark NCL CTA Catania, Italy NUE Nuremberg, Germany CWL Cardiff, UK OLB Olbia, Italy DTM Dortmund, Germany OSL Oslo, Norway DUS Düsseldorf, Germany PMO Palermo, Italy EDI Edinburgh, UK PSA Pisa, Italy EMA East Midlands, UK RIX Riga, Latvia FLR Florence, Italy SCN Saarbruecken, Germany FRA Frankfurt, Germany SOU Southampton, UK GLA Glasgow, UK STN London Stansted, UK GOA Genoa, Italy STR Stuttgart, Germany GVA Geneva, Switzerland SZG Salzburg, Austria HAJ Hanover, Germany TRN Turin, Italy HAM Hamburg, Germany TRS Trieste, Italy LBA Leeds Bradford, UK VCE Venice, Italy LCY London City, UK VIE Vienna, Austria LEJ Leipzig, Germany ZRH Zurich, Switzerland LGW London Gatwick, UK 42 Descriptive Statistics Mean Median Maximum Minimum Std. Dev. Aeronautical revenue, thousand Euros (year 2000 prices) 103,907 39,385 1,287,187 3,633 176,848 Non-aeronautical revenue, thousand Euros (year 2000 prices) 77,286 28,151 889,370 627 144,556 Passengers 9,084,926 4,439,804 67,869,000 419,680 12,340,683 Cargo (metric tons) 135,769 19,678 2,190,461 0 318,072 Aircraft Movements 110,819 69,600 492,569 4,113 108,939 Charge per aircraft movement (year 2000 prices) 712.51 651.59 3,005.96 136.47 408.90 Cost-Based regulation 0.35 0.00 1.00 0.00 0.48 Price-Cap regulation 0.17 0.00 1.00 0.00 0.38 Single-till regulation 0.34 0.00 1.00 0.00 0.47 Ex post regulation 0.48 0.00 1.00 0.00 0.50 Private ownership share 38.38 8.00 100.00 0.00 42.79 43 Estimation Results Base Model Regression Specification: Price-Cap regulation Single-Till regulation Ex-Post regulation Private Ownership Share Hub Nearby Airports Log(non-aeronautical revenue per pax) Log (Real GDP per capita) Log (Population) Log(Passengers/ Aircraft Movements) Log (cargo volume) Lagged dependent variable Dynamic Panel Data Model System GMM Dynamic Panel Data Model #1 FE #2 FE + IV #3 FE #4 FE + IV #5 IV for Yt-1 0.0030 (0.0322) -0.1223** (0.0500) -0.2592** (0.0957) -0.0027** (0.0004) 0.1308** (0.0547) 0.0067 (0.0322) 0.0290 (0.0397) -0.1288** (0.0598) -0.2703** (0.1112) -0.0029** (0.0005) 0.1880** (0.0483) -0.0030 (0.0353) -0.0019 (0.0195) -0.0719** (0.0257) -0.0719 (0.0853) -0.0009** (0.0003) 0.0523** (0.0218) 0.0206 (0.0255) 0.0121 (0.0281) -0.0844** (0.0317) -0.1679** (0.0698) -0.0014** (0.0005) 0.1095** (0.0339) 0.0040 (0.0308) 0.0228 (0.0724) -0.0993** (0.0465) -0.0858 (0.0557) -0.0009** (0.0003) 0.1000** (0.0489) 0.0117 (0.0109) #6 IV for Yt-1 and more 0.0719 (0.0871) -0.0765* (0.0476) -0.1493** (0.0543) -0.0014** (0.0005) 0.1242* (0.0702) 0.0261 (0.0372) 0.1367 (0.0888) 0.3721** (0.1393) -0.1481** (0.0617) 0.0362 (0.1304) -0.0999 (0.0644) -0.0024 (0.0954) 0.2212* (0.1170) 0.0199 (0.0776) 0.2002** (0.0942) -0.0046 (0.0092) 0.2355** (0.0946) 0.3093** (0.0718) 0.2280* (0.1345) 0.0303* (0.0176) --- --- 0.1527* (0.0865) 0.1622** (0.0414) -0.1971** (0.0835) -0.0003 (0.0060) 0.7683** (0.0397) 0.0760 (0.1838) 0.1781** (0.0476) 0.0700 (0.1838) 0.0230* (0.0135) 0.6241** (0.1346) 0.1156 (0.0726) -0.0861 (0.0579) -0.1535** (0.0365) 0.0003 (0.0034) 0.7459** (0.0448) 0.0596 (0.0823) 0.1589* (0.0819) -0.2211** (0.0538) 0.0146* (0.0090) 0.7188** (0.0602) 44 Conclusions • We studied determinants of airport charges in a panel of 61 diverse European airports • We find: – Hub airports charge more (Expected, yet studied) – Single-till regulation yields lower charges (Expected) – Airport appears to be a ‘local monopoly’ – Privatized airports have lower charges (Need to identify the channels?) 45 3.1 Public versus private airport behavior Airport pricing • A general setting with airport’s objective as: , where is the airport profit, CS is consumer surplus and is carrier profits. Total surplus is maximized if ownership parameter is equal to one, while only airport profit is maximized when is zero • The per-passenger airport charge is determined by • Since it is natural to assume and , the private airport charge is excessive from social viewpoint • If differences in time valuation exist, it can thus be that is positive in sign; consequently, it is unclear whether private airport charges are excessive or not from the social viewpoint • Basso and Zhang (2008) develop a theoretical model and show that private profitmaximizing airports use PLP, irrespective of the airline market structure, whilst public welfare-maximizing airports may not. Capacity choice • If airport charge is given by , capacity choice is: • Since it is natural to assume , private airport capacity is socially insufficient • Zhang and Zhang (2003) found that a profitmaximizing airport is less inclined towards capacity expansion than a welfare-maximizing airport • On the contrary, Zhang and Zhang (2006b) find a private airport overinvests in capacity when carriers have market power and the passenger quantity is given (Figure 1) • If there is no congestion (after increasing capacity), the airport charge must be increased until up to in order to keep the passenger quantity at the given level in the monopoly case. The increase of revenues is greater than the reduction of congestion cost . This shows the airport’s incentive