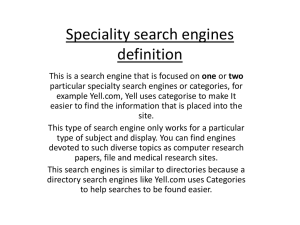

Competition in the web search market

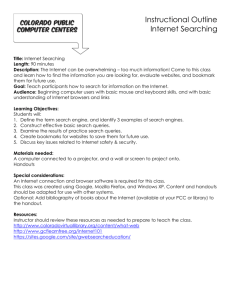

advertisement