JDA Software - Henley & Company, LLC

advertisement

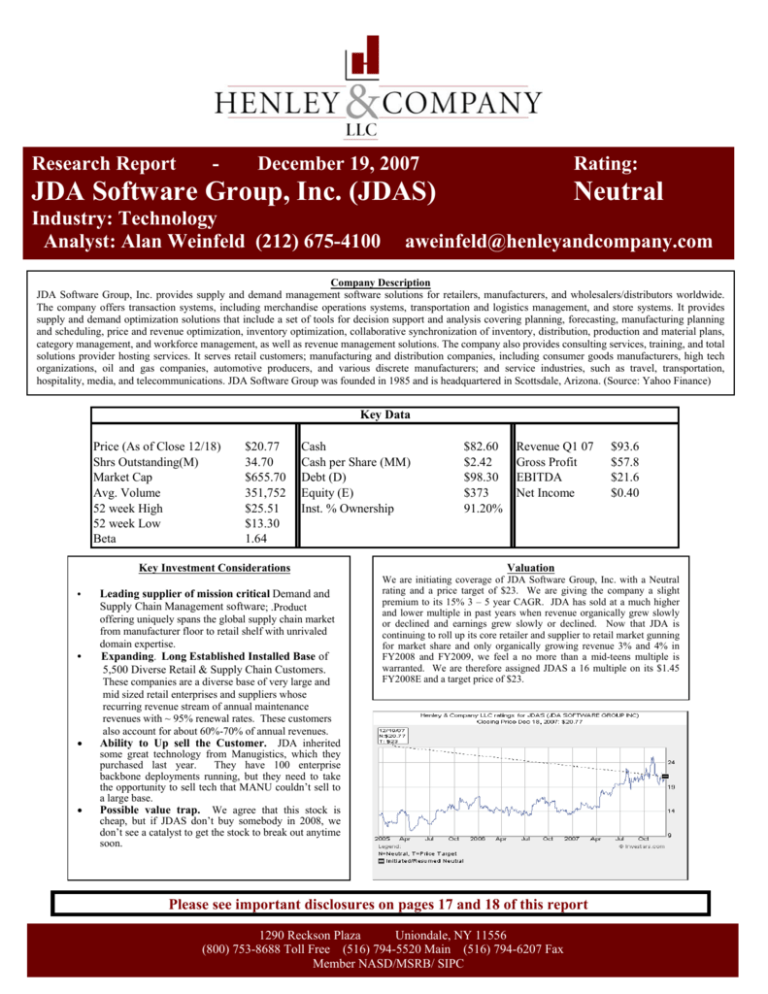

Research Report - December 19, 2007 Rating: JDA Software Group, Inc. (JDAS) Industry: Technology Analyst: Alan Weinfeld (212) 675-4100 Neutral aweinfeld@henleyandcompany.com Company Description JDA Software Group, Inc. provides supply and demand management software solutions for retailers, manufacturers, and wholesalers/distributors worldwide. The company offers transaction systems, including merchandise operations systems, transportation and logistics management, and store systems. It provides supply and demand optimization solutions that include a set of tools for decision support and analysis covering planning, forecasting, manufacturing planning and scheduling, price and revenue optimization, inventory optimization, collaborative synchronization of inventory, distribution, production and material plans, category management, and workforce management, as well as revenue management solutions. The company also provides consulting services, training, and total solutions provider hosting services. It serves retail customers; manufacturing and distribution companies, including consumer goods manufacturers, high tech organizations, oil and gas companies, automotive producers, and various discrete manufacturers; and service industries, such as travel, transportation, hospitality, media, and telecommunications. JDA Software Group was founded in 1985 and is headquartered in Scottsdale, Arizona. (Source: Yahoo Finance) Key Data Price (As of Close 12/18) Shrs Outstanding(M) Market Cap Avg. Volume 52 week High 52 week Low Beta $20.77 34.70 $655.70 351,752 $25.51 $13.30 1.64 Cash Cash per Share (MM) Debt (D) Equity (E) Inst. % Ownership Key Investment Considerations • • Leading supplier of mission critical Demand and Supply Chain Management software; .Product offering uniquely spans the global supply chain market from manufacturer floor to retail shelf with unrivaled domain expertise. Expanding. Long Established Installed Base of 5,500 Diverse Retail & Supply Chain Customers. • • These companies are a diverse base of very large and mid sized retail enterprises and suppliers whose recurring revenue stream of annual maintenance revenues with ~ 95% renewal rates. These customers also account for about 60%-70% of annual revenues. Ability to Up sell the Customer. JDA inherited some great technology from Manugistics, which they purchased last year. They have 100 enterprise backbone deployments running, but they need to take the opportunity to sell tech that MANU couldn’t sell to a large base. Possible value trap. We agree that this stock is cheap, but if JDAS don’t buy somebody in 2008, we don’t see a catalyst to get the stock to break out anytime soon. $82.60 $2.42 $98.30 $373 91.20% Revenue Q1 07 Gross Profit EBITDA Net Income $93.6 $57.8 $21.6 $0.40 Valuation We are initiating coverage of JDA Software Group, Inc. with a Neutral rating and a price target of $23. We are giving the company a slight premium to its 15% 3 – 5 year CAGR. JDA has sold at a much higher and lower multiple in past years when revenue organically grew slowly or declined and earnings grew slowly or declined. Now that JDA is continuing to roll up its core retailer and supplier to retail market gunning for market share and only organically growing revenue 3% and 4% in FY2008 and FY2009, we feel a no more than a mid-teens multiple is warranted. We are therefore assigned JDAS a 16 multiple on its $1.45 FY2008E and a target price of $23. Please see important disclosures on pages 17 and 18 of this report 1290 Reckson Plaza Uniondale, NY 11556 (800) 753-8688 Toll Free (516) 794-5520 Main (516) 794-6207 Fax Member NASD/MSRB/ SIPC Business Description JDA Software Group, Inc. is the global leader in helping more than 5,500 retail, manufacturing and wholesale-distribution customers in 60 countries realize real demand chain results. By capitalizing on its industry position and financial strength, JDA commits significant resources to advancing the JDA Solutions suite of vertically-focused supply and demand chain solutions. JDA Solutions enable high-performance business process optimization and execution to achieve a connected view of the customer from raw materials flowing into production to end-consumer products at the shelf. With offices in major cities around the world, JDA employs the industry’s most experienced supply and demand chain experts to develop, deliver and support its solutions. JDA Software is a global leader in providing integrated software and professional services that address real-world issues to help multi-channel retailers and consumer product goods companies (CPG) manage their mission-critical operations. In a more difficult applications software environment, a vertical focus in an industry with growing software spending is very favorable. JDA’s global Consulting Services Group (CSG) is one of the largest and most experienced demand chain consultancies in the world. CSG is also uniquely positioned to deliver comprehensive services across all areas of the value chain. From manufacturing all the way to finished goods at the shelf edge, customers can leverage CSG to more effectively run business and maximize bottom lines. When licensing a JDA solution, CSG empowers customers to benefit from the industry’s lowest cost implementation in time frames that support customers’ immediate gains. Certified on the latest JDA releases, JDA’s consultants apply proven methodologies that consistently result in projects completed on-time and on budget. We also work with third-party business alliances, consulting firms and system integrators. JDA's consulting, client support and maintenance services are very strong and will contribute close to 81% of JDA's revenue in 2007. JDA also partners with system integrators, but it is able to keep costs low with its own in-house design, planning, implementation, training and maintenance services. This in-depth knowledge has made JDA a strategic choice for many companies worldwide and allowed it to integrate its solutions into some other vendors' products to capture market share. Best of Breed Versus Integrated Suite? JDA Software Satisfies Both. Retail IT commitment is growing as a one-stop shop for packaged software is now available through inside divisions of large companies and JDA Software. In our opinion, other enterprise and applications software companies do not have truly effective merchandising modules (the ERP system for retail). Large retailers, most of Oracle's client base and the target clients that JDA has been attempting to reach, have difficult scalability challenges, due to the number of SKU/store combinations. Retailers Are Finally Spending On Software. Why Now? Over the past five years, retailers have undergone a sea change in their thinking regarding technology in general, and software in particular. We estimate that in the 1980s and 1990s, retailers invested approximately 1% of revenue on information technology. Companies focused their capital expenditure budgets instead on new square footage to drive growth. This is changing. According to AMR Research and the National Retail Federation, retail IT budgets rose to high single digits in the last few years, which was double the increase experienced in the beginning of the decade. Forrester also said that in retail, companies that raised their IT budgets in 2005 did so by an average of approximately 20%, versus the 12% they are predicted for the rest of the economy. Forrester