to invest is excessive Figure 1: Price effects of an increase in capacity depending on carrier market power 3.2 Regulation forms • Two principal types of economic regulation: the traditional cost-based (that is, rate of return) regulation and the more incentive-minded price-cap regulation • Under ROR regulation, the airport is allowed to charge a price equal to efficient costs of production plus a market-determined rate of return on capital investment • Price-cap regulation adjusts an airport’s charges according to the price-cap index that reflects the overall rate of inflation in the economy and the ability of the airport to gain efficiencies relative to the average firm in the economy Yang and Zhang (2012): • find that for a monopoly profit-maximizing infrastructure (e.g. airport), its capacity and service quality levels are the highest under cost-based regulation, which is followed by ROR regulation, no regulation, and price-cap regulation • Whilst cost-based regulation leads to lower productivity than price-cap regulation, it is associated with higher service quality • Another more-recent regulatory mechanism that has been employed in the airport sector is ex post regulation, i.e., no regulation is applied to the airport unless the “regulated” airport sets prices, earns profits, or reduces service quality beyond certain critical levels 3.3 Concessions • Airports worldwide currently derive as much revenue, on average, from concession services (retailing, advertising, car rentals, car parking, and land rentals) as from aeronautical ones • More importantly, concession operations tend to be more profitable than aeronautical operations • With concessions, the airport’s objective is: with being the profit derived from aeronautical services, the profit derived from concessions, and the surplus parameter • The airport behavior is given by: (6) for , where denotes the aeronautical charge while denotes the charge for airport concession services Private airport pricing • Assuming , concessions reduce the private aeronautical charge • It is based on the assumption that the aeronautical charge can impact passenger demand and concession demand, while prices for concession services have no effect on the passenger quantity • However, when concession services shift passenger demand, Czerny (2006) shows that the private aeronautical charge is increased by the existence of concession revenue Public airport pricing • Czerny (2012) shows that the public and private aeronautical charges can be the same when a part of the concession demand is independent of traveling ( ) • If the passenger quantity is independent of concession services, then the private concession price will exceed the welfare-optimal concession price; if an increase of concession price reduces the passenger quantity, both the private and public airport operators have further incentives to reduce concession prices Capacity choice • Assuming that airport capacity K is perfectly divisible and that an increase of K increases the passenger quantity, the private capacity is increased by concession revenues, since adding capacity increases concession revenues • The private incentives are insufficient from the social viewpoint because the private airport ignores the positive effects of a capacity increase on passengers and carriers Empirical evidence • Geuens et al. (2004) find that airport shopping can elicit travel-related needs such as airport-atmosphere-related and airport infrastructure-related motivations • Van Dender (2007) found empirically that the perpassenger concession revenues are declining in the passenger quantity • Altogether, there is only little empirical evidence on whether, and to what extent, airport concession services can change the passenger quantity • Another open empirical question is to what extent the demand for airport concession services is independent of traveling activities 3.4 Single-till versus dual-till • Under the single-till approach, operating profits from both the aeronautical and concession operations are considered in the determination of regulated aeronautical charges (more traditional) • Under the dual-till approach, the aeronautical charges are determined solely on the basis of aeronautical activities (relatively recent) • Aeronautical charges are likely set lower under singletill price-cap regulation than under dual-till price-cap regulation, due to the cross-subsidy from the usually (largely unregulated) profitable commercial operation • Zhang and Zhang (1997) and Czerny (2006) point out that such cross-subsidization can be welfare enhancing at a non-congested airport • A major critique of the single-till approach is that aeronautical charges are set too low at congested airports • Yang and Zhang (2011) show that dual-till price-cap regulation can be more desirable than single-till pricecap regulation at a congested airport 3.5 Empirical studies A relative scarcity of literature on airport pricing: • Van Dender’s (2007) study shows that that market structure may affect airport charges • Bel