ECCO Sko A/S - StudentTheses@CBS

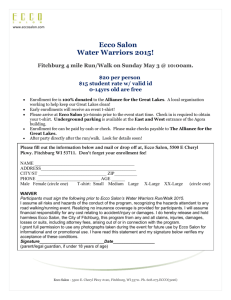

advertisement