believes that 38% of this increase in retailer IT budgets went toward new spending initiatives such as application software. In particular, we believe retailer technology dollars are being spent on software tools that facilitate multi-channel customer relationships, Java Point of sale systems, strategic merchandising and inventory and supply chain management. Survey of Dozens of Large Retailers: Packaged Software Is a Budgetary Priority. In the time since we have been following JDA we have surveyed dozens of large and small customers of JDA Software and have walked through stores outfitted with JDA software to see their products working over time. Results suggest that corporations are shifting their budgetary priority to improved inventory turnover, Point-of-Sale Systems and automated replenishment. The majority of retailers are running legacy systems, which were mostly internally built and which are over 10-15 years old. For the average retailer today, 50% of the software developers' efforts go toward maintaining existing applications, not building the tools of the future. Scalability and integration are very difficult with the current retail IT architecture. We believe there is a major shift under way in the retail technology landscape toward packaged applications software, and away from home-grown systems. Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 2 of 18 Top-50 Retailers Are Moving Toward Packaged Software. The penetration of packaged software into the top-50 retailers (by revenue) is currently 80% and we estimate that 100% of the top-50 retailers will purchase some modules, if not the entire footprint, by 2010 (see Top-50 table). To be fair, some of the top 50 like Starbucks, or McDonalds, are probably using POS (Point of Sale) systems which may be sold by an array of vendors like Micros. ROI Driving Push Toward Retail Applications Software Due to Extremely "Overstored" Nature of the Retail Industry. The extremely over stored retail industry has refocused on ROI, maximizing the assets they already possess. In the U.S., there are more than 20-retail-square-feet per capita, versus 5-square-feet per capita in 1970. If we examine retailers Abercrombie & Fitch, Ann Taylor, Bebe and The Gap this group's square footage grew at an annual growth rate of more than 20% from 1994 to 2003. This group's productivity (sales per square foot) fell an average of approximately 18% from 1999 to 2003, and profitability (operating margins) fell an average of 500 to 700 basis points from 1999 to 2003 as the economy reverted to a more normal 3% growth rate. This combination is driving retailers to find software solutions that help them maximize sales per square foot. The favored retail IT solution is a one-stop shop for packaged software. Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 3 of 18 Top 50 Domestic Retailers Moving to Packaged Software ($ Billions) Retailer 2006 Revenue Software Vendor Softlines Wal-Mart Home Depot Kroger Costco Target Sears Holdings Walgreen Lowe's CVS Safeway Best Buy SuperValu Federated Department Store Ahold USA Publix Supermarkets McDonald's JC Penney Staples Rite Aid TJX Companies Delhaize America Gap Kohl's Office Depot 7-Eleven Toys'R'Us Meijer H.E. Butt Grocery Circuit City Pilot Travel Centers Jean Coutu Group Amazon.com Limited 348.7 90.8 66.1 60.2 59.5 53.0 47.4 46.9 43.8 40.8 35.9 28.0 27.0 24.0 21.7 21.6 19.9 18.2 17.5 17.4 17.3 15.9 15.5 15.0 15.0 13.1 12.8 12.8 12.4 11.8 11.1 10.7 10.7 Retek for .com, i2, MANU, JDA Portfolio Space Mgmt & Intellect, MANH Logistics.com Retek for Data Warehouse & Store Operations, i2, JDA Portfolio Space Management Retek Supply Chain, i2, JDA Intactix & PMM for Fred Meyer undetermined i2, JDA Portfolio Space Management, Intellect & Neovista, MANH Warehouse Mgmt JDA Portfolio Space Mgmt, Win/DSS, Arthur, MDS Outlook, Pinpoint & SMM, Replenishment, Retek for Canada, i2 for UK, Retek, JDA Portfolio Intellect, MANH i2, JDA Portfolio MDS Outlook and Pinpoint & JDA MMS for Eagle Retek, i2, JDA Portfolio Collaboration, E3Trim, Pinpoint & MDS Outlook i2, JDAS, MANH Retek XI, i2 Trans. Mgmt, JDA Portfolio Arthur, Replenishment and Space Mgmt, DSGX, ARBA Retek, JDA Portfolio Space Mgmt & Replenishment for Bigg's, MANH Retek Merchandising, i2, JDA Portfolio Arthur, Merchandising, Win/DSS, Retail IDEAS for Liberty House, MANH JDA Portfolio Replenishment, Intactix, E3 also in Europe, MANH i2 undetermined Retek, i2, Eckerd is using JDA Portfolio Replenishment Optimization & MANH MANU, JDA Portfolio Merchandising, Arthur, Replenishment & Allocation, MANH for online MANU, JDA Portfolio Collaboration, E3, Intactix, MDS Outlook And Pinpoint i2, JDAS i2, JDA Portfolio for Hannaford Division Retek XI, JDA Arthur Retek, i2, JDA Portfolio Arthur, Replenishment, MDS Outlook and Pinpoint Retek Merchandising, JDA Portfolio Merchandising, Space Mgmt, Win/DSS for international stores, MANH Retek Logistics (warehouse mgmt system), JDA Portfolio Intactix, Prosort, Profusion, Prospace i2, Retek Demand Planning, Babies 'R'Us - JDA Portfolio Space Mgmt, MANH JDA Portfolio Arthur, Intactix, Intellect, Merchandising JDA Portfolio Merchandising, Intactix, Intellect, Arthur Planning, Allocation, MANH JDAS undetermined undetermined undetermined Retek DMS, i2, MANU, JDA Portfolio Planning, Assortment, Allocation, Retail IDEAS, JDA TPS at Aura Science, Merchandising for Bath & Body Works, Replenishment for IBI, MANH Alimentation Couche-Tard Yum! Brands Dollar General OfficeMax Army Air Force Exchange Nordstrom BJ's Wholesale Club Dillard's Starbucks Winn-Dixie QVC A&P Bed, Bath & Beyond Menard Family Dollar Giant Eagle The Pantry Total 10.2 9.6 9.2 9.0 8.9 8.6 8.5 7.8 7.8 7.2 7.1 6.9 6.6 6.6 6.4 6.1 6.0 undetermined MICROS JDA PMM, Arthur, Intactix, Intellect, MANH JDA Portfolio Space Mgmt, Assortment, Merchandising for International, Retek Retek, MANH for department stores and direct business JDA Portfolio Replenishment, MDS Outlook! And Pinpoint!, MANH i2 undetermined i2, Retek, JDAS undetermined Retek, JDAS JDAS, MANH undetermined Retek MANH & JDAS undetermined $1,394.7 Source: Henley & Company, National Retail Federation and JDA Software Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 4 of 18 Industry Competition Source: JDA Software Product-Market Principal Competitors Retail Enterprise Systems AC Nielsen Corporation, Aldata Solutions, Alphameric PLC, Connect3 Systems, Inc., Island Pacific, Inc., Micro Strategies Incorporated, Lawson Software, NSB Retail Systems PLC, Oracle and SAP AG. CRS Business Computers, Kronos Incorporated, MICROS Systems, Inc., Radiant Systems, Inc., Tomax Technologies, Workbrain, Inc. Workplace Systems International, NSB Retail Systems PLC, and SAP AG (Campbell Software Division). AC Nielsen Corporation, i2 Technologies, Information Resources, Inc., and Synchra Systems. IBM Global Services, Cap Gemini, Ernst & Young, Kurt Salmon Associates and Lakewest Consulting. In-Store Systems Collaborative Systems Consulting Services As you can see, JDA has plenty of competitors, but with the Manugistics acquisition they broaden their footprint and can do many more services for the same customer. They certainly lose point solutions like in-store systems to Micros or large back office deal to Lawson Software, JDA wins their fair share in their sweet spot, which is medium to large retail and consumer goods enterprise application software with a consulting tail for a good year. EO Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 5 of 18 Products and Solutions • Supply & Demand Optimization o Enterprise Planning o Space & Category Management o JDA Enterprise Planning – A workflow-driven planning solution that helps in the synchronization process of all planning metrics, including sales, margins or turns, across functional organizations and reconciles them up and down the enterprise hierarchies. This single, integrated solution for financial, merchandise, channel and key item planning enables rapid response to changing market conditions and supports and optimizes the financial and operational planning activities in the value chain. JDA Allocation- To be discussed in detail below. JDA Enterprise Knowledge Base- Provides an infrastructure for Enterprise Planning that is powered by Arthur®. It stores business entity relationships including store groups, assortment time periods and assortments. It is completely scalable to Tier 1 retailer volumes and provides the capability for assortment planners to adjust their plans to reflect changing store sales trends while maintaining original store group targets while integrating Enterprise Planning suite with other JDA applications. JDA Size Scaling- To be discussed in detail below. JDA Clustering- To be discussed in detail below. Efficient Item Assortment by Intactix- A strategic knowledge-delivery solution that follows the industry’s best practice EIA procedure to streamline the analysis and decision making process inherent to category management. Categorized by a number of key capabilities: Assortment implementation based on consumer demand data, master assortment lists generated at the push of a button, assortment decision management by exception, recommendation review enabling final decisions on adds, deletes and retains. Space Planning by Intactix- The most widely used planogram tool which streamlines execution of top-level category plans. Space Planning enables multiple planograms to be managed simultaneously, improving consistency and accuracy as products are quickly and easily added, replaced or updated across the entire planogram set. It supports optimization and analyzing of planograms against any metric (i.e., balance space to sales and/or days of supply). Floor Planning by Intactix- Floor Planning maintains store floor plan accuracy as well as increases store productivity. Create and maintain precise store-specific floor plans that enable the maximization of positions, performances and layouts of product categories on new and existing store floors – right from a computer desktop. This solution also allows the user to perform cross-category and cross-floor plan analyses to instantly compare the layouts of its best and worst performing stores, which is critical to maximizing selling space effectiveness. Shelf Assortment by Intactix- Shelf Assortment supports analysis of assortment-to-space metrics, enforces inventory modeling and merchandising rules, and executes assortment decisions with available space. JDA Channel Clustering- Replaces inefficient and traditional store clustering methods with a scientific approach that proves intelligent, predictive, and descriptive data mining algorithms. It groups stores based on consumer purchasing behavior, refines and improves clustering results, correlates census data, enables tailored assortments, and supports cluster-specific marketing strategies. Price & Promotion Management JDA Trade Event Management for Retail- Optimizes pricing and promotions planning and execution to generate maximum sales and margin dollars. Price and Promotion Management improves financial predictability and utilization of promotional dollars at all levels, optimizes the pricing of promotions, and generated maximum value from excess inventory. VistaCPG- VistaCPG is a fully integrated, web-based business application that was developed by consumer goods industry experts for the consumer goods industry. VistaCPG provides a closed loop solution that supports more efficient and effective promotions, resulting in increased profitability. Providing real-time visibility of performance to budget by account/market, VistaCPG enables you to improve service levels, increase sales and avoid overspend. Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 6 of 18 o Demand o JDA Advertising- Enables the production of targeted promotions that drive profitability and category sales. This closed loop application allows for the strategic management of all promotions processes including offer determination, ad production and ROI measurement. JDA Promotions Management- Creates promotional what-if scenarios, establishes promotional price at any level of the product hierarchy, evaluates promotional prices at the level of the product/location hierarchy at which they were established for availability to price management systems. JDA Markdown Optimization- Powered by Manugistics®, provides complete markdown event profiles, time-phased price adjustments, multi-dimensional planning framework, and forecasted spend, revenue and gross margin. JDA Promotions Optimization- JDA Promotions Optimization (Promotions) identifies optimal promotional campaigns, so that retailers can shape demand and achieve their merchandising goals and objectives. The solution employs advanced statistical methods to predict the results of a promotion at various levels of segmentation, such as store or channel. It provides real-time, consumer driven promotion simulation, scenario analysis, and calculation of halo and cannibalization effects both within and across categories. JDA Shelf Price Optimization- JDA Shelf Price Optimization establishes optimal shelf prices by customer and market segment, considering a variety of factors such as corporate pricing strategy, volume and margin goals, competitive influences, varying customer responses to prices and other causal factors. JDA Shelf Price Optimization provides the intelligence and discipline to help retailers to better understand customers, better predict demand, and establish base prices that influence demand in effort to achieve business objectives. JDA Demand- JDA’s Demand solutions leverage multiple forecasting algorithms and methodologies to drive forecast improvement across all types of products – fast- and slow-moving, lumpy, short life cycle, trending, steady, highly seasonal, casual driven – across the Customer-Driven Value Chain. JDA Seasonal Profiling- Uses pattern analysis to identify and assign persistent seasonality at product location and location level. Season Profiling also provides exception management for effective profiling of outlier cases, and automation takes care of the other 95+ percent. JDA Seasonal Profiling produces profiles at low levels of the product hierarchy, on a location-by-location basis and with indications of individual location/product time curves. JDA Demand Decomposition- Provides users with a deeper understanding of demand history as well as promotional impact and activity. It utilizes a collection of advances statistical algorithms that segment exogenous factors from base demand history, and defines a better baseline forecast. Allocation & Replenishment JDA Allocation- JDA Allocation enhances and translates customer knowledge into pinpointed allocations. With JDA Allocation, optimization of store-specific product assortments across entire retail organizations is possible. Including a full range of allocation techniques, all details are allocated properly and efficiently. Advanced Warehouse Replenishment by E3- Determines how often to buy from vendors for maximized