and Fageda (2010) find that airport charges are higher at larger airports in terms of passenger quantity • Bilotkach et al. (2011)’s empirical findings indicate the that the onset of single-till regulation generates lower aeronautical charges and that airport privatization leads to lower aeronautical charges on average • Yan and Winston (2011) indicates that private airports would be profitable and would improve the welfare of commercial carriers and travelers 3.6 Main insights • A private and monopolistic airport may charge excessive prices to airlines and passengers, while capacity investments may be too low. However, if the passenger quantity is fixed, the private airport may overinvest in capacity when carriers have market power • Price-cap regulation may be preferred to ROR regulation • Airport concession revenues can reduce the private airport’s incentive to charge excessively high prices • If there is plenty of capacity, single-till should be used. By contrast, if capacity is scarce, dual-till may be appropriate 4. Alliances • A major strategic action taken by airlines postderegulation involves the proliferation of alliances, both international and domestic • The result: three global alliances – Star Alliance, oneWorld, SkyTeam – made up 73.6% of world market in 2008 • Prevalence of international alliances are due in large part to constraints of existing international regulatory regime 4.1 Alliance: Link of complementary networks 4.2 Competition policy issues 4.3 Rivalry between alliances 4.4 Main insights 4.1 Alliance: Link of complementary networks • Network complementarity is fundamental to explaining those alliances that result in the extension of an airline’s network • Consider Figure 2: Airline 1 uses city H as its hub, operates routes to the domestic endpoints A and B as well as an overseas route to city K, which serves as the hub for the airline 2 Figure 2: Network structure (Brueckner 2001) • Under Cournot competition, Brueckner (2001) shows alliance reduces interline fares owing to elimination of “double marginalization” in vertical integration • Using a Bertrand competition approach, Bilotkach (2005) also predicts alliance reduces fares for the interline trips 4.2 Competition policy issues • Antitrust immunity allows alliance carriers to practice cooperative pricing without being subject to antitrust law • For: power to resolve the double marginalization in interline markets • Against: slot constraint; the potential effect on non-interline passengers and competition on “parallel routes” Airport slots • Alliance may reduce competition via concentration of airport slots and other airport facilities • Ciliberto and Williams (2010) investigate role of limited access to airport facilities as a determinant of airfares (“hub premium”): 8% for tickets out of a hub; 6.4% for tickets into a hub Non-interline passengers • Bilotkach (2005) observes “code sharing” may allow partners to price discriminate spoke-to-hub passengers from “connecting” spoke-to-spoke passengers (“bundling”) • Czerny (2009) shows: Whilst the price for spoke-to-spoke passengers falls following code-sharing, the fares for spoketo-hub passengers can rise and as a consequence, total welfare can be reduced by code-sharing activities • Armantier and Richard (2006, 2008) empirically found that code-share agreements between Continental and Northwest reduced average prices for interline passengers but increased average price paid for non-stop flights Parallel routes • Alliance, by reducing competition, is likely to raise fares in “parallel” markets • Brueckner’s (2001) simulation analysis indicates that both consumer and total surplus typically rise following formation of an alliance despite harm to inter-hub passengers • Adler and Hanany (2010) consider not only airfares but also schedule delays, showing competitive code-share agreements increase, in all cases, welfare relative to the competitive outcome when there are business passengers with a high time valuation relative to leisure passengers Carve outs • A “carve out” is a type of regulation that prohibits cooperation of alliance partners in hub-to-hub market while allowing cooperation elsewhere • Brueckner and Proost (2010) use a network structure similar to Figure 2: A carve-out imposed on non-JV alliances always improves welfare. For the JV case, however, the net effect is in general ambiguous, since although carve-out mitigates anti-competitiveness in hub-to-hub market, it also restricts cost synergy that can arise in this market Route choices • Researchers typically assume that passengers travel as long as possible with their home carrier irrespective of airfares • By contrast, Czerny et al. (2012) elaborate on a symmetric environment where the route choices depend on airfares and show that a symmetric solution does not exist when economies of traffic density exist Route choices • To illustrate Czerny et al. (2012), assume airline 1 charges for the AH-connection and for the AK-connection, while airline 2 charges for the KD-connection and for the