e00093 Coca Cola 10

advertisement

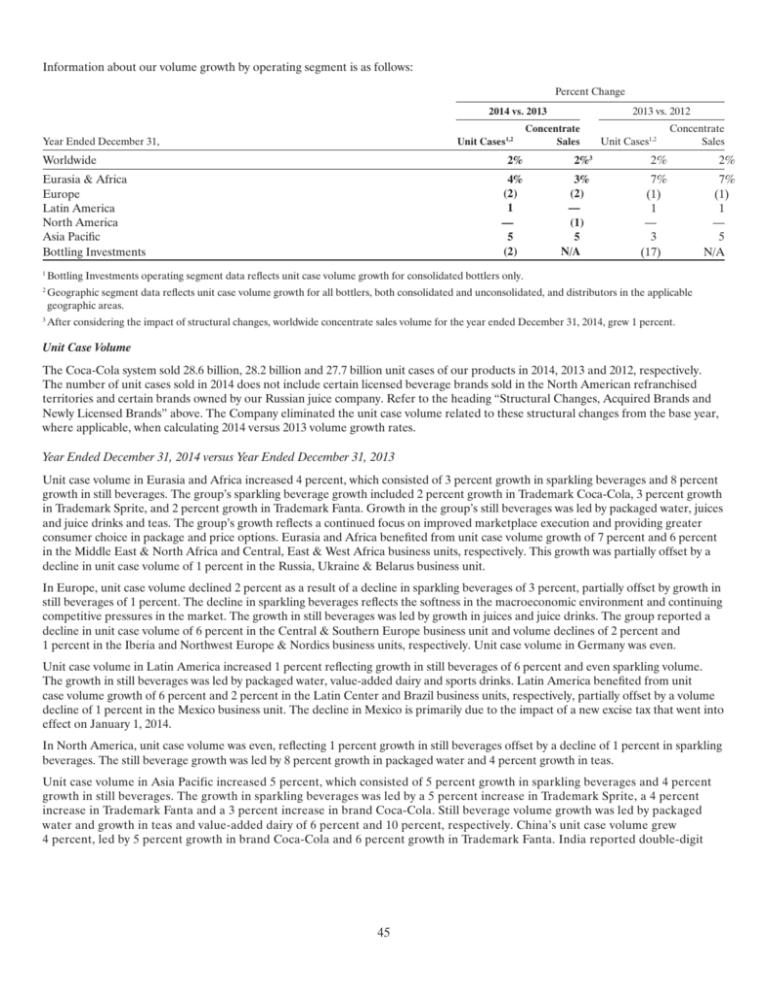

Information about our volume growth by operating segment is as follows: Percent Change 2013 vs. 2012 2014 vs. 2013 Year Ended December 31, Unit Cases1,2 Worldwide Eurasia & Africa Europe Latin America North America Asia Pacific Bottling Investments 1 Concentrate Sales Unit Cases1,2 Concentrate Sales 2% 2%3 2% 2% 4% (2) 1 — 5 (2) 3% (2) — (1) 5 N/A 7% (1) 1 — 3 (17) 7% (1) 1 — 5 N/A Bottling Investments operating segment data reflects unit case volume growth for consolidated bottlers only. Geographic segment data reflects unit case volume growth for all bottlers, both consolidated and unconsolidated, and distributors in the applicable geographic areas. 2 3 After considering the impact of structural changes, worldwide concentrate sales volume for the year ended December 31, 2014, grew 1 percent. Unit Case Volume The Coca-Cola system sold 28.6 billion, 28.2 billion and 27.7 billion unit cases of our products in 2014, 2013 and 2012, respectively. The number of unit cases sold in 2014 does not include certain licensed beverage brands sold in the North American refranchised territories and certain brands owned by our Russian juice company. Refer to the heading “Structural Changes, Acquired Brands and Newly Licensed Brands” above. The Company eliminated the unit case volume related to these structural changes from the base year, where applicable, when calculating 2014 versus 2013 volume growth rates. Year Ended December 31, 2014 versus Year Ended December 31, 2013 Unit case volume in Eurasia and Africa increased 4 percent, which consisted of 3 percent growth in sparkling beverages and 8 percent growth in still beverages. The group’s sparkling beverage growth included 2 percent growth in Trademark Coca-Cola, 3 percent growth in Trademark Sprite, and 2 percent growth in Trademark Fanta. Growth in the group’s still beverages was led by packaged water, juices and juice drinks and teas. The group’s growth reflects a continued focus on improved marketplace execution and providing greater consumer choice in package and price options. Eurasia and Africa benefited from unit case volume growth of 7 percent and 6 percent in the Middle East & North Africa and Central, East & West Africa business units, respectively. This growth was partially offset by a decline in unit case volume of 1 percent in the Russia, Ukraine & Belarus business unit. In Europe, unit case volume declined 2 percent as a result of a decline in sparkling beverages of 3 percent, partially offset by growth in still beverages of 1 percent. The decline in sparkling beverages reflects the softness in the macroeconomic environment and continuing competitive pressures in the market. The growth in still beverages was led by growth in juices and juice drinks. The group reported a decline in unit case volume of 6 percent in the Central & Southern Europe business unit and volume declines of 2 percent and 1 percent in the Iberia and Northwest Europe & Nordics business units, respectively. Unit case volume in Germany was even. Unit case volume in Latin America increased 1 percent reflecting growth in still beverages of 6 percent and even sparkling volume. The growth in still beverages was led by packaged water, value-added dairy and sports drinks. Latin America benefited from unit case volume growth of 6 percent and 2 percent in the Latin Center and Brazil business units, respectively, partially offset by a volume decline of 1 percent in the Mexico business unit. The decline in Mexico is primarily due to the impact of a new excise tax that went into effect on January 1, 2014. In North America, unit case volume was even, reflecting 1 percent growth in still beverages offset by a decline of 1 percent in sparkling beverages. The still beverage growth was led by 8 percent growth in packaged water and 4 percent growth in teas. Unit case volume in Asia Pacific increased 5 percent, which consisted of 5 percent growth in sparkling beverages and 4 percent growth in still beverages. The growth in sparkling beverages was led by a 5 percent increase in Trademark Sprite, a 4 percent increase in Trademark Fanta and a 3 percent increase in brand Coca-Cola. Still beverage volume growth was led by packaged water and growth in teas and value-added dairy of 6 percent and 10 percent, respectively. China’s unit case volume grew 4 percent, led by 5 percent growth in brand Coca-Cola and 6 percent growth in Trademark Fanta. India reported double-digit 45