profits, optimizes the order cycle that will maximize profitability, all while considering costs, service level goals, forecasts, bracket discounts, and purchase and selling price. Advanced Warehouse Replenishment is used in hundreds of companies in a wide variety of industries, ranging from food and drug to fashion, hardware and auto parts, and eliminates the time-consuming, laborintensive manual processes of vendor to distribution management and replenishment. Advanced Store Replenishment by E3- Proactively manages promotional profiles, focuses on profitable inventory buying strategies, builds profitable orders, and enhances inventory management productivity. It’s a true inventory management solution involving scientific and statistical evaluations of each of the numerous variables involved in making a buying decision. Vendor Managed Replenishment by E3- From communications, negotiations and other key elements of Collaborative Planning, Forecasting and Replenishment (CPFR), VMR enables vendors to execute forecasting and replenishment based on a retailer’s point-of-sale data, while building optimum orders for distribution centers (DCs) and stores. Vendor Managed Replenishment presents the information needed by retail analysts so that they can take advantage of the best offers, manage exceptions, monitor promotions and perform additional buying and merchandising services for their customers. Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 7 of 18 o JDA Fulfillment- Offers multi-level replenishment planning, a large-scale processing engine, finished good allocation flexibility, date-sensitive inventory management, forecast consumption, purchase optimization and forward buying capabilities, and dynamic deployment. JDA Dynamic Demand Response- An intelligent, highly scalable short-term forecasting solution that introduces science into the process of allocating, consuming and adjusting short-term forecasts. It transforms the time-consuming task of monitoring known demand signals into an automated, efficient process. JDA Size Scaling- By rapidly reviewing a massive input of POS data, Size Scaling will determine a best-fit size template for ordering, allocation and replenishment by style, class or department. Features include: store-size level size demand history used to determine size scales by product by location, pre-pack optimization to select optimal size/color packs, and provides optimal packs generated for each size grouping and distribution error is calculated. Supply & Manufacturing Management JDA Master Planning- JDA Master Planning helps companies determine the best time and place to make the product to meet consumer demand. The solution allows consumer goods firms to manage production across multiple sites efficiently in response to changing consumer demand. It offers multi-level capacity planning, the ability to constrain simultaneously on material and capacity, and the ability to employ optimization. JDA Supply- JDA Supply enables manufacturing organizations to plan material and capacity needs in one system to create a production plan that minimizes cost and improves customer service. It begins with an initial manufacturing plan, and then reviews new and scheduled purchase, transfer or manufacturing requirements to determine new requirements. New material and manufacturing requirements are calculated, and the solution then performs a series of what-if simulations that balance the demand picture with available material and capacity to determine various constrained plans. JDA Sequencing- JDA Sequencing generates a synchronized, demand-driven manufacturing schedule that optimizes materials and resource capacities across each stage of the manufacturing process. As part of the process, Sequencing considers detailed capacity, product mix and labor constraints. It enables companies to create sequenced plans for all products while gaining visibility into assembly line constraints. Source: JDA Software o Network & Inventory Optimization JDA Inventory Policy Optimization- Helps companies determine safety stock levels at various locations in retail and distribution supply chains so as to achieve the user-specified fill rate or in- Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 8 of 18 o Collaboration • JDA Marketplace Replenish- Supporting full-scale Collaborative Planning, Forecasting and Replenishment (CPFR®) programs, Marketplace Replenish follows the VICS CPFR model steps 3-5 and 9. Allows users to create sales forecasts, identify sales forecast exceptions, collaborate on exception items and generate orders. It also helps improve the effectiveness of promotions and assortments by leveraging each business side’s knowledge. JDA Marketplace- JDA Marketplace is a network of private exchanges, and can be defined as a hybrid of the public and private marketplace models. JDA Marketplace connects trading partners to private marketplaces and provides content and community to the trading partners participating in the site. It enables trading partners to have visibility and interaction on a many-to-many basis. JDA Collaborate- JDA Collaborate offers robust, role-based access, so all collaborative stakeholders can view and adjust data designed just for their products, customers and geographies. Using tools such as flexible hierarchies and conversion factors, users can also create their own views to present the data exactly as they want to see it. Allows for flexible hierarchies for viewing data, multiple data versions and tracking, flexible user view creation, and joint business plan creation and monitoring. Transportation & Logistics Management o o o o o o o • stock targets. It provides individual and group level performance metrics, seamless integration with demand and replenishment planning, and also provides reverse safety stock capability. JDA Strategy- JDA Strategy is a comprehensive tool set designed to analyze the key factors associated with operating an end-to-end supply network, including costs, capacity and locations, and then optimize the network to help you achieve the lowest total landed cost and the highest possible profits. JDA Transportation Planning- JDA Transportation Planning is designed to manage, optimize and execute the strategic, operational and tactical business processes that support the global movement of goods. This solution integrates the many facets of today’s transportation and logistics departments, creating a webenabled command and control center for domestic and international business operations. JDA Logistics Sourcing - JDA Logistics Sourcing delivers an electronic method of distributing RFQs to logistics service providers. The solution gathers lane, price and capacity information and then awards bids to the optimal service providers. JDA Freight Order Management – A platform for collaborating with suppliers on activities related to inbound shipments. It provides visibility to the supply process and allows collaboration between vendor and shipments. JDA Freight Audit & Payment - JDA Freight Audit & Payment provides shippers with a means to effectively manage their freight audit processes in-house and provide opportunities to increase productivity, reduce freight expenses, and stay compliant with tight financial regulations. JDA Shipment Execution - JDA Shipment Execution creates a web connection through which a carrier can view the loads and bookings a shipper has tendered to them. Depending on the level of security access a shipper has configured, the carrier can respond to tender offers, set