Wealth and Substitution Effects in Labor and Capital Markets

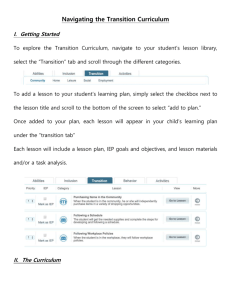

advertisement