HDconnection • If route choices depend on fares and airline services are perfect substitutes on the hub-to-hub part, a symmetric demand equilibrium can only exist if • the carriers’ profit margins must be the same for both routes in a symmetric equilibrium, i.e., and • Carrier 2 could reduce by a small amount. All passengers would then travel the long distance with carrier 2, which increases margins due to economies of traffic density and profit. There is no symmetric equilibrium in this scenario for this reason Figure 2: Network structure (Brueckner 2001) 4.3 Rivalry between alliances • Alliance rivalry has been analyzed in Zhang and Zhang (2006a) with a simple four-firm, four-product model. • The inverse demand function is pi = pi ( q1 , q2 , q3 , q4 ) with p (Q ) > 0, p (Q ) > 0, p (Q ) > 0, p (Q ) > 0 , indicating demand complementarity between goods 1 and 2 (3 and 4). • Firms 1 and 2 contemplate to form a (potential) alliance, with 3 and 4 forming the other pair (see Figure 3). Alliance behavior is modeled as: 1 2 2 1 3 4 4 3 Max π 1 + απ 2 ≡ Max π 12 (Q;α ) q1 q1 Max π 2 + απ 1 ≡ Max π 21 (Q;α ) q2 q2 with α being the degree of cooperation between Firm 1 and Firm 2 ( β for Firm 3 and Firm 4). Figure 3: Competition between two alliances (Zhang and Zhang 2006a) • It can be shown that: φα1 + φα2 = (1 − α )(π 12 qα1 + π 21qα2 ) + [(π 31 + π 32 ) qα3 + (π 41 + π 42 ) qα4 ] (9) with φ i denoting firm i’s profit in the first stage. • Expression (9) shows that the effect of a change in α on profit can be split into two parts: i) a direct effect of the shift on the alliance pair’s profit (first term), and ii) an indirect effect of the shift in the marginal profits which in turn changes the equilibrium (second, bracketed term), both of which are positive. • The indirect effect is unique to competing alliances – it works by indirectly influencing the behavior of the rival firms (which in turn improves own profits) and so may be referred to as the “strategic effect” of alliance. • Zhang and Zhang’s (2006a) analysis therefore suggests that an alliance may confer a strategic advantage by allowing the partners to credibly commit to greater output levels, owing to both within-alliance complementarities and cross-alliance substitutabilities • Rivalry between different alliances tends to improve welfare because it would, owing to the strategic effect, result in greater output levels than would be found in the absence of the rivalry 4.4 Main insights • Cooperative pricing can reduce airfares and increase welfare in interline markets • Alliances may lead to collusion on potentially competitive parts of the networks, but carve-outs can be a useful measure • Seat swaps can improve welfare even on parallel routes when frequencies and passenger types are incorporated • Welfare effects of cooperative pricing can depend on the passengers’ route choices, and abstracting away from route choices may underestimate social benefits of airline alliances • Theoretical and empirical results that cooperative pricing can increase airfares for non-interline passengers • Account for the interaction between rival alliances 5. Concluding Remarks 5.1 What we have learned • Carriers may internalize self-imposed congestion at a congested airport, and the incentive for selfinternalization depends crucially on existence of a competitive fringe • Slots may reach welfare maximum without an extra burden on small carriers, and airport revenues can be higher with slots, contributing to airport cost recovery • There may be a discrepancy between the welfareoptimal and private airport behaviors; price-cap regulation may be preferred to rate-of-return regulation • When airport concession revenues exist, there might be little welfare gains from regulation • Single-till should be used if there is plenty of capacity, while dual-till may be appropriate at congested airports • Cooperative airline pricing can increase welfare in interline markets • Seat swaps can improve welfare even on hub-to-hub routes when passenger types with distinct time valuations exist • Carve-outs may be used to resolve collusive pricing behavior on these markets • If route choices are endogenously determined by airfares, the positive welfare effects of alliances can be further increased • Cooperative pricing can increase airfares for non-interline passengers and reduce the social benefits of alliances • It is important that the social evaluation of airline alliances incorporate the interactions between rival alliances 5.2 Avenues for future research • Interactions between 5 elements: (i) carrier market power and structure (ii) network complementarities (iii) schedule delays (iv) passenger types (v) third-degree airline price discrimination • “Land value capture” mechanisms through which internalization of the positive externalities could be realized • Variations of social objective function to derive results that better match real-world policy problems • Consider “countervailing power” of dominant carriers over airports • Influence of airports on airline performance?