pickup and delivery appointments, communicate shipment status information and submit freight invoices. This web connection between shippers and carriers can serve as an efficient alternative to fax, telephone or electronic data interchange (EDI) tendering methods. JDA Fleet Management – Uses constraint-based optimization to create detailed work plans that manage a private fleet based on shipment requirements. It plans and dispatches the fewest routes that cover the least number of miles in the shortest time, and enables more volume to be moved with no additional resources. JDA Logistics Event Management & Visibility – Optimizes and resolves global exceptions, generates automatic notification of business process exceptions, and has a real-time view of all trading network aspects. This full exception management and monitoring platform is also completely customizable. Store Systems o o JDA Point-of-Sale - A JAVA application that features component-based architecture and industry standard database and operating system choices that deliver extreme scalability and flexibility. It allows customers to make system-managed configuration changes or application upgrades on every register as frequently as needed, without affecting custom code, at a reduced cost. JDA Back-Office System – A Web Services back office solution that streamlines inventory movement and transaction management. J2EE compliant, BOS utilizes an industrial-strength application server that delivers Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 9 of 18 o o • Merchandise Operations o o • Portfolio Merchandise Management (PMM) - Ensures timely, accurate transaction information across your enterprise as the starting point for inventory optimization. Control every item on shelves by counting, costing, ordering, pricing, moving, valuing, and promoting them. Delivers broad functionality including inventory control and procurement; vendor, price, cost and promotion management; receiving, allocation and replenishment; financial management; and trading partner data synchronization. Merchandise Management System-I (MMS) – A reliable, streamlined implementation at the lowest cost of ownership. Features fully integrated merchandising, warehouse management and financial applications for multiple sales channels. Its closed-loop architecture gathers, integrates and distributes data throughout organizations to support the core inventory control, cost and price management, purchase order management, automated replenishment and allocation of products. Also including decision support capabilities to provide process tools to make more informed and timely decision, respond rapidly to changes in the competitive environment, monitor store-level activity and achieve operational efficiencies. Contract Manufacturing o o o • extreme scalability, flexibility and reliability when processing and posting transactions to internal and external systems. JDA Workforce Management – Features include forecasting POS data, scheduling advanced algorithms and combining projection and forecast data to determine the optimum schedule to meet traffic demands, time and attendance facilitating recording and tracing, and corporate reporting for analyzing labor operations. JDA Customer Relationship Management – Allows customers to gain greater visibility into its customer base at every point of sale so that they can better serve their individual needs and foster their long-term journey. JDA Maintenance, Repair & Overhaul- Provides the capabilities to meet the challenges of unique service environments. Powerful solutions that help intelligently and profitably plan and schedule maintenance programs, parts, materials, tools and manpower to meet the asset utilization, cost and customer service goals required by customers. Features such as statistical forecasting, inventory optimization and multi-site finite capacity scheduling help ensure your ability to optimally deploy spares, consumables and repair resources to meet the needs of both planned and unplanned activities. JDA Make-to-Order- Provides manufacturers with the information, planning tools and management controls needed to help maximize on-time customer delivery performance. Also applicable in engineer-to-order (ETO) and assemble-to-order (ATO) environments, MTO includes essential capabilities to help you streamline operations, improve efficiency, meet specific customer requirements and enhance profitability. JDA Procurement Management- JDA Procurement Management captures strategic agreements with suppliers that not only define the specifics of the relationship, but also ensure that each purchase order is created with the correct terms and conditions. Strategic agreements capture relationship information such as price breaks, lot charges and payment terms. Directly integrating these agreements into the purchasing process enables the organization to decrease maverick buying and improve contract compliance. Workflow tools automate the end-to-end procurement life cycle by creating custom business process flows that incorporate the right individuals, giving both internal and external partners greater visibility into transaction events. Performance Management o o o JDA Analysis & Discovery- JDA Analysis & Discovery delivers specialized analytical capabilities tailored to the business processes completed by JDA’s Supply & Demand Optimization solutions. Providing timely analytical capabilities as an integral part of business processes and assisting your users in reducing time to insight, JDA Analysis & Discovery facilitates decision making and provides managers and executives with visibility into the trends that can affect your company strategy. Information is united from across JDA Supply & Demand Optimization solutions in a variety of environments tailored to users needs and to the business process being completed. It supports knowledge workers through insight into performance indicators, unites data across Supply and Demand Optimization solutions, delivers actionable analysis through business processes, and enables collaborative analytics. JDA Reporting & Analytics- JDA Reporting & Analytics provides increased network and trading partner visibility, consolidating key data elements that enable you to monitor and measure your company and supply chain performance. Using a best practices approach, Reporting & Analytics works as a combined offering to embed critical monitoring and measuring capabilities across JDA Solutions. Performance Analysis by IDEAS- IDEAS is the only data warehouse designed specifically around the retail business model. It is a client/server data warehouse that is secure, scalable, and centralized. Since this Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 10 of 18 flexible solution can be easily customized, users will correctly believe that they have their own ’personalized’ decision and action support software right on their desktop. • Enterprise Architecture o o o JDA Enterprise Architecture- Coupled with JDA’s world-class solutions, JDA Enterprise Architecture synchronizes decisions based on “One View of Demand” that drive business innovation without sacrificing IT efficiency, supporting competition in today’s expanding global markets. Built to deliver deep, industryspecific functionality, JDA Enterprise Architecture enables rapid implementation, allows for interoperability with other IT assets and drives lower total cost of ownership. JDA’s grid technology enables companies to solve business challenges through parallel processing in any hardware configuration, even those that span hardware boundaries. JDA Integrator- JDA Integrator provides centralized visibility and management of integration processes, as well as tools to facilitate error management and resolution. JDA Integrator additionally provides an accelerated timeline to complete integration tasks for JDA Supply & Demand Optimization solutions using predefined integration solutions. JDA Monitor- Features include the identification and resolution of exceptions, user defined business rules and thresholds, and rule prioritization. It allows for the monitoring and managing of critical planning and event information. Source: JDA Software • Revenue Management o Airline Revenue Management- Airline Revenue Management helps airlines maximize revenue and profits by accurately forecasting future demand, optimizing price plans and optimally allocating capacity, based on passenger price sensitivity as a key driver. It runs frequent optimization of prices and controls based on pricesensitive demand, available capacity and airline business rules, and provide optimization of overbooking along with powerful reporting and data exploration capabilities. o Rail Revenue Management – Helps forecast passenger journey demand in order to set the optimal quota of seats available at the optimal fare. In other words, it allocates inventory so that availability for most valuable customers is ensured while avoiding empty seats of services for which sufficient demand exists. o Media Revenue Management – Media Revenue Management combines time series demand forecasting and optimization processes to equip pricing analysts with the ability to manage the monitoring and adjusting of pricing and products for thousands of future program air dates. The forecasts are dynamically updated with data from the latest program air dates to keep the forecasts synchronized with current trends. The benefits of this solution include reacting to spikes of demand to increase prices (or restrict availability) before sellout occurs or, alternatively, to highlight early in the booking cycle those program air dates for which additional sales emphasis is required to avoid last minute fire sales. o Hospitality Revenue Management – Hospitality Revenue Management enables hotel and hotel/gaming companies to more accurately forecast future demand and optimally allocate capacity according to customer Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 11 of 18 o o o value and length of stay patterns. It features top-line growth for enhanced profitability, optimal price allocation, accurate prediction of future demand dates, and determines what length of stay should be available to each market segment for every upcoming arrival date. Tour Revenue Management – JDA’s Tour Revenue Optimizer (TRO) offers sophisticated and advanced revenue management and pricing capabilities. It provides the opportunity to generate significant profit increases while improving customer service levels. Cargo Revenue Management – Routinely considers the complexities of decision processes including late bookings, shifting capacity and demand, competitor actions, variable and opportunity costs, market share objectives, and other conditions. Cruise Revenue Management – A powerful solution that offers comprehensive, sophisticated answers to the continuing challenge of cruise revenue management. With Cruise Revenue Management customers gain an exceptional ability to manage availability controls reservation systems to help maximize revenue from expected demand, continually fine-tune performance and monitor results. Evaluation Considerations Compelling reasons to “BUY” ¾ JDA Software Group, Inc. is the global leader in helping more than 5,500 retail, manufacturing and wholesaledistribution customers in 60 countries realize real demand chain results. ¾ Their recent takeover of Manugistics has improved profitability and improved their product offering and continued to show that JDA is good an execution with acquired best of breed products. ¾ JDA is finally offering real enterprise architecture to move their massive amount of IBM i-Series or AS/400 to the 21st century backbone of applications. ¾ The stock is incredibly cheap selling at its 15% long-term growth rate and 1.8 Enterprise Value (EV)/Sales. The Downside at JDA Software ¾ Software license lumpiness could continue to hamper organic growth, no matter how many acquisitions the company may make. ¾ We need to see the sustainability of higher margins as the company has realized most of the near-term cost synergies from the integration, the services utilization is still struggling. ¾ Retailers’ decision to continue spending on using their legacy systems and not upgrading. ¾ An extended and prolonged economic unpredicted downturn could negatively impact the general IT spending. Valuation We are initiating coverage of JDA Software Group, Inc. with a Neutral rating and a price target of $23. We are giving the company a slight premium to its 15% 3 – 5 year CAGR. JDA has sold at a much higher and lower multiple in past years when revenue organically grew slowly or declined and earnings grew slowly or declined. Now that JDA is continuing to roll up its core retailer and supplier to retail market gunning for market share and only organically growing revenue 3% and 4% in FY2008 and FY2009, we feel a no more than a mid-teens multiple is warranted. We are therefore assigned JDAS a 16 multiple on its $1.45 FY2008E and a target price of $23. Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 12 of 18 Henley and Company, LLC JDA Software Income Statement Mar 17.0 2007E Jun Sept 18.6 15.5 26.7 2.5 29.2 44.5 26.5 2.7 29.2 43.0 90.7 0.5 21.3 2.5 11.1 35.3 55.5 61.1% ($ in millions) 2008E Jun-E Sept-E 19.5 17.0 Dec-E 20.1 2006 49.0 Fiscal Years 2007E 2008E 69.7 74.3 2009E 77.6 28.2 3.0 31.2 46.4 25.4 3.2 28.6 47.1 90.1 9.1 99.2 129.2 112.7 11.0 123.7 176.2 108.6 11.6 120.2 184.4 114.1 11.9 126.0 190.0 95.9 0.7 20.0 2.8 11.7 35.2 60.7 63.3% 94.6 0.6 19.8 3.0 11.8 35.1 59.6 63.0% 95.8 0.9 18.7 3.2 12.0 34.8 61.0 63.7% 277.4 2.0 65.8 9.1 31.4 108.3 169.1 60.9% 369.5 2.7 82.4 10.8 46.3 142.2 227.2 61.5% 379.0 2.7 78.9 11.7 47.0 140.3 238.7 63.0% 393.6 2.8 80.5 11.9 49.3 144.6 249.1 63.3% 12.2 15.3 10.5 0.9 12.4 15.5 10.8 0.9 12.6 15.3 11.0 1.0 12.8 17.6 11.2 1.0 55.8 48.2 33.8 0.6 49.8 62.1 42.2 3.8 50.0 63.8 43.5 3.8 52.0 67.3 44.8 4.0 40.2 $19.5 38.1 $20.2 38.7 $23.0 38.8 $21.8 41.6 $20.4 137.8 $31.9 158.0 $69.2 161.0 $77.7 168.0 $81.1 23.1% 20.6% 21.8% 23.9% 23.0% 21.3% 11.5% 18.7% 20.5% 20.6% 4.2 4.0 1.9 5.2 4.0 1.9 4.0 4.0 1.9 3.2 4.0 1.9 4.2 4.0 1.9 5.2 4.0 1.9 9.6 9.6 16.5 15.9 16.5 15.9 16.5 16.0 Dec-E 18.5 Mar-E 17.7 31.5 2.9 34.4 43.8 28.0 2.9 30.9 45.0 27.2 2.6 29.8 45.1 27.8 2.8 30.6 45.8 90.8 0.7 20.3 2.7 11.7 35.5 55.3 60.9% 93.6 0.6 20.5 2.8 12.0 35.8 57.8 61.8% 94.4 0.9 20.4 2.9 11.6 35.8 58.6 62.1% 92.6 0.5 20.4 2.7 11.5 35.2 57.4 62.0% 13.8 14.8 10.6 0.9 12.0 15.1 10.6 0.9 11.9 14.9 10.4 1.0 12.1 17.3 10.8 1.0 Operating Expenses Operating Profit 39.2 $17.2 37.7 $18.5 37.2 $21.6 Operating Margin 19.0% 20.4% 4.0 4.0 1.9 3.2 4.0 1.9 Software Licenses Services Consulting Reimbursed Expenses Total Services Pure Maintenance Total Revenues Software Licenses Consulting Reimbursed Expenses Pure Maintenance Total Cost of Revenues Gross Profit Gross Margin R&D Sales & Marketing G&A Stock-based Comp Amortization of intangibles Restructuring and asset dispositio In-process R&D Net interest & other income ($2.8) ($2.4) ($1.8) ($1.5) ($1.3) ($1.0) ($0.7) $0.0 ($3.8) ($8.5) ($3.0) $2.5 Pretax Profit Pretax Margin $14.4 15.9% $16.2 17.8% $19.8 21.2% $18.0 19.0% $18.9 20.4% $22.0 22.9% $21.1 22.3% $20.4 21.3% $28.1 10.1% $60.8 16.4% $74.7 19.7% $83.6 21.2% Taxes/(Benefit) Tax Rate $5.0 24.9% $5.7 25.9% $6.2 24.2% $6.0 25.2% $5.7 30.0% $6.6 30.0% $6.3 30.0% $6.1 30.0% $9.9 35.1% $24.4 40.1% $24.7 27.2% $25.1 30.0% Net Income (Operating) $9.4 $10.5 $13.6 $12.0 $13.2 $15.4 $14.8 $14.3 $18.2 $36.4 $50.1 $58.5 Net Income (Reported) $7.5 $8.6 $11.8 $10.1 $11.3 $13.5 $12.9 $12.4 $8.7 $19.9 $33.6 $42.0 EPS (cash) $0.28 $0.31 $0.40 $0.34 $0.38 $0.45 $0.43 $0.41 $0.58 $1.33 $1.45 $1.65 EPS (reported) $0.22 $0.25 $0.34 $0.29 $0.33 $0.39 $0.37 $0.36 $0.27 $0.58 $0.97 $1.18 31.5 34.1 34.6 35.5 Diluted Shares 33.6 34.0 34.4 34.7 34.8 34.5 34.6 34.6 18.8% 29.5% 49.0% 38.9% 61.1% 97.3% 20.5% 19.0% 15.2% 16.3% 11.7% 20.5% 29.2% 47.3% 39.1% 60.9% 96.1% 23.2% 20.4% 13.2% 16.6% 11.6% 16.6% 33.6% 46.7% 38.2% 61.8% 95.9% 35.1% 23.1% 12.7% 15.9% 11.1% 19.6% 29.7% 47.6% 37.9% 62.1% 95.1% 27.3% 20.6% 12.8% 18.3% 11.4% 19.1% 29.3% 48.8% 38.0% 62.0% 96.9% 24.7% 21.8% 13.2% 16.6% 11.4% 20.3% 29.0% 47.7% 36.7% 63.3% 96.4% 28.2% 23.9% 12.9% 16.1% 11.3% 18.0% 29.8% 49.0% 37.0% 63.0% 96.8% 30.1% 23.0% 13.3% 16.2% 11.6% 21.0% 26.5% 49.2% 36.3% 63.7% 95.5% 26.4% 21.3% 13.4% 18.4% 11.6% 17.7% 32.5% 46.6% 39.1% 60.9% 95.9% 26.9% 11.5% 20.1% 17.4% 12.2% 18.9% 30.5% 47.7% 38.5% 61.5% 96.1% 26.9% 18.7% 13.5% 16.8% 11.4% 29.2% 33.7% 37.0% 37.0% 63.0% 96.9% 29.0% 12.8% 20.9% 18.2% 12.1% 29.2% 33.7% 37.0% 36.7% 63.3% 96.9% 29.0% 12.8% 20.9% 18.2% 12.1% 89.6% 99.5% 736.2% 328.2% 75.3% 85.3% 487.3% 217.2% 5.0% 6.5% 61.0% 99.4% 6.4% 2.6% 47.1% 69.9% 2.1% 3.4% 17.3% 35.9% 5.7% 9.8% 23.8% 44.6% 1.1% 3.0% 0.8% 7.7% 1.5% 4.1% 4.8% 19.8% 28.5% 593.2% 23.9% 606.5% 29.2% 1452.0% -9.0% 965.3% 2.6% 5.1% 12.3% 8.8% 3.9% 4.3% 4.3% 14.0% 2.3% -2.9% 29.9% 37.6% 0.0% -0.3% 7.9% 10.5% 3.2% 4.3% 25.8% 41.9% 0.8% 1.3% -10.0% -13.0% -1.9% -2.1% 3.6% 10.1% 3.6% 5.9% 13.9% 17.5% 2.2% 3.9% 8.0% 12.6% 1.2% 2.4% -6.4% -3.3% As a % of Revenues Software Licenses Consulting Maintenance Cost of Revenue Gross Margin Software Margin Consulting Margin Operating Margin R&D Sales & Marketing G&A Annual Change Total Revenues Gross Profit Operating Profit EPS Sequential Change Total Revenues Gross Profit Operating profit EPS Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 13 of 18 Henley and Company, LLC JDA Software Balance Sheet ($ in millions) 2005 Mar _______ ASSETS Current assets: Cash and equiv. A/R Prepaid and other Jun _______ Sept _______ Dec _______ Mar _______ 2006 Jun Sept _______ _______ Dec _______ Mar _______ 2007 Jun _______ Sept _______ $80.8 48.1 13.2 _______ $142.1 $93.9 40.3 15.2 _______ 149.3 $96.7 48.5 15.4 _______ 160.6 $111.5 42.4 13.7 _______ $167.6 $118.0 43.1 13.5 _______ $174.6 $130.8 36.9 15.9 _______ 183.7 $56.9 72.6 39.3 _______ 168.7 $53.6 79.5 33.7 _______ $166.8 $61.1 89.4 36.1 _______ $186.7 $65.4 76.5 16.8 18.6 $177.2 $178.6 $2.8 4.9 47.3 133.6 _______ $325.9 12.1 45.5 117.3 _______ $324.2 44.0 127.7 _______ $332.3 42.8 120.1 _______ $330.6 42.0 118.0 _______ $334.6 41.1 116.3 _______ $341.1 46.1 403.9 _______ $618.7 48.4 409.6 _______ $624.7 46.0 407.6 _______ $640.2 45.1 395.3 _______ $617.6 43.8 397.7 _______ $620.1 LIABILTIES and SHAREHOLDERS' EQUITY Current Liabilities: Accounts payable $4.0 Accrued liabilities 25.6 Other 34.0 _______ Total Cur. Liab. $63.6 3.1 18.6 30.8 _______ 52.5 1.8 19.2 34.6 _______ 55.7 $1.8 18.7 28.2 _______ $48.6 $1.8 16.2 32.9 _______ $50.9 1.5 19.1 34.3 _______ 54.9 $3.1 47.4 72.8 _______ 123.3 $4.8 47.2 73.7 _______ $125.7 $5.9 45.3 92.0 _______ $143.1 $5.1 45.4 90.2 _______ $140.7 $3.7 45.3 83.8 _______ $132.8 $139.8 17.1 12.0 _______ 168.8 $137.8 $20.9 $126.4 $23.5 $102.8 $16.7 _______ 158.7 _______ 149.8 _______ 119.5 $98.3 $12.8 $3.5 _______ 114.5 292.1 284.4 293.0 260.3 247.3 Tot. Cur. Assets Investments Deferred Expenses PPE Intangible assets, net Total Assets Non Current Liabilities: Long Term Debt, net Accrued Expenses noncurrent, net Other _______ _______ _______ _______ _______ _______ $63.6 52.5 55.7 $48.6 $50.9 54.9 Total NonCur. Liab Total Liabilities Temporary Equity Stockholders' equity Preferred stock Common stock Additional paid-in capital Deferred stock-based compensation Accumulated other comprehensive loss Retained earnings (deficit) Total Stockholders' Equity Total Liab. and Stkhldrs' Equity Age of A/R, days --gross 50 50 50 82.6 70.3 25.7 50 50.0 271.0 _______ $334.7 271.7 _______ $324.2 276.7 _______ $332.3 282.0 _______ $330.6 62 283.7 _______ $334.6 286.2 _______ $341.1 64 326.6 _______ $618.7 73 340.4 _______ $624.7 81 347.3 _______ $640.2 357.4 _______ $617.6 89 76 372.8 _______ $620.1 68 Source: Company reports Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 14 of 18 JDA Executive Team Executives Hamish Brewer, CEO Promoted in August 2003 to current position responsible for overseeing all aspects of JDA and developing company strategy. The Company’s Chief Operating Officer and Executive Vice President/CFO report directly to Brewer. Prior positions include President from 2001 to 2003; Senior Vice President, Worldwide Sales from 2000 to 2001; Senior Vice President, Enterprise Systems, from 1999 to 2000; Senior Vice President, International, from 1998 to 1999; and Vice President, Europe, Middle East & Africa Operations from 1996 to 1998. Joined JDA’s UK office as an account manager in 1994 with a focus on sales and marketing. Prior to JDA, worked for eight years at IBM as a retail specialist in sales and marketing. Also worked at a retailer in England with responsibilities for operations, information management, and stock control. Education: B.Sc. in Production Engineering and a B.Com. in Economics from the University of Birmingham, UK. Kristen L. Magnuson, Executive Vice President and Chief Financial Officer Joined JDA in 1997 as CFO with more than 20 years financial management experience. Promoted in March 2001 to EVP overseeing JDA’s finance, investor relations, legal, accounting, IT and human resources departments. Prior to JDA, spent seven years as Vice President of Finance and Planning for Michaels Stores, Inc. Successfully completed four public offerings, negotiated five acquisitions and several capital transactions. Responsible for investor relations, banking relations, strategic planning and long range financial forecasting. Other previous positions include Senior Vice President and Controller for an $8 billion financial institution and Principal in the audit department at Ernst & Young. Gained experience in mergers and acquisitions and several industries including, software and services. Education: B.B.A. from University of Washington; Certified Public Accountant. Chris Koziol, Chief Operating Officer Joined JDA in 2005 to assume the newly created Chief Operating Officer position, bringing with him more than 23 years of leadership in technology industry organizations. Prior to JDA, spent 16 years with MicroAge, Inc., culminating to the position of President and Chief Operating Officer. Participating in MicroAge’s growth from a privately held organization to a $6 billion NASDAQ company. Served as president of MicroAge Technology Services where he managed a $1.8 billion P&L, as well as led the company’s $5 billion Pinacor distribution subsidiary. Education: Graduate of the Harvard Business School Program for Management Development. B.S. in Business Administration (Marketing), University of Arizona, Tucson, AZ. Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 15 of 18 Senior Management Team Philip Boland, Senior Vice President, Worldwide Consulting Services Responsible for leading JDA’S global customer solutions and consulting services organization. Previously served as Regional Vice President of Customer Solutions and Services; Asia Pacific; Vice President of Consulting Services, Asia Pacific from 1999 to 2005; Director of Consulting Services, Asia Pacific 1998 to 1999 Joined JDA in 1996 as Country Manager, Australia and New Zealand as part of JDA’s entry into that market. Prior to JDA was a Principal Consultant for the Retail Industry IT practice at Price Waterhouse, Australia. Before returning to Australia served as Vice President Development and Professional Services for Uniquest Inc (formerly PRJ& a global supplier of retail application solutions and implementation services) in the US. At PRJ& also served as Managing Director PRJ& Europe and Director of Consulting US Eastern Region. Previously spent 10 years with Myer, Australia’s largest retailer, and held management positions in Buying, Sales and IT. Education: B.A. (Economics) University of Melbourne, Post Graduate Diploma (Marketing) David Syme Business School, Caulfield Institute of Technology. Tom Dziersk, Senior Vice President, Americas Joined JDA in August 2006 to assume the Senior Vice President, Americas position, bringing with him over 20 years of experience in the retail and supply chain enterprise software market. Prior to JDA, spent five years as President and Chief Executive Officer for ClearOrbit, Inc. Successfully rebranded and re-positioned the company, as well as its product and services offerings. Other previous positions include a variety of senior management as well as sales and marketing positions at several emerging technology companies, including Essentus International, Inc. (formerly Richter Systems) and JBA International, Inc (a major ERP software provider). Education: B.A. in Economics with a minor in Computer Science, University of Michigan. Wayne Usie, Senior Vice President, Retail Transitioned into the Senior Vice President, Retail position in July 2006 to assume responsibility for strengthening executive level relationships with JDA’s retail customers and key prospects. Assumed Senior Vice President, Americas position in January 2003 to bring his in-depth understanding of JDA Portfolio and demand chain requirements to lead the development of customers in JDA’s largest region. All associates in sales and services in the Americas report to Usie. Joined JDA in January 2001. During his tenure, led the research and product development organization through a great deal of change and growth, including the launch of JDA Portfolio 2003. Previously served as Vice President of IT at multi-billion dollar Family Dollar Stores, Inc. Led the implementation and management of a number of large packaged systems, including Oracle and Retek, and internally developed applications, to support over 4,000 retail locations and six distribution centers. Also worked in executive positions for a regional retailer and a consulting firm. Education: B.S. in Business Administration, Louisiana State University, Baton Rouge, LA. Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 16 of 18 Market Making and Investment Banking Disclosures At the time this report was published, Henley and Company, LLC did not make a market in JDA Software, Inc. (JDAS), or any other company mentioned in this report. Stock Rating System Henley and Company’s stock rating system is designed to reflect the type of investment decisions customers make on a regular basis. The language of the rating system used is a specific action Henley and Company would take in regard to the specific stocks we cover. Below, are an overview and an explanation of each of the types of recommendations Henley and Company would assign to stocks covered. Please understand that the rating system and the assigned definitions are predicated purely based on the total return of the individual stock in absolute dollar terms and not based on a relative value to a specific index or industry group. Henley & Company’s Stock Rating System Buy: Indicates stocks we believe have a market capitalization that is comparably undervalued to its market peers and offers a greater relative performance to the market. We believe stocks in this category offer excellent risk reward potential and we recommend purchase based on its current relative value. Note, as with all equities there is always downside risk. Speculative Buy: Indicates stocks we believe should be purchased based on its growth potential and long term outlook of its industry. We believe stocks in this category offer excellent reward potential but have a greater specific investment risk and are subject to greater volatility then our normal buy recommendation. Neutral: Indicates stocks we will not advocate a buy or sell recommendation based on current conditions. Under-Perform: Indicates stocks we believe are currently fairly valued and offer limited upside reward relative to its specific investment risk. Sell: Indicates stocks we believe are currently overvalued relative to its market peers, and/or is experiencing major operational challenges. We believe stocks in this category should be avoided and the specific investment risk outweighs any potential reward. Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 17 of 18 Further Disclosures The information and statistical data contained herein have been obtained from sources, which we believe to be reliable but in no way are warranted by us as to accuracy or completeness. We do no undertake to advise you as to changes in figures or our views. This is not a solicitation of any order to buy or sell. Henley and Company is fully disclosed with its clearing firm, Pershing LLC, is not a market maker and does not sell to or buy from customers on a principle basis. The above statement is the opinion of Henley and Company and is not a guarantee that the price target for the stock will be met or that the predicted business results of the company will occur. There may be situations when fundamentals, technically, and quantitative opinions are not met. We, our affiliates, any officer, director or stockholder or any other member of their family may from time to time purchase or sell any of the above mentioned or related securities. Analyst or members of the Research Department are prohibited from buying or selling securities issued by the companies that Henley and Company has a research relationship with, except if ownership of such securities was prior to the start of such relationship, then the analyst or member of the research Department may sell such securities after obtaining expressed written permission from the Director of Research. All research issued by Henley and Company is based on public information. Henley and Company does not currently have an Investment Banking relationship, and was not a manager or co-manager of any offering for the company within the last three years.. I, Alan Weinfeld, the research analyst of this report, hereby certify that the views expressed in this report accurately reflect my personal views about the subject securities and issues, and that no part of my compensation was, is, or will be directly or indirectly related to the specific recommendation or views contained in the report Henley & Company LLC · 1290 Reckson Plaza · Toll Free 800-753-8688 · Phone 516-794-5520 · Uniondale, NY 11556 Fax 516-794-6207 Page